The Bank of England (BoE) decided on Thursday last week to raise interest rates again by 25 basis points, increasing the current bank base rate from 4.25% to 4.5%.

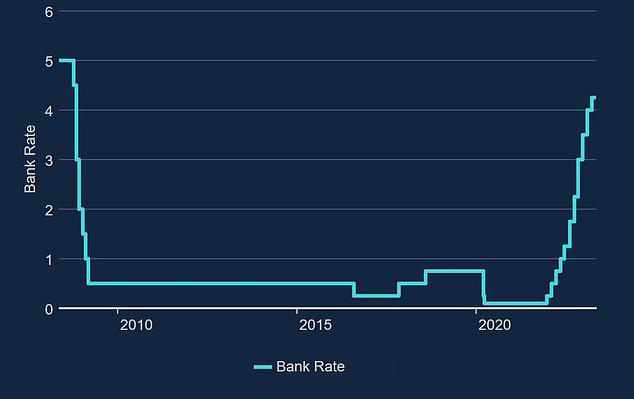

Seven members of the bank’s Monetary Policy Committee (MPC) voted for the 0.25% increase, while two members preferred to maintain bank rate at 4.25%. The bank rate has now increased for the 12th consecutive time, with rises at each of the MPC meetings since December 2021, causing the base rate to gradually climb from a record low of 0.1% to the highest level it has been since the economy was hit by the 2008 global financial crisis. Inflation is not expected to fall to target until 2025, while food inflation will continue to outpace the headline rate.

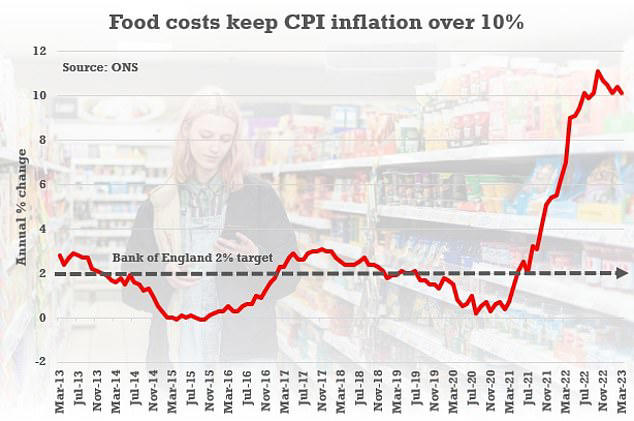

The central bank has been trying to control soaring inflation by increasing the cost of borrowing, but it has not been very successful last year with inflation even hitting a four-decade high of 11.1% in October. While annual inflation eased at 10.1% in March, it is still a long way from the government’s inflation rate target of 2%.

The move follows similar decisions by the European Central Bank and the Federal Reserve in the US, ending hopes from earlier this year that the last round of hikes would be the final one in the cycle. But inflation has remained higher than predicted forcing central banks to continue taking action to try and bring it down. We explain why the Bank of England is continuing to raise interest rates and what it could mean for you mortgage, savings and the wider economy.

Why are interest rates still rising?

The Bank of England is raising what is officially known as bank rate but more commonly called base rate to try to tame inflation.

The MPC sets interest rates to try to keep inflation at the Bank's 2% target, however the consumer price index sat at 10.1% in March. This came as a surprise to some experts who expected the figure to fall to single digits after months of running above 10%. It also ended speculation that March's rate rise would be the last in the cycle and the debate is now open again as to when central banks will begin cutting interest rates.

Paul Dales, chief economist at Capital Economics, says, "the central bank may continue to push up rates to 4.75 or even 5% if 'domestic inflation proves more resilient than we expect."

In fresh forecasts, inflation is expected to fall to around 7% by mid-summer and then to 5.2% by the end of year.

The Bank of England's Monetary Policy Committee continues to try and get inflation down

© Provided by This Is Money

The situation has been compounded by the mini budget in September last year which send the cost of borrowing soaring as the market baulked at then Prime Minister Liz Truss' list of unfunded tax cuts. Some of the sharp rise in mortgage rates has since been unwound, but they remain far higher than they were.

