The housing market is off to a strong start in 2025 amid the rush to beat the drop in Stamp Duty thresholds this April, Zoopla data suggests.

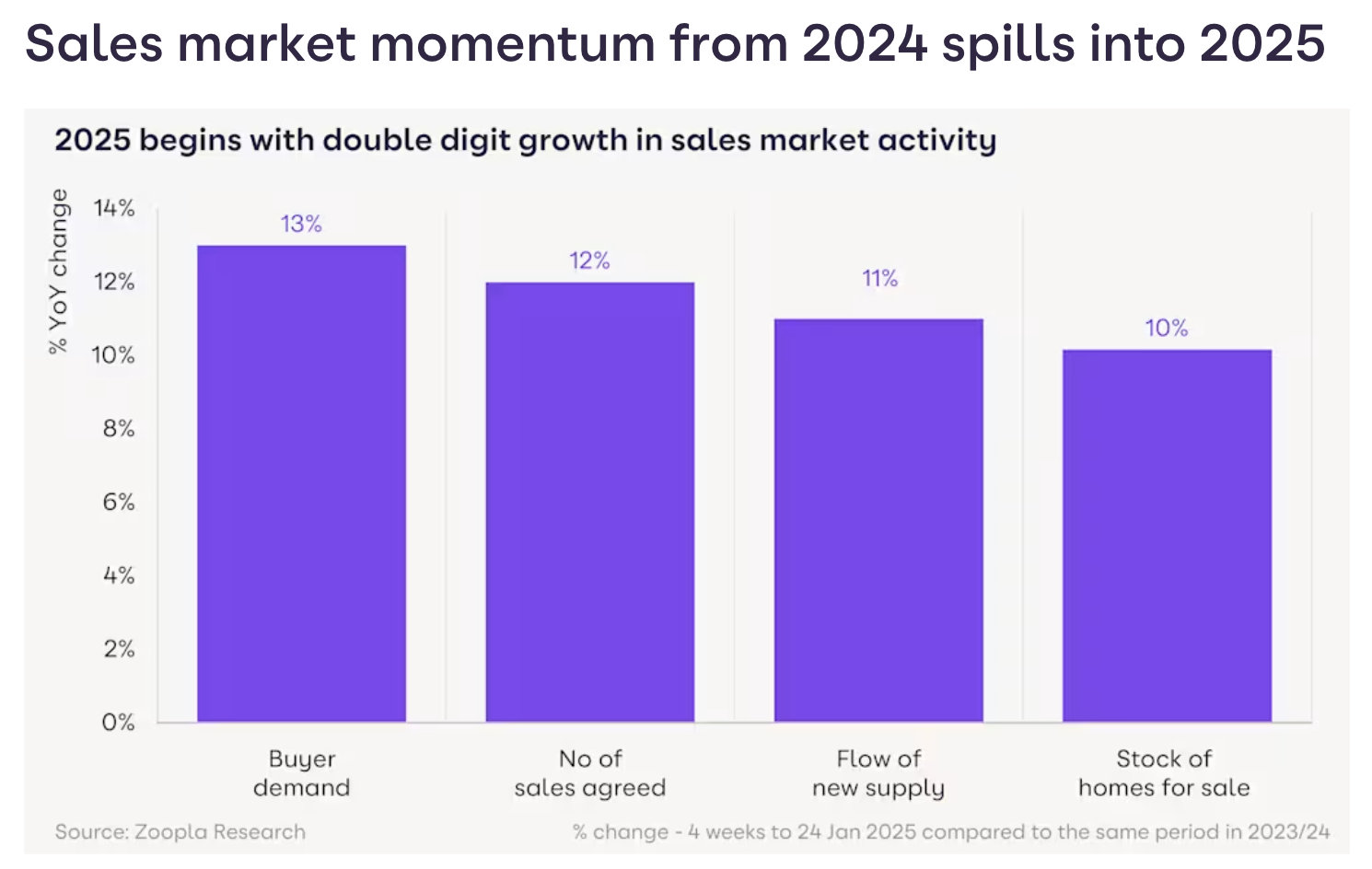

The portal’s latest house price index shows new sales agreed are up 12% annually.

