Total residential planning applications dropped to their lowest annual total in a decade in 2022, while the proportion of applications that were successful versus those that were rejected also currently sits at its lowest since 2008.

Analysis on historic data looked at the number of approved, rejected and pending residential planning applications between 2002 and 2022 and how the number of applications has changed. The research shows that in 2022 an estimated total of 60,986 residential planning applications were either approved, rejected or are still awaiting a decision.

Not only was this the lowest annual total seen since 2012 (59,013), but it marked a -5% annual decline versus the 64,419 seen in 2021. The -5% year on year decline seen in 2022 was also the fifth consecutive annual decline seen, with total applications having fallen every year since 2018. Of the 45,182 residential planning applications seen in 2022 that were either approved or declined, 32,956 were approved versus 12,226 that were rejected.

As a result, planning application approvals accounted for 73% of the total versus the 27% that were rejected. The 2022 success rate of 73% was down from 75% over the previous three years and was also the lowest success rate seen since 2008 when, in the midst of the financial crisis, just 68% of all applications were approved.

Mitchell Fasanya, Co-founder and CEO of Searchland, the development site sourcing specialists responsible for the analysis, said, “despite the residential property market benefitting from a pandemic inspired boom, the number of planning applications made has been in steady decline in recent years. This is down to a number of factors, including the higher cost of materials and labour shortages that will have impacted developer abilities to execute efficiently. Not to mention the market uncertainty that has developed following a string of interest rate hikes which will have seen many developers tread with greater caution in anticipation of a reduction in market values. While less significant, the recent Help to Buy deadline is also sure to have had an influence with many developers pausing to reevaluate where, what and to whom to target their efforts. Although the market has stood firm so far, it will be interesting to see how this trend materialises over the coming year but one thing is for certain, the housing crisis is going nowhere and we need to encourage more homes to be built, not less, which starts with planning approval.”

UK Property Development Hotspots

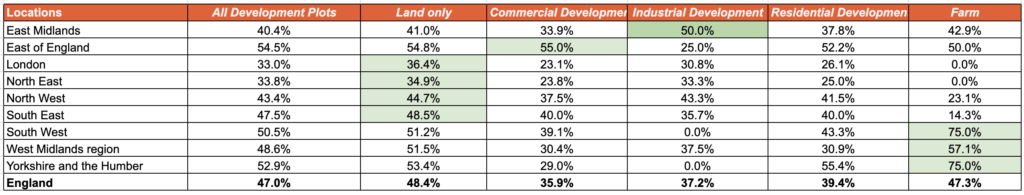

New data looking at the current market trends for land and development investment in England has highlighted a strong demand for land-only and farming plots among developers throughout England. The research analysed demand for various types of development plots across the country, based on the number of land plots that have already gone under offer or sold subject to contract.

Strong overall development plot demand

The research indicates that the overall demand for development opportunities is high, with 47% of all development plots already under offer or sold subject to contract. The East of England leads the way, boasting a demand level of 54.5 per cent for development plots, followed by Yorkshire and the Humber (52.9%) and the South West (50.5%).

Land-only and farming plots most popular

When examining demand for different plot types, land-only plots emerged as the most popular choice among developers, with 48.4% of such plots across England already snapped up. Agricultural and farmland plots followed closely behind, with 47.3% secured, while residential development opportunities ranked next (39.4%), trailed by industrial sites (37.2%) and commercial development plots (35.9%).

Data sourced from Rightmove (4/04/2023) – Sample of 9,367 available land plots

Demand score is based on the number of land plots that have already gone under offer or sold subject to contract as a percentage of all available listings.

Regional variations in demand

Regionally, land-only plots remain the most sought-after development opportunities in London (36.4%), the North East (34.9%), North West (44.7%) and South East (48.5%). Conversely, farming plot opportunities are most in-demand in the South West (75%), Yorkshire and the Humber (75%) and West Midlands (57.1%). The East of England has seen the highest demand for commercial plots (55%), while the East Midlands experienced the strongest interest in industrial sites (50%).

Mitchell Fasanya, Co-founder and CEO of development land sourcing specialists Searchland, which conducted the research using data from a sample of 9,367 available land plots on Rightmove, said: “despite the wider economic landscape there remains a robust appetite for the development of all land site types across England, but it’s certainly land only and agricultural plots that are proving the most popular amongst investors and developers. This is hardly surprising given the clean slate that a land only plot provides and the time and cost saved during the development stage as a result.”

Fasanya also observed that developers are increasingly looking to the agricultural sector for land suitable for commercial projects, such as logistical sites and warehouse storage, particularly in regions with a prominent agricultural heritage, such as Yorkshire and the South West.