London has seen the strongest rental growth over the last year according to an analysis by lettings agency Hamptons.

The average rent in the capital rose to £2,425 pcm, some 11.8% or £255 pcm more than in November 2022. Consequently, tenants in the capital paid a record £32.1 billion in rent this year, up from £28.7 billion in 2022 and £17.5 billion a decade ago. This means that the total rent bill in London is bigger than the bill in the North of England, Midlands, Wales and Scotland combined.

Rental growth in London continues to be driven by Inner London. Here, rents on new tenancies grew 13.2% last month. Beyond the capital, the Midlands where rents grew 10.9% year-on-year, overtook Scotland as the second fastest region for rental growth last month.

However, rental growth across Great Britain continued to cool a little from its 12.0% peak in August. Seven of the 11 regions in Britain saw the pace of rental growth slow last month. Scotland and the South East saw the biggest monthly slowdown. Even so, rental growth has not decelerated as much as we expected given landlords’ rising costs and a lack of homes available to rent.

The agency also says the total amount of rent paid by tenants in Great Britain this year will hit £85.6 billion - over twice the level of 2010 and 10% more than in 2022.

Hamptons says double-digit rental growth over the last year means the total rent bill has increased by £8 billion over the last year from £77.6 billion in 2022, marking the biggest annual jump on record. The total rent bill is now more than double the £40.3 billion in 2010, partly because the number of households renting has increased by 25% or 1.1m over that period and partly because rents have risen too.

The average rent on a newly let home in Great Britain rose to £1,348 pcm in November, this year up 10.2% or £125 pcm on the same month last year. This marked the seventh double-digit increase over the last 12 months and the strongest annual rate of growth recorded in any November since Hamptons records began in 2014.

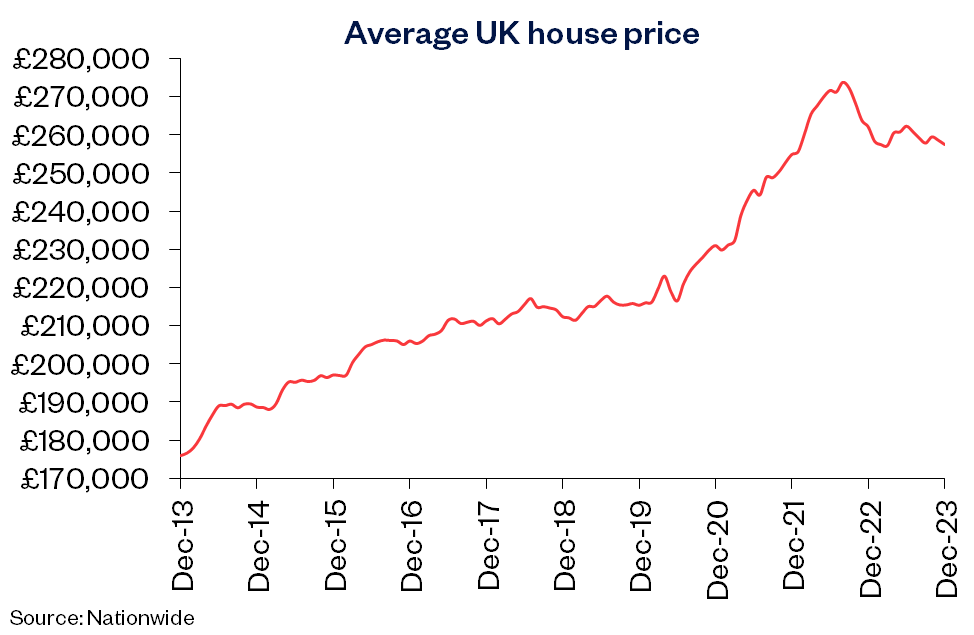

House prices down 1.8% over 2023

The last Nationwide House Price index for 2023 shows a fall in the market of 1.8% over the last year with the average Uk house price for December at £257,443

However, outperforming the rest of the UK, Northern Ireland was up 4.5% and Scotland up 0.5% last year.

Nationwide’s Chief Economist, Robert Gardner, commented “UK house prices ended 2023 down 1.8% compared with December 2022, leaving them almost 4.5% below the all-time high recorded in late summer 2022. Prices were flat compared with November, after taking account of seasonal effects. Housing market activity was weak throughout 2023. The total number of transactions has been running at 10% below pre-pandemic levels over the past six months, with those involving a mortgage down even more (20%), reflecting the impact of higher borrowing costs. On the flip side, the volume of cash transactions has continued to run above pre-Covid levels.

Even though house prices are modestly lower and incomes have been rising strongly, at least in cash terms, this hasn’t been enough to offset the impact of higher mortgage rates, which in recent months were still more than three times the record lows prevailing in 2021 in the wake of the pandemic. As a result, housing affordability has remained stretched. A borrower earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 38% of take-home pay, well above the long-run average of 30%.

