Rents could rise more than four times as fast as house prices between the end of 2022 and the end of 2026, according to a forecast.

Across Britain, rents could soar by 25% over the four-year period, compared with 5.5% growth in house prices, estate and lettings agent Hamptons predicts. As mortgage rates gradually fall and households benefit from real income growth, Hamptons said it expects house price falls to come to a halt in 2024, with growth picking up in 2025.This is likely to be the year when a new housing market cycle starts, the property services firm predicted.

It expects just under a million house sales to take place across Britain in 2023, which would be down on 1.2 million completions in 2022. Slightly lower mortgage rates and improved affordability in 2024 will encourage 1.1 million completions in 2024, it predicts.

House price growth

© Provided by The Telegraph

Meanwhile, a build-up of long-term supply issues combined with rising landlord costs will continue to put pressure on rents, Hamptons suggested. A combination of lower rental yields and more landlords being reliant on finance will put added pressure on investor profits in London in particular, it added.

Aneisha Beveridge, head of research at Hamptons, said "price falls this year are expected to be followed by a slow recovery as households adjust to higher rates. This will be more akin to the ‘U-shaped’ downturn of the early 1990s than the ‘V-shaped’ crash and subsequent speedy recovery in 2008. On paper, the house price falls we forecast are minor in nominal terms. But high inflation for other goods and services means that in real terms, the average price of a home will have fallen around 11% between 2022 and 2024. This essentially reflects the correction caused by higher rates. It’s also why we expect prices to rise again in both real and nominal terms from 2025 as rates fall to their new normal and a new housing cycle begins.”

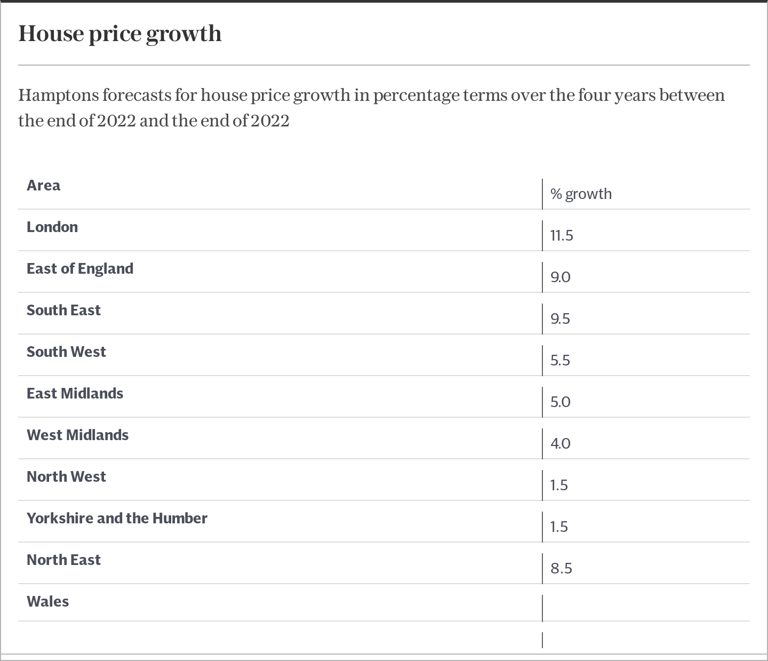

In the North East of England, Hamptons is expecting relatively strong house price growth of 8.5% by the end of 2026, while in Wales, house price growth is predicted to stall overall, at 0.0%.

Researchers explained that house price growth in Wales has already been relatively strong in recent years, while in the North East it has been slower compared with some other regions. Housing affordability there is also less stretched than in some areas, allowing capacity for further house price rises.

Hamptons used Office for National Statistics and Bank of England data for its forecasts.

RICS survey predicts yet more rent rises

The latest lettings market snapshot from the Royal Institution of Chartered Surveyors shows that a significant majority of members expect yet more rent rises in between now and Christmas. The RICS survey is based on sentiment and prediction, and the latest - out today - has a net balance of +47 of respondents noting a rise in tenant demand; however, new landlord instructions fell slightly with a reading of -20.

The institution says that given this mismatch between demand and supply, a net balance of +60% of contributors foresee rental prices being driven higher over the coming three months.

In the sales market, the pace continues to slow with house prices remaining on a downward spiral.

The survey indicator for house prices nationally, in terms of net balance, continued to fall from -55 in July, to -68, marking the most negative reading since 2009. New buyer enquiries declined slightly from the -45 posted last time, to -47, with new sale instructions following a similar trend, slipping from -17 in July to -26 this time round.

Survey respondents reported a decline in newly agreed sales, falling from -45 to -47, which marks the weakest reading for this indicator since the pandemic. RICS Chief Economist, Simon Rubinsohn, comments “the latest round of feedback from RICS members continues to point to a sluggish housing market with little sign of any relief in prospect. Buyer enquiries remain under pressure against a backdrop of economic uncertainty and the high cost of mortgage finance. Meanwhile, prices are continuing to slip albeit that the relatively modest fall to date needs to be seen in the context of the substantial rise recorded during the pandemic period. Critically, affordability metrics still remain stretched in many parts of the country. The other side of the softer demand in the sales market is the continuing strength of rental demand. The yawning gap with rental supply is clearly visible in the RICS Rent Expectations indicator which remains close to an all-time high. Anecdotal comments from contributors that landlords are leaving the sector suggests the challenging environment for tenants is unlikely to improve any time soon”.

More tenants struggling to pay rent - government figures

More people are struggling to pay their rent according to a new government survey.