The number of homes for sale is also 10% higher, with 31 listings per agency – the highest level for seven years.

Demand for homes is also 13% higher than the same time last year, Zoopla said.

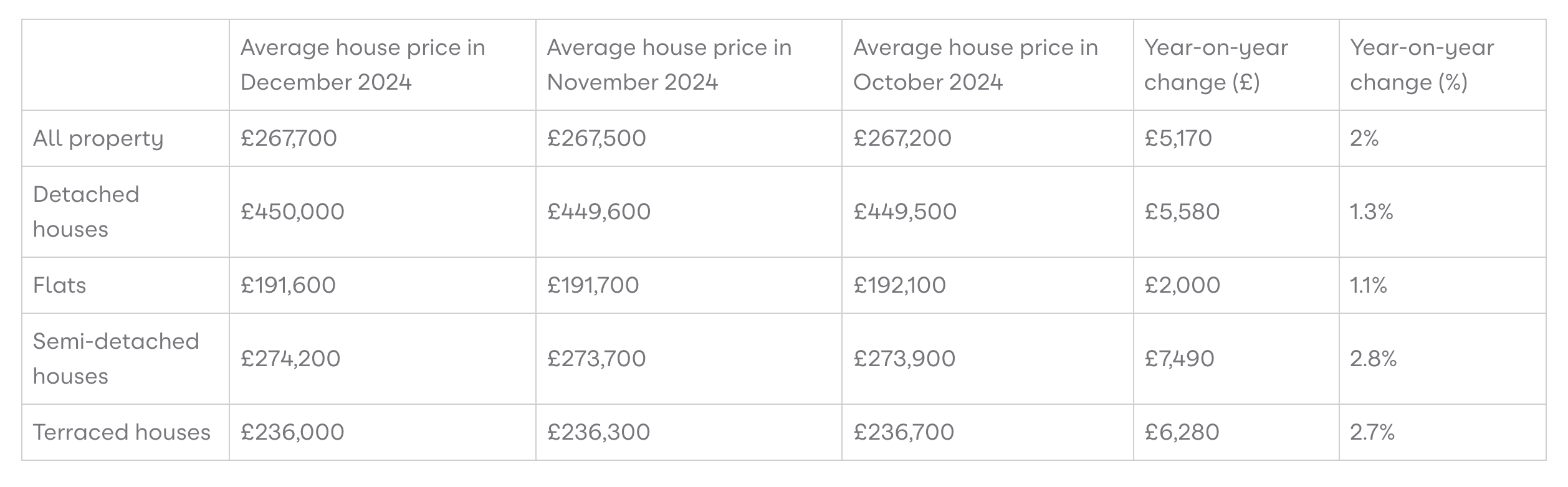

The portal said the annual rate of UK house price inflation is running at 2%, up from -0.9% a year ago, with sales growth supporting modest price gains. This is the highest level of house price growth since April 2023. The average UK house price is £267,700 as of December 24, an increase of £5,200 over 2024 following a £2,400 decline in 2023.

In some bad news for first-time buyers, Zoopla warned that it is now too late to agree and complete property purchases before the end of March 2025 and pay lower Stamp Duty.

But Zoopla’s monthly Consumer Tracker shows there has still been an increase in the proportion of households looking to buy in the next two years at 22% among renters and 17% for existing homeowners compared with a year ago.

The property website said it is a positive sign that first-time buyer demand remains higher year-on-year, in line with the wider market, which it said suggests claims of a “cliff edge in home buyer demand” after April are overdone.

Richard Donnell, executive director at Zoopla, said “the first few weeks of each year tend to provide a clear indication of how the rest of the year is likely to unfold. 2025 has started well, better than 2024 and 2023 which bodes well for market activity over the rest of the year, supported by evidence of more people looking to move.

It is important not to read too much into the increase in Stamp Duty for more buyers from April as three in five first-time buyers will still pay nothing from April. The extra costs to homeowners remain manageable and unlikely to reduce sales but they will keep price rises in check.”

