House prices rise across the UK as London veers into positive territory. But homeowners looking to sell must be wary of overpricing.

Key takeaways

- Over the first 7 months of 2024, house prices have risen by 1.4%.

- All areas of market activity are up year-on-year – the long-awaited base rate cut has not had a major impact so far

- Price inflation has improved across all regions of the UK. It remains slightly negative in southern England, but London’s positive at 0.2%

- 1 in 5 homes have had their asking price cut by 5% or more, an above-average level showing continued price sensitivity amongst buyers

- It takes 28 days to sell a home with no asking price reduction, but 73 days if you overprice and then need to reduce by 5% or more

- House prices are on track to be 2.5% higher over 2024 with 1.1m sales

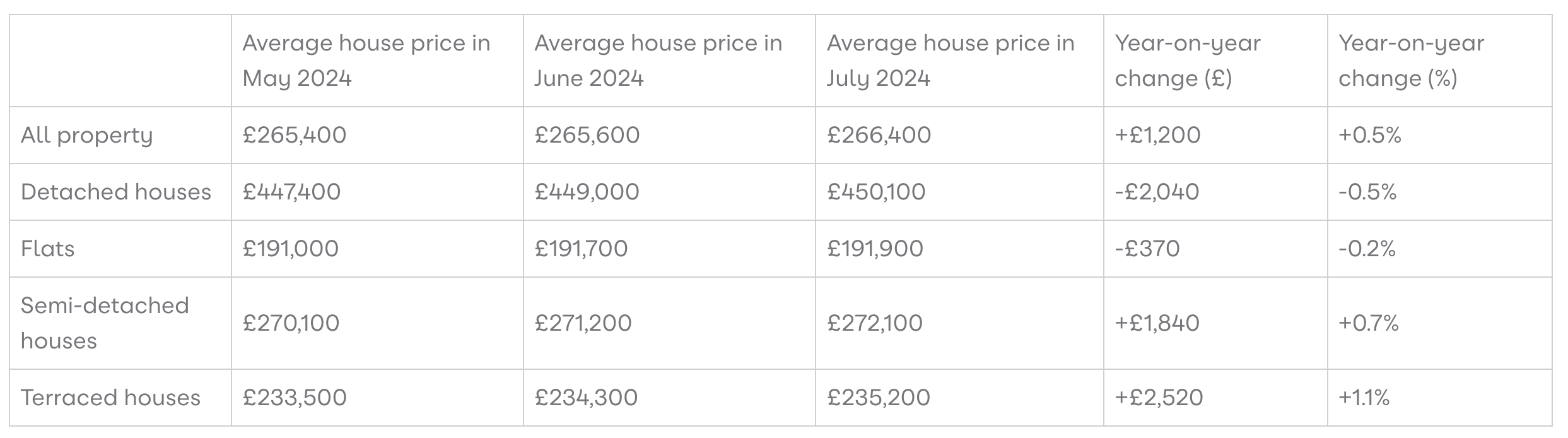

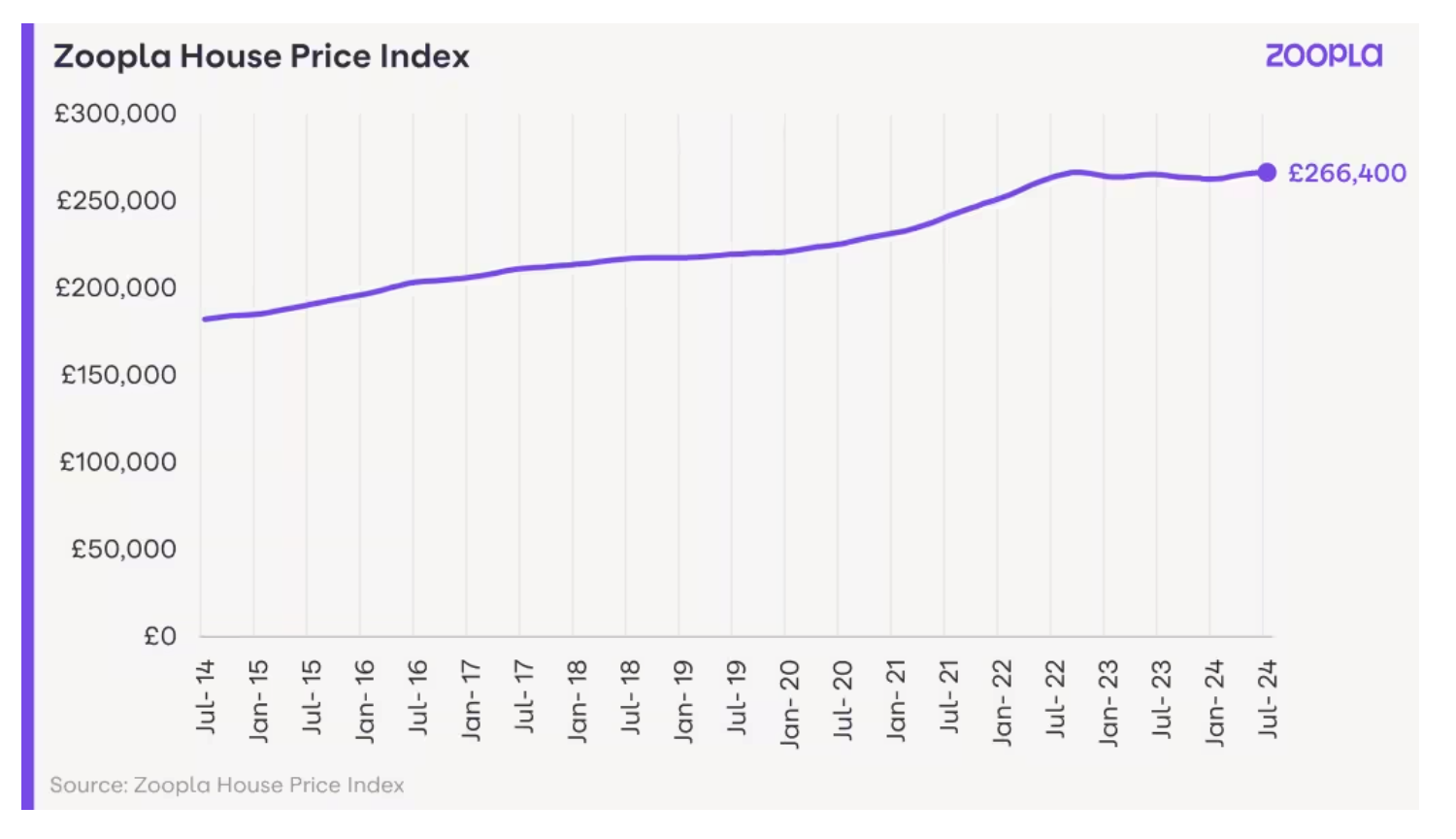

The average house price in the UK is £266,400 as of July 2024 (published in August 2024).

Property prices are now at 0.5% inflation compared to a year ago. However, the average UK house price is set to rise by 2.5% by the end of the year.

