House prices are set to fall by thousands of pounds next year as interest rates remain high, forecasters have said.

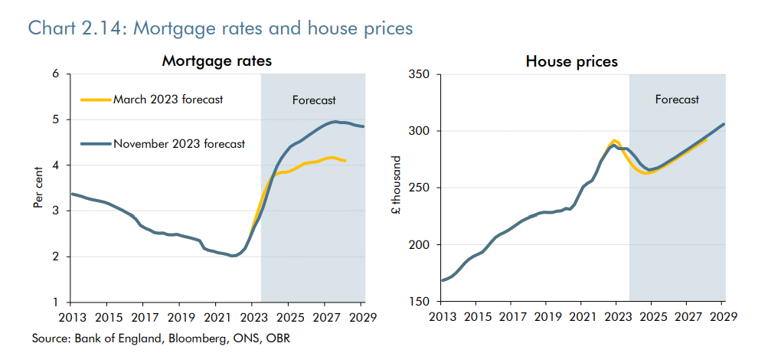

The Office for Budget Responsbility (OBR) said "house prices will grow this year by 0.9%, but then plunge by 4.7% in 2024. This would be consistent with the price of the average UK home reaching a low of around £266,000 at its trough in the final quarter of 2024."

This means that overall house prices will be 7.6% lower in the fourth quarter of 2024 compared to their high in the first three months of 2022, which is less than the OBR expected. The forecaster said they do expect house prices to recover, but they will not reach their 2022 peak until 2027. The OBR added that house prices are particularly sensitive to “changes in interest rates and household income growth”.

It added that economic indicators suggest the market will stay “weak”, for example new buyer inquiries are at their lowest level - excluding the pandemic - since 2008. It comes after average house prices in the UK rose in October for the first time in six months, but still remain lower than a year ago, according to analysis from Halifax.

In addition to that home-mover completions with a mortgage in the first half of 2023 were a third lower than 2019 levels, while first-time buyer numbers were around a quarter lower, according to Nationwide.

There was disappointment in parts of the housing industry that Jeremy Hunt did not announce more support in his autumn statement for first-time buyers, or a stamp duty holiday to stimulate the market.

Richard Davies, COO of agent agent Chestertons, said “aspiring homeowners will feel disappointed about the Autumn Statement not including measures to help property buyers. Many would have welcomed cutting Stamp Duty which would have resulted in house hunters, who previously paused their property search, to re-enter the market. A Stamp Duty exemption for downsizers would have also been a crucial step to help those wanting to move to a smaller property. Each year, we meet countless homeowners who are planning to downsize but, due to the Stamp Duty which can be as much as 12%, are put off to do so. A tax exemption would have encouraged downsizing which in turn frees up large, under-occupied family homes. We would have also liked to have seen the Chancellor introduce more initiatives to assist young house hunters get on the property ladder. With the cost of living, many are struggling to save up a sufficient deposit or find a property within their budget.”

And Paula Higgins CEO of HomeOwners Alliance, said "there was very little to help homeowners and first time buyers. First time buyers need more of a hand up, there are more barriers now than ever and yet we’ve heard nothing today to help give young hardworking Brits to achieve the security and safety of their own home. Instead the government continues to turn a blind eye to their plight. The Bank of England’s approach to tackling inflation means homeowners bear the brunt with soaring costs of borrowing. To get on the ladder, first time buyers need astronomical deposits, are older than ever and have to spread their mortgage term over 35 years or more.”

Chancellor Jeremy Hunt announced back in his Spring Budget that the Capital Gains Tax (CGT) allowance will be reduced from £6,000 to £3,000 in April 2024. And experts state there is "no surprise" Mr Hunt didn't mention CGT changes in the Autumn Statement as he "gives with one hand and takes with the other".

Samuel Gee at Manning Gee Investments said "what the Chancellor gives with one hand, he has already taken away in another. The Capital Gains Tax (CGT) allowances have taken a nosedive from a decent £12,300 before April 2023 to a measly £3,000 starting April 2024. And there's no surprise that all was quiet on this in the Autumn Statement."

Currently, CGT is payable on profits earned when people sell or gift certain items worth more than £6,000 such as antiques or art, or assets including second homes and shares held outside of an ISA or PEP.

Individuals in the basic income tax band pay 10% on their gains and 18% on gains realised with a residential property. Higher and additional rate taxpayers pay 20% on gains and 28% on residential property.

Experts warn this means higher tax bills for investors and people who run their own businesses and pay themselves in dividends.

Mr Gee continued "while CGT has often been considered a tax on the rich, it is not difficult for everyday investors with modest portfolios to be caught, possibly quite unexpectedly in the CGT trap. From a small landlord needing to sell a property that has supplemented their income, to a non-ISA investor with a modest portfolio as low as £60,000, CGT can now sneak up unexpectedly, increasing tax receipts for the government and creating a costly headache for those who never expected CGT to apply to them. This isn't too surprising when the allowance will have been reduced by over 75% by April 2024. There's just time to make sure you are invested as effectively as possible before the last hit takes place. Holding your investments in the right tax-wrappers can make a significant difference to the CGT position so while there's still time, investors should consider how best they can mitigate any unexpected bills - as HMRC will know if it's due!"

For the tax year 2023-24, the annual exemption amount was reduced from £12,300 to £6,000 for individuals and personal representatives, and from £6,150 to £3,000 for most trustees.

HMRC found that reducing the annual exemption by £6,000 saw an additional 235,000 people report their capital gains.

A higher rate taxpayer who enjoys gains of £22,300 in the next tax year would have to pay £1,260 extra tax compared to this tax year.

This would be compounded by a potential further £600 liability in the following tax year.

If the gain relates to the disposal of residential property (taxed at 18% or 28%), the liability to CGT will be higher still. By the 2024/25 tax year, the Government estimates that an additional 260,000 individuals and Trusts may be liable for CGT, which otherwise would not have, been had these changes not been implemented.

Sarah Coles, head of personal finance, Hargreaves Lansdown said "the capital gains tax and dividend tax thresholds dropped in April, and are set to fall again next April, meaning higher tax bills for investors and people who run their own business and pay themselves in dividends. Given the government's growth agenda, and drive to encourage investment into UK companies, halting the planned threshold cuts could help promote this agenda, and ease pressure on investors."

Jason Hollands, Managing Director of Evelyn Partners continued "if the focus is now on encouraging growth and investment, pressing ahead with such a measure [halving the allowance] sends the wrong message."