Zoopla is forecasting that the healthy stock of homes for sale will keep price rises in check and predicts a 2.5% rise for 2025, with 5% more sales than last year at 1.15m.

Donnell added “rising incomes and base rate cuts will improve affordability and support consumer sentiment.”

Commenting on the research, Tom Bill, head of UK residential research at Knight Frank, took a different views, adding “demand in the UK housing market feels artificially high. As well as the prospect of higher Stamp Duty from April, a number of borrowers are sitting on sub-4% mortgage offers that pre-date the Budget, which will support prices and transaction volumes in the first quarter of this year. As the impact of higher mortgage costs kicks, we expect a period of downwards pressure on house prices that will only be alleviated once rate cut expectations rise.”

Gareth Samples, chief executive of The Property Franchise Group, said “the year has started with an increase in market activity, with property transactions expected to be much healthier this January compared to last year. This is driven by factors such as marginally lower mortgage rates, a robust sales pipeline, and more favourable market conditions. Many prospective buyers who were waiting for mortgage rates to drop, have also been spurred on by the upcoming Stamp Duty changes and are hoping to get their transaction over the line before April. While some may have preferred to wait longer for mortgage rates to ease further, the looming deadline has motivated them to accelerate their plans.

The increased demand, coupled with an improving economic outlook, is helping to sustain house prices. While we may see demand moderate somewhat after the Stamp Duty changes, factors like the anticipated interest rate cuts are expected to bolster market confidence.”

