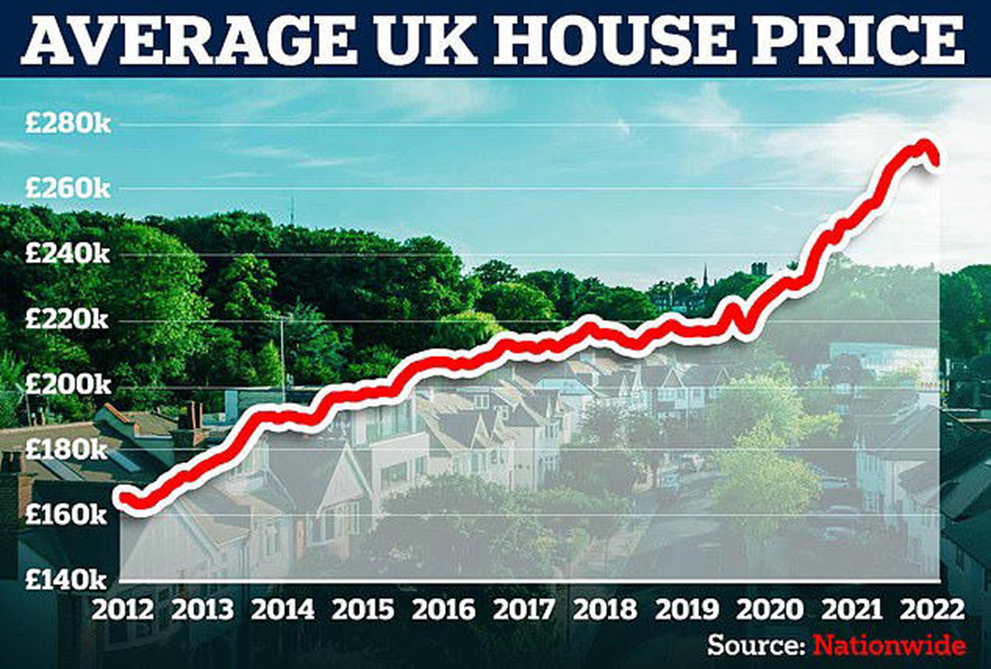

The average house price fell by 1.4 percent month on month in November, marking the biggest drop since June 2020, according to an index.The average house price fell by 1.4% month on month in November, marking the biggest drop since June 2020, according to an index.

November's drop followed a 0.9% month-on-month fall in October.

Across the UK, annual house price growth slowed sharply to 4.4%, from 7.2% annual growth recorded in October.

The average house price in October was £268,282 but this fell by nearly £4,500 this month, down to £263,788 in November, Nationwide Building Society said. The lender previously warned that house prices could fall as much as 30% next year.

Mortgage rates jumped following the mini-budget in September, with Bank of England base rate rises also pushing up borrowing costs, against a backdrop of households being squeezed by rising bills generally.

Nationwide had revealed this week that house prices fell by 0.9 per cent month-on-month for the first time in 15 months in October and the sharpest drop since the start of the pandemic© Provided by Daily Mail

Last month, MailOnline reported demand for new homes have fallen by a third since the widely criticised September mini-budget. The budget saw two and five-year fixed-rate mortgage rates surpass 6% for the first time since 2008.

Tomer Aboody, director of property lender MT Finance, said: “With the full impact of the Kwasi Kwarteng Budget being felt, the fall in prices isn’t surprising as markets reacted sharply, resulting in higher mortgage rates and lack of confidence.

“As the market continues to stabilise since Rishi Sunak took over, we should see a steadier picture going forward.

“With buyers stretched when it comes to affordability, the government needs to assist in helping banks be more flexible in their lending and helping buyers continue to move. Could the government potentially help by writing off some mortgage payments against tax for example.”

Robert Gardner, Nationwide's chief economist, said: 'The fallout from the mini-budget continued to impact the market, with November seeing a sharp slowdown in annual house price growth to 4.4%, from 7.2% in October.

'Prices fell by 1.4% month on month, after taking account of seasonal effects - the largest fall since June 2020.

'While financial market conditions have stabilised, interest rates for new mortgages remain elevated and the market has lost a significant degree of momentum.

'Housing affordability for potential buyers and home-movers has become much more stretched at a time when household finances are already under pressure from high inflation.

'The market looks set to remain subdued in the coming quarters. Inflation is set to remain high for some time and bank rate is likely to rise further as the Bank of England seeks to ensure demand in the economy slows to relieve domestic price pressures.

'The outlook is uncertain, and much will depend on how the broader economy performs, but a relatively soft landing is still possible.'

Some mortgage products have returned to the market in recent months, after more than 1,600 of them were canned following the mini-budget.

Mr Gardner said longer term borrowing costs have fallen back in recent weeks and may moderate further.

'Given the weak growth outlook, labour market conditions are likely to soften, but they are starting from a robust position with unemployment still near 50-year lows,' he said.

'Moreover, household balance sheets remain in good shape, with significant protection from higher borrowing costs, at least for a period, with around 85% of mortgage balances on fixed interest rates.

'Stretched housing affordability is also a reflection of underlying supply constraints, which should provide some support for prices.'

Tom Bill, head of UK residential research at estate agent Knight Frank, said: 'The impact of the mini-budget continued to reverberate in November, with the largest monthly fall in house prices since the early days of the pandemic.'

