UK house prices continued to rise year-on-year in March, although the pace of growth slowed compared to the previous month, Halifax reveals.

Its house price index shows that annual property price growth came in at 0.3%, down from 1.6% in February. There was a slight dip in monthly prices too, with the average house price falling by 1.0% in March – following a rise of 0.3% in February.

The average UK home now costs £288,430, around £2,900 less than last month.

Despite the national slowdown, there were significant regional variations as Northern Ireland maintained its position as the strongest performing region, with growth of 4.3%. This puts the average house price in Northern Ireland at £194,743, a rise of £7,972 over the year.

Wales and Scotland also saw positive annual growth, although at a slower pace than the previous month.

Annual property price growth in Wales slowed to 1.9% in March, down from 3.9% in February. The average Welsh home now costs £219,213 while Scottish house prices rose 2.1% year-on-year to stand at £204,835.

England displayed a north-south divide with the North West seeing the strongest growth, up by 3.7% to £232,315.

However, properties in Eastern England recorded the biggest decline, with a 0.9% drop and homes there now sell for an average of £330,627, a £2,878 drop over the last year.

London retained its crown as the most expensive region, with the average house price reaching £539,917 – but growth was just 0.4% over the last year.

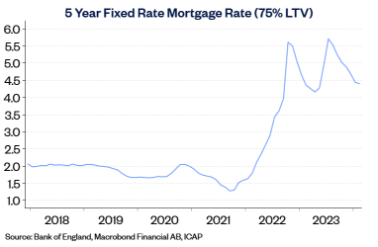

Kim Kinnaird, the director of Halifax Mortgages, said “that a monthly fall should occur following five consecutive months of growth is not entirely unexpected, particularly in view of the reset the market has been going through since interest rates began to rise sharply in 2022. Despite this, house prices have shown surprising resilience in the face of significantly higher borrowing costs. Affordability constraints continue to be a challenge for prospective buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full effect of higher interest rates.

The broader picture is that house prices are up year-on-year, reflecting the opposing forces of an easing cost of living squeeze – now that pay growth is outpacing general inflation – and relatively high interest rates. Taking a slightly longer-term view, prices haven’t changed much over the past couple of years, moving in a narrow range since the spring of 2022, and are still almost £50,000 above pre-pandemic levels.”

Sarah Coles, the head of personal finance at Hargreaves Lansdown, said “mortgage rate rises have finally taken a toll on the housing market, and prices fell 1% in March. Rising rates haven’t been an overnight sensation, but gradual upwards nudges through February and March have taken the average two-year fix from 5.56% at the end of January to 5.81% by the end of March. It has started to sap the life out of a market that was starting to flourish. Rates have been rising ever since the banks decided they’d got ahead of themselves in assuming the Bank of England was going to cut rates in the spring. Now they’re convinced that rates will stay put until June or August, they’re boosting mortgage prices to reflect the new assumptions.”

The director of Benham and Reeves, Marc von Grundherr, said “it’s clear that the nation’s homebuyers are marching on, determined to realise their aspirations of homeownership in 2024, regardless of higher mortgage rates and a lack of any government offered incentives. This determination has already had a positive impact on the UK property market, and we’ve started the year with a far greater degree of market stability than we’ve seen in recent months, with conditions only likely to improve as the year progresses.”

Foxtons’ chief executive, Guy Gittins, said “house prices have continued to creep up since the start of the year and this improvement in market health has been driven by the returning appetite of UK homebuyers. While higher mortgage rates certainly remain an obstacle, there has been a dramatic increase in buyer activity levels and it’s not just in the form of enquiries and viewings, with more offers also being made. With the general expectation that interest rates are set to fall sooner rather than later, we anticipate that market conditions will only continue to improve as buyer confidence builds.”

