The Bank of England has revealed its latest decision on base rate - which in turn has a strong influence on interest rates.

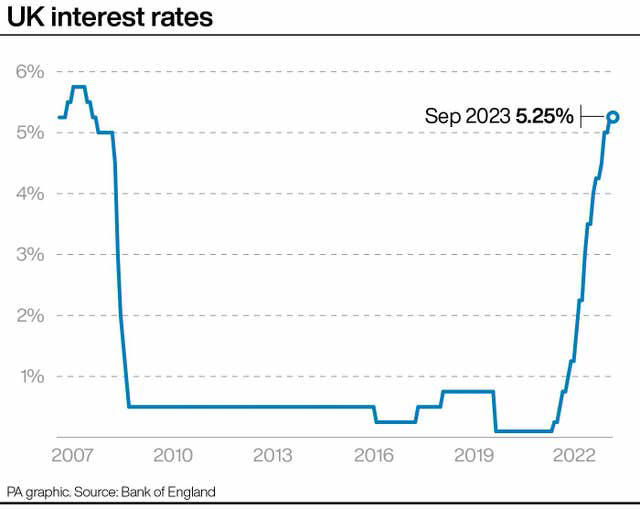

Its monetary policy committee has agreed to keep base rate at 5.25%. The Bank has been hiking rates since December 2021 in an effort to tackle inflation in the UK, which is running at 6.7% - far above the 2.0% target rate agreed.

In the minutes from its latest meeting, the MPC says that since June inflation had fallen much faster than expected to 6.7% in August. Simultaneously there were “increasing signs” that higher rates were starting to hurt the UK economy. For these reasons the MPC says it kept rates on hold but warned they must remain “sufficiently restrictive for sufficiently long” to get inflation back down to 2.0%.

Chancellor Jeremy Hunt says “we are starting to see the tide turn against high inflation, but we will continue to do what we can to help households struggling with mortgage payments. Now is the time to see the job through. We are on track to halve inflation this year and sticking to our plan is the only way to bring interest and mortgage rates down.”

Interest rates unchanged but it’s not the end for house price drops

The Bank of England has held off on further interest rate rises for now but agents warn that there is still further for house prices to drop. The cost of borrowing had been raised for 14 consecutive months between December 2021 and August 2023 from 0.1% to 5.25% in an effort to tackle high inflation.

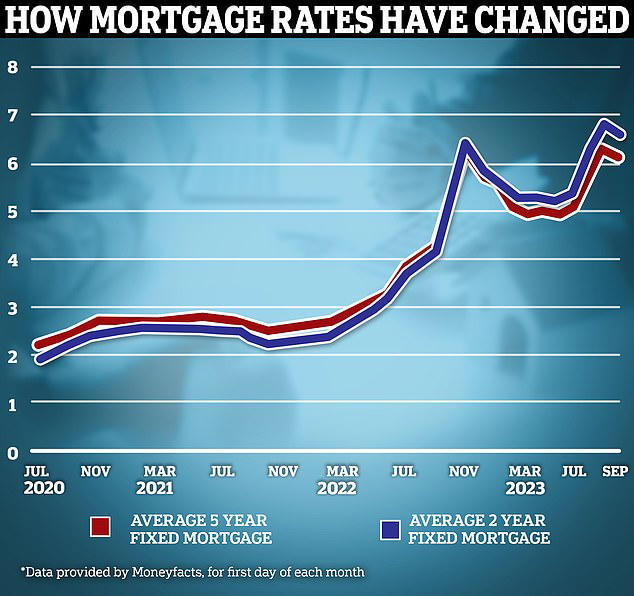

At the same time, average mortgage pricing has risen above 6%, hitting buyer budgets and pushing house prices down as the market slows. But inflation has been easing recently, prompting the Bank of England to hold interest rates at its latest meeting.

The central bank said there were signs that the rate rises were hitting the economy and the labour market.

Commenting on the announcement, Lucian Cook, head of residential research at Savills, said “the Bank of England’s decision to maintain the current base rate is an important signal to the mortgage markets and should take some of the edge off the affordability pressures buyers are currently facing. However, a material improvement in mortgage affordability requires the prospect a cut in interest rates coming onto the horizon. That still looks some way off, suggesting buyers’ budgets are going to remain constrained and that there is a little way to go before house prices bottom out.”

Rate hike pause ‘will offer some relief to those struggling with housing costs’

Some homeowners may be breathing a sigh of relief after the Bank of England’s decision to press pause on interest rate hikes, but many are yet to fully feel the impact of the increases that have already taken place. With many homeowners sitting on fixed-rate mortgages, the effects of previous rate rises are still working their way through, as people’s deals come to an end and they take out new deals at higher rates.

According to trade association UK Finance, around 800,000 fixed-rate mortgage deals are due to end in the second half of this year and 1.6 million are due to end next year.

The pause follows 14 rises in a row, taking the base rate from 0.1% to 5.25%.

Earlier last week, consumer group Which? highlighted concerns around those who are due to come off fixed-rate deals around Christmas, a time when finances are often squeezed. Average two-year fixed-rate mortgages are currently above 6%, according to data from financial information website Moneyfacts.

But Which? said that some of those who had previously fixed their deal in December 2021 could have got a rate below 2%.

Sam Richardson, deputy editor of Which? Money, said “this latest decision may offer some relief for those around the country struggling with housing costs. However, Which? warned this week that around half a million homeowners are set to come off their fixed-term deals over the Christmas period, meaning households already under pressure due to the cost-of-living crisis could see their monthly repayments increase by hundreds of pounds. Those concerned about how they will repay their mortgage should contact their lender straight away – and doing so will not affect your credit score. Options may include extending the term of your mortgage, only paying the interest on your deal or taking a temporary payment holiday – and the most suitable will depend on individual circumstances. That’s why it’s crucial that lenders are available to help customers with appropriate and tailored support.”

