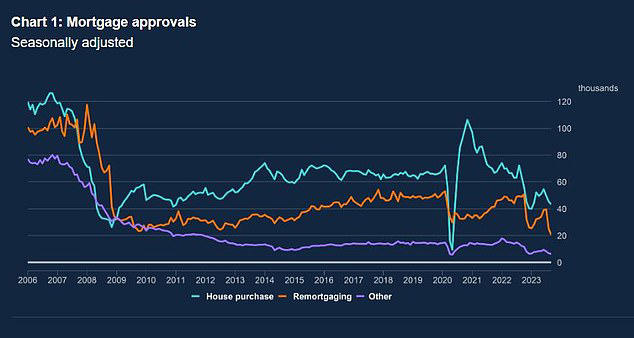

Mortgage borrowing for house purchases continued to fall in September, with activity down by more than a third compared with the same period in 2022.

Mortgage approvals for house purchases, which is an indicator of future borrowing, fell from 45,400 in August to 43,300 in September, according to the latest Bank of England data - the lowest level since January. To put that in perspective, this time last year, mortgage approvals for house purchases fell from 74,400 in August to 67,200 in September.

Mortgage approvals for house purchases fell to 43,300 in September, the lowest level since January 2023. Remortgage approvals fell to the lowest level since January 1999

© Provided by This Is Money

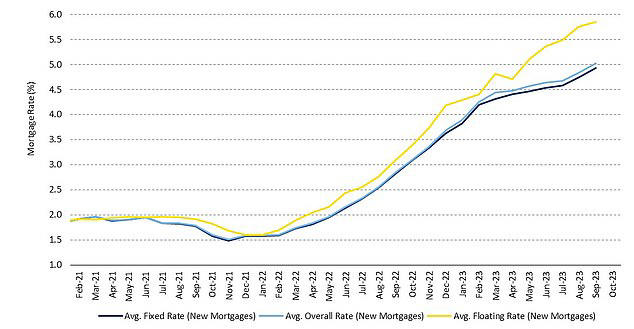

Anthony Codling, managing director for equity research at RBC Capital Markets, says 'mortgage approvals for house purchases declined in September for the fourth month in a row. The housing market appears to be catching a cold, and we do not expect November's Autumn Statement to administer a booster jab. It could be a cold and dark winter for the UK housing market. Higher interest rates are thought to be the key driver behind this drop in mortgage activity. The 'effective' interest rate – the actual interest paid – on newly drawn mortgages saw a 19 basis point increase and now sits at 5.01%, according to the Bank of England. As we lap the Mini-budget average mortgage rates continue to climb.

The overall average mortgage rate for new business in September 2023 was 5.03%, up from 2.85% one year ago. We estimate that the average first time buyer mortgage payment has increased by £200 to £1,127 over the last year with a corresponding rise of £141 for home movers."

Heading higher: The 'effective' interest rate – the actual interest paid – on newly drawn mortgages saw a 19 basis point increase and now sits at 5.01%

© Provided by This Is Money

Net approvals for remortgaging also continued to decline, according to the Bank of England's figures, falling from 25,100 in August to 20,600 in September, the lowest level recorded since January 1999. This is thought to be down to rising numbers of borrowers opting to stick with their existing lender rather than switching to a new lender to secure a better rate.

According to UK Finance, 84% of remortgagers remained with their current lender instead of moving elsewhere between April and June this year. The benefit of product transfers is that borrowers don't have to go through the same checks and balances they would if switching to a new lender - though it might also prevent them from getting the best possible deal.

Product transfers tend to require less paperwork, no new affordability assessment, and no re-valuation of the property.

Alice Haine, of Bestinvest, said "net approvals for remortgaging, which captures remortgaging with a different lender, also saw a rapid decline in September as more homeowners stuck with their existing lender rather than switch to a new provider to avoid affordability checks."

The further decline in mortgage lending in September will continue to weigh on activity, particularly in the housing market. All eyes were focused on the Bank of England's meeting last week to see whether it will continue holding interest rates at 5.25% or deliver its fifteenth rate hike.

Howeer with rates held, 5.25% is still sky-high in comparison to the lows experienced just two years ago.

Many people emerging from the cheap deals they secured before the tightening cycle are still facing a significant jump in repayments and with most borrowers on fixed-rate mortgages, the drag from high interest rates will continue to have repercussions for mortgage lending – and possibly the property market - for some time to come.

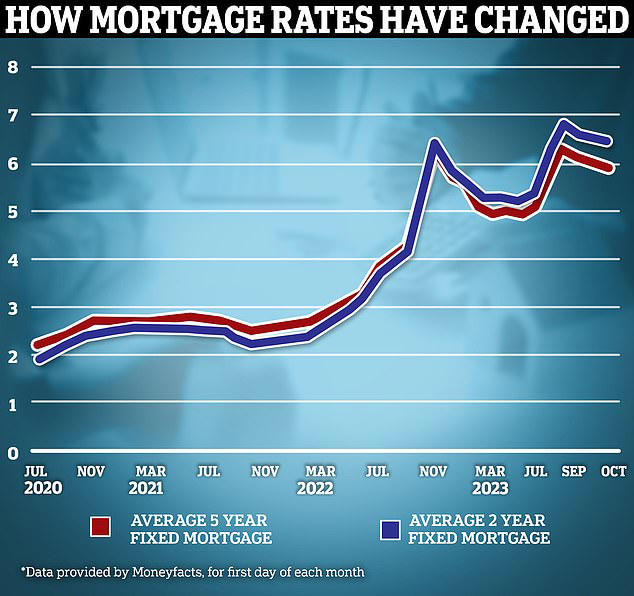

U-turn: Mortgage rates have been on a downward trajectory in recent weeks, with markets having lowered their expectations of where the Bank of England's base rate will peak

© Provided by This Is Money

However, there is some room for optimism. Mortgage rates have been falling in recent months.

The average two-year fix is 6.31% and the average five year fix is 5.87%, according to Moneyfacts, down from peaks of 6.86% and 6.37% respectively in the summer. Borrowers with at least 40% deposits can now secure mortgage rates as low as 4.64% when fixing for five years and 5.14% when fixing for two-years.

Haine added 'if the Bank of England decides to pause again, it would deliver some early Christmas cheer for first-time buyers and homeowners looking to refinance. Improving interest rate expectations have already fed through to the market, with average two-and five-year fixed rates dropping over the past month as lenders compete more aggressively for business. Pair that with softening housing prices and first-time buyers may be able to secure slightly better deals, though they should be wary of overextending themselves in a falling market. However, those hoping for interest rates to fall significantly from here may find themselves waiting for some time."

Capital Economics, an independent economic research business, is forecasting base rate to be held at its current levels until the second half of next year. It therefore suggests that mortgage rates will remain close to current levels and that lending will remain weak over the next few quarters.

Paul Dales, chief UK economist at Capital Economics, said "the loosening in the labour market so far has only been modest and inflation expectations remain unusually high. This suggests that the downward trends in core inflation and wage growth will be slow rather than sudden. So although we doubt the Bank of England will raise interest rates further, we continue to think it won't be in a position to cut interest rates until late in 2024."