Key figures

Housing market activity stronger than last year

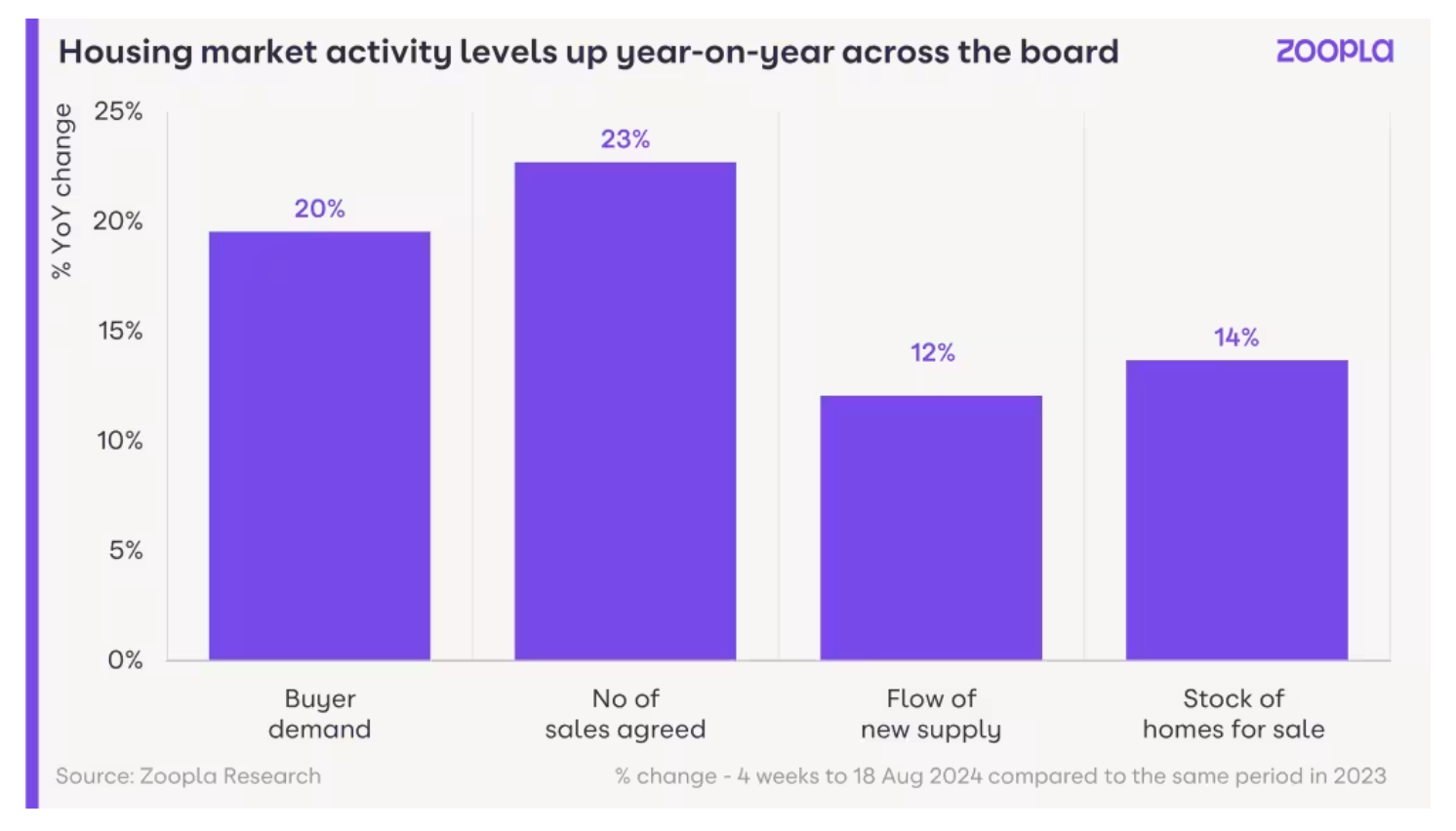

All key measures of sales market activity are higher than they were in 2023. This has largely been supported by economic growth and rising consumer confidence.

Buyer demand for homes is a fifth higher than this time last year. Additionally, new sales agreed are almost a quarter higher, building on the increased momentum in sales from earlier in the year. Mortgage rates have fallen to an average of 4.5% for a 5-year fixed rate at 75% loan-to-value.

Sellers continue to bring homes to market at an above-average rate. Many of these sellers are also buyers, which explains why the number of sales agreed continues to increase.

