Inflation and high interest rates hit renters and landlords – but investors can mitigate impact.

Economist welcomes chancellor’s package but warns of economic cost if household expenditure drops.

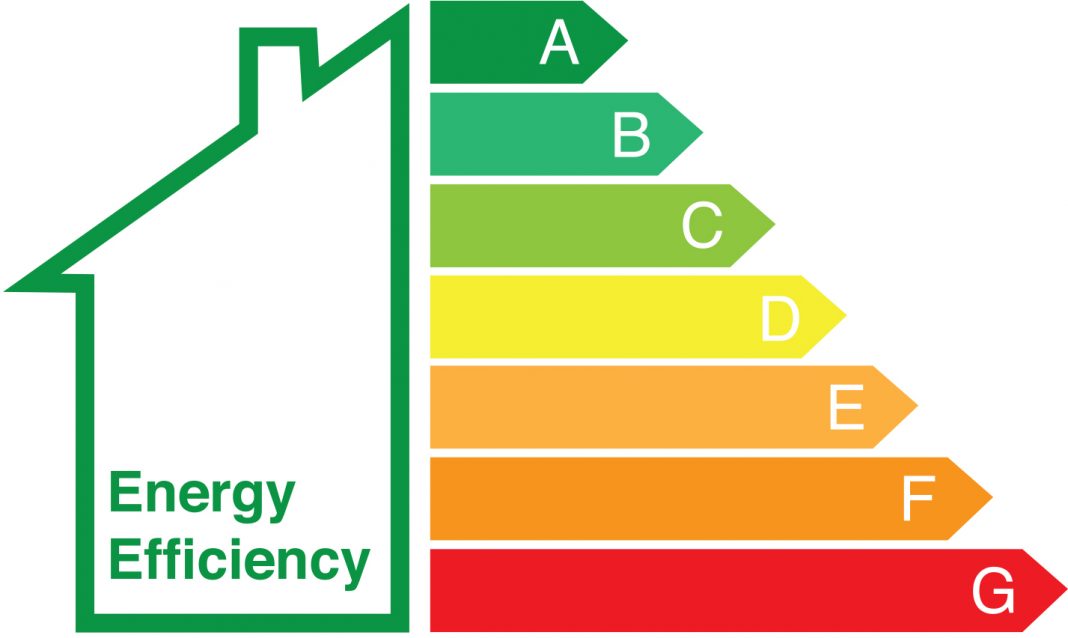

A new survey gives an indication of how quickly properties with poor Energy performance Certificates are falling out of favour in the private rental sector.

New research has revealed that the number of rental properties within the UK property market has climbed by over 1.1m in the last decade, placing the UK in the top 10 globally when it comes to the balance between homeownership and renting.

Schofields Insurance has claimed that there are pros and cons for and against second homes as the dispute about second home owners pricing out locals continues to rage.

It’s been more than two years since the start of the pandemic, and the importance of our homes has never been more in focus.

- Is the Property Market Boom Over?

- Inflation Jumps to Highest Level In 40 Years

- Empty Homes Clampdown Will Boost Supply

- Biggest Change to Renters Law in A Generation

- 1 In 30 Homes Are Being Downvalued By Lenders

- When is a property sale most at risk from money laundering?

- What Support Is Available For Property Owners With Cladding Issues?

- April House Price Index Revealed