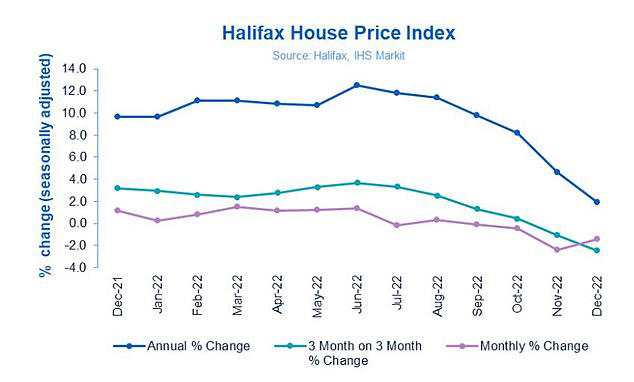

Average house prices in the UK have fallen for the fourth consecutive month with the prospect that an annual price fall is likely, Halifax reports.

In December, average house prices fell by -1.5% and the annual rate of growth dropped to +2.0%. According to the data, the average UK property now costs £281,272, that’s down from November’s £285,425.

The price falls were recorded in all regions and nations

Leading to an overall slowing of the market, Kim Kinnaird, the director of Halifax Mortgages, said: “As we’ve seen over the past few months, uncertainties about the extent to which cost of living increases will impact household bills, alongside rising interest rates, is leading to an overall slowing of the market. These trends need to be viewed in the context of historic prices. The cost of the average home remains high – greater than it was at the start of 2022 and over 11% more than house prices at the beginning of 2021.”

Ms Kinnaird added: “As we enter 2023, the housing market will continue to be impacted by the wider economic environment and, as buyers and sellers remain cautious, we expect there will be a reduction in both supply and demand overall, with house prices forecast to fall around 8% over the course of the year. “It’s important to recognise that a drop of 8% would mean the cost of the average property returning to April 2021 prices, which still remains significantly above pre-pandemic levels.”

Led to an expensive winter for many households, Emma Cox, the managing director at Shawbrook, said: “The continual raising of interest rates by the Bank of England coupled with the ongoing cost of living and energy crises has led to an expensive winter for many households. This challenging economic climate has filtered through to the housing market, as it now enters a fourth successive month of price falls.”

She adds higher mortgage rates and soaring inflation have seen a reduction in transaction numbers – and the market looks set to experience a ‘price correction’.

Ms Cox said: “Yet whilst first-time buyers are holding out for more stable times before making their leap onto the housing ladder, it’s likely we’ll still see opportunistic landlords capitalising on lower prices and market uncertainty to build their portfolios. With figures at the end of 2022 also pointing to an increase of buy-to-let limited companies, it could also suggest a further professionalisation of the buy-to-let market in the coming months.”

A miserable December for house prices, Sarah Coles, a senior personal finance analyst at Hargreaves Lansdown, said: “It was a miserable December for house prices, as the rot set in, and prices slumped again. We saw a fourth consecutive monthly price drop, and average prices are now up just over £5,000 in a year. While this month’s fall was less spectacular than November, it was more comprehensive – as prices fell in every region across the UK. This is a world away from June when they were up 12.5% in a year.”

She adds that the current figures reflect a three-month lag between agreeing a sale and completion which the data shows buyer confidence in September – which only included a single week after the mini-Budget.

Ms Coles said: “A major chunk of these sales were based on mortgages that had already been approved, so the chaos unleashed in the mortgage market by Kwasi Kwarteng’s announcement won’t necessarily have personally affected these buyers.”

Predictions vary, but several analysts have suggested house prices could fall between 10 and 15% over the next two years. The Office for Budget Responsibility has said house prices are set to fall 9% between the end of 2022 and the end of 2024. Elsewhere estate agent Savills has updated its forecast to a 10% fall in house prices over 2023. All nations and regions saw annual house price inflation, although the rate of growth has slowed, Halifax said.

On an annual basis, the North East saw the greatest slowdown in growth, with annual house prices rising by 6.5%, compared to 10.5% the prior month. Average house prices in the region are now £169,980.

