The latest rental market report from Zoopla offers tenants little hope that rents will begin falling any time soon – as landlords ‘rationalise their portfolios’ or leave the market altogether.

The Nationwide HPI reveals a 3.1% drop in March as the housing market continues to see a slowdown.

Every week, landlord news portals all over the UK are reporting on the exodus of landlords selling up as rising costs leave landlords feeling the pinch and are either on the brink of (or already) making a loss.

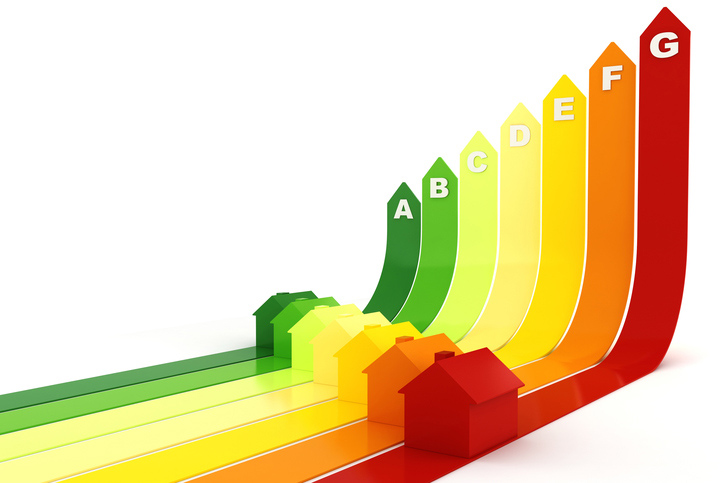

The government will this week announce a new consultation on private rental sector energy efficiency - in particular, insulation.

A new 'How to Rent' guide has been released by the government today, with letting agents and private landlords reminded they MUST serve this version at the start of any new tenancy or on renewal.

The looming ban on fixed-term tenancies as part of the Renters Reform Bill will cause chaos for both students and landlords in the university rental sector, experts say.

Sales of new homes are expected to plunge by more than 50,000 a year as onerous planning regulations and turmoil in the property market take their toll on development.

The central bank's Monetary Policy Committee (MPC) has announced a 0.25% point increase to the country's base rate. For the past year, the Bank of England has hiked interest rates multiple times in an attempt to rein in inflation with this being the 11th increase in a row.

- Why do Investors Bother with Buy to Let?

- Rents Record High in February

- Number of Properties Under Offer Rises Despite Market Uncertainty

- Have we Avoided a Property Crash?

- No News Wasn’t Necessarily Good News in The Budget!

- Unexpected Bounce in UK’s February House Prices

- Landlords MUST Get Help to Boost EPCs

- Housing Market Still Downbeat but Showing Signs of Stability