It has been a turbulent year for homeowners, with mortgage rates surging and signs house prices could be starting to drop. Interest rates have steadily risen, with the Bank of England raising its base rate for the ninth time in a row to 3.5%.

To put this into perspective, the base rate was 0.1%. Why is this important if you have a mortgage? If you’re on a tracker deal, your mortgage will go up in line with the base rate. Standard variable rate (SVR) deals are normally affected too, although it is down to your lender to decide whether it passes on any base rate hikes. If you’re on a fixed rate mortgage, then you’re protected from immediate rises - until your deal ends.

For those who locked in years ago on a cheap rate, it is likely you’ll pay hundreds of pounds more each month due to how much rates have risen by this last year. People with a fixed-rate deal due to expire at the end of 2023 are facing an average increase of £250 a month, according to the Bank of England Financial Stability Report. But fixed rate products have started to fall, following the catastrophic Mini-Budget. New data from Moneyfacts shows the average rate for a two-year fix has fallen to 5.82%.

The average five-year fix has now come down to 5.63%, and the 10-year fix average rate is now 5.47%. Mortgage costs had surged after the disastrous Mini- Budget, peaking at 6.65%. As well as rising mortgage rates, homeowners have also had to contend with cooling house prices. There are lots of different house price indexes that are closely followed.

The most recent figures from Halifax Building Society - based on mortgage lending - show average house prices fell by 2.3% on a monthly basis in November to £285,579. Nationwide Building Society reported a 1.4% monthly drop in its November house price index, which is also based on mortgage lending, putting the average price at £263,788.

Rightmove - which bases its figures on asking prices - suggests the average asking price fell by 2.1% last month to £359,137.

The latest data from the Land Registry - which works on a two-month lag but is based on actual property sales - shows house prices rose 0.3% between September and October 2022 to reach £296,422.

Keep in mind prices have been hugely inflated in recent months anyway, largely following the stamp duty holiday that was implemented during the Covid pandemic. But what exactly is going to happen to mortgage rates and property prices in 2023?

Of course, no one has a crystal ball and can know for sure, but we've asked the experts for their guesses. These are just predictions and should not constitute financial advice.

Will mortgage rates fall in 2023?

Richard Dana, CEO at Tembo mortgage brokers: "Interest rates for fixed rate mortgages are likely to reduce to be closer to 4% as inflation is brought under control and the impact of the recession starts to impact demand.

"Affordability will still continue to be a huge issue for both buyers and those looking to remortgage.

"The average earnings to house price will continue to be seven times - meaning there will still be a significant gap between what lenders will lend and what homes cost."

Matthew Jackson, director at Mint FS mortgage brokers: "Broadly speaking, I would expect fixed rates to continue to soften slightly and settle between just under 4% and 5% for the majority of 2023. "Lenders will of course set targets for mortgage borrowing early in the year and I would suspect we will see a raft of exclusive or limited availability products priced competitively in the first three months of the year."

Peter Higham, managing director at Gascoigne Halman estate agents: "Mortgage rates have been historically low for a considerable time and the recent rate increases have not been too drastic it just feels so because of how low they were previously. "There are outside factors which will influence future rates but we feel there will still be affordable fixed rate deals going forward."

Tim Leonard, personal finance expert at NerdWallet financial products company: "What will happen to mortgage rates in 2023 is hard to predict. "Homeowners and prospective first-time buyers will be hoping that the gradual drop-off in fixed mortgage rates seen in recent weeks will continue and bring them back closer to where they were before the ill-fated Mini-Budget which caused them to spike so high. "But while further decreases could happen, fixed rates could easily start to increase again too. Whatever the direction of travel, it’s likely that we will need to get used to higher mortgage rates generally than have been seen for many years."

Will house prices drop in 2023?

Craig Fish, founder and director at Lodestone Mortgages & Protection: "It's widely expected that the house price declines we are now witnessing will continue long into this year. "I suspect we will see drops of around 10%."

Lewis Shaw, owner and mortgage broker at Riverside Mortgages: "With mortgage rates rising, this puts downward pressure on house prices because everyone has a finite amount of disposable income. "If people can't afford to take out the mortgages they need, then prices will have to reduce to meet them. It's not going to be a great year, but there's no point dwelling on it; we are where we are."

Jack Roberts, CEO of home moving platform SlothMove.com: "While the last recession that followed the global financial crisis saw unemployment soar to over 8%, the labour market is expected to prove far more resilient this time around. "As a result, the 2023 downturn could prove shallower than first feared, prompting a bounceback in transactions later in the year as buyers and sellers adjust. "A shortage of housing supply will also act to buttress prices so drops of between 5% and 9% are more likely than double-digit falls."

Gary Boakes, director at Verve Financial financial planners: "House prices will fall but probably back to 2021 prices, so just expect last year increase to be wiped out this year."

