With savers receiving poor returns from banks and building societies, thousands of people unsurprisingly continue to turn to residential property as a means of supplementing their income, supported by high demand from tenants and stable yields, as buy-to-let remains the investment of choice.

The 10.1% figure is marginally down from the 10.5% previously recorded and means inflation has fallen further back from a 41-year high of 11.1% recorded in October.

Zoopla has launched a property inheritance calculator to help children work out what support they could get from the Bank of Mum and Dad to help them onto the property ladder.

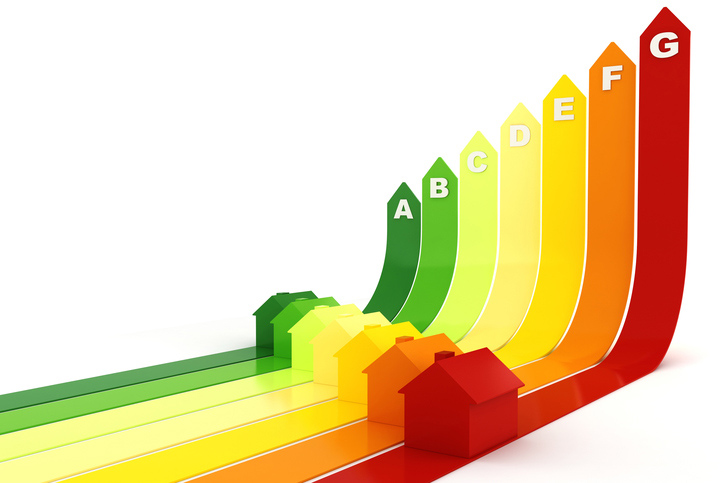

Landlords have spent nearly £9,000 on improvements to meet proposed EPC requirements, according to new research.

Almost a third of private landlords with a buy-to-let mortgage face the prospect of significantly higher costs this year according to new research.

Nicola Schutrups, managing director at brokers The Mortgage Hut, said the flurry of rate cuts demonstrates lenders’ confidence in the resilience of the housing market.

The private rented sector has an important economic and social role to play across the country, according to a new report published recently.

- Government Urged to Address Chronic Undersupply of Housing

- Mortgage Rates Fall in Fierce Price War

- Nationwide Reveals Latest on UK House Prices

- UK Economy Narrowly Avoids Recession

- Landlords Look to Increase Rents to Offset Successive Hikes in Interest Rates

- North-South House Price Divide is Narrowing

- 6 Weeks for Developers to Sign Contract to Fix Unsafe Buildings

- How Interest Rate Rise Will Affect Property Market and Mortgages