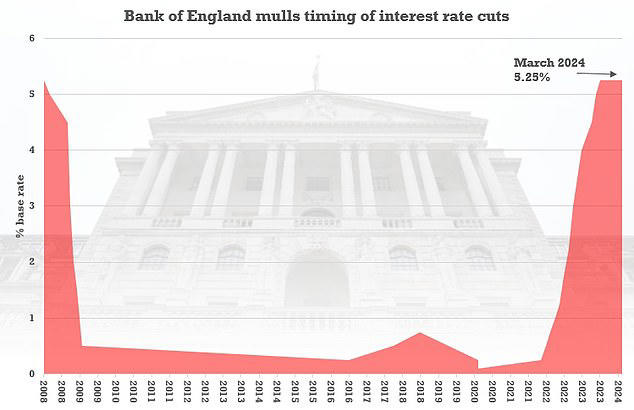

The Bank of England has announced it has frozen interest rates at 5.25%. The bank's Monetary Policy Committee (MPC) voted by a majority of 8 to 1 to hold the base rate as it is, for the fifth consecutive time.

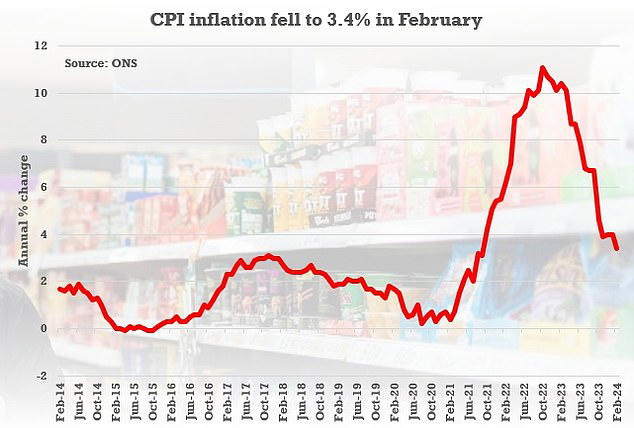

After several continuous hikes over the course of last year, the interest rate has now been sat at 5.25% since August 2023. Many hoped that February's lower-than-expected 3.4 % inflation figure announced on March 20th would provoke a lower base rate, but sadly this was not the case.

The Monetary Policy Committee kept base rate at the 15-year high at its latest meeting, as had been widely expected by markets © Provided by Daily Mail

The Bank's rate influences how much homeowners pay for their mortgage, and due to the current high rate, many people are now paying much more each month than they used to. Following the Bank of England's decision to pause the base rate again, many experts are calling for the Bank to seriously consider cutting it in a bid to help boost the UK's 'stagnating' property market.

Following the decision to hold rates at 5.25%, Bank of England governor Andrew Bailey said “in recent weeks we’ve seen further encouraging signs that inflation is coming down. We’ve held rates again today at 5.25% because we need to be sure that inflation will fall back to our 2% target and stay there. We’re not yet at the point where we can cut interest rates, but things are moving in the right direction.”

This is the fifth consecutive time the Bank has decided to freeze the base rate which has a direct influence on mortgage rates and payback loans across the country. It comes after the latest CPI figures showed that the annual rate of inflation fell to 3.4% in February - down from 4%.

Inflation is now expected by many experts to fall to 2% in April, which may open the way for the base rate to begin to fall in the near future.

Chancellor Jeremy Hunt hailed a sharper-than-anticipated drop in the headline CPI yesterday, saying it 'opened the door' for Threadneedle Street to act soon © Provided by Daily Mail

David Hannah, Group Chairman of Cornerstone Tax, comments "2023 was an extremely turbulent year in the UK property market, with successive interest rate increases and a generally hawkish approach to the control of inflation by the Bank of England. Emerging trends indicate that the BoE may have overcompensated at the expense of the property market. February's inflation figures and mortgage approvals should indicate an overall cooling off of the UK economy which must be acknowledged by the BoE and, in an effort to avoid a sudden crash of inflation, will increase pressure on the MPC to start reducing interest rates sooner rather than later.

I’d urge the MPC to seriously consider cutting the interest rate as even a reduction by a quarter percentage point would signal optimism within the UK economy, with a target base rate of 3-3.5% being the overall goal if the BoE want to truly prioritise buyers in the new year."

But Kate Steere, housing expert at personal finance site finder.com, says "the bank's decision to hold interest rates is not all bad news for mortgage holders. Although many will be frustrated to see the base rate held once again at 5.25%, it's not all bad news. The housing market has been gaining strength in recent months, buoyed by experts believing that the Bank will cut the rates during 2024. On top of this, lower than expected inflation figures reported on 20 March has only added fuel to this fire. In fact, Natwest has already announced that they will be cutting their remortgage and tracker deals from today.

Mortgage rates have been abnormally unstable over recent months, with new deals being pulled from the market sometimes within just weeks of going live. The concern is that this constant up and down could start to erode the fragile confidence that has been building amongst buyers."

Matt Smith, Rightmove’s mortgage expert, also appeared optimistic as he said "although today isn't the day for the first Base rate cut, each day that passes is one step closer, and it's very much a 'when' rather than 'if' we see the first drop from 5.25%. Mortgage rates have risen slightly over the last 6 weeks but it does feel like the pressure on lenders to increase rates has dissipated, with some lenders having already cut rates in response to yesterday's positive inflation news. This may mean that average mortgage rates start to fall back in the next couple of weeks. If this is the case it will be first time average rates will have reduced in over a month."

Home-movers shouldn't expect to see a rush of rate cuts, but the two announcements this week should hopefully continue to give movers more confidence than they perhaps had at the start of last year. That's certainly been the theme so far after the first quarter of the year - with more people enquiring to purchase homes, more sellers come to market and more sales being agreed than this time last year."