However, the successive interest rate rises have been good news for savers. Savings accounts now offer some of the highest interest rates in recent years on deposits. In theory this encourages people to save more and spend less, pushing down inflation by slowing the economy. But it also means slower growth overall. Furthermore, the recent collapse of a number of US banks and Credit Suisse in Europe has shone a harsh light on the impact rapid rate rises have on lenders.

Katrin Löhke, economist at DWS asset management, said, "in the UK, both the inflation figures and the wage increases have recently been much stronger than hoped for - the issue of fighting inflation is therefore not yet over. The British economy has held up better than expected and has probably even made it through the winter without a recession, despite the unprecedented decline in real incomes. Interest rate hikes are only reaching the broad economy with a significant delay. This means that the BoE will continue to act in a very data-dependent manner. Wages and underlying inflation dynamics will remain in focus."

Laith Khalaf, head of investment analysis at AJ Bell, adds" 'whether by accident or design, food inflation is at record highs and will be one of the key metrics considered by the Bank of England in their monetary ruminations. While the Bank may deem higher interest rates necessary to tame rampant inflation, the harsh irony is this heaps even more pressure on household budgets in the short term."

The rate of Consumer Prices Index inflation decreased to 10.1 per cent in March from 10.4 per cent in February, according to the ONS. This takes it back to the level seen in January

© Provided by Daily Mail

Riz Malik, director at mortgage brokerage R3 Mortgages, commented, “while increasing interest rates may be a viable strategy to combat inflation, it is crucial to consider the wider implications of such actions. The repercussions of countless interest rate hikes have become painfully evident as the UK teeters on the brink of economic stagnation. It is high time for a re-evaluation of this approach – enough is enough.”

Wes Wilkes, chief executive at wealth management firm Net-Worth NTWRK, agreed, saying "that the Bank of England should not have raised rates today. Raising rates is a knife in this particular inflationary gunfight, but it’s the only weapon Threadneedle Street has,” he remarked. “It is a fight of the bank’s own making due to it being so late in tackling inflation.”

Justin Moy, managing Director at brokerage EHF Mortgages, added "that this would have been the right time for the Bank of England to do nothing after 11 consecutive increases over the past year or so. The markets are telling us all that rates can drop soon once inflation is under control, so to increase the bank rate now seems a little pointless and just ebbs away at the confidence of borrowers, both individual and businesses."

Graham Cox, founder at SelfEmployedMortgageHub.com, believes that "the BoE made the decision to hike the base rate “as not doing so when the Fed and ECB have just raised their rates could cause Sterling to weaken against the dollar and euro. On the other hand, raising rates risks over-tightening and causing huge damage to the economy, talk about being between a rock and a hard place.”

Rob Gill, managing director at Altura Mortgage Finance, pointed out that the rate hike is already “largely priced in by mortgage lenders. There is widespread expectation inflation and interest rates will fall late this year and early next."

Will mortgage rates go up?

Whether or not your mortgage rate will go up may depend on the type of deal you have. While tracker and variable rates are likely to move in response to the raise, but fixed rates are less certain.

The typical cost of new fixed rate mortgages has been pushed up over the past 12 months, despite the cost not being directly linked to the base rate. The average two-year fixed mortgage rate is now 5.26%, with a five-year fix at 4.97%, according to Moneyfacts. This time last year those mortgage rates were 3.03% and 3.17% respectively.

Almost three in five home loans coming up for renewal in 2023 are at rates below 2% according to ONS statistics, well below the current rates being offered by lenders despite the drop in prices since the start of the year. The average borrower coming off a two-year fix at the moment will see their rate rise from 2.57% to 5.26% when they remortgage.

On a £200,000 mortgage being repaid over 25 years, a typical borrower in this situation will see their monthly repayments rise by £296, from £904 to £1,200. That equates an additional £3,552 a year in mortgage payments.

Will tracker and variable rate mortgages rise?

Fixed-rate mortgages are the most popular choice for homeowners in the UK, with around three quarters of borrowers opting for the product. But around a quarter of UK mortgages are on variable deals.

Variable rate mortgages include tracker rates, 'discount' rates and also standard variable rates. Monthly payments on all these types of loan can go up or down. Trackers follow the Bank of England's base rate plus or minus a set percentage, ie base rate plus 0.5%. Standard variable rates are lenders' default rates that people tend to move on to if their fixed or other deal period ends and they do not remortgage on to a new deal.

