England’s PRS stayed robust in August, with average monthly rents hitting £1,480 per property, just shy of the record set in July, according to the Goodlord Rental Index.

This figure marks the second-highest rent since the index began tracking data in 2019.

Despite a slight 1% dip from July’s peak of £1,496, rents are up 2.9% compared to August 2024, adding £504 annually to tenants’ bills.

The firm’s chief executive, William Reeve, said “It’s been another busy month for the market. Whilst it was unlikely that we would see July’s average rent record broken, the regional picture across Greater London, the South East and the East Midlands shows that we haven’t hit the rental price ceiling just yet. We are expecting another month of high rents in September, before things start cooling off as we move into the autumn.”

The next six months will be pivotal for the market; the pace of rent inflation is going down and there are indications that supply, and demand pressures are slightly easing. Combine this with the disruption that the Renters’ Rights Bill will bring, and potential tax changes for landlords in the Budget in the autumn, and we’re in for a very interesting period for the sector.”

Goodlord’s data shows that the South East led with a striking 11% monthly increase, pushing average rents past £1,600 for the first time.

Greater London followed, with a 5.5% rise, reaching £2,322, the second-highest average ever for the capital.

The East Midlands also saw a notable 4% uptick. However, not all regions followed this trend with the North West experiencing a sharp 20% drop from July’s high.

The North East, South West and West Midlands also reported lower averages.

While rents climbed 2.9% year-on-year, the pace of growth is slowing and in March there was a 4.6% annual increase, suggesting a potential stabilisation of rents in 2026.

The North West and Greater London recorded the largest annual gains at 6.6% and 5.3%, respectively.

In contrast, the North East saw a slight dip, with averages falling from £1,107 in August 2024 to £1,106 in 2025.

Goodlord also says that properties sat empty for longer in August, with voids increasing from 12 days in July to 15 days, matching last year’s figures.

Rightmove

Average advertised rents across Great Britain hit a new high of £1,577 per calendar month in August, 3% higher than last year. It comes as constrained supply continues to push prices up, according to the latest figures from Rightmove.

However, the imminent return to the table of the Renters’ Rights Bill on Monday and the possibility of taxation on landlord rental income also looming in the autumn budget continues to unnerve landlords.

Rightmove’s landlord insights suggest that one in three landlords say they are considering exiting the market at some point, with two-thirds (66%) feeling unsupported by the government.

Legislative changes such as new taxation and regulation (68%) topped the list of landlord frustrations which is driving some to plan on decreasing their property portfolio over the next year.

However, in the short-term, half (51%) of surveyed landlords plan to maintain the size of their portfolio over the next year, and one in five (20%) are looking to increase it.

Rental supply remains low

Rental supply has improved, with the number of available homes to rent now 8% higher than at this time last year. However, this is the lowest this figure has been in 2025 and the number of available homes to rent is still 27% below the same month in pre-pandemic 2019.

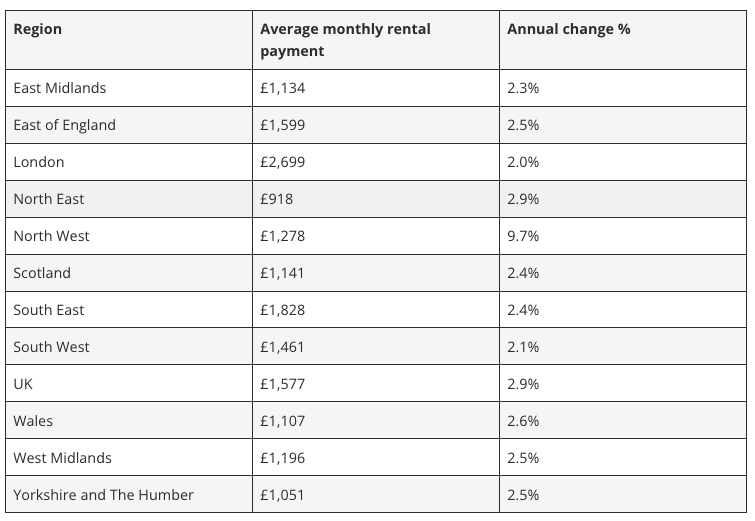

Regionally, rents are rising fastest in the North West, with average rents 10% higher than a year ago, and slowest in London, where average rents are now 2% higher than this time last year.

August monthly rents

The latest picture of buy-to-let lending is also encouraging, according to Rightmove. The total number of buy-to-let loans given for residential investment in the first six months of this year was 16% higher than the first half of last year, according to the latest UK Finance data.

The number of loans for new rental home purchases is also outpacing remortgages, with a 23% uplift in number of loans for new rental home purchases versus a 14% increase in buy-to-let remortgaging.