House prices could fall by 8% in 2023 warn lenders and estate agents

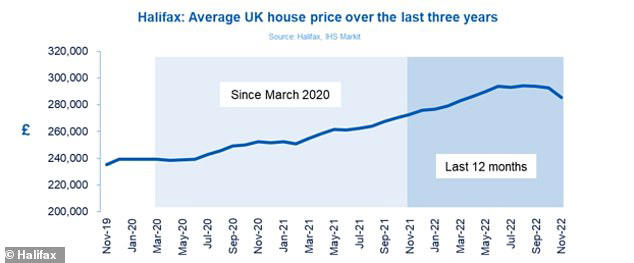

House prices could fall by as much as 8% this year, after the property market enjoyed some of the biggest increases on record. Average values rose by nearly £55,000 between March 2020 and August of last year, according to Halifax.

But it said that the housing market will now 'rebalance' amid a more challenging economic environment. The lender, along with some estate agents, gave their verdicts on the housing market and where values are likely to head this year. The forecasts come after the Bank of England increased interest rates by 0.5% to 3.5%. The latest rate rises bring further pressure on households already struggling amid the cost of living crisis as food, fuel and energy bills continue to soar.

Halifax said that last year started off with house prices 'continuing to rise at pace' but values are expected to drop 8% this year. While it declined to put a monetary value on this drop - saying it doesn't yet have the data for this month - it said that this level of fall would take prices back to roughly what they were in April 2021, which was £258,295.

It reported that annual house price growth slowed dramatically in November to just 4.7 per cent, down from 8.2 per cent in the 12 months to October. It means the average value of a home in Britain costs £285,579, down £6,827 from £292,406 in November 22.

Andrew Asaam, of Halifax, said: 'This year kicked off with average house prices continuing to rise at pace, still supported by low interest rates and strong demand from buyers.

'We saw some of the biggest house price increases the market has ever seen over the last few years. Between March 2020 and August 2022, the average house price increased by nearly £55,000, an increase of 23%, to £293,992, a new record high.

'As the increasing cost of living puts more pressure on household finances and rising interest rates impact customers' monthly mortgage payments, there's understandably now more caution among both buyers and sellers - particularly following recent market volatility - which has seen demand soften as people take stock.

'Looking ahead to next year, it will clearly be a more challenging economic environment and the housing market will continue to rebalance to reflect these new norms. 'We expect house prices will decrease by around 8% this year. To put this into perspective, such a fall would place the average property price back at roughly the level it was in April 2021, reversing only some of the gains made during the pandemic.'

Monetary Policy Committee members voted 6-3 to raise interest rates by 0.5% points - taking the bank rate to its highest level since October 2008. It is the Bank of England's ninth consecutive base rate hike in 12 months - taking rates from only 0.1% to 3.5% in December - which has led to a significant rise in mortgage rates.

Lawrence Bowles, director of research at Savills, said: 'The Bank of England's decision to slow the pace of rate rises today will bring some relief for mortgage borrowers, who have seen their debt costs balloon over the last few months. 'While rates today are the highest they have been for more than a decade, they have risen by less than markets or economists were predicting earlier in the year. 'It means affordability at the point of getting a mortgage offer will look slightly less stretched than we had anticipated previously. 'However, debt costs are still far higher than they were 12 months ago. This means we're likely to see a slowdown in transaction activity from mortgaged buyers over the next few months, with cash buyers gaining a relative advantage. 'However, with the pace of interest rate hikes slowing and the possibility of rate cuts on the horizon, the picture looks like it will improve for mortgaged buyers in 2024 and beyond. 'On the assumption that interest rates peak then gradually ease back a predicted peak of 4% from the middle of 2024, Savills is forecasting that values will begin to recover and that the average house price will rise by 6 per cent over the next five years. 'This means that by the end of the forecast period - 2027 -, the average house price is expected to be at £381,578, a £22,290 gain over five years. 'This will put prices a significant £92,000 above the pre-pandemic level, following two and a half years of considerable growth (up 24% to the end of September)'.

Estate agents Chestertons is bucking the trend in its latest forecast by predicting that values will not see the widely anticipated drop in values next year. Instead, it believes that prices will see only a slight dip in 2023, before a 1.3 per cent increase in England and Wales. It forecasts that prices across England and Wales will drop by around 1 per cent in 2023.

The agent doesn't believe that prices will fall substantially as 'strong underlying demand' for homes combined with 'fewer-than-expected forced sales will cushion prices'. Instead, it expects that many homeowners will adopt a 'wait-and-see' approach for the first half of 2023, which will reduce the number of property sales that take place. " Many lockdown legacies remain, in particular the race for space as flexible working is accepted as a permanent staple. Buyers in 2023 are looking for family homes that are bigger, with an office room or garden large enough for a standalone studio"

Nick Leeming, Jackson-Stops. It claims that this lack of activity will cause a high degree of 'buyer frustration' in the second half of the year which, when released, will support the rapid price growth they expect in 2024.

Matthew Thompson, of Chestertons, said: 'As supply and activity continue to fall going into 2023, we believe this should counteract the majority of the downward pressure on house prices.'