At the same time, deposit requirements remain prohibitively high for many of those wanting to buy. A 20% deposit on a typical first-time buyer home equates to 105% of average annual gross income, down from the all-time high of 116% recorded in 2022, but still close to the pre-financial crisis level of 108%. During 2023, there were signs that more buyers were looking towards smaller, less expensive properties, with transaction volumes for flats holding up better than other property types.

This may be because affordability for flats has held up relatively better as they experienced less of a price increase over the pandemic period.”

Buyer demand across England crept up during the final months of 2023 but remains down annually, research has revealed.

Analysis has revealed that demand rose 0.3% in the final quarter of 2023, although it remained down 6.7% versus the fourth quarter of 2022. The figures came from GetAgent’s Hotspots Demand Index, which monitors homebuyer demand across England on a quarterly basis based on the proportion of sale stock listed as sold subject to contract or under offer.

Just one area of England saw positive movement year on year. Across the City of London, buyer demand climbed by 2.4% during the fourth quarter on an annual basis.

Durham saw the largest annual decline in buyer demand levels, down 15.7%, followed by Suffolk and Cheshire. While overall demand only crept up by 0.3% on a quarterly basis, there are far more prominent signs of growing market momentum at county level, GeAgent said.

Rutland saw buyer demand increase by 3.8% on a quarterly basis while both Buckinghamshire and Berkshire also showed strong signs of growth at 3.4%.

Colby Short, co-founder of GetAgent, said “our latest index very much echoes wider industry data on market performance during the closing stages of 2023. While the landscape remains largely subdued, there are green shoots of positivity starting to show and in some areas, these shoots are growing at a far swifter rate than the national picture alludes to. Although the market is yet to spring back into action when viewed on an annual basis, there’s no doubt that things are improving and this puts us in a great position as we enter the new year.”

It comes as Propertymark members reported a fall in both supply and demand during November.

There were on average just six new homes placed for sale per member branch in November, a 26% drop on October’s figure, according to the agency trade body's latest Housing Insight Report.

Meanwhile. the number of buyer registrations reduced from 53 in October to 49 in November.

Nathan Emerson, chief executive of Propertymark, said “economic uncertainty continues to pervade the UK economy and housing markets. In the residential sales sector, seasonal trends are undoubtedly weighing on market performance. However, there are also strong indications that the market is cooling in general. Demand, as measured by new buyer registrations, is trending downwards and though offset by a reduction in existing stock levels and new supply, price pressures are increasing. This is evidenced by the majority of members reporting that properties continue to sell for less than asking price.”

UK house prices in 2024 – major lenders make their forecast

Prices did better than expected this year, says Halifax

Against the backdrop of broader economic challenges, UK house prices are predicted to fall by between 2% and 4% next year, following a modest decline of 1% this year.

Halifax, in its housing market review and outlook for 2024, said a partial recovery in market confidence and transaction volumes is also expected next year as interest rates ease and affordability improves.

Meanwhile, Nationwide Building Society’s own house price review and forecast indicated that a rapid rebound in house prices is unlikely in 2024, with expectations that prices will see low single digit decline or remain broadly flat next year. “If the economy remains sluggish and mortgage rates moderate only gradually, as we expect, house prices are likely to record another small decline (low single digits) or remain broadly flat over the course of 2024,” commented Robert Gardner, Nationwide’s chief economist.

Today, the average UK house price, according to Halifax, stands at £283,615 after a fall of £2,713 from £286,328 a year ago. Prices are £44,439, or 18.6%, higher than at the onset of the pandemic and have increased by 59% over the last decade.

“UK property prices held up better than expected over the last year,” stated Kim Kinnaird, director at Halifax Mortgages. “This resilience – which owes more to the shortage of available properties for sale than strength of demand among buyers – means average house prices end the year just 3% down on August 2022’s peak of £293,025, but £44,000 above pre-pandemic levels. To some extent, this masks the fluctuations we’ve seen in the housing market throughout 2023. As wider economic headwinds began to bite, house prices fell for six consecutive months between April and September, before rising again later in the year as prospects improved.”

According to Kinnaird, now that inflation is falling back, financial markets are pricing in cuts to the base rate during 2024. “Mortgage rates are already falling, with a typical five-year fixed 75% LTV deal now below 5%, having been as high as 5.7% as recently as July, all being equal, these rates are expected to fall further over the coming months. Overall, with the combination of cost-of-living pressures and interest rate levels that are still much higher than even two years ago, we will likely see continued mild downward pressure on house prices. Our latest forecast suggests a fall of between 2% and 4% in 2024, though it should be noted, as with recent years, forecast uncertainty remains high given the current economic environment, she said.