Buy-to-let investors are enduring mixed fortunes at the moment.

On one hand, they are battling high interest rates and inflation, which are driving up the costs of being a landlord. On the other, they benefit from strong rental growth and demand from tenants. But the national picture does not tell the whole story.

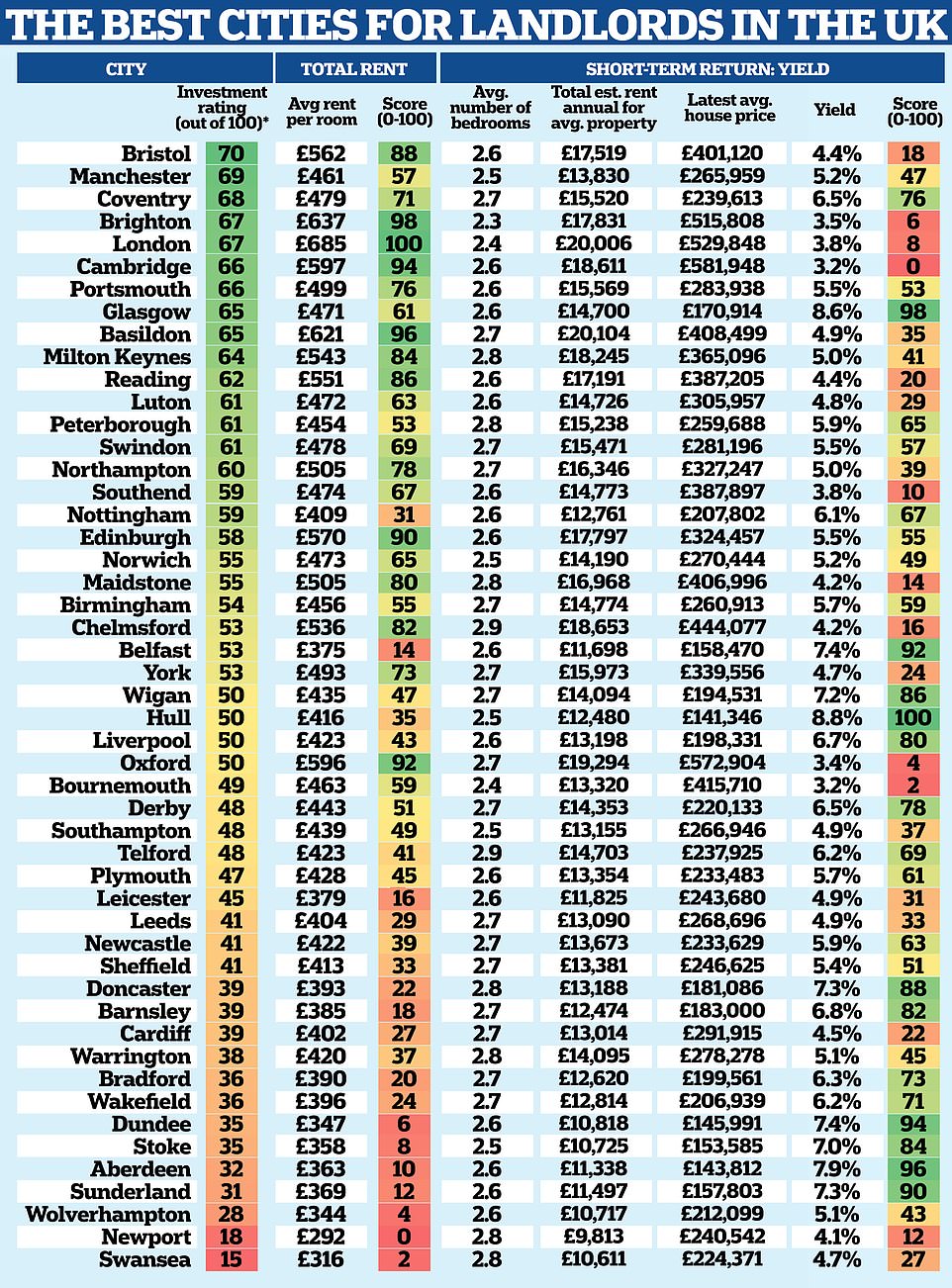

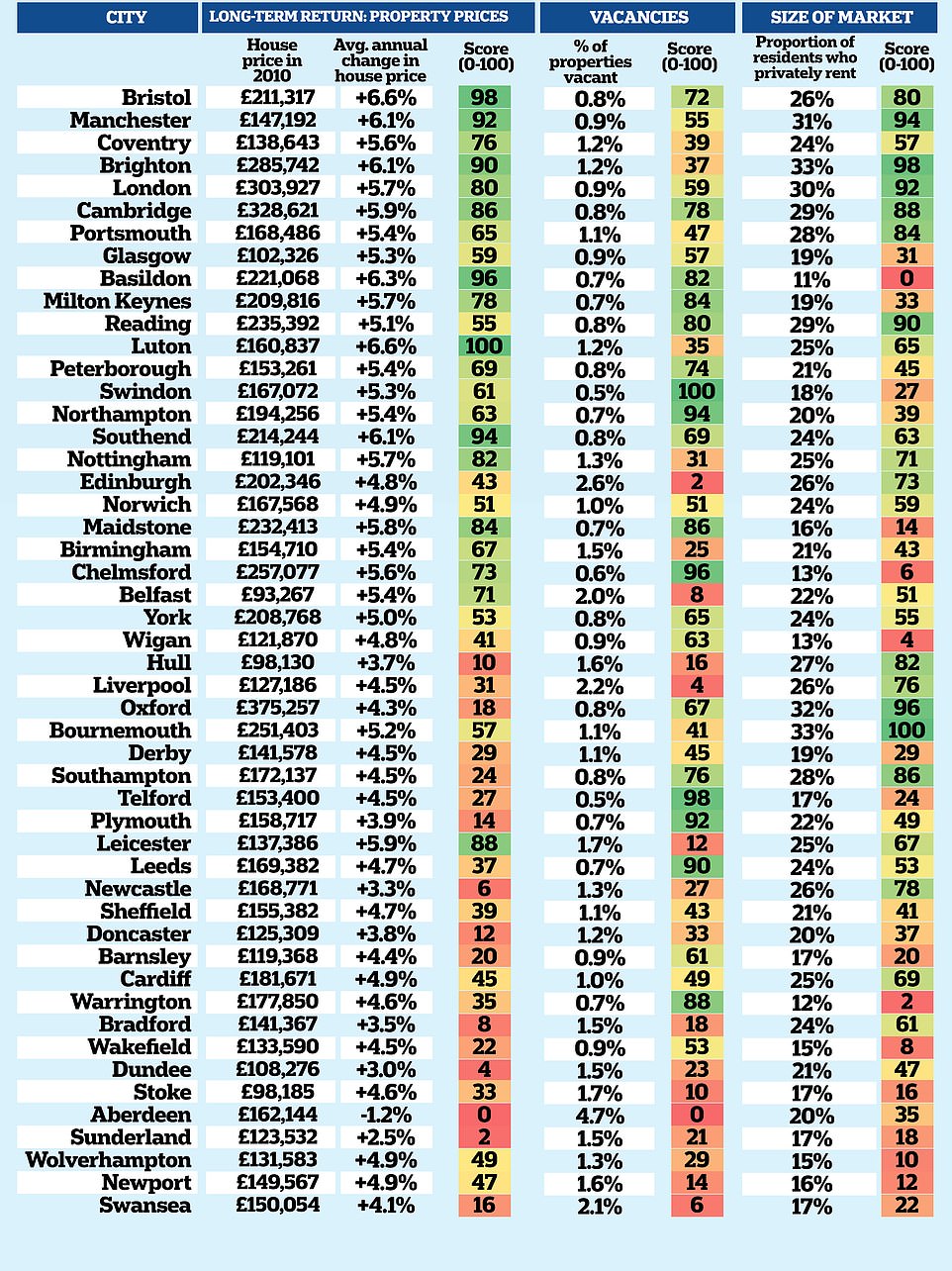

The fortunes of landlords have varied greatly from city to city, with rental yields — the main measure of the return on your investment — ranging from 3.2% to a healthy 8.8%. Bristol has been crowned the best place in the UK for landlords to invest, according to analysis carried out for Money Mail by Aldermore Bank.

While rental yields are typically the only important indicator used in most analyses of the buy-to-let property market, it is just one of a number of key criteria landlords should be studying. When compiling the rankings, researchers assessed cities on a range of additional factors, including long-term house-price growth, size of the rental market and how many vacant properties there are in the area. Bristol is not the only city to enjoy a buy-to-let boom.

Letting agents in some of the UK’s thriving buy-to-let markets said why they are hot investment spots — and those in markets struggling to compete.

Jon Cooper, head of mortgages at Aldermore, said "usually a few regions dominate, but this year we see a wider range making it into the top ten. Each region is made up of multiple smaller markets with unique conditions and challenges."

West Country wows commuters

Bristol ranks as the number one city in the UK for landlords, largely thanks to its high average rents per room of £562 per month — 24% higher than the average across all 50 cities.

House prices there have grown by 6.6% annually over the past decade, compared to the average 4.8% annual growth across the UK. Renters need a property — just 0.8% of rental properties are vacant. Rental yields sit at 4.4% — lower than the average 5.5% across the 50 cities, due to Bristol’s high house prices.