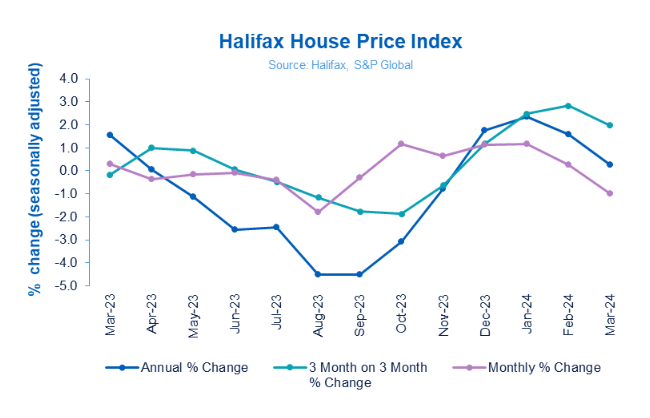

Annual house price growth edges up in March

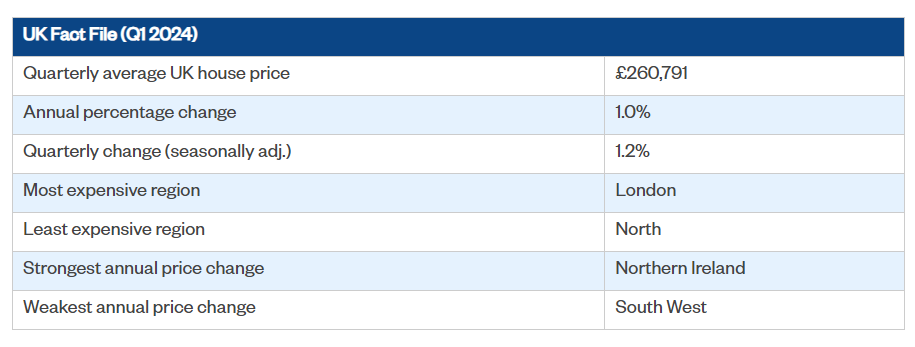

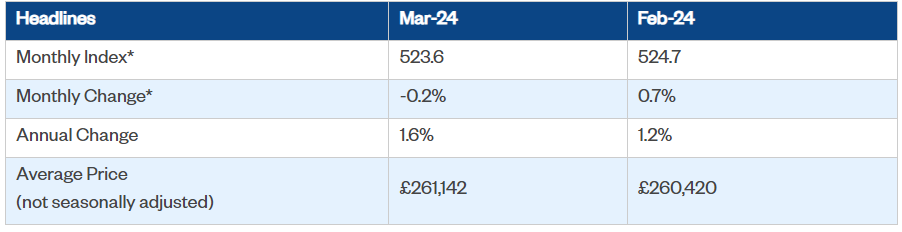

- UK house prices up 1.6% compared with a year ago

- Northern Ireland best performing region, with prices up 4.6%

- South West weakest performing region, with prices down 1.7% over the year

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said “UK house prices fell by 0.2% in March, after taking account of seasonal effects. Nevertheless, the annual rate of house price growth edged higher to 1.6% in March, from 1.2% in February. Activity has picked up from the weak levels prevailing towards the end of 2023 but remains relatively subdued by historic standards. For example, the number of mortgages approved for house purchase in January was around 15% below pre-pandemic levels. This largely reflects the impact of higher interest rates on affordability. While mortgage rates are below the peaks seen in mid-2023, they remain well above the lows prevailing in the wake of the pandemic (as shown in the chart below).

“With cost-of-living pressures easing as inflation moves back towards target, consumer sentiment is improving. Indeed, surveyors report a pickup in new buyer enquiries and new instructions to sell in recent months. Moreover, with income growth continuing to outpace house price growth by a healthy margin, housing affordability is improving, albeit gradually. If these trends are maintained, activity is likely to gain momentum, though the pace of the recovery is still likely to be heavily influenced by the trajectory of interest rates.

