According to Rightmove, average rents climb 8.5% in a year.

If you’ve rented a home in the past few years, you’ll probably have first-hand experience of just how busy the market has been.

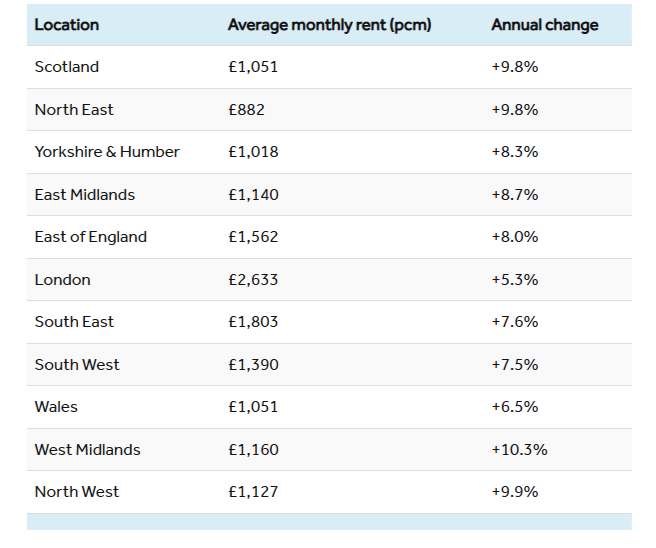

While we’ve seen fewer people competing for the number of rental homes available, we’ve still seen average advertised rents hit a 17th consecutive record, climbing to £1,291 a month. In London, the average monthly rental payment has risen to £2,633 a month.

The number of homes available to rent has improved (+11%) in the first three months of this year, compared to the same period in 2023. And there are less tenants (-17%) looking for a home to rent than at the same time last year.

But if we compare this to the steadier rental market before the pandemic began in 2019, there is still 15% fewer rental homes available , with lots more people looking to rent now (+54%) than in 2019.

The analysis shows that to bring the number of available rental homes back to anything like we saw in 2019, we’d need to see a significant increase in the number of rental properties come onto the market.

RM property expert, Tim Bannister, says “even with some improvements to the number of rental homes available to rent, we’re still nearly 50,000 properties behind the pre-pandemic market, which is a stark reminder that we need more good quality rental homes, and we need to encourage investment from landlords to provide them.”

So, why are rents still rising?

At the beginning of 2023, there were around19 tenants enquiring about every home available to rent. While that’s fallen to 13 enquiries per property this year, this is still almost three times more tenant enquiries than we were seeing per property back in March 2019. With not enough homes to meet demand, rents are continuing to be pushed upwards.

Tim adds “the rental market is no longer at peak boiling point, but it remains at a very hot simmer. Looking at across the whole market, we can see some slow improvements for tenants, with more choice available, and competition with other tenants is slowly starting to ease. However, tenants may not feel the benefit of some of these improvements in their local market, as the balance between supply and demand remains so far from pre-pandemic levels.”

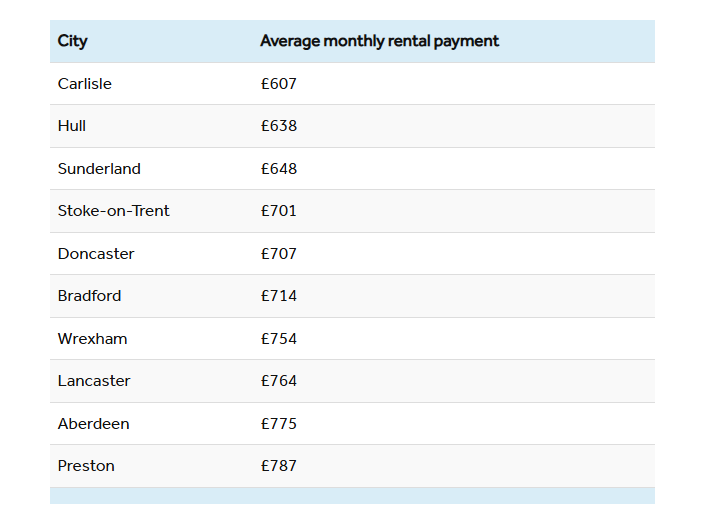

The 10 cheapest cities to rent

RM have compared the average advertised rents in more than 50 cities across Great Britain to highlight where the cheapest cities are for those looking for a home with two bedrooms or fewer.

The city of Carlisle, in Cumbria, takes the spot spot, with the average advertised rent for an equivalent two-bedroom or smaller property now £607 per month. Hull, in East Yorkshire, is the second cheapest spot, with average monthly rents of £638, and Sunderland in Tyne and Wear is third, with an average rent of £648.

In contrast, Oxford is the most expensive city outside of London to rent a two-bedroom or smaller home, with an average of £1,561 per month.