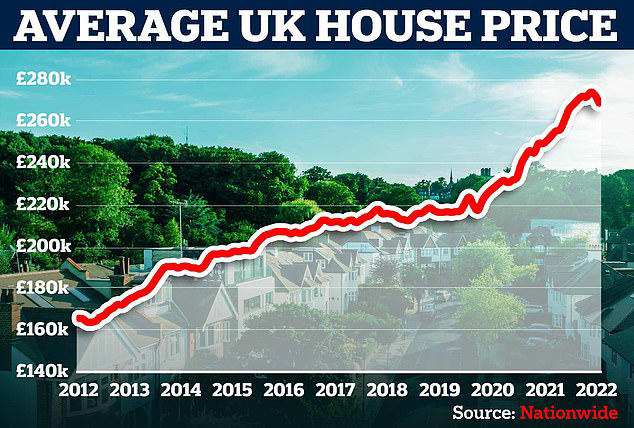

Soaring inflation following the long-term impacts of the coronavirus pandemic and Russia's war with Ukraine has led to a rollercoaster ride for Britain's housing market over the past three years.

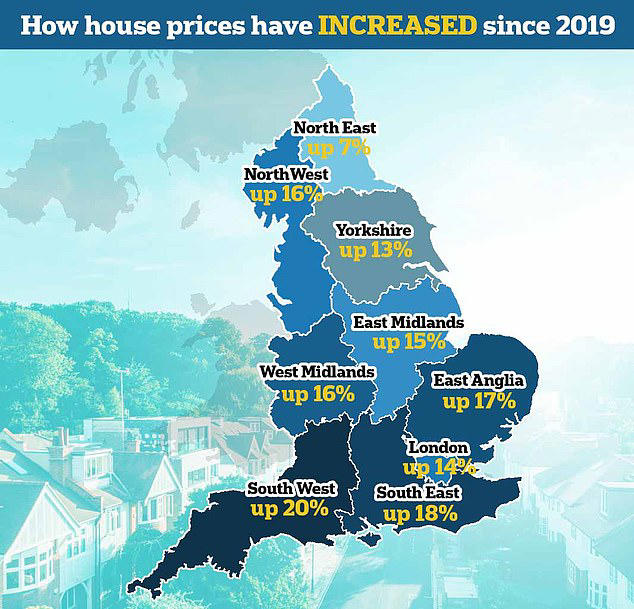

House prices have rocketed by up to 20% in some areas of the UK since 2019 - with the biggest increases seen in the south east and south west of England, according to Rightmove and the tumultuous journey for home buyers is only set to continue, as the latest predictions from the Office of Budget Responsibility has forecasted a nine per cent drop by the third quarter of 2024. Meanwhile young first-time buyers are facing fears of negative equity - when a home is worth less than an owner borrowed to pay for it - after entering into risky mortgages in 2020 and 2021.

House prices rocketed by up to 20 per cent in some areas of the UK since 2019 - with the biggest increases seen in the south east and south west of England, according to Rightmove in December

© Provided by Daily Mail

Up to 90,000 first-time homeowners could be barred from remortgaging their homes because they have fallen into negative equity, analysis has suggested. The south west has seen the biggest rise in house prices since 2019, with the average cost of a home up a massive 20 per cent from £294,000 in 2019 to £353,852 over the past year, according to Rightmove.

The south east is close behind, with the £478,188 average house price up 18 per cent on the 2019 level of £403,980. The most expensive average house price over the past year was in central London at £1.7million. The city as a whole saw a 14% price hike since before Covid.

At the other end of the scale, the north east has only seen a seven per cent increase in house prices, from £169,894 to £180,984 since 2019. However the OBR has forecast a 9% drop by the third quarter of 2024, driven by 'significantly higher mortgage rates as well as the wider economic downturn'. That would bring the average home price to around £268,450, wiping out price increases in the last 12 months.