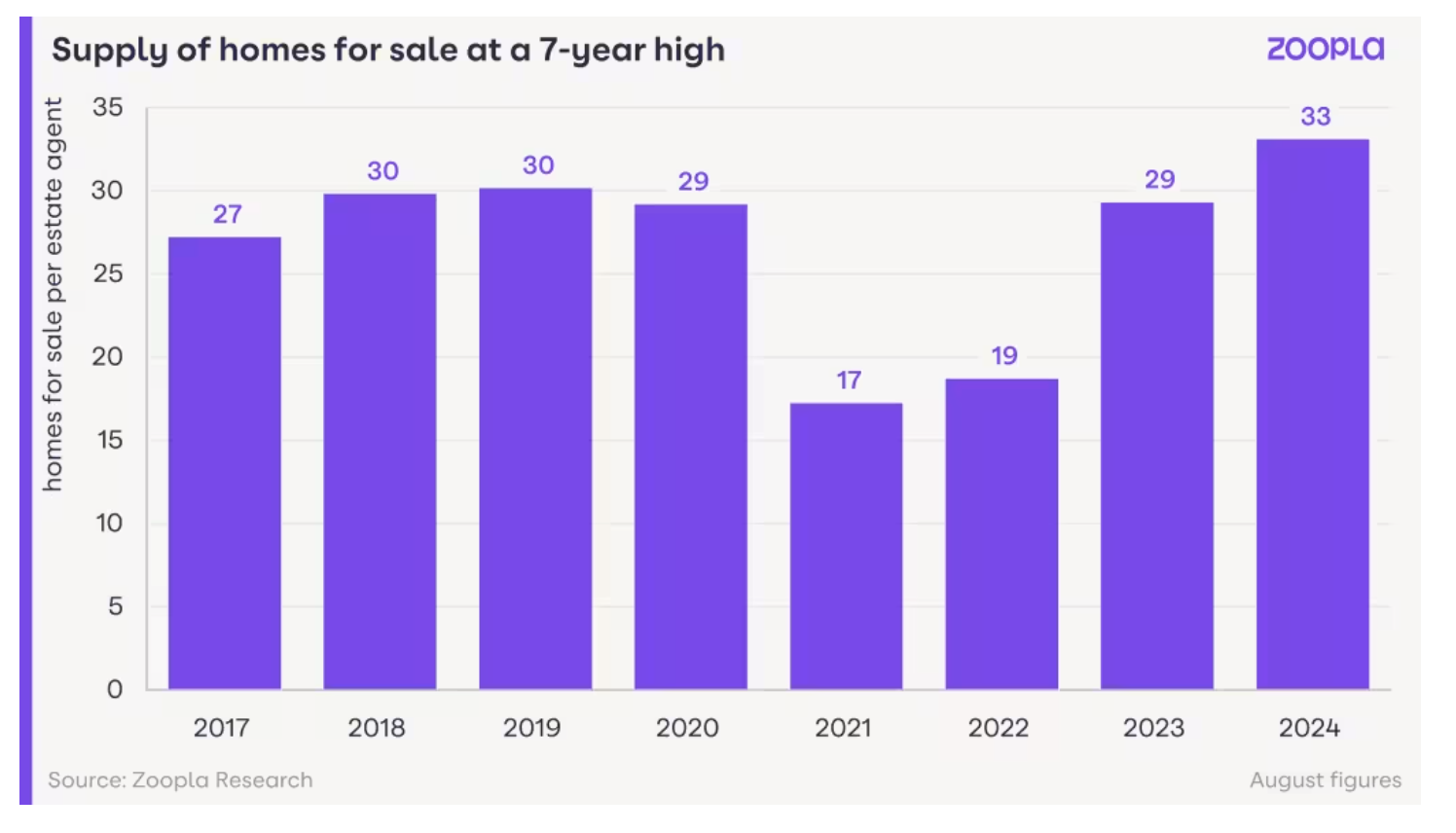

The stock of homes for sale continues to increase and now stands at a 7-year high of 33 homes per agent, giving buyers even more choice. A higher supply of homes will keep headline price inflation in check over 2024 and into 2025. Serious sellers must price realistically to agree a sale within a reasonable time.

No material impact from August base rate cut

The long-awaited cut in the base rate in August was welcome news for the wider economy and consumer sentiment, but it has had no material impact on levels of buyer demand compared to the underlying trend over recent weeks.

The real reason buyer demand for homes is 20% higher than last year is down to a fall in demand over summer 2023, which was in response to the spike in mortgage rates.

However, our data did register a modest increase in the number of new sales agreed in the days following the base rate reduction as wary buyers waited for a rate cut to agree a sale.

The good news is that there is sufficient buyer demand to support rising sales volumes. The number of sales agreed rising by 23% is a truer reflection of the health of the sales market which remains on track for 10% more sales than 2023.

UK house prices increase 1.4% so far this year

A modest recovery in house price inflation is occurring due to rising numbers of new sales agreed, as well as buyers paying a greater proportion of the asking price.

Our UK index shows that the average UK house price has risen by 1.4% so far since the beginning of the year and is on track to be 2.5% higher over 2024.

The annual rate of inflation in our UK house price index is lower at +0.5% as it includes price falls over the latter part of 2023.

