A mere seven weeks after the final games of the 2019-20 season, the Premier League has returned for the 2020-21 season. Last season’s games were severely delayed due to the Coronavirus pandemic with most games being played behind closed doors. While it appears there’s still a long road ahead before the football league stadiums are allowed to welcome the team supporters back through their gates, new research has highlighted some clear early winners in a completely different, but related, competition – the football stadium house price league.

This new research has revealed which teams have scored high for buoyant house price growth and which towns are facing relegation at the bottom of the house price league table.

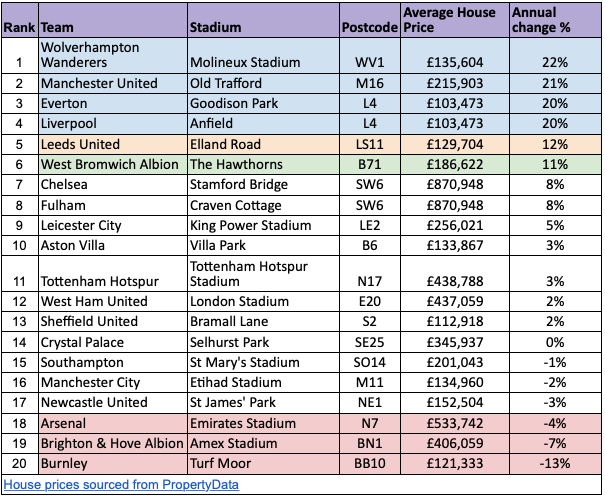

The research from estate agent comparison site GetAgent.co.uk has pulled house price data for properties surrounding every Premier League stadium to find the current house price league winners as well as identifying properties that have enjoyed the largest property price increases since last season.

Current Property Price Premier League Winners

Perhaps unsurprising where current house prices are concerned, the top four Premier League property price winners are London-based teams.

Chelsea, the fourth-placed Premier League team in the 2019-20 season, and newly promoted Fulham share this year’s property price cup, with both Stamford Bridge and Craven Cottage located within the SW6 postcode, which is home to the highest average house price out of all the Premier League stadiums of £875,361.

Average property prices around Arsenal’s Emirates Stadium (£533,741), The T.H. Stadium home to (Tottenham Hot) Spurs (£438,788), and West Ham’s London Stadium (£437,059) complete the top five property price Premier League winners, while average property prices around Brighton & Hove Albion’s Amex Stadium of £406,059 make it the most expensive club to live close to outside of the capital.

However, a strong team sheet when looking at average house prices does not guarantee success where house price growth is concerned.

Data source www.propertydata.co.uk

Biggest House Price Increases

While London Stadiums have netted top scores for overall house price values, they’ve certainly trailed behind the more affordable locations for house price growth since last season.

In fact, when it comes to house price rises, Wolves – who took 8th place in the football Premier League for 2019-20 – are the top performers with house prices in the WV1 postcode, home to Molineux Stadium, increasing by 22 percent in the last year – the biggest increase in the league.

Properties near 2019-20 Premier League’s third-placed team Manchester United’s Old Trafford Stadium (+21%), league winners Liverpool’s Anfield Stadium (20%), and 12th place Everton’s Goodison Park (20%) have also secured ‘champion’ house price growth since last season, while newly promoted Leed’s stadium Elland Road (+12%) and West Bromwich Albion’s stadium The Hawthorns (11%) also scored high in the property price growth league table.

Unfortunately, not all newly promoted teams have fared as well. Despite football Premier League promotion, Burnley is home to one of the lowest average house prices of £121,333, and the largest property price percentage decline over the last year with house prices in Turf Moor’s BB10 postcode falling by 13% in the last year.

Perhaps more surprisingly, high property price performers Brighton & Hove Albion’s Amex Stadium (-7%) and Arsenal’s Emirates Stadium (-4%) join Burnley in the property price increase relegation zone, while Newcastle’s St James’ Park (-3%), 2019-20 Premier League runners up Manchester City’s Etihad (-2%) and Southampton’s St Mary’s stadium (-1%) have also experienced house price declines since last season.

Founder and CEO of GetAgent Colby Short commented: “A very alternative Premier League table and one that is unlikely to materialise where sporting prowess is concerned. However, it does demonstrate the diversity of the property market and how high prices don’t necessarily result in positive house price growth.”