The UK’s rental supply crisis is now most acute in towns as more renters are priced out of cities, according to Q2 2025 research by flat-share site, SpareRoom.

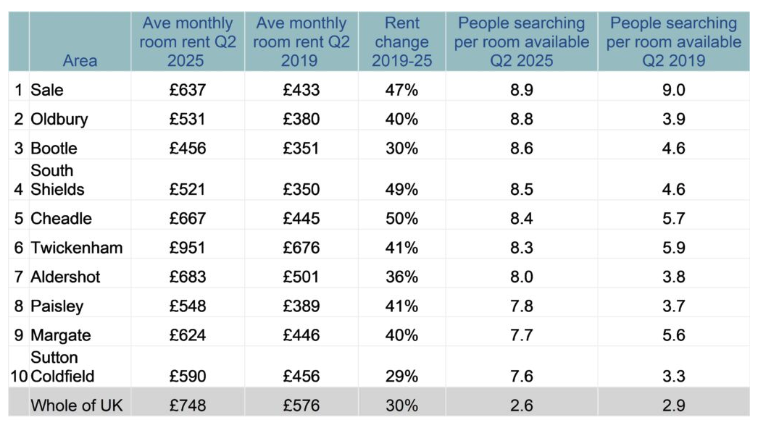

Sale, near Manchester, is seeing the fiercest competition among flat-sharers in the whole of the UK, with 8.9 people searching for every room available. The average room rent here is £637 per month, compared to £689 per month in Manchester – a saving of £624 a year.

Second in demand is West Midlands market town Oldbury, linked to Birmingham by a 12-minute train, but where rents – at £531 per month – are £984 per year cheaper than rents in Birmingham (£631pm).

The Merseyside town of Bootle is the cheapest place to rent in the whole of the UK at £456 per month, and it’s seeing huge demand among renters with 8.6 people searching per room available.

Being driven further out

Those priced out of inner London are driving demand in Twickenham and Aldershot in Surrey where demand is around eight people searching per room available.

Only two cities appear on the list of the highest-demand areas of the UK among renters, further evidence that renting has become so unaffordable in cities, even flat-sharers are being driven further out. Demand has more than doubled since 2019 in Oldbury, Aldershot, Paisley, Sutton Coldfield, and Solihull.

However, some towns may soon become unaffordable to flat-sharers, too. Compare rent increases since 2019 in these highest-demand towns against the average for the whole of the UK (30%) and most have seen higher-than-average rises, with increases in Cannock (69%), St. Helens (65%), and Salford (60%) the highest, and more than double the UK average rent rise.

The table below shows the top ten most in-demand areas of the UK among renters, where more than five people were looking per room available to rent in Q2 2025:

Zoom out and rental supply across the UK is rising, driven largely by ads – placed by both landlords and agents, and by lodger landlords – for rentals outside of Greater London. However, supply could be impacted by landlords reacting to the Renters’ Rights Bill which begins its final stage in the House of Lords Monday.

Matt Hutchinson, director of SpareRoom, said “across the country, rental supply in the flatshare market is still rising but that doesn’t do justice to the picture in suburbia, which is groaning under the weight of demand from renters priced out of city living. When renters reach their ceiling of affordability, there isn’t really a choice, they have to move somewhere cheaper. The worry is that demand in these areas is now so high it’s inevitable prices will rise, until average rents are similar to those in the city they originally moved out of. And then where do renters go?”

2nd Cities offer strongest yield growth for investors

A new wave of UK ‘second cities’ is delivering the strongest growth in rental yields, research shows.

These emerging markets are offering investors the chance to achieve attractive returns, driven by rising rents and comparatively lower entry costs compared with the traditional major hubs.

West One Loans analysed both rental market data and house prices across the UK’s 63 largest cities and towns, combining these to calculate estimated yields for 2025 and comparing them with figures from 2023 to identify where growth has been strongest.

The research shows that Glasgow currently offers the highest average yields for investors, but it is Ipswich, Leicester, and Portsmouth that have seen the fastest growth in yields over the last two years.

Ipswich leads this growth with an estimated yield increase of 1.1 percentage points, rising from 4.1% in 2023 to 5.2% in 2025.

Leicester follows closely with a 1.0 percentage point rise to 5.3%, while Portsmouth has seen its yield climb by 0.9 percentage points to 6.3%.

Other notable second cities showing strong growth include Norwich, Exeter, Reading, and Southampton, all registering increases of around 0.9 percentage points over the same period, reflecting a combination of rising rents and manageable property price growth.

This highlights the rise of a new wave of second cities, where rental prices are increasing and property values remain comparatively affordable, giving investors the potential for strong returns without the higher entry costs of the major hubs.

As urban regeneration projects continue to reshape many of these cities, the opportunity for development finance in these emerging markets is significant. Whether for first-time investors or seasoned developers, West One Loans offers tailored finance solutions, including development exit finance and bridging loans, to support investors looking to capitalise on these high-growth opportunities.

A West One spokesperson says “Birmingham and Manchester are no longer second cities and are now on a similar footing to London when it comes to investment, regeneration, and popularity, not just for residents, but also for property investors. However, high demand and rising property prices mean initial investment costs are significant. This has created an opportunity for a new wave of second cities, where investors can access more favourable deals and benefit from strong yield growth, particularly when using specialist finance solutions to support urban regeneration and property investment projects.”