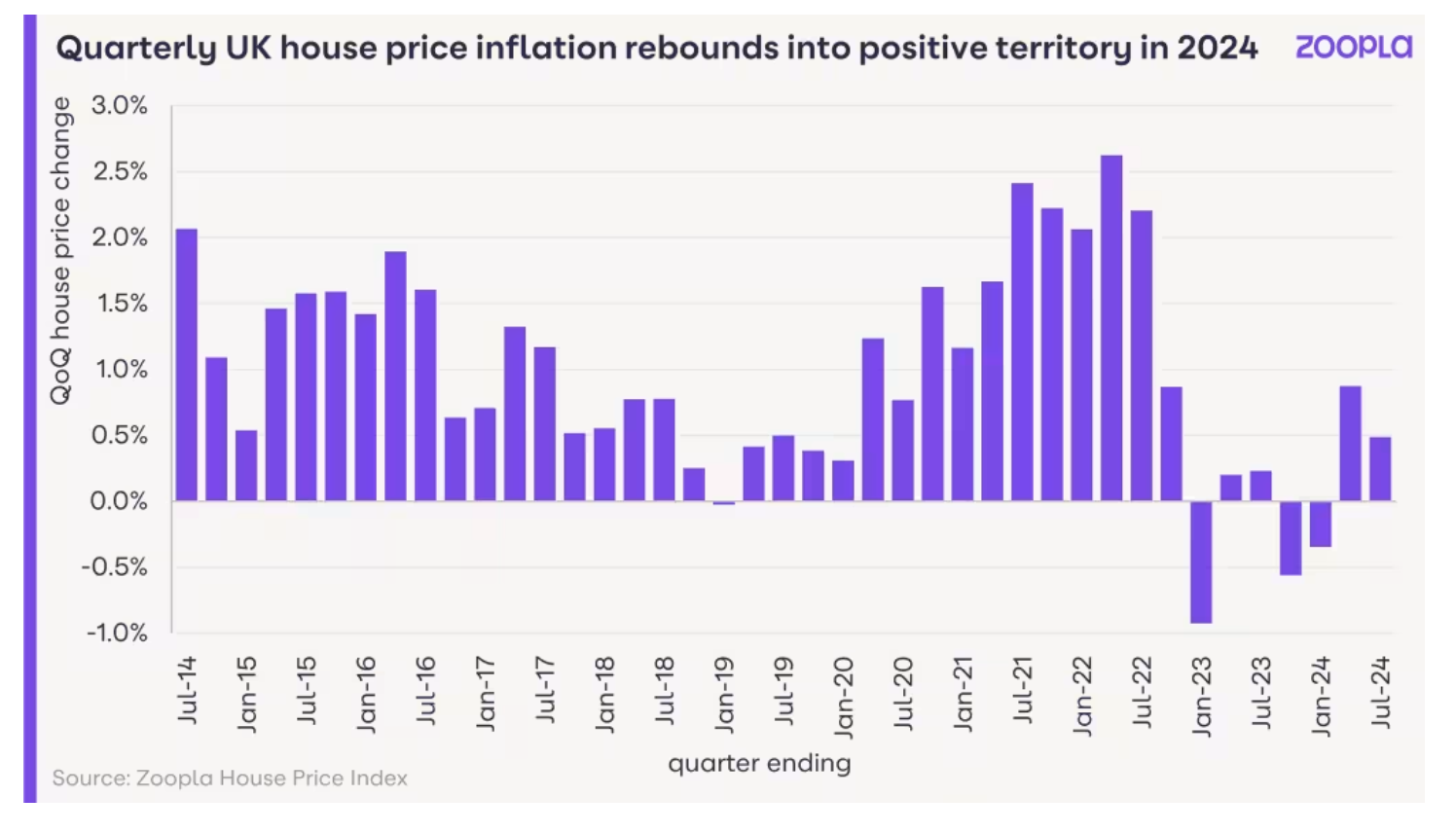

Over the last decade, house price falls have only occurred during Q4 2022, Q3 2022, and Q4 2022. These falls were all in response to higher mortgage rates. This year has seen a return to low rates of house price inflation, albeit slowing in the last three months.

