Chaos has surrounded the delivery of Chancellor Rachel Reeves’ second Budget. The Office for Budget Responsibility (OBR) accidentally released full details of the Budget even before Reeves spoke in the Commons.

Rachel Reeves revealed a much-expected mansion tax and also higher income tax for landlords during her parliamentary statement.

The Budget’s main headlines are:

- Mansion tax introduced on properties worth more than £2m, taking effect from 2028;

- Higher National Insurance on property and dividend income;

- Freeze on tax thresholds extended by three years;

- Two-child benefit cap to be scrapped from April 2026;

- Fuel duty to be frozen until next September;

- Salary-sacrifice pension contributions above £2,000 to be taxed;

- New mileage tax for electric vehicles from April 2028.

Here are the main tax rises in detail:

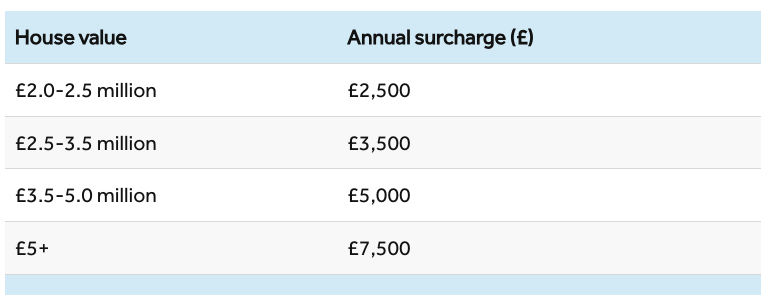

- Mansion tax: A council tax surcharge ranging from £2,500 to £7,500 annually, on properties worth over £2m – raising £0.4 billion;

- Freezing tax thresholds on personal tax and employer National Insurance contributions thresholds for three years from 2028-29 – raising £8bn;

- Pensions: Taxing salary-sacrificed pensions contributions – £4.7bn;

- Property, savings and dividends: Increasing the tax rates on dividends, property and savings income by 2 percentage points – £2.1bn;

- Corporation tax change: Reducing the writing down allowance main rate in corporation tax – £1.5bn;

- Electric vehicles: A new mileage-based charge on battery electric and plug-in hybrid cars from 2028 – £1.4bn;

- Gambling: Changes to taxation of gambling – £1.1bn;

- Reduced capital gains tax relief on disposals to employee ownership trusts – £0.9bn;Tax admin and debt collection: Tax administration, compliance and debt collection measures – £2.3bn;

- Fuel duty: These tax rises are partially offset by a freeze to fuel duty for a further five months, followed by staged increases from 2026, costing £2.4bn next year and £0.9bn each year afterwards;

- Other taxes: A range of other tax measures, including a Sizewell C levy raise a further £4.4bn

What the Autumn Budget Means for the Property Market

No Change to Stamp Duty

The government has chosen to leave Stamp Duty Land Tax (SDLT) unchanged. Given how disruptive previous SDLT reforms have been for transaction volumes, this continuity may be seen as a stabilising move. Buyers at typical price points avoid any new up-front tax burdens, which should help maintain market activity.

New Annual Surcharge on Homes Over £2 Million

From April 2028, a new annual charge will apply to properties valued above £2 million:

Homes between £2 million and £2.5 million will face an approximate £2,500 yearly levy.

Properties worth more than £5 million will pay around £7,500.

This is designed to target wealth concentrated in the highest-value homes. Although it affects only a small percentage of properties nationwide, it introduces a meaningful additional ongoing cost for those at the top end of the market.

Increased Tax on Rental Income

Landlords and property investors will face higher taxes from April 2027. Standard income-tax rates on rental income will rise by two percentage points, increasing the basic, higher and additional rates to 22%, 42% and 47%.

This is another squeeze on private landlords, who have already weathered a series of cost pressures in recent years. Reduced net yields may lead some to reassess the viability of their portfolios, potentially increasing the trend of landlords leaving the market.

What Didn’t Happen

Notably absent were several widely discussed proposals: there is no broad annual property tax, no restructuring of council tax bands, and no overhaul of SDLT for mainstream buyers. This will come as a relief to many homeowners who feared more sweeping changes.

What This Means in Practice

First-Time Buyers and Typical Homeowners

For the majority of households, the impact is minimal. With SDLT unchanged and no new tax pressures on moderately priced homes, first-time buyers and typical purchasers benefit from a relatively steady financial environment. This stability may help support confidence in the market heading into next year.

Landlords and Buy-to-Let Investors

The rental tax increase is likely to be felt more keenly. It may push some landlords toward rent increases to offset reduced margins, while others may choose to downsize or sell their portfolios altogether. Any decline in supply could add further pressure to rental prices, particularly in high-demand areas.

Owners of High-Value Homes

For those with properties above £2 million, the new surcharge could become a significant factor in ownership decisions. Some may bring forward planned sales to avoid the charge once it comes into force, while others may find that higher carrying costs affect affordability calculations for future purchases. The luxury end of the market may see more cautious price negotiation as buyers price in the new annual costs.

Overall Market Outlook

The Budget is unlikely to cause major shockwaves across the broader housing market. The lack of changes to SDLT removes a potential source of volatility, and the new surcharge is confined to the upper end of the market.

However, the private rented sector remains fragile, and the tax changes aimed at landlords could reduce rental supply further. If demand remains steady, this could continue to place upward pressure on rents over the coming years.

Why Not Relaunch The Investor Visa?

Campaign group Foreign Investors for Britain (FIFB) is calling for the launch of an investor visa for the UK.

FIFB estimates that an investor visa would raise £225 billion over a decade through a combination of a fixed annual charge of £200,000 and a minimum investment of £2.5 million over the ten years.

The group made the case for a new visa at its Investment and Growth summit at the House of Lords last week.

Leslie MacLeod-Miller, chief executive of FIFB, said “the closure of the Tier 1 Investor Visa in 2022 created a vacuum for productive foreign capital. At the same time, the non-dom tax changes did not find the right balance for the UK to be internationally competitive to retain and attract foreign investment.

The Global Investor Visa is not merely a tool for attracting capital but a vital lifeline for securing Britain’s economic future amidst fierce global competition for investment.”

The non dom departure

Under the previous regime, non-doms could live in this country without paying UK tax on their overseas wealth. New residence-based rules were introduced in April that have a four-year time limit and mean overseas assets are subject to UK inheritance tax.

As a result, a large number of non-doms have left for countries including the UAE, Switzerland and Italy, though some have kept hold of their UK properties.

The more hostile environment faced by wealthy overseas investors, which also includes increased stamp duty for additional homes, means prime property markets have slowed this year.

Prices in prime central London fell 4% in the year to October, compared to average UK growth of 1.9%.

The government recently lost £2.5 million on a single deal thanks to the pre-Budget uncertainty, according to Stuart Bailey, head of prime central London sales at Knight Frank.

Bailey said “we’ve lost transactions because buyers have believed some of the speculation and pulled out. One of those transactions had two and a half million pounds of stamp duty attached to it. You can imagine how many millions the government has lost as a consequence.”