New data reveals that UK Build to Rent investment exceeds £1.1bn in Q1 2023, as rental demand soars and investor appetite remains.

Initial data reveals that investment into UK Build to Rent in Q1 2023 exceeded £1.1bn – demonstrating investor appetite for opportunities across the sector. Rental demand sours amid first time buyer affordability challenges, which have been further exacerbated by the likes of the removal of Help-to-Buy and the recent rises in mortgage rates.

The analysis – conducted by BNP Paribas Real Estate – shows that the Build to Rent sector recorded this strong recovery following total volumes in 2022 equating to around £4.3bn – hitting an investment record for its fourth consecutive year.

Notable Build to Rent investment deals in Q1 2023 include the PGIM purchase of the Goldman Sachs portfolio for single-family homes in Manchester and Liverpool for £190m, the Harrison Street, NFU Mutual and Apache forward funding on Moda’s Great Charles Street for £302m, and Realstar’s £108m forward funding deal for Phase 2 of UNCLE Leeds.

Whilst other sectors have noted a more obvious slowdown in investment activity, the Build to Rent sector has recorded a significant uptick of recent, particularly across both regional cities and in new territories such as single-family housing. Investors paused for breath after the turbulence as a result of Liz Truss’s leadership and the worsening economic conditions, but we can see resilience and strong rental growth has resulted in a strong start to the year, in line with comparative quarters where economic conditions were more positive.

Rebecca Shafran, Senior Associate Director, Alternative Markets Research, "of the £1.1bn invested, BNP Paribas Real Estate estimates that around 75% to 80% of investment activity was outside of London – around major regional cities such as Manchester and Birmingham, and into single-family housing in suburban areas. The company is also seeing an increased appetite for London and London commuter belt development opportunities, as new investors seek out lower risk locations. Investment interest and allocation of capital remains strong across the entire living sector, led by Build to Rent, student accommodation and single-family housing. New investors have also entered the market in the last 12 months with a lower cost of capital, increasing demand for investment opportunities and we anticipate a stark increase in transactions towards the end of the year, particularly across London, commuter belt and key regional cities. However, as it stands, higher interest rates are impacting investor levered returns, resulting in a shift of some investors towards higher yielding or value-add living sector investments.”

Andrew Screen, head of residential capital markets at BNP Paribas Real Estate, "evidencing shifting housing requirements, Strutt & Parker’s latest Housing Futures survey of 2,000 people from across the UK provides insights into what consumers want from their next home and how they would like to live in the future."

The survey found that 67% said sustainability of their future home was important to them when decision making. Of this 67%, around a third (31%) would compromise on the size of rooms, and 30% on the number of bedrooms to have a more sustainable home. Commute, at 38%, was highlighted as the most negotiable aspect.

What is Build to Rent?

Build to Rent are new build developments designed specifically for renting. They come with a range of perks from longer tenancies to a dedicated on-site manager and purpose built communal spaces, as well as a premium price tag. Here's everything you need to know about Build to Rent.

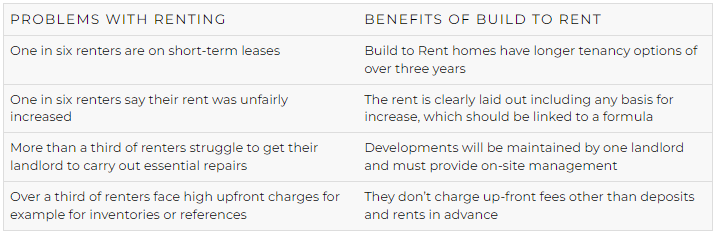

Renting comes with its issues. According to our 2019 Annual HomeOwners Survey conducted by YouGov, four in ten renters are stuck in cold, damp properties that their landlord’s refuse to repair. Meanwhile 17% of renters are on short-term leases with no security that they will be able to live in their home for the long-term. While improvements to the rental sector are slowly trickling through, the issues highlighted in our research are likely to be a feature of a private rental sector for years to come. Buying a home addresses a lot of the insecurities and unattractive aspects of renting, that’s not an option for everyone. So how can the relatively new trend of Build to Rent properties help?

Build to Rent describes new build apartment blocks that have been built specifically for renters. They have to include at least 50 homes and they are all owned and managed by one landlord. They have been created to address many of the problems that renters face from short-term leases to unscrupulous landlords to sky-high fees.

Build-to-rent homes are designed, constructed and managed specifically for people renting. They aim to redefine the entire experience of renting a home. Build-to-rent apartment developments have a range of in-house luxury conveniences, most of them included in the rent. On top of stylish furnishing, there are gyms, cinemas, communal chill-out zones and gardens, concierge services and even in-house baristas for your pre-work flat white at no extra cost.

The number of Built to Rents currently available is small – there are 20,800 across the UK – but it is a growing area. There are a further 118,000 under construction or in the planning stages. The British Property Federation predict that there will be 200,000 Build to Rent sites being developed within the next two years. Given that there are an estimated five million rental properties in the UK, Build to Rent represents a very small percentage, but it is growing.

What are the benefits?

Here at the Homeowners Alliance our 2019 Annual HomeOwners Survey found renters face a litany of problems in the private rental market. Build to Rent could address a lot of these problems.

The big benefit is having one landlord responsible for managing and operating the whole development. This should make it easier for tenants to get in touch with the landlord and get problems resolved quickly.

But, an added benefit is the landlord must have a complaints procedure in place and be a member of a recognised ombudsman scheme. This means if things do go wrong tenants should have a clear way to complain and get issues addressed.

Will Build to Rent make things better for renters?

Our research suggests the benefits of Build to Rent could be significant. Almost half of renters told us that paying no additional up-front fees beyond a deposit and rent advice would have a major positive impact on their rental experience.

On top of that, 40% said they would appreciate renting directly from a responsible company or housing provider rather than a private landlord or lettings agent.

Over a third said renting a high-quality home which complied with safety and energy efficiency standards would significantly improve their rental experience. That’s hardly surprising when you consider that more than a third of renters can’t currently get their landlords to perform basic repairs or provide them with a warm, dry home, according to our research.

The disadvantages

So, are there any disadvantages to Build to Rent? Yes. Firstly, there aren’t enough developments and they are very concentrated in London at present. As of March 2019, there were 20,800 Build to Rent homes across the country, with 12,000 of those in London.

Secondly, you may not qualify to live in the existing Build to Rent developments. That’s because many of the ones that are already built are targeted at specific demographics such as over 55s or young professionals or people with pets. Finally, and most significantly, living in a Build to Rent property isn’t cheap.

Is Build to Rent affordable?

All the benefits of Build to Rent don’t come cheap. The extra facilities and services mean the average rent on these developments is higher than the norm. JLL’s Build to Rent Report 2018 found that the average rent on a Build to Rent home was 9.3% higher than the average rent for the local area. In London Build to Rent homes cost an average 8.4% more than other rental homes.

With many offering communal workspaces, laundry services, concierge, event spaces and gyms it isn’t surprising they can come at a premium. But this high-spec living is only likely to be affordable for high earning young professionals.

Paying a premium for your rent is going to make it even harder to save if you are hoping to one day buy your first home. If you are looking at rental but one day want to afford to buy, take a look at our saving for a deposit guide. Other government schemes (Rent to Buy and Shared Ownership for example) may also enable you to get on the property ladder while renting.