Looking back at the housing market in 2025 and what we can expect from the UK Housing Sector in 2026.

The word that best describes the housing market in 2025 is ‘resilient’. Even though consumer sentiment was relatively subdued, with households reluctant to spend and mortgage rates around three times their post pandemic lows, mortgage approvals remained near pre-Covid levels.

Stamp duty changes that took effect at the beginning of April created volatility through the spring and summer. Activity spiked in March as purchasers brought forward transactions to avoid paying additional tax, and this led to some softness in the following months. However, the underlying picture was little changed as demand held up well throughout.

House prices evolved broadly in line with our expectations. Annual price growth slowed steadily from 4.7% at the end of 2024 to 2.1% in the middle of 2025 and then to 1.8% in November. As a result, prices were close to the all-time high recorded in the summer of 2022 as the year drew to a close.

With price growth well below the rate of earnings growth and a steady decline in mortgage rates, affordability constraints eased somewhat, helping to underpin buyer demand. The first-time buyer share of house purchase activity was above the long run average, supported by easier credit availability, with the share of high loan to value lending (i.e. with a deposit of 15% or less) reaching its highest level for over a decade.

Regional trends: Northern Ireland outperformed by a wide margin

Annual house price growth in Northern Ireland outpaced the rest of the UK by a wide margin, averaging 11% in the first nine months of the year, almost four times faster than the 3% recorded in the UK as a whole and more than double the 5.1% recorded in the next strongest performing region (the North of England). This strong performance mirrored that in the border regions of Ireland over the same period.

Despite these significant price gains, house prices in Northern Ireland are still around 6% below the all-time high recorded in 2007, while UK prices are almost 50% higher over the same period. As a result, the price of a typical home in Northern Ireland is currently around 79% of the UK average price, while in 2007 it was around 25% higher.

Wales broadly matched the wider UK trend in 2025, while Scotland saw a marginally stronger rate of house price growth.

London was the weakest performing region in the first nine months of the year with annual growth averaging 1.3%. This was part of a wider trend that saw house price growth in the northern regions of England outpacing the southern regions. As a result, the price differential narrowed to its lowest since 2013. The average price of a home in northern regions of England is now almost 58% of that in the southern regions, well above the lows of c48% seen in 2017.

Growth Hotspots

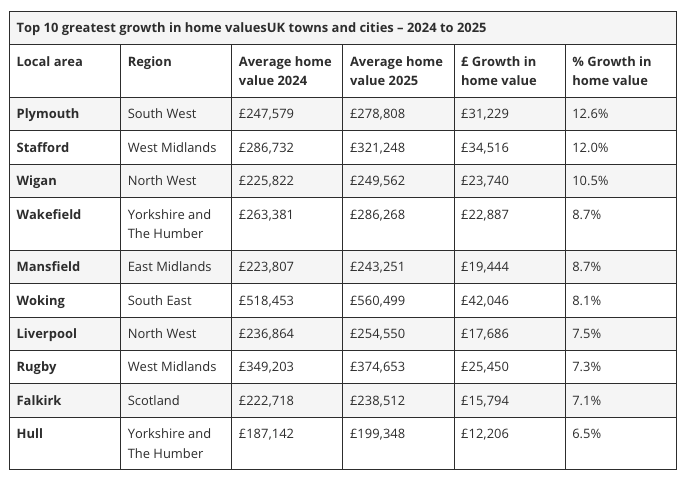

Plymouth saw the steepest rise in the value of homes during the past year, research shows.

Analysis by Lloyds Banking Group found average prices are up 12.6% in the city.

Stafford and Wigan also recorded double-digit growth, up 12.0% and 10.5% respectively.

Budget 2025: How it affects landlords, homeowners and buyers

Income tax surcharge for landlords

Landlords in England, Wales and Northern Ireland will pay higher Income Tax on their property income from 6 April 2027. Property Income Tax rates will be set 2% above the regular rate of Income Tax for that tax year, making them:

- 22% for income between £12,571 and £50,270

- 42% for income between £50,271 and £125,140

- 47% for income over £125,141

- Property income will be taxed before savings and dividend income, but after any other form of income such as employment or pensions. A landlord who makes £50,000 from their day job and £10,000 from their property investments would therefore pay the 42% property higher rate on all income over £50,271.

