Buy-to-let lenders need to ready themselves for a “prolonged period of stress” when it comes to assessing mortgage applications, the Bank of England has warned.

The Bank sent a letter to banks and building societies asking them to respond to the current environment, where interest rates are rising, there’s high inflation, the cost-of-living is rising, and there’s geo-political uncertainty. The letter reads: “The operating environment for firms remains challenging… Firms need to be ready for a prolonged period of stress.

“In recent years, including through events like the Covid-19 pandemic, firms have tightened underwriting standards, enhanced forbearance tools, and increased operational preparedness for collections. However, these enhancements are untested under the current combination of risk factors. Therefore, it is important that firms ensure their credit risk management practices are robust, portfolios are closely monitored.”

The Bank added: “We expect firms to take proactive steps to assess the implications of the evolving economic outlook on the sustainability of their business models.”

In August last year mortgage stress tests were loosened so lenders only had to apply a stress rate of at least 1% above the lender’s revert-to rate (standard variable rate). Before then they were expected to stress test against the SVR plus 3% for mortgages fixed for less than five years.

Bank of England orders lenders to be ‘ready for a prolonged period of credit stress’

The executive director of the Bank of England financial watchdog, David Bailey, has warned that the Bank of England intends to increase scrutiny on lending to landlords.

Mr Bailey said: “Our assessment of firms’ credit risk management will include a focus on traditionally higher risk areas including retail credit card portfolios, unsecured personal loans, leveraged lending, commercial real estate, Buy-to-Let, and lending to small- and medium-sized enterprises.”

Tougher criteria checks on lending to landlords could cause a significant lack of competition amongst lenders when renewing their current deals.

As a result, borrowers should be prepared for rates to exceed the market average if these tougher checks force them to remain with their existing lenders.

With the average Buy-to-Let two-year fixed-rate deal standing at 6% in December, up from just 2.89% a year earlier, and close to £1 trillion currently borrowed by landlords, the recent increases in borrowing costs and the effects of Section 24 raise the risk that landlords will own a business which will be losing money over a sustained period of time.

This could have horrifying results as many landlords will either choose to sell up… or in a worst-case scenario, hand the keys back to the lender.

Solution for private landlords

However, there is one option which many private landlords could utilise to deduct their mortgage interest payments from their income, which section 24 has stopped. This will improve private landlords’ financial position and navigate the forecasted period of ‘credit stress’ more comfortably.

UK banks to ease pressure on mortgage holders as late payments set to surge

Some of the UK’s largest banks have agreed measures with the government to help struggling borrowers as they brace for a surge in late mortgage payments. The so-called forbearance measures, which were used during the 2008 financial crisis, are an attempt by banks including HSBC, Barclays, Lloyds Banking Group and NatWest to avoid repossessions and more pain for borrowers on top of soaring inflation and high energy bills.

Some measures could include switching mortgage holders to interest-only deals or moving them on to competitive fixed-rate deals without having to take another affordability test. The move follows a meeting this month between Jeremy Hunt and the UK’s largest banks, when the chancellor made clear lenders would need to help struggling homeowners repay their debt. It highlights the difficult time ahead for borrowers with about 1.8mn people in Britain needing to remortgage next year as their existing fixed-rate deal comes to an end, leaving them with the prospect of much higher costs.

One of the bankers at the recent meeting said the tone was: “lean in to help, which we all are. The last thing any bank wants to do is repossess a house.”

UK lenders are already preparing to set aside further provisions in their full-year results in February to cover the expected increase in loan losses as more borrowers struggle with their mortgage repayments. But Nigel Terrington, chief executive of Paragon Bank, said: “Banks are likely to achieve strong profit growth this year, so the extra provisioning will be affordable.”

He said the situation was not comparable to the property market collapse in the global financial crisis, when the number of UK home loans in arrears reached nearly 400,000. Banks are more prudent today than they’ve ever been, and a lot of lending has been at the lower end of the loan-to-value range,” he added.

