Prominent industry figure Jonathan Rolande says, “It is hard to see why anyone would still want to buy to let given that there seems little prospect of capital growth and returns.”

A recent report reveals 10% year-on-year increase. At an average of £1,230 per month for a newly let home, rents across the UK hit another record high in February, residential estate agent Hamptons has reported.

The number of properties listed as sold subject to contract (SSTC) has increased by 5% so far this year versus the closing stages of 2022.

A property expert believes the worst may now be behind us!

It is fair to say that Jeremy Hunt’s first budget did not send many pulses racing in the property industry.

Property values increased by 1.1% month-on-month in February but are down by £8,000 overall from their August peak, according to mortgage lender Halifax.

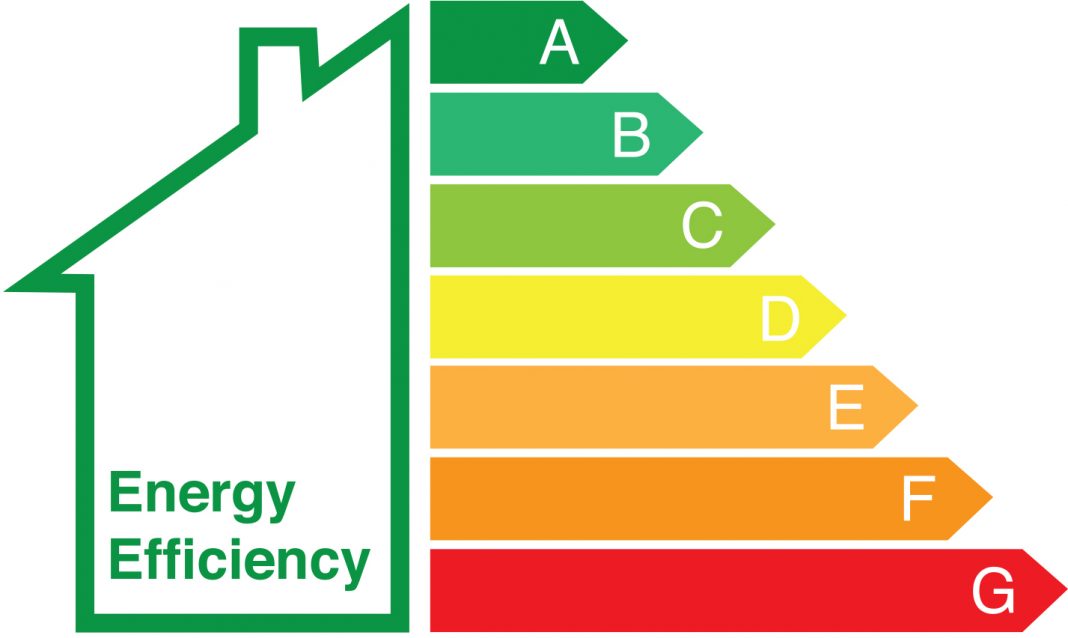

Industry body’s key recommendations for Net Zero strategy will be put forward to the Welsh government and beyond.

The UK housing market continues the trend of being generally downbeat, but there are several indicators demonstrating a more stable picture emerging through the course of 2023, the Royal Institution of Chartered Surveyors (RICS) believes.

- BOE Urged to Reject Further Rate Hikes

- House Prices Fall and New-Build Home Numbers Halve

- Whats Ahead in the Spring Budget 2023?

- The End of The Help to Buy

- House Prices at Their Most Expensive Level for 147 years

- Rental Market Stays Strong as First Time Buyer Numbers Decline

- City Leaders Call for Rent Freeze and Eviction Ban in England

- HMRC Reveals Latest UK Property Transactions Data