People should bear in mind that extending the mortgage term or going interest-only for a period may mean that they end up paying more money to their lender in interest charges over the longer term.

Property professionals said the base rate pause could bring some “welcome reassurance” to the housing market.

Jeremy Leaf, a north London estate agent, said of Thursday’s rate pause “stability is so important to the property market and brings confidence to buyers and sellers sitting on the fence finding it difficult to budget before deciding to make their moves. This hold, after many months of rises, will bring some welcome reassurance.”

Riz Malik, director of Southend-on-Sea-based mortgage broker R3 Mortgages, said “the markets should react positively, and we might witness even larger reductions in fixed rates.”

Gary Boakes, director of Salisbury-based mortgage broker Verve Financial, said “we can finally breathe a sigh of relief after 14 straight base rate rises. This is truly fantastic news.”

(PA Graphics)

© Provided by PA Media

Andrew Montlake, managing director of the UK-wide mortgage broker Coreco, said “it now looks like we are at the very top of the interest rate cycle, with swap rates (which underpin mortgage pricing) continuing to ease and giving lenders more space to engage in a rate war as they battle for market share and look to get a good start to 2024. As this competition increases, we will see more products available starting with a four rather than a five and this will inevitably start to encourage more buyers back into the market as they seek to take advantage of the buyers’ market whilst it lasts.”

Renters are also feeling the impacts of rent hikes, as higher mortgage rates feed through to them from landlords’ additional costs.

According to Office for National Statistics (ONS) figures released on Wednesday, private rental prices paid by tenants in the UK rose by 5.5% in the 12 months to August 2023, accelerating from 5.3% in the year to July 2023.

This was the biggest annual percentage change since the UK-wide records started in January 2016.

Meanwhile, savers have been making the most of jumps in cash savings rates as the base rate has increased. Some providers have recently reported seeing significant rises in savers fixing into deals.

Ed Monk, associate director for personal investing at Fidelity International, said “we know that more and more of our investing clients have been turning to cash as rates have risen, with money market and cash funds jumping to the top of Fidelity Personal Investing’s best-sellers lists this year. A pause in rate rises is further evidence that rates may have topped out and investors should understand the risks when they take shelter in cash. Rates on deposit accounts remain below inflation meaning a loss in real terms, while investors in cash may also be missing out on bigger – although less certain – gains from shares.”

Sarah Coles, head of personal finance at Hargreaves Lansdown, said of cash savings rates “the very best deals may not be around for much longer. If you haven’t switched your easy access rate for some time, it’s also worth making a move while there are some really attractive rates on the market. However, this isn’t time to panic. If your current fixed-rate deal doesn’t come to an end for a while, don’t lose faith. The Bank of England’s insistence that the fight against inflation is ongoing means we could see more rises further down the line, and at the very least is likely to mean it keeps interest rates higher for a considerable period. It means that while we may see some of the most competitive rates retreat, we’re not expecting dramatic drops in the immediate future.”

What the interest rate pause means for your mortgage

The higher base rate has created a mortgage crisis for some - especially those who are due to remortgage in the near future. That's because home loan rates have risen significantly over a short space of time. Mortgage borrowers on tracker and variable rates will likely be breathing a sigh of relief today.

Variable rate mortgages include tracker rates, 'discount' rates and also standard variable rates. Monthly payments on all these types of loan can go up or down. Trackers follow the Bank of England's base rate plus or minus a set percentage, ie base rate plus 0.5%. Standard variable rates are lenders' default rates that people tend to move on to if their fixed or other deal period ends and they do not remortgage on to a new deal.

These can be changed by lenders at any time and will usually rise when base rate does, but they can go up by more or less than the Bank of England's move. As for fixed rate borrowers, most are protected by the fact that their deal is fixed in for a period of time. For those approaching their remortgage, they may have noticed that mortgage rates have also been falling of late.

The average two-year fixed mortgage rate is now 6.58%, according to Moneyfacts. The average five-year fix is 6.07%. This is an improvement from two months ago. A succession of base rate rises and disappointing inflation figures saw average two-year fixed mortgage rates reach a high of 6.86 per cent at the end of July, while five-year fixed rates hit 6.37%.

However, it is still up from 5.17% and 5.49% on 1 June. And well up on two years ago, when the average two-year rate was 2.52% and the average five-year rate was 2.75%. Of course, it's important to also remember these are the average rates across the entire market. The cheapest deals available paint a slightly more positive picture.

It's possible to get a rate of 5.61% on a two-year fix, and as low as 4.99% when fixing for five years. It is worth speaking to a mortgage broker to find the cheapest deal that you may be eligible for.

© Provided by This Is Money

But even if they can bag a below-average rate, those who need to remortgage this year are still likely to face a serious hit to their finances. The average borrower coming off a two-year fix would see their rate increase from 2.52% to 6.58%, if they fixed for two years again today. On a £200,000 mortgage over a term of 25 years, this would mean monthly mortgage payments rising from £899 to £1,360 – an increase of £461 a month or £5,532 a year.

" A more stable interest rate environment, even if high, can bring some predictability"

Karen Noye, mortgage expert at Quilter says 'persistently high rates will pile continuous pressure on those with mortgages and force some to sell up. While these rates can help manage inflation and ensure economic steadiness, they can cause people to spiral into further debt as they fall into arrears. A more stable interest rate environment, even if high, can bring some predictability. For aspiring homeowners, notably first-timers, this can be invaluable. A more stable mortgage rate landscape can help these buyers budget better and not have to deal with unpredictable rate spikes that can disrupt financial plans."