The government has also rejigged rules on allowances and reliefs, including the £12,570 personal allowance. These will now be applied to income that isn’t from property, savings or dividends first, meaning that more of landlords’ income will attract property Income Tax.

However, the basic rate relief for mortgage interest payments will be applied at the new property basic rate of 22% instead of the current rate of 20%.

And the rumour that National Insurance could be applied to rental income also hasn’t come true, saving landlords from a potentially much higher tax bill than the Income Tax adjustment.

High-value properties to attract “Mansion Tax”

A new High Value Council Tax Surcharge will be applied to high-value homes in England from April 2028. Homeowners will be charged:

- £2,500 a year for properties worth £2 - 2.5m

- £3,500 a year for properties worth £2.5 - 3.5m

- £5,000 a year for properties worth £3.5 - 5m

- £7,500 a year for properties worth over £5m

Properties will be valued by the Valuation Office in 2026, and then revalued every five years. From 2029-30, the charges will be increased in line with CPI inflation – but the government hasn’t said if the thresholds will be updated. Many of the details will be consulted on next year.

The vast majority of properties won’t be touched. Estate agency Knight Frank estimates that 190,000 homes will be affected when the new tax comes into force in 2028. At last count (in 2023), the Department for Levelling Up, Housing and Communities estimated that there were 25.4 million homes in England.

But for those high-priced homes, the Treasury estimates that it will knock an average of 2.5% off the value, or £50,000 off a £2 million home.

Private Rented Sector (PRS)

It’s safe to say that 2025 has been one of the most significant years for the Private Rented Sector (PRS) in recent memory.

With the Renters’ Rights Act finally passing into law after months of amendments, votes, and back and forth, reform is set to sweep across the sector.

Key provisions include:

- Abolition of Fixed-Term ASTs: Tenancies now default to periodic arrangements, offering greater long-term security for tenants.

- End of No-Fault Evictions: The Section 21 process for no-fault evictions was abolished. Landlords must now rely on legitimate grounds under Section 8 to regain possession.

- Enhanced Tenant Protections: Tenants benefit from limits on rent increases, rights to request pets (subject to landlord approval), and strengthened minimum property standards.

- Compliance and Reporting: Landlords face increased reporting obligations, safety checks, and energy efficiency requirements, with a national PRS database and oversight expected in future phases.

The private rented sector (PRS) remains a vital component of the UK housing landscape. In 2025, rental demand was high, though growth began to moderate in certain regions.

Average Rents: By mid-2025, average monthly rent in the UK reached £1,339, a 7% increase year-on-year. In England alone, the figure was approximately £1,399.

Regional Variations:

- North East: Highest annual growth, up 9.7% in June 2025.

- Yorkshire & The Humber: More modest growth, around 3–4%.

- Market Moderation: Rent inflation has shown early signs of slowing, influenced by falling migration, changing demand, and macroeconomic pressures. Late 2025 saw rent rises at the slowest pace in four years in some areas, according to market reports.

What happened to housebuilding in 2025?

Planning approvals show that only 208,000 homes were approved in the last year, down 15%, leaving Housing Secretary Steve Reed well short of his target.

The Government’s 1.5 million new homes target is looking like a forlorn hope after the latest set of planning figures were released.

New data from the Ministry of Housing, Communities and Local Government reveals that permission for 208,000 homes was given in the year to September, when 300,000 new builds per year are needed.

That total is down 15% from the 245,000 homes granted permission in the year to September 2024 at a time when ministers want to see building ramped up.

Housing Secretary Steve Reed (main picture) has been quoted as saying his priority was ‘build baby build’ as he tries to galvanise the country to create more homes.

Other figures show that 37,700 decisions were made on applications for residential developments, of which 28,500 (76%) were granted, down 8%.

Major residential developments granted were 3,700, down 3% from the previous year.

This news comes as the Planning and Infrastructure Act, which is designed to speed up approvals, was passed late in December 2025.