Energy efficiency will become key considerations for buyers next year while those with cash will be preferred purchasers, Jackson-Stops has predicted.

The national estate agency brand’s outlook for this year predicts that mainstream house prices will either be flat or see a minor adjustment in localised markets of between 0% and a 4% decline depending on how the economy deals with a recession.

It predicts that waterside and coastal market are likely to be relatively immune from economic headwinds, especially on the South and East coast with close links back to London. The overwhelming trend of lifestyle purchases is predicted to continue, driven by the swelling demographic of equity rich baby boomers looking to downsize, the agency said.

The middle market will get busy in the spring once buyers who are waiting to see what happens to mortgage rates get involved, the outlook suggests.

Jackson-Stops also highlighted that the prime country homes market in particular is not a ‘cappuccino market – all froth on top and funded by borrowing and instead cash purchases are much more commonplace than ever before. It suggests energy efficiency will become an even greater priority for buyers next year, with many house hunters opting for homes with electric charging points, upgraded insulation and ground source heat pumps, to offset rising running costs. Homes with planning permission already in place will continue to command a premium, with the potential to save months of time by allowing buyers to do a ‘double jump’ purchase.

As the cost of moving home rises, 2023 will continue to see many buyers look to future-proof their next move and buy a property with the opportunity to extend or convert in order to cater for possible lifestyles changes in the future, Jackson-Stops said.

Nick Leeming, chairman of Jackson-Stops, said: “While the market will remain subdued until the end of 2022, we expect continued, if sometimes selective demand over 2023, with a return to more normal transaction volumes. Across our network we expect to see greater levels of supply enter the market in spring 2023 as long-term mortgage rates begin to level out, giving both buyers and sellers more clarity. House values next year will feel much more dependent on the slightest variables, from the perfect location to pristine finishes, without the backdrop of unprecedented demand to wipe away any such compromises. For a seller to command the best price, they must now be aware of more choice than we’ve seen in the past 18 months, making a purchasing decision all the more discerning and negotiations likely.”

He suggests that recent interest rate rises and changes to Stamp Duty thresholds could put first-time buyers and those looking to buy with smaller deposits on the backfoot in the short term, adding: “Yet, at the higher end of the market, where sellers will have more equity to buy with, broadly these buyers will remain insulated from mortgage rate rises and issues around affordability. Many lockdown legacies remain, in particular the race for space as flexible working is accepted as a permanent staple.”

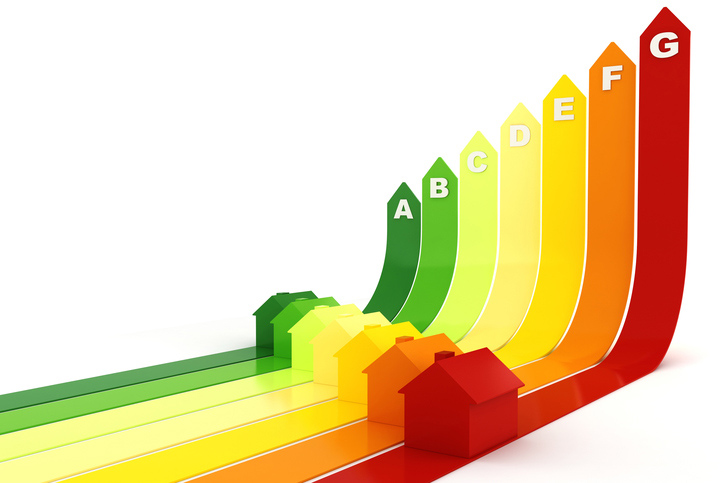

Landlords Need Clarity on Energy Efficiency Targets

This month marks two years since the end of Government consultation on energy efficiency targets in the private rented sector, yet just two years from the proposed implementation date we are none the wiser as to what these might be. Ben Beadle, Chief Executive of the National Residential Landlords Association (NRLA) explains why the Government must tell landlords what’s going on.