Overall price trend is upwards but there are some localised falls

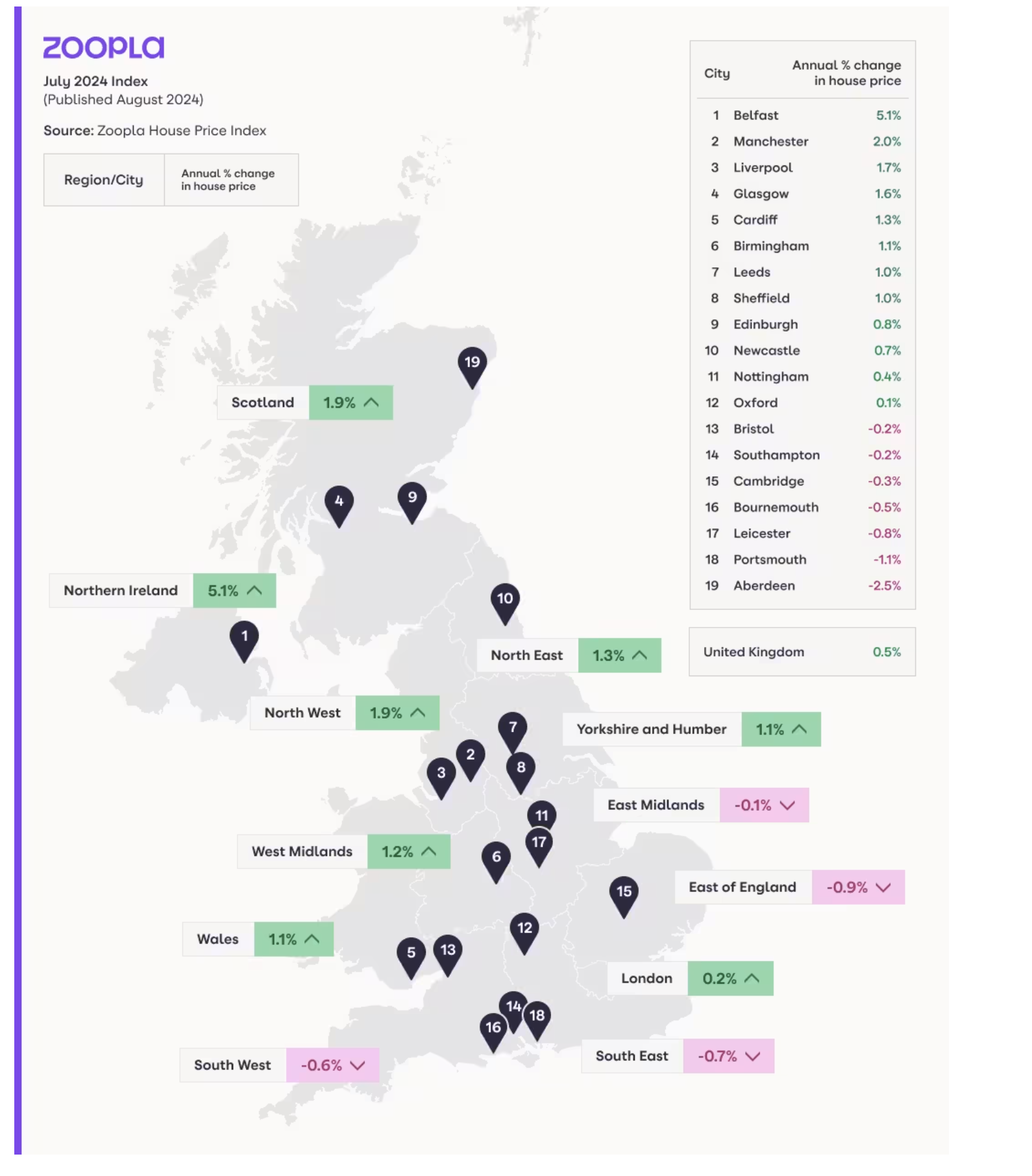

The improvement in house prices over the year-to-date is being felt across most areas of the country.

Annual house price inflation ranges from -0.9% in the east of England to +5.1% in Northern Ireland.

Price inflation has turned positive in London (+0.2%), while prices are seeing small falls in the South East (of England), South West (of England) and East Midlands.

There remain pockets of the country where house prices continue to see small falls on both a quarterly and annual basis. This includes Taunton (TA, -2.0%), Dartford (DT, -1.3%), Enfield (EN, -1.1%) and Harrogate (HG, -1%). From this data we can see that house prices are still adjusting to the impact of higher borrowing costs in local areas.

However, house prices are seeing above-average annual gains in more affordable housing markets, which are often in proximity to larger cities. This includes Wolverhampton (WV, 3%), Oldham (OL, 2.8%) and Wakefield (WF, 2.7%).

Across the Scottish borders, house prices are rising even faster, from Dumfries and Galloway (DG, 4.4%) to Galashiels (TD, 3.1%), as well as in the Falkirk postal area (FK, 3.1%).

1 in 5 homes have cut asking price by more than 5%

While measures of market activity are higher and price inflation is positive, it’s important that sellers remain realistic on pricing, especially if they are serious about moving home.

The continued growth in the supply of homes for sale is boosting choice for buyers. This will keep UK house price inflation in check into 2025.

Buyers remain price-sensitive as their purchasing power has been eroded by higher mortgage rates. This is slowly being offset by faster income growth but there is further to go to fully repair affordability.