The rental yield signifies how much rent the property generates compared to the price paid for it.

The average home is now valued at £401,120, making it more costly for landlords to generate an income. The city’s popularity, says Ben Chapman, lettings partner at Romans Lettings, is down to its now commutable distance from London and Birmingham.

Renters have been willing to commute further since the pandemic as many companies now allow staff to work from home for part of the week. Mr Chapman says "you can still get a lot of property for your money here."

Though rents are higher than average, they remain affordable for Bristolians, unlike London rents which have outpaced salaries. But shrewd landlords won’t settle for low yields.

Mr Chapman adds "most landlords look for a rental yield of between 7 and 8% so they buy properties for a bargain at auction for around £290,000 and refurbish them to rent them out for £600 per room."

Manchester and London still strong

Manchester took second position in our rankings table, while London is down in fifth place.

Manchester’s strengths, says Baljit Arora, managing director of agency Orlando Reid, "lie in its affordable homes and growing population of young professionals wanting to rent. Landlords charge an average rent per room of £461 per month. A fraction higher than the £455 average across the 50 cities but lower than fellow top ten cities Coventry, Brighton and Portsmouth. Landlords can expect a slightly lower-than-average yield of 5.2% but that’s not a deterrent for Manchester landlords. Rental demand is so strong there’s a lower likelihood of the property standing empty."

Just 0.9% of rental properties are vacant and nearly a third of the city’s residents rent privately in Manchester, mirroring London’s competitive market, according to Aldermore.

In the capital, dramatic increases in rental prices have led to a recent slowdown in tenant demand. High interest rates on buy-to-let mortgages have made it hard for landlords, too. According to property data experts Hometrack, the proportion of landlords who have dropped rental asking prices by more than 5% is highest in London. The average rent per room in the capital is £685 a month — the most expensive in our table. But with such high house prices, the average yield is low at 3.8%.

Coventry’s a rising star

Coventry is one of the most-improved cities and most promising locations for buy-to-let landlords, Aldermore says.

Compared to the bank’s analysis for previous years, the city climbed seven places between 2022 and 2023 to claim third position. Offering an attractive rental yield of 6.5%, the city also has strong demand from tenants thanks to its two universities, Coventry and Warwick, and the employment opportunities offered by big manufacturing names such as Jaguar Land Rover.

Laura Green, director at Shortland Horne, said "Coventry is an improving city, it is green and the city centre is being developed. With just an hour’s train ride to get to London, it is an attractive commuting option. In the past year, rents for a two-bed property have increased from £800 to £900 a month, but this remains affordable for many prospective tenants."

Hull and Glasgow offer best yields

Yield-chasers who want to offset the cost of a purchase fast could look to Hull, which boasts the best yield of all 50 UK cities — at 8.8%.

Landlords charge an average £416 per bedroom on properties in the Yorkshire city — lower than the average £455 elsewhere.

This amounts to an estimated £12,480 in rental income each year, with the average property having 2.5 bedrooms. But the lower rent is offset by its stock of relatively cheap homes, as the typical property costs just £141,346. Despite having the highest yield, Hull is halfway down our table in 26th place. It scores poorly on its annual house price growth over the past decade — 3.7% versus the average 4.8% for the cities in our list — and its number of vacant properties.

Glasgow has the second-best rental yield of the UK cities, at 8.6%. But it ranks far higher than Hull when other key indicators are included — and is in eighth.

That’s because landlords can expect rental income of £14,700 on the average property, which costs £170,914. Annual house price growth sits at a healthier 5.3%, outpacing the average and there are few vacant properties. Its only weakness is that just 19% rent privately.

Low yields lead to Oxford blues

After just missing out on tenth position in 2022, Oxford slid 17 places to rank 28th.

Rental returns per room are higher than the national average at £596 and there is a high proportion of renters, but yields are one of the lowest of all the cities at 3.4% due to high property prices.

Rhys Hathaway, director of family firm Hathaway’s Estate and Lettings Agency, says that "Oxford’s house prices rocketed in the stamp duty holiday in 2020 and 2021 and many landlords decided to cash in because of the situation, and so left the market entirely. The majority of landlords we have here are small accidental landlords not large-scale professionals. Demand for flats and houses has fallen over the past 12 months. We were getting ten to 20 enquiries per property, now it is more like five to ten. However, homes still let quickly and that demand for shared houses is strong."

…And the worst places to invest?

Welsh cities Newport and Swansea are ranked 49th and 50th for the third year. They attract low rents of £292 and £316 a month respectively.

The properties are lower-than-average priced but cost more than in Bradford, for example, which fetches rents of £390.

Buy-to-let broker Sunny Budhdeo director of Unique Property Finance says "Swansea is popular with landlords who buy large houses or commercial properties to convert into high-end student accommodation."