New targets that could see landlords paying up to £10,000 per property for energy efficiency improvements have been on the cards for two years now. A consultation into the controversial plans, which proposed all new tenancies in the PRS should have an Energy Performance Certificate (EPC) rating of C or above by 2025 – extending to all tenancies by 2028 – were first mooted at the end of 2020. However the Government has remained tight-lipped ever since. As we start 2023, with the Government’s initial implementation date fast approaching, it is clear this is a completely unrealistic expectation.

What will the proposed changes mean?

The implications of the proposals as they stand will be far reaching. Across England more than 58%of private rented households have an energy rating below a C, and a third of PRS homes were built prior to 1919, making the kind of improvements needed both challenging and expensive. The cost implications of the plans alone are already giving many landlords sleepless nights, and not knowing what the targets might be, or when work will need to be completed makes it impossible for them to budget or plan for a programme of works. The blanket £10,000 cap on improvement works is also ill-conceived and unfair, disproportionately affecting landlords with properties in less affluent areas, where rents are lower, who will find it harder to fund improvement works. All these concerns are also likely to be compounded by other issues, including severe shortages of labour and building materials, meaning even if landlords have the money to fund improvements it may be challenging to get work done quickly.

What the NRLA wants to see

The NRLA is now calling on the Government to put an end to speculation, and produce firm guidance as to what the new targets will be and the dates for compliance. Even if these details are yet to be finalised, at the very least landlords need to know when the results of the consultation will be published and a timetable for any required legislation after that. It is abundantly clear Ministers must scrap the initial 2025 and 2028 deadlines, as well as having a serious rethink on other elements of the plan, in particular the £10,000 cap on improvement works.

Instead we want to see the amount landlords should be expected to pay to be linked to average market rents in any given area.Under the NRLA’s proposals this would mean the amount a landlord would need to pay would taper from £5,000 to £10,000, taking into account different rental values (and by implication, property values) across the country. Alongside this, the NRLA is calling for a package of fiscal measures to support investment. This should include the development of a new tax allowance for landlords who are undertaking works towards reaching Net Zero.

Everyone wants to see properties as energy efficient as possible, but the plans as they stand are, to us, dead in the water. The Government needs to go back to the drawing board to come with a fair, sensible set of proposals and a realistic timescale in which to implement them.

The plans as they currently stand, rely on a misguided assumption that landlords have unlimited sums of money. They also fail to accept the realities of different property and rental values across the country, and that the private rented sector contains some of the most difficult to retrofit homes. We know from our own research landlords are not the ‘fat cats’ we are made out to be by the media and in addition to the delays stifling the provision of new homes to rent, it could also force landlords out of the market during a time of rental supply crisis.

Ministers need to take a smarter approach if we want to ensure improvements to the rental housing stock are made, while keeping good landlords in the market and encouraging them to continue to invest.

Call for ‘national mobilisation’ to improve epcs

An all-party and influential committee of MPs says the UK should be put on a war footing to improve the energy efficiency of homes. The Environmental Audit Committee is calling for “a national mobilisation” to reduce household energy bills, cut climate-changing emissions and reduce reliance on fossil fuel imports. And it says despite the government’s Energy Price Guarantee, the government has missed an opportunity to accelerate energy efficiency installations in the warmer months of 2022.

It continues that in England alone, over 13m or 59 per cent of homes are below EPC level C. The number of UK energy efficiency installations peaked in 2012 at 2.3m, yet in 2021 fewer than 100,000 upgrades were installed.

The committee is calling for at least one million energy efficiency installations a year by 2025, with an ambitious target of 2.5m properties a year by the end of the decade.

Such an effort would require funding, including investment in people to deliver this step change. A new Energy Efficiency Taskforce should be directed to estimate the levels of funding and workforce skills which will be needed and the MPs say a proportion of the windfall tax on energy companies should be allocated immediately to help fund energy efficiency improvements.