Lloyds Banking Group, the largest mortgage lender, said just 4% of its lending was above 80% loan-to-value. John Cronin, analyst at Goodbody, pointed out that while there will be “pockets of problems within loan portfolios, the listed UK banks have minimal exposure to those lower-income cohorts who are most severely impacted by inflationary forces”.

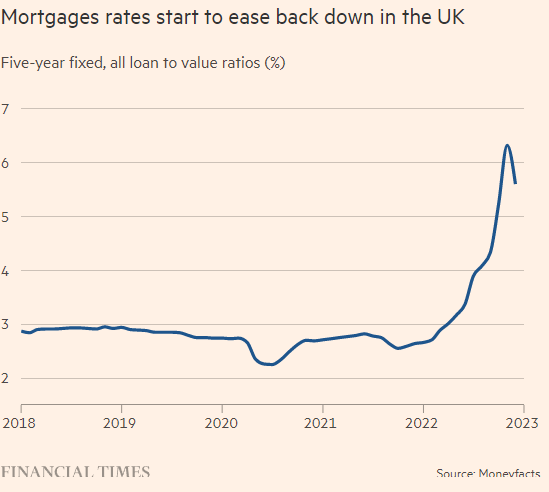

There has been little evidence of borrower defaults so far, even though mortgage costs shot up to their highest level since the financial crisis after the “mini” Budget in September. The fiscal statement boosted gilt yields, which banks use to price fixed-rate mortgages. Although rates have since eased back, they remain high compared with the start of the year. The average five-year, fixed-rate mortgage is above 5.6% up from 2.66% in January, according to data provider Moneyfacts. The number of products also shrank as banks struggled to price loans and withdrew deals. There were 5,394 products at the start of the year, which has fallen to just over 3,780.

Brokers have warned that the higher rates and pressure from inflation will lead more borrowers to fall behind on repayments in 2023. Ray Boulger, analyst at broker John Charcol, said: “No doubt we will see arrears pick up, although they’ve been at historically low levels for quite some time.”

According to the banking industry body UK Finance, the number of mortgages in arrears is predicted to reach 98,500 next year, up from an estimated 80,100 in 2022. The number of housing transactions is also likely to drop as prices fall and home movers in particular grapple with the prospect of taking out a costlier mortgage.

“There is subdued demand from home movers, who will be considering how much more a bigger mortgage could cost them,” said Roland McCormack, mortgage distribution director at TSB.

UK Finance said it expected transactions to drop by a fifth next year. Gross lending is predicted to fall to £275bn in 2023, down from an estimated £322bn this year. James Tatch, a data and research expert at UK Finance, said: “As we look ahead, the mortgage market is expected to enter a period of relative weakness from next year as house prices, the cost of living and interest rate pressures put a brake on new demand.”

Banks said they were ready with forbearance plans. Matt Hammerstein, chief executive of Barclays UK, said it had a “dedicated team” for borrowers in need of support and could switch them to interest-only terms among other solutions.

HSBC said options included a product switch to reduce the interest rate, a reduced payment arrangement, and an extension of the term. Nationwide said it would allow borrowers to temporarily reduce their monthly repayments or extend the mortgage term to cut monthly costs as part of its measures.

Alison Rose, chief executive of NatWest, said: “We have proactively contacted customers 8mn times so far this year to help them to get more control over their finances, and we will continue to play an active role in supporting customers and communities across the country.”

Repossessing houses is a last resort, though. “Repossession can take two years before it is granted, so any increase in the number of repossessions will be modest,” said Boulger at John Charcol.

The Bank of England increased rates again this month, to 3.5%, although some brokers argued that further expected rate increases had already been priced into gilt markets. Some brokers predicted that banks would struggle to pass on significant further rate rises given the weakening housing market. “Demand for property has already slowed so I expect the lenders will do more to attract borrowers next year,” said Aaron Strutt, a broker at Trinity Financial. “We are already starting to see mortgage rates come down but they are still much higher than they were.”