The Chancellor, Rishi Sunak recognised the key part the housing sector would play in supporting the UK’s economic recovery and announced a temporary discount to England and Northern Ireland’s Stamp Duty Land Tax (SDLT) by increasing the tax threshold from £125k to £500k on a homebuyer’s main residence with immediate effect.

This reduction means that people completing a home purchase during the SDLT discount period (between 8 July 2020 to 31 March 2021) won’t need to pay stamp duty on the first £500,000 of the purchase price, thereby giving homebuyers a significant discount on their house purchase costs with the average buyer benefiting from a £4,500 reduction in costs.

The temporary reduction in the SDLT tax, which will apply to both first time buyers (whose previous threshold was £300k) and those that have owned a property before, will come as a welcome relief for homebuyers in England and Northern Ireland as nearly nine out of ten people buying a main residence will pay no stamp duty at all while others buying properties above the £500k threshold will only pay SDLT on the purchase cost above £500 rather than above the previous threshold of £125k. For example, a person buying a house for £800,000 will save close to £15,000 on their purchase costs!

Table 1. Residential rates on purchases in England and N. Ireland from 8 July 2020 to 31 March 2021 (including First Time Buyers)

Table 1. Source gov.co.uk

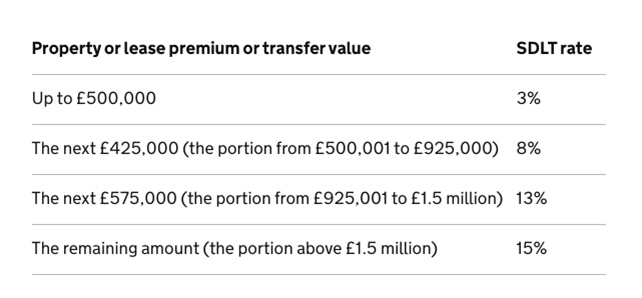

STLT Rates for additional properties in England and N. Ireland

Property investors buying a second or further additional properties in England and Northern Ireland above £40,000 will also benefit from the changes paying just 3 percent SDLT on purchases up to £500,000 until the discount period ends on 31 March 2021 (see table 2).

Table 2: Regional Breakdown of Property Purchases (All Buyers)

Table 2. Source gov.co.uk

The government says that companies and individuals buying residential property worth less than £500,000, will also benefit from these latest changes, as will companies that buy residential properties of any value where they meet the relief conditions from the corporate 15 percent SDLT charge.