These can be changed by lenders at any time and will usually rise when base rate does, but they can go up by more or less than the Bank of England's move. Discount rates are deals that track the bank or building society's standard variable rate rather than the base rate. If the SVR changes, so will rates on these.

Mortgage holders on a base rate tracker product will see their payments increase to reflect the Bank of England rise. Those on a variable discount rate or who have fallen onto their lender's standard variable rate, will see their rate change in line with whatever their lender decides to do. Some announce immediately, some wait to tell borrowers. However, most will likely see rates edge up over the coming weeks.

Fixed rate mortgages are expected to level off somewhere between 4% and 5% over the year

© Provided by This Is Money

How high will fixed rate mortgages go?

Fixed mortgage rates are not tied to the base rate, but lenders do often pass on increases in the base rate to customers taking out new fixes. However, despite the base rate continuing to rise, fixed rates have come down from their high in October although they are now seemingly levelling off.

This fall from last year is due to the increase in rates in the wake of the September mini-budget ran well ahead of the base rate rises and so there has been room for costs to fall. However, the picture this time is less certain as fluctuations in swaps – the mechanism most lenders use to set their fixed rates – have made it hard to price fixed mortgage rates.

Nicholas Mendes, of broker John Charcoal, said, 'while the markets have already priced in a 0.25% base rate rise, there continues to be volatility in the markets with swaps over the last few days. These fluctuations are influencing lender pricing, with many lenders increasing their fixed rates in the last few days."

Expectations of a price war seem to have diminished at least in the short term. With the market's inability to settle, we could expect to see further lender increases. Virgin and NatWest have also increased rates. Trying to second guess when the right moment to fix and for how long will continue to be debated amongst many households, and why now more than ever speaking with a broker who can assess your circumstances can ensure you are making the right decision.'

According to Moneyfacts, the average standard variable rate is now at 7.37%, up from 4.78% a year ago. On a £200,000 mortgage over a 25-year term, the rise would mean an additional £317 a month on mortgage payments, or £3,804 more a year.

Markets Unsettled After Bank of England Rate Hike

An unsettled feeling has descended on indices after the Bank of England failed to rule out further rate hikes and investors turn jittery again about deposit flight from the US regional banking sector. The FTSE 100 retreated during afternoon trade, though regained a little ground later in the session, after a chill emanated from the Bank’s warning that inflation will take longer to come down than expected, while a lower open on Wall Street froze confidence out further.

Investors are now zeroing in on troubles at PacWest, after the lender said deposits fell by almost 10% last week and was forced to pledge more assets to the Fed in return for increasing its borrowing capacity. With yet another regional bank taking emergency action in response to fleeing customers, worries about the fragility of the regional banking sector show little sign of abating.

The game of whack a mole has resumed – with fresh problems popping up as soon as regulators and larger lenders find solutions to others.Consumers in key markets have having to make difficult choices about where to spend dwindling incomes and concerns about what else could lie ahead prompted shares to slide, helping to drag down the S&P 500.

Oil prices have retreated again, with Brent crude nudging back to around $75, as worries persist about falling demand. Energy and mining companies were among the biggest fallers on the FTSE 100 as investors assess the impact of a slowing global economy on appetite for commodities. A fresh rate hike from the Bank of England and worries that it may not be the last have been weighing on house building stocks in afternoon trade.

There had been signs that house price wobbles were stabilising, but with expectations that the Bank could be forced to push rates up to around 5%, this would dampen down enthusiasm for expensive new house purchases. As more and more people reach the end of mortgage deals, and are forced to remortgage at higher rates, this has the potential to dent any newfound optimism in the market.

After rising immediately after the rate hike, the pound has once again retreated below $1.26. While the Bank of England is forecasting the UK may avoid a recession, the economy still looks like its stagnating and tomorrow’s GDP snapshot will give a sharper reading. Although sterling has strengthened significantly since the disastrous days of the Truss administration last September, it remains very weak compared to the level it traded at before the vote for Brexit.

This intensifies the inflationary headache for the Bank of England as it makes the cost of imported goods more expensive, fuelling scorching consumer prices.