Simon Gerrard, managing director of Martyn Gerrard estate agents comments:'But the big issue continues to be supply. There simply aren't enough properties coming onto the market, which could well have reduced the magnitude of today's reported drop in house prices, which is lower than that for November.'

Iain McKenzie, CEO of The Guild of Property Professionals, adds: 'After hitting an all-time high of nearly £300,000 in the summer, house prices have now fallen back below the level they were in March. There's no need to panic, as a readjustment in the market was to be expected following more than two years of inflated house prices. Fortunately for sellers, the demand for quality housing is still high, and many areas of the country are still seeing a shortage of stock, which will keep prices buoyant in the months ahead. Pessimism over the future of house prices may be misplaced. Employment figures remain strong, and there are signs we may soon see falls in the wholesale fuel prices, which have helped drive up inflation and the cost of living over the past year.'

The housing market was a mixed picture in 2022.

We saw rapid house price growth during the first six months, followed by a plateau in the summer before prices began to fall from September, as the impact of cost of living pressures, coupled with a rising rates environment, began to take effect on household finances and demand.

These trends need to be viewed in the context of historic prices. The cost of the average home remains high – greater than it was at the start of 2022 and over 11% more than house prices at the beginning of 2021.

The first half of last year was a very strong period for sellers, between January 2022 and August 2022, the average cost of a home rose by over £17,000 to £293,992 (growth of 6%), setting a new record high.

As we enter 2023, the housing market will continue to be impacted by the wider economic environment and, as buyers and sellers remain cautious, we expect there will be a reduction in both supply and demand overall, with house prices forecast to fall around 8% over the course of the year.

It’s important to recognise that a drop of 8% would mean the cost of the average property returning to April 2021 prices, which still remains significantly above pre-pandemic levels, said Kim Kinnaird, Director, Halifax Mortgages.

Housing activity

HMRC monthly property transaction data shows UK home sales increased in November 2022.

UK seasonally adjusted (SA) residential transactions in November 2022 were 107,190 – up by 0.2% from October’s figure of 107,010 (up 4.3% on a non-SA basis). Quarterly SA transactions (September-November 2022) were approximately 3.3% higher than the preceding three months (June 2022 – August 2022).

Year-on-year SA transactions were 13.3% higher than November 2021 (12.1% higher on a non-SA basis). (Source: HMRC)

Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in November 2022, by 20.4% to 46,075.

Year-on-year the November figure was 33.2% below November 2021. (Source: Bank of England, seasonally-adjusted figures)

The November 2022 RICS Residential Market Survey results show overall activity across the sales market continues to weaken.

New buyer enquiries was in a negative net balance for a seventh month at -38%, compared to -53% previously.

Agreed sales had a net balance of -35% (-45% previously) and new instructions returned a net balance of -9% (previously -16%). (Source: Royal Institution of Chartered Surveyors’ (RICS) monthly report).

Experts predict house prices will fall in 2023 – but it’s not all bad news for homeowners

Homeowners can expect to see house prices fall this year by as much as six per cent over the year, according to a leading property association.

The boss of the National Association of Property buyer Jonathan Rolande does though expect activity and demand to pick up in the summer months. “This will negate some of the price reduction but it’s looking very likely that by the end of 2023 there will have been no increase in prices and perhaps even a fall of up to 6 per cent.” he said.

“But there are reasons to be more optimistic. In 2022 there were eight interest rate rises, five Housing Ministers, three Prime Ministers and four Chancellors. We had a fuel crisis, a post-pandemic slump and raging inflation. If the property market could withstand all of this, just imagine how easy things might be without such chaos. The property market has come through tougher times than this, and it will do so again,” the boss of the association said.

Will house prices go down in 2023?

Rolande’s comments echo a host of other predictions that house prices could be set for a tumble in 2022, driven by a lack of demand.

The Bank of England revealed in its monthly credit report that mortgage approvals had hit a level not experienced since the beginning of the Covid-19 crisis. Higher interest rates have fed through to more expensive mortgages – decreasing demand to buy and also potentially increasing supply, if homeowners are unable to meet mortgage payments.

Halifax Bank predict an 8% fall in the coming year, which would equate to the average UK home losing more than £20,000 from its current price tag.

Rightmove predict a fall in house prices of only around 2% over the course of 2023.