Other changes demanded by the committee include a greater focus on the potential of onshore wind and tidal energy, ending the UK’s reliance on fossil fuels, and setting a clear date for ending new oil and gas licensing franchises. The MPs are also calling for faster action from the oil and gas sector to reduce its operational emissions produced during oil and gas extraction.

Committee chairman Philip Dunne MP says: “To reduce the UK’s demand on fossil fuels, we must stop consuming more than we need. We must fix our leaky housing stock, which is a major contributor to greenhouse gas emissions, and wastes our constituents’ hard-earned cash: we must make homes warmer and retain heat for longer.

“The government’s welcome new Energy Efficiency Taskforce can lead a national mobilisation to install energy efficiency upgrades, which we would like to see achieve an initial target of a million homes a year and more than double this by the end of the decade. To help fund this, the government should funnel some of the revenue from the new Energy Profits Levy to crack on with the task at the earliest opportunity.

“The UK has enormous renewable energy potential and sectors such as offshore wind are booming. But more must be done to harness the opportunities which onshore wind, tidal and solar technologies provide. Developers should be required to fit solar panels on new homes as standard.”

The UK remains dependent on fossil fuels for 78 per cent of its energy needs. The committee concludes that as a result of Russia’s invasion of Ukraine, the UK has been exposed to the biggest global fossil fuel price shock since the 1970s.

UK needs EPC campaign to truly make a difference

The UK government should launch a national campaign to ensure landlords get on board with upgrading their rental properties to an EPC rating of C by 2025, brokerage Mortgage Advice Bureau has urged. Britons are gradually putting EPC ratings at a higher priority, as 46% of potential buyers say they would rather have good insulation than a larger garden.

Ben Thompson, deputy chief executive of Mortgage Advice Bureau, said: “It’s safe to say we all know the pain that inefficient homes are having on our bank accounts, but it is also having an impact on the climate. Retrofitting is the best way to combat the UK’s leaky homes. Wall, floor and loft insulation are some of the best ways to improve efficiency, but these can be costly. There are, however, a number of ways people can improve their homes gradually over time for very little cost, such as switching to more efficient LED bulbs to reduce electricity consumption, or using things like draft excluders under external doors.”

Majority of renters would avoid a property with low epc rating

Tenants – especially younger ones – are paying closer attention to energy efficiency. More than half of private renters (58%) would less likely consider renting a property that is energy inefficient or has an EPC rating of ‘D’ or below.

Citing the findings in its Confronting the EPC Challenge report, specialist lending bank Shawbrook said that young private renters are particularly engaged on energy efficiency, with 72% of renters aged 18 to 34 saying they always check the EPC rating of a property before making any decisions.

The lender noted that with energy costs expected to stay high during this winter and beyond, energy efficiency has become an increasing priority for many homeowners and tenants.

Still, the research, which surveyed over 1,000 private renters, also found a significant knowledge gap surrounding energy efficiency ratings.

Just 7% of respondents felt they “know a lot” about EPC requirements, while a quarter (27%) of tenants say they have heard of EPC requirements but “don’t know anything about them.” A further quarter (27%) had never heard of them, with half (56%) of renters admitting to not knowing the rating of their current property.

Previous research from Shawbrook showed that the energy crisis had pushed more landlords to make improvements to their properties. A quarter (26%) have made energy efficiency upgrades to help reduce energy bills for their tenants.

“With an unprecedented energy crisis, the energy efficiency rating of our homes has become increasingly important,” Emma Cox, managing director of real estate at Shawbrook Bank, said. “However, the research also indicates that we, as an industry, still have much to do in terms of educating those in the rental market on this issue. Interestingly young renters are paying closer attention to the energy efficiency of their properties. While we don’t know whether this is driven more by cost or an interest in sustainability, landlords should assume that it’s only going to increase in importance for tenants. Landlords are already making changes to their properties to support their tenants and bring their properties up to the standard that is likely to soon be expected. However, this can be a costly exercise, particularly with the increasing costs of materials and labour.”