What do the figures mean for mortgages?

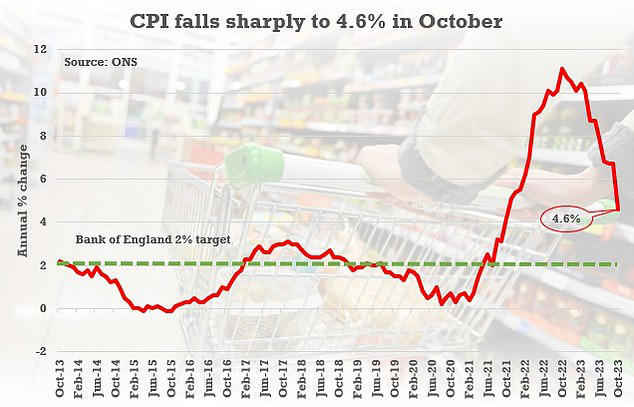

Annual inflation rate in the UK dropped significantly to 4.6% in October – the slowest rate of annual price rises in two years. The latest consumer price inflation (CPI) data published by the Office for National Statistics (ONS) on Wednesday showed a continued downward trend in annual inflation rate, with last month’s figure down from 6.7% in September.

Core CPI also fell to 5.7% in October from 6.1% in the previous month, while CPI including owner occupiers’ housing costs dropped to 4.7% from 6.3%.

The largest downward contribution to the monthly change in CPI annual rates came from housing and household services, where the annual rate for CPI was the lowest since records began in January 1950. This was followed by food and non-alcoholic beverages, where the annual rate was the lowest since June 2022.

Grant Fitzner, chief economist at the Office for National Statistics said “inflation fell substantially on the month as last year’s steep rise in energy costs has been followed by a small reduction in the energy price cap this year. Food prices were little changed on the month, after rising this time last year, while hotel prices fell, both helping to push inflation to its lowest rate for two years. The cost of goods leaving factories rose on the month. However, the annual growth was slightly negative, led by petroleum and basic metal products.”

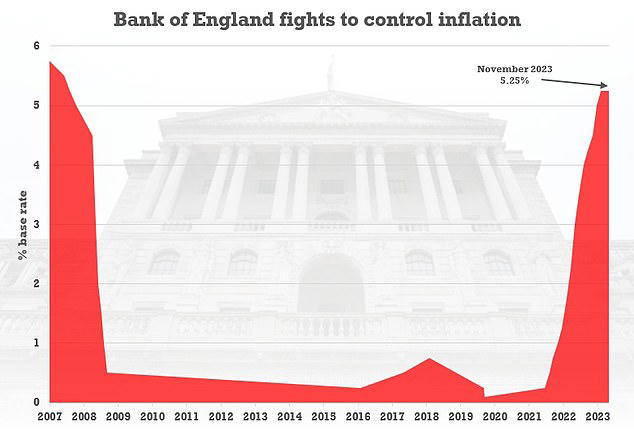

What do the inflation figures mean for mortgages? “This latest inflation data should be enough to keep base rate at 5.25%, although there is still division in the MPC,” commented Simon Webb, managing director of capital markets and finance at LiveMore.

The Bank of England’s chief economist Huw Pill recently suggested there was no need to increase base rate as inflation is steadily falling. However, governor Andrew Bailey believes it is too soon to say that rate rises have ended.

David Hollingworth, associate director at L&C Mortgages said "better than expected inflation data should only help to underpin the improvements in rate outlook that has already seen fixed mortgage rates dropping. Two-year fixed rates have edged below 5% in the last couple of weeks, with major players like Halifax and HSBC joining the leading pack today,” he noted. “Five-year rates are nudging closer to 4.50% and could dip below that mark in coming weeks. Although it’s worth remembering that three members of the MPC voted for a base rate rise this month, increasingly, the hope will be that it’s now peaked, and that the conversation could turn to when rates could be cut next year.”

Adam Oldfield, chief revenue officer at Phoebus Software, said "bringing inflation down was the intent from the Bank of England when it first started increasing the bank base rate. We are, at last, getting to see the impact, the headline figure will no doubt be one that gives a level of confidence to many.”

Oldfield, however, pointed out that while the news that inflation is coming down is great, it does still mean that prices are rising over double the amount that the government is targeting.

“We saw last week that arrears continue to increase, and the governor has already stated that the base rate won’t be coming down any time soon, even if inflation continues to fall,” he said. “So, next week’s budget is a huge opportunity for the Chancellor to step in and bring some much-needed help to a housing market that should be contributing massively to the UK economy. How far he will go and what impact anything he does introduce will have, is up for debate. We have seen too many times how successive governments use the UK’s appetite for home ownership as a bargaining tool as we get closer to a general election. Will this government be any different?”

For Ben Thompson, deputy chief executive at Mortgage Advice Bureau, "another month of inflation falling is good news for homeowners and prospective buyers alike. Consecutive drops will reinforce the view that the worst of the interest rate hikes is behind us, and we’ve now reached the peak. Although base rates will likely remain high for some time to force a further drop in inflation, we could see a host of lenders looking to drop their rates further in the coming weeks. For homeowners approaching the end of their current deal, it’s vital they seek guidance from a mortgage adviser to find the right option for them. Likewise, prospective buyers should now be thinking about how to get mortgage ready by speaking with an adviser.”

Don't get your hopes up!

The Bank of England governor tried to cool hopes of imminent interest rate cuts as he warned inflation is still a major threat. On the eve of Jeremy Hunt's crucial Autumn Statement, Andrew Bailey said markets were putting 'too much weight' on recent dip in the headline CPI rate.

He told the Treasury Select Committee that the fall from 6.7% to 4.6% in October was in line with the Bank's expectations. Mr Bailey suggested the 'potential persistence' of inflation was being 'underestimated' by those betting the first rate cuts will happen in the first half of next year. The comments came after Rishi Sunak and the Chancellor insisted they can start cutting taxes now because the economy has turned a corner with inflation easing.

Mr Bailey suggested the 'potential persistence' of inflation was being 'underestimated' by those betting the first rate cuts will happen in the first half of next year

© Provided by Daily Mail

Mr Bailey said "he could not speculate on what was coming in the Autumn Statement. But he pointed out that the Treasury watchdog will give a verdict on the numbers, unlike with Liz Truss's mini-Budget. The big difference between this years Autumn Statement and what happened a year ago is that the OBR is involved," Mr Bailey said.

Mr Bailey told the Treasury Select Committee that the fall from 6.7% to 4.6 % in October was in line with the Bank's expectations

© Provided by Daily Mail

But Mr Bailey said "that while the peak seemed to have been reached, rates were likely to remain high for an 'extended period. We are concerned about the potential persistence of inflation, he told the MPs. I think the market is underestimating that."

Mr Sunak and Mr Hunt have signed off on what has been described as a 'Thatcherite' package expected to include trimming national insurance - with more promised for next Spring.