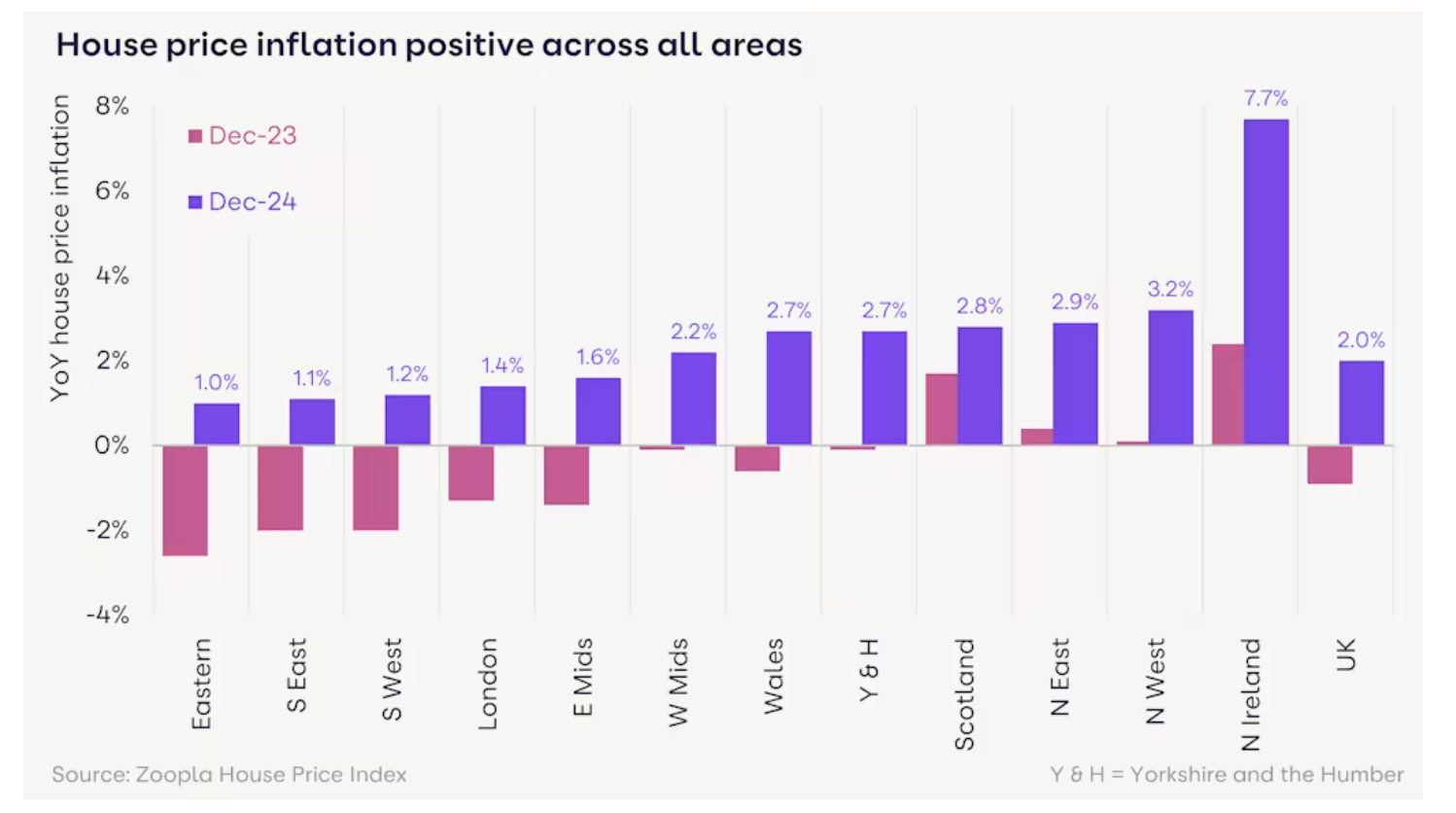

House price inflation increases across all markets

The fastest growth in average house prices is in Northern Ireland (7.7%), where prices are rebounding off a low base, followed by North West England (3.2%).

The North West of England, Scotland and Northern Ireland have recorded faster employment growth over the last 2 years than the regions of southern England. Locally, prices are rising the fastest in Wigan in the North West (5.6%) and Motherwell in Scotland (4.9%).

Southern regions of England are recording the lowest rates of house price inflation, below 1.5%. The recent boost to FTB demand is more concentrated in London and South East England and we expect this to support near-term price inflation in these regions.

There are signs that the recent upturn in prices is starting to level out as mortgage rates drift higher and buyers have plenty of homes to choose from. This will keep price inflation in check over 2025, but the current north-south divide in house price inflation is expected to continue over the year ahead.

Rightmove claims there’s been a record number of early-bird new sellers coming to market from Boxing Day and into January.

And the portal claims this shows pent-up demand to move.

The number of new properties coming to market is 11% ahead of the same period at the start of last year, while the average number of homes for sale per estate agency branch is currently at the highest for this time of year in 10 years.

High buyer choice has contributed to increases in buyer enquiries and sales agreed compared to a year ago, but also means fierce seller competition to attract these new year buyers.

The portal says "sellers may find that they have been too optimistic on their initial pricing and get left on the shelf in favour of more competitively priced neighbours. We’ve also seen a strong start to the year in new seller asking prices, though given the higher-than-anticipated seller competition, we would expect this to slow down over the next few months” cautions Rightmove’s new spokesperson, Colleen Babcock.

“The record number of sellers we’re seeing is a double-edged sword. It’s encouraging to see so many sellers with the confidence to come to market, providing buyers with fresh choice. However, with lots of homes for buyers to consider, sellers will need to work even harder to stand out from the crowd and attract a buyer. This could be with a tempting asking price, standout home features, immaculate presentation of the home, or a combination of all of these. It’s vital that in a competitive market, sellers take on the recommendations of their agent, particularly when it comes to setting a realistic price.”

The portal adds that buyer activity is also starting the year encouragingly, as many festivity-distracted buyers return to make their move happen.

Since Boxing Day, the number of buyers contacting estate agents about homes for sale is up by 9% on the same period last year. The combination of good choice and healthy buyer demand has kept the sales trend positive, with the number of sales being agreed between buyers and sellers now 11% ahead of this time last year.

Rightmove has also recorded its busiest start to a year for prospective home-movers applying for a Mortgage in Principle to understand what they may be able to borrow from a lender, which is evidence of future buyer intent.

All of these very early lead indicators at the start of this year point to a busier 2025. Rightmove forecasts a larger number of transactions this year of 1.15 million, and an average asking price increase of +4%.