He continued: 'Mortgage rates should keep edging downwards as the effects of the mini-budget wash through the system, which should settle the nerves of buyers and sellers, even as a 13-year period of ultra-low borrowing costs comes to an end.

'We expect house prices to fall by 10% over the next two years and the reality of higher rates will bite more after Christmas. Mortgage offers made before the mini-budget will begin to lapse and increase downwards pressure on prices from 2023.'

Jeremy Leaf, a north London estate agent and a former residential chairman of the Royal Institution of Chartered Surveyors (Rics), said: 'Prices are softening but could have fallen further were it not for those two stalwarts, shortage of supply and strong employment, despite continuing concerns over the rising cost of living and particularly mortgage repayments.

'The problem is not existing sales, the overwhelming majority of which are proceeding, but new business. However, some buyers are returning now that mortgage rates are beginning to fall but they are more aware of their stronger position so are negotiating hard.'

James Forrester, managing director of estate agent Barrows & Forrester, said: 'With dwindling economic headwinds in 2023, we expect the property market to perform well.'

Nicky Stevenson, managing director at estate agent group Fine & Country, said: 'While a further cooling of prices is expected over the winter, this effect may be mitigated in part by the return of stability to lending markets and more realistic pricing of loans.'

Gabriella Dickens, a senior UK economist at Pantheon Macroeconomics. said: 'All told, we expect a peak-to-trough fall in house prices of around 8%, reversing around one-third of the increase since the start of the pandemic.'

Jack Roberts, chief executive of home moving platform SlothMove, said: 'Mortgage rates have climbed sharply this year, affordability was already stretched and there's a groundswell of industrial action threatening a new winter of discontent.'

House Sales Are Plummeting – Here’s What It Means for Homeowners

The post-pandemic housing market has been turned on its head and the consequences for homeowners will be serious.

During lockdowns, and immediately after, house sales were booming. Families entered into a “race for space” during the pandemic and demand for second homes soared. All seemed well for house owners as sales boomed and prices rocketed.

However, after the umpteen interest rate rises in 2022, the debt cost for higher-priced houses has shot up. Demand has fallen and the gulf between flats and houses dwindled. The Centre for Economics & Business Research, a think tank, expects this to continue and be reflected in sharper drops in prices for houses versus flats.

Such a gulf will have serious ramifications for the country’s housing market. The Telegraph takes you through the numbers.

Prices will fall faster

Agreed sales have been falling more sharply for houses than for flats. House sales were 16.5% lower this month than during the same period three years ago, compared with a 1.6% drop for flats, according to TwentyCi, an analyst.

Aneisha Beveridge, of Hamptons estate agents, said flat sales dropped to a record low last year but have generally recovered to pre-Covid levels.

The market for flats, particularly those without outdoor space, declined during the pandemic amid a “race for space” that led more buyers to seek out houses.

Andrew Wishart, of Capital Economics, a think tank, said: “A shift to remote and hybrid working allowed office workers to live further from the office and use their financial clout to buy homes with more space as opposed to paying a premium for being close to work.”

But employers have started to demand at least a partial return to the office. Visits to workplaces have returned to around 80% of pre-pandemic levels, according to Google mobility data analysed by Capital Economics.

Mr. Wishart said: “Employees will value a short commute more than they might have in 2020 and 2021 when office occupancy was lower.”

Space isn’t important

Houses now cost 29% more than they did in January 2020, while flats are up 14%, according to Capital Economics. This was most stark for detached houses, which cost 30.4pc more than three years ago, according to the CEBR.

During the first year of the pandemic, areas with properties that have more outdoor space experienced the sharpest growth in prices. But during the following year, there was a reversal of this trend and a return to pre-pandemic patterns. Areas with properties that have the least amount of outdoor space experienced the steepest growth in house prices in the year to March 2022.

Karl Thompson, of CEBR, said: “There’s a broader trend of workers returning to city centres, contributing to a reversal of the race for space.”

Mr Wishart said the current situation was markedly different from the one in 2008 – the last time mortgage rates climbed above 6%. During the financial crisis it was flats that were affected by a steeper fall in prices.

He said: “The average house costs about 41% more than the average flat now whereas in 2007 the gap was just 17. That’s because the cost of mortgage payments was already quite high in the lead up to the financial crisis which meant the phenomenon of buyers economising on space in order to buy had been running for some time.

“This time around the jump in mortgage rates has been far sharper, so we are only now seeing stretched affordability cause demand to shift towards less expensive flats from larger houses.”

Houses are unaffordable

Buyers were already having to stretch themselves to afford houses, but sky-high mortgage rates have now made them increasingly out of reach. The average five-year mortgage rate is 5.8%, while two-year deals cost 6.01%, according to analyst Moneyfacts. A year ago they were 2.64% and 2.34% respectively.

In November 2020 someone buying a property with a 10% deposit and a 25-year mortgage would have needed to earn £5,500 more per year to afford a house, according to Hamptons estate agents. By November 2021 this had risen to £8,900, and last month this difference hit a record £13,000.

The income needed to buy the average house is now £65,447, up from £52,525 two years ago. For a flat, the income required is £52,422, compared with £46,990 during the same period, Hamptons data showed.

Ms Beveridge said: “Affordability constraints may mean that more buyers settle for slightly smaller homes than they would have liked. This is likely to be particularly true in the most unaffordable markets, such as London and the Southeast.”