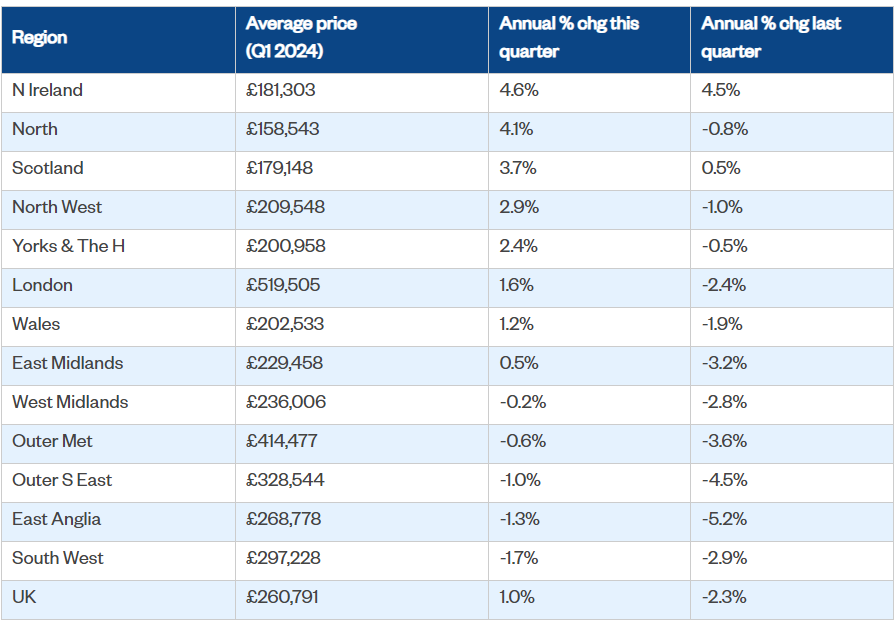

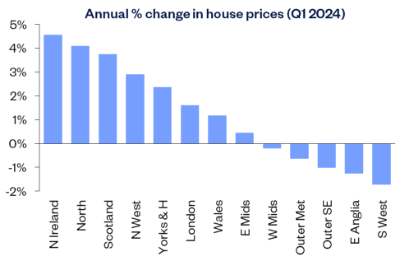

All regions saw an improvement in annual rate of change in first quarter of 2024

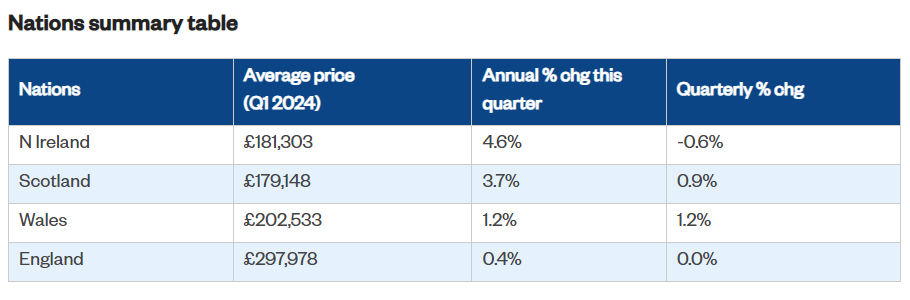

Our regional house price indices are produced quarterly, with data for Q1 (the three months to March) indicating that while some regions recorded annual price declines, there was an improvement in the annual rate of change across all areas. Northern Ireland remained the best performing area, with prices up 4.6% compared with Q1 2023. The biggest improvement in terms of annual price growth was in the North, where annual price growth picked up from -0.8% in Q4 2023, to 4.1% in Q1 2024, making it the best performing English region.

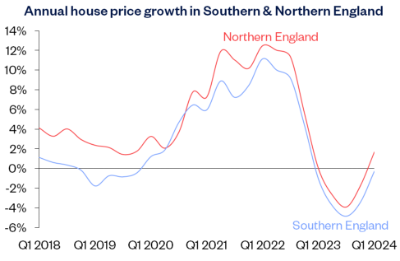

Across England overall, prices were up 0.4% compared with Q1 2023, while Wales saw a 1.2% year-on-year rise. Meanwhile, Scotland saw annual price growth pick up to 3.7%. Across northern England (which comprises North, North West, Yorkshire & The Humber, East Midlands and West Midlands), prices were up 1.7% year on year.

Meanwhile southern England (South West, Outer South East, Outer Metropolitan, London and East Anglia) saw a 0.3% year-on-year fall. London remained the best performing southern region with annual price growth recovering to 1.6%. The South West was the weakest performing region, with prices down 1.7% year-on-year.”

Quarterly Regional House Price Statistics (Q1 2024)

Please note that these figures are for the three months to March, therefore will show a different UK average price and annual percentage change to our monthly house price statistics.

Regions over the last 12 months