Jackson-Stops also believes that house prices will either be maintained overall with a 0 per cent change or see a minor adjustment of between 0 per cent and a drop of 4 per cent.

Nick Leeming, of Jackson-Stops, said: 'While the market will remain subdued until the end of 2022, we expect continued, if sometimes selective demand over 2023, with a return to more normal transaction volumes. 'We expect to see greater levels of supply enter the market in spring 2023 as long-term mortgage rates begin to level out, giving both buyers and sellers more clarity.' He added: 'Many lockdown legacies remain, in particular the race for space as flexible working is accepted as a permanent staple. 'This means buyers in 2023 are looking for family homes that are bigger, with an office room or garden large enough for a standalone studio. The flexibility to work from home has made buyers more open minded, both on location and property type. 'Whereas once it needed to be within walking distance of a station for the daily rat race, now to be within just a few miles drive of a major train station will often suffice, opening up a plethora of new properties in the process. 'For young professionals that may struggle to buy their first home in cities such as London or Bath, applying for jobs that only demand them to be in the office part-time opens up many more avenues of their property search - a real plus for the UK market more broadly.'

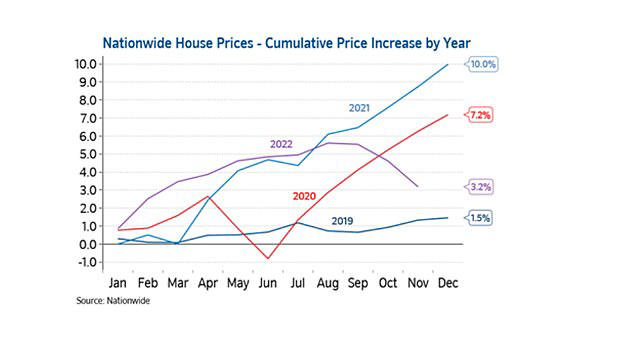

Will house prices have a soft landing? Britain's biggest building society Nationwide predicts a modest 5% house price fall in 2023

Nationwide has predicted house prices will fall by 5% this year as activity is expected to stabilise to just below pre-pandemic levels. The prediction from the UK's largest building society suggests a softer landing for the property market in 2023 than others have forecast, despite the choppy economic conditions.

The Government's Office for Budget Responsibility forecast a 9 per cent fall in the next two years, estate agent Savills predicted a 10% fall in 2023, and Rightmove founder Harry Hill said house prices could drop 20% if the UK entered a deep recession. Early signs show that property price growth is already starting to slow, with Halifax reporting a 2.3% or £6,800 fall in November 22.

Robert Gardner, Nationwide Building Society's chief economist, said: 'It will be hard for the market to regain much momentum with economic headwinds set to strengthen, as real earnings fall further, the Bank of England moves interest rates higher and with the labour market widely projected to weaken as the economy shrinks. 'The risks are skewed to the downside, but there is still a good chance that we can achieve a relatively soft landing next year with activity stabilising modestly below pre-pandemic levels and house prices edging lower, perhaps by around 5%.'

Furthermore, while mortgage rates are falling they are yet to go back to the levels seen before the autumn when they shot up in the wake of September's 'mini-Budget'.

On 1 August 2022, the average two-year fixed rate across all deposit sizes was 2.52%, according to data from Moneyfacts. The figure peaked at 6.65% on 20 October with the five-year fixed rate at 6.51% on the same day. However, average fixed rates for both two and five year mortgages have steadily fallen since.

Currently the two-year fixed average is 5.8 per cent, while the five-year is at 5.61%, continuing to fall despite the Bank of England's recent rate rise to 3.5%; it's highest level since October 2008. However, in contrast to Nationwide, others believe the fall in house prices will run into double digits.

Estate agency Knight Frank expects values to fall by 10% over the next two years as buyers and sellers 'recalculate their options'. 'Mortgage rates will eventually settle at least 2 percentage points higher than they were this spring, which means it could be a "wake up and smell the coffee" moment for the housing market,' said Tom Bill, head of UK residential research at Knight Frank. 'Higher borrowing costs will keep transaction volumes in check and result in more widespread price declines in 2023.'

Savills' November forecast of a 10% fall in 2023 represented a far gloomier outlook than the prediction of a 1 per cent drop it made in May.

However, the estate agent said it expects prices to rebound and rise 1% in 2024 – a marginally more hopeful outlook than rival knight Frank.

In December Nationwide's latest house price index revealed house price growth slowed to just 4.4% in November, down from annual property inflation of 7.2% the month before. Between October and November house prices fell by almost £4,500. This 1.4% decline was the largest monthly fall since June 2020 and more than the 0.9% fall recorded between September and October.

Further sign of market cooling came from Rightmove that reported the average asking price fell by nearly £8,000 in December, the largest slip in almost four years. The property portal said the fall was triggered by the mortgage crunch as home sellers 'adjusted their expectations' in the new market conditions. The asking price of the average home for sale is now £359,137 compared to £366,999 last month, it said.