The majority of local authorities have failed to build a single council home in the past five years, according to shocking analysis that lays bare the scale of the social housing paralysis.

The number of tenants signing up with a lettings agent to find a new home showed a 'sizeable jump' in July, new figures reveal.

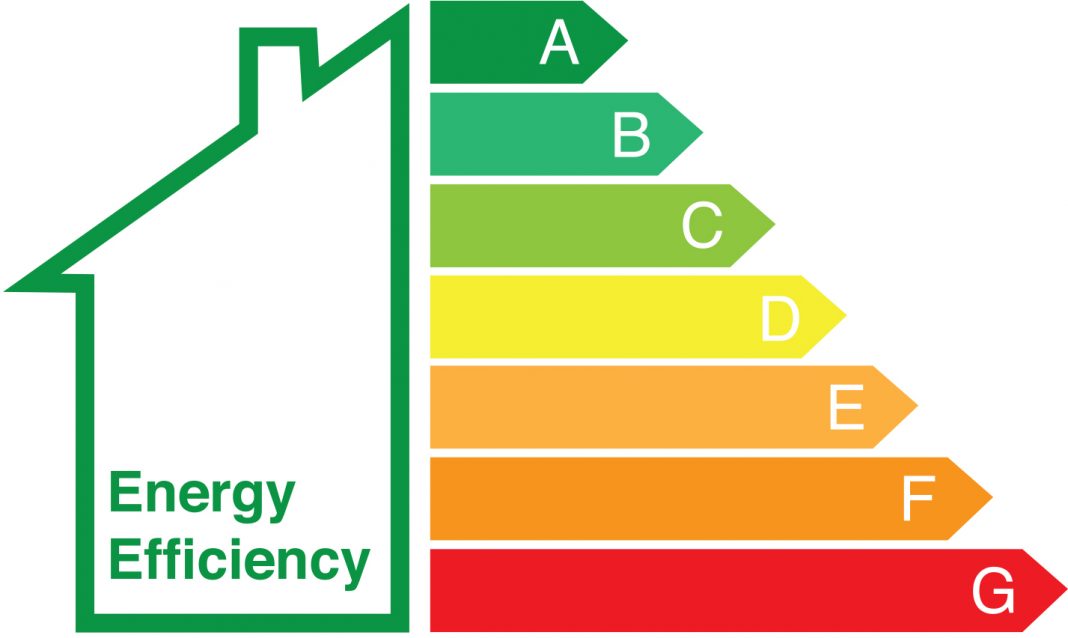

Prime Minister Rishi Sunak has thrown his weight behind Housing Secretary Michael Gove’s proposals to delay deadlines for EPC improvements in the private rental sector.

July was a record breaking month for the rental market, claims a PropTech company.

The average UK house price fell at the fastest annual rate in 14 years in July, Nationwide Building Society has reported.

Over recent years, as successive governments have tightened lettings legislation and increased the tax burden on landlords, some with investment properties have reduced their profits.

British lenders approved more mortgages than expected in June and net unsecured lending to consumers shot up by the most in over five years, despite rising interest rates, Bank of England data showed.

The Bank of England (BoE) raised interest rates by 0.25%, increasing the current bank base rate from 5% to 5.25%.

- Only Top 10% of English Earners Can Afford Average home in Under 5 Years

- 1 in 5 Tenants Put Their Property Purchase Aspirations on Hold

- Bank of England Set to Raise Rates to 5.25%

- Prime Minister Commits to 1 Million New Homes Promise

- Rent Prices Set to Continue Rising as Bleak Autumn Looms

- House Prices Still Rising Annually but Growth Slows

- Sellers STILL Want More for Homes Despite the Mortgage Crunch

- UK Inflation Reduces to 7.9%