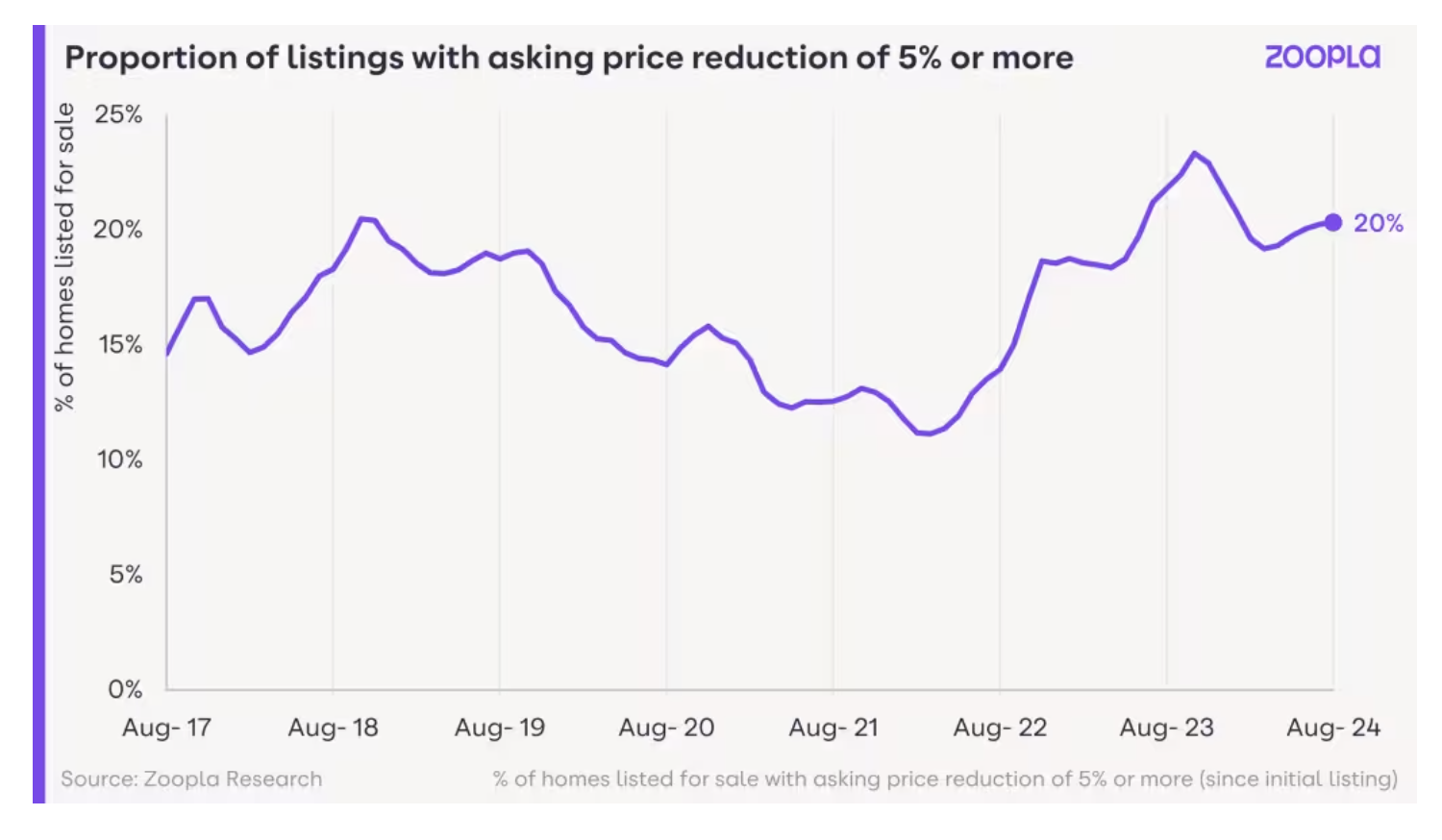

We’ve found that 1 in 5 homes that were listed for sale in August have had an asking price reduction of 5% or more to attract buyer interest. This is above average, but lower than the 23% high recorded last autumn, when higher mortgage rates hit demand and house prices fell.

There is no major variation in asking price cuts across different parts of the country, but reductions are more common for 1 and 2-bed flats.

Homes that need an asking price cut take more than twice as long to sell as homes without asking price changes. Our data shows time to agree a sale is 28 days for a home with no price reduction, and 73 days for a home with a 5%+ reduction. Getting the asking price right at the outset is essential to secure a timely sale.

Housing market outlook for 2024

The housing market is more balanced now than it’s been at any time over the last 5 years.

Lower mortgage rates and an improving economic outlook has brought more sellers and buyers into the market, supporting sales volumes and business plans for builders, estate agents and lenders.

How much lower mortgage rates will move depends on expectations for base rates.

Our view is that average mortgage rates will remain above 4%, which is sufficient to support more home moves and sales. Healthy growth in household incomes remains as important as borrowing costs for the overall health of the housing market as we look ahead into 2025.