Predictions from the Office of Budget Responsibility have now suggested prices will fall £26,550 by summer 2024. The average house price already fell 1.4% month on month in November - marking the biggest drop since June 2020.

House price expert Nick Karamanlis, former director of Stirling Ackroyd, said: "The market stalled during the pandemic when people couldn't buy and view houses. But then the market exploded when everyone came back at the same time and the government abolished the stamp duty. Demand outwaved supply and 20 or 30 people would be looking at a property at once. Sealed bids came back which haven't been seen for over ten years. But he added that the market over the coming year is very difficult to predict."

Nick also said: 'We're in a transitional period at the moment. It's possibly at the beginning of a downturn but it's usually very quiet in November and December anyway. Six months ago house prices were probably at their peak. They seem to have come down to their corrected level but we'll have to wait to see if they come down further next year."

Ahead of the forecasted price drops, many young homeowners fear they may fall into negative equity and mortgage holders in Scotland and the north of England are those most at risk, according to a Freedom of Information request to the Financial Conduct Authority.

In Motherwell, Glasgow, for example, 29%of all mortgages in 2021 were to buyers with deposits of ten per cent or less, reported the Telegraph, 8.4% of buyers had a deposit of just 5%- putting them at high risk of negative equity.

Nick, now a property agent in east London who gives advice on TikTok and Instagram, said that those most at risk of negative equity are first-time buyers, especially those who have bought new-build homes as they tend to be sold at an inflated price.

Meanwhile other financial experts have predicted that Yorkshire, Lincolnshire and West Midlands will be in the firing line.

How much have house prices increased since 2019? Source: RightMove

| Region | 2019 | 2022 |

| East Midlands | £219,451 | £255,538 |

| East of England | £341,222 | £401,318 |

| London | £628,951 | £718,731 |

| North East | £169,890 | £183,021 |

| North West | £199,906 | £234,158 |

| South East | £403,967 | £482,182 |

| South West | £294,589 | £357,010 |

| West Midlands | £231,333 | £269,675 |

| West Yorkshire | £197,712 | £226,948 |

David Jabbari, CEO of nationwide conveyancers, Muve, said: "House prices have remained high since the pandemic, although Nationwide expects them to start dropping next year. That's a concern for those looking to sell their home, as selling it for less than you bought it for can lead you into negative equity. Negative equity was a feature of the 1990s housing market, and many will have forgotten how awful it feels to sell a house for less than you paid for it. It is only a problem if you are selling up and not buying another house because taking a hit on your selling price is likely to be countered by the deal you can obtain on the purchase."

Confidence in the property market edges towards rock bottom as buyers put plans on hold amid rising costs

Over the longer term, as the 90's generation found, it tends to all work out fine because, given the lack of housing supply in the UK, the long-term direction of prices will still be upwards. For now, it's difficult to predict which areas of the UK will likely see property prices slump the most. It could be that the areas that saw the fastest growth during the pandemic, predominantly cities outside of London, are the ones that are hit the most. Counties such as Yorkshire, Lincolnshire and the West Midlands could be in the firing line, but unfortunately, we won't know until the decline starts to bite.

The Zoopla House Price Index has predicted that price growth may dip into negative territory in 2023. The research found that current house price inflation has slowed to 7.8 per cent, the slowest rate of growth recorded since November 2021, following October's mini-budget which saw the property market stall.

Property experts at Zoopla expect price growth to dip into negative territory as the market adjusts to weaker buying power and concerns over the economic outlook. Chancellor Jeremy Hunt said: 'The OBR expects housing activity to slow over the next two years, so the stamp duty cuts announced in the mini-budget will remain in place but only until March 31, 2025. After that, I will sunset the measure, creating an incentive to support the housing market and all the jobs associated with it by boosting transactions during the period the economy most needs it.'

On September 23, 2022, the Government increased the threshold from which stamp duty was paid from £125,000 to £250,000 for all residential properties purchased in England and Northern Ireland.