House Price Index - country, region and city summary

UK house prices ‘on track’ to rise this year

UK house prices remain on track to edge higher this year, according to Knight Frank, as a mortgage pricing war and expectations of another Bank of England interest rate cut in the final quarter of the year rekindle the property market.

After a year of sustained price falls in 2023, the estate agency updated its forecast for UK house prices in May to rise by 3% in 2024, up from an earlier estimate of a 4% drop.

Against a backdrop of falling inflation and growing anticipation of interest rate cuts, it said that it expected an increase in transactions.

In the three months since its last housing market forecast in May, there has been a general election and a rate cut, and this is helping to support confidence in the housing market.

Tom Bill, head of UK residential research at Knight Frank said “our forecasts appear on track but the first Labour government in 14 years and the first rate cut since March 2020 have clearly changed the mood music, we have left our numbers unchanged for now but will reassess them after the Budget on 30 October."

So, how has the landscape in the UK property market altered over the last 90 days?

Knight Frank says that the mainstream sales market has been impacted by the rate cut more than the change of government.

Following the drop to 5% from 5.25% and lower-than-expected inflation data, SONIA five-year swap rates fell towards 3.5% in August. Financial markets were pricing in a further cut in November.

It will lead to a “meaningful increase” in the number of lenders offering sub-4% mortgages this autumn said Simon Gammon, head of Knight Frank Finance. As a result, demand and sales volumes will be stronger in the final months of this year than in 2023.

HMRC data shows that the number of transactions was 19% below the five-year average (excluding 2020) in 2023, largely due to stubbornly-high inflation and fast-rising borrowing costs.

In terms of prices, the Halifax and Nationwide indices registered growth of just over 2% in July, meaning our 3% forecast for the year looks like it should be met if not exceeded.

Nationwide also showed growth of 1.6% in Greater London in the year to June, which means prices in the capital are fast-approaching our 2% forecast for 2024.

The prospect of the Budget means the outlook in prime markets is hazier.

The decision to charge private schools VAT from January rather than September next year has created a mood of wariness ahead of 30 October.

The measure by itself will not have a dramatic impact in prime property markets, but together with other potential tax rises, it may keep demand in check, according to Tom Bill.

He sated "given the government’s pledge not to raise income tax, VAT or National Insurance, speculation has centred on capital gains tax, inheritance tax and pension tax relief among others. Changes will also be made to rules surrounding non doms, the 74,000 individuals living in the UK who do not pay tax on their non-UK income. How pre-existing overseas trusts are treated for inheritance tax purposes will be a particular focus for those wondering if large numbers of them will leave the UK.”

Knight Frank’s prime central London (PCL) forecast is therefore subject to a bigger revision than our other projections later this year. The annual decline was -2.4% for the third successive month in July, which we forecast will narrow to -1% by December.

Bill said: “any impact would be less marked in prime outer London (POL), where we forecast an increase of 2% this year. Average prices in POL rose 0.6% in the six months to July, putting them on track for a low single-digit increase in 2024 as demand strengthens this autumn. Prime country prices continue their descent from the highs of the pandemic and the so-called ‘race for space.

Our forecast of -2% for 2024 is broadly on track, though it may prove overly-negative as demand strengthens in the final months of the year. The annual decline recorded in June was -3%.”

Knight Frank adds that its forecasts for rents in 2024 also appear broadly on track, if you ignore the uncertainty surrounding the Renters Reform Bill.

In PCL, the agency forecast growth will fall to 2% this year as supply increases from the lows of the pandemic. The increase was 0.9% in the six months to June.

Meanwhile, rental values in POL increased 0.7% in the six months to June. Our forecast is 2.5% for the whole year.

In the wider UK market, annual growth was 8.6% in July and falling, which means it should end the year close to our 6% forecast.

Again, the agency says it will reassess the numbers after the Budget (once it knows more about the government’s plans for the lettings industry).

For now, only two things are certain, Bill explained:

“First, the Labour government will introduce their own version of the Conservative Party’s Renters Reform Bill during this Parliament. Second, it has been talking tougher on landlords.

Measures could include making it harder to evict tenants and tighter rules around green credentials for lettings properties, according to recent press reports. Meanwhile, capital gains tax could also rise in October’s Budget. If enough landlords sell because the new rules are too financially punitive, it will increase upwards pressure on rents, which our forecasts would reflect.

We therefore expect the next three months to provide more clarity about the longer-term future for the UK housing market than the last three.”