The study, by the Office for National Statistics, does not differentiate directly between tenants and owner occupiers but among those currently paying rent or a mortgage, 45% reported that their rent or mortgage payments had gone up in the past six months. Among those who are currently paying rent or a mortgage, 42% reported finding it very or somewhat difficult affording these payments; this was 35% at this time last year.

Around half of adults reported that their cost of living had increased compared with a month ago, 46% reported it had stayed the same and three per cent said it had decreased. When asked about what people are doing because of the increases in the cost of living, around two-thirds said they were spending less on non-essentials, half of all adults were shopping around more, and 45% were spending less on food shopping and essentials.

However in the same survey, when asked about the important issues facing the UK today, housing was not in the top three.

The most commonly reported issues continued to be the cost of living (89%), the NHS (86%) and the economy (73%). Fourth was housing (64%) with climate change and the environment on 63%.

Meanwhile another survey - from the Hargreaves Lansdown business consultancy - suggests that higher rents are wearing down the financial resilience of tenants. The HL survey claims the average renting household has just £180 left at the end of the month, while a household with a mortgage has £337.

They’re less likely to have enough emergency savings to cover three months’ of essential spending. Only 45% cross the threshold, compared to 72% of those with a mortgage. They’re also less likely to have enough sick pay or income protection cover. Only 62% cent do, compared to 91% of those with a mortgage.

Only 34%t of them have enough life cover, marginally less than mortgagees at 35% - and way behind those who own outright at 84%. They’re well behind on pension savings too. Only 18 per ware on track for a moderate retirement income, compared to 54 per ware of those with a mortgage.

Sarah Coles, head of personal finance at Hargreaves Lansdown, says “rent is such a massive drain on our finances that trying to build anything for the future while meeting monthly rental costs is like trying to run a bath with the plug out. It means the financial resilience of renters is being washed down the plughole. The relative cost of renting and paying a mortgage is shifting, so that on average it’s more expensive to buy a property with a mortgage than it is to rent the same property. However, renters earn much less on average – at a household average of £30,294 compared to a mortgaged household at £56,188. This means their rent swallows a bigger slice of their income.”

Tenants forced into signing ‘rent tracker’ contracts

Letting agents say they are being asked by landlords to offer tenants a ‘rent tracker’ agreement – which enables rent rises that follows a rise in the Bank of England base rate. Research by the i newspaper highlights that the trend appears to be on the rise as landlords pass on the cost of their mortgages to their tenants.

It reports that one tenant in London had to agree to a 20% rent hike, plus a clause that could trigger another increase in six months, to secure her home. She said she felt like she had no choice, as the demand for rental properties is so high that she would struggle to find another place.

Include the clause in tenancy agreements

The newspaper quotes Marc von Grundherr, of London-based estate agents Benham and Reeves, who reveals that landlords are increasingly asking him to include the clause in tenancy agreements. He says "that the agency has drafted two agreements so far that make clear that rents can be increased if the Bank of England rate rises."

James Lindsay, a Liverpool lettings agent, told i "that one landlord had asked for a similar clause after he had agreed something similar with a tenant in another city." He tells the newspaper that he refused to do it, saying the landlord was trying to ‘game’ the situation in their favour.

Raised its base rate 14 times since the end of 2021

The Bank of England has raised its base rate 14 times since the end of 2021, and it is expected to do so again on 21 September, to 5.5%.

This means that landlords who have variable or tracker mortgages are paying more interest every month.

Some letting agents say they have refused to comply with these requests, as they think it is unfair for tenants who are already facing record-high rents and inflation. But others have apparently agreed, saying that some landlords are struggling to make ends meet and need to protect themselves from further rate rises.

Renters are facing fierce competition

Rents have soared across the UK over the past year, as the supply of rental properties has not kept up with the demand and now renters are facing fierce competition for every property.

Some letting agents report they receive between 30 and 100 applications per property – which gives landlords more power to impose their terms and conditions on tenants, who often have little room for negotiation. The i says the situation is likely to worsen as interest rates continue to rise, putting more pressure on landlords and tenants alike.

‘Unusual’ to see these tenancy clauses

A project co-ordinator at Renters’ Rights London, Portia Msimang, says it is ‘unusual’ to see these tenancy clauses – and they typically only apply to those for more than one year.

She says she would advise a tenant not to sign the agreement if there was such a clause. "

Shelter’s chief executive, Polly Neate, said that tenants are being back into a corner because they have an impossible choice.Either they agree to the clause, or they miss out on the property."

A spokesperson from the Department for Levelling-Up, Housing and Communities, told i “rents should be agreed between landlords and tenants, and landlords should have a route to change rents, only when it is necessary. Our landmark Renters (Reform) Bill currently going through Parliament will deliver a fairer, more secure and higher quality private rented sector. It will deliver the government’s commitment of a better deal for renters and landlords by improving the system for both responsible tenants and good landlords.”

Rent Controls would force a third of landlords to quit Buy To Let

Over a third of private landlords would sell properties if rent controls were introduced in their area, according to a trade survey. The data, from polling firm YouGov for the National Residential Landlords Association, shows 37% would reduce the number of properties they let if an external agency like a council was given authority to set rents both during and between tenancies.

The NRLA says that such an exodus of landlords could have “a devastating impact on the supply of homes to let at a time of ever-increasing demand.”

The Scottish Parliament has recently announced that it’s so-called emergency rent controls are in fact here to stay as long as the Scottish National Party and Green alliance stay in power north of the border. The current UK Government has been clear that it has no plans to introduce such measures and Labour’s previous shadow housing secretary dismissed rent controls - although the party’s London Mayor Sadiq Khan have been vocal in his calls for controls to be introduced in the capital.

The Labour Welsh Government has recently published a Green Paper calling for some form of rent controls to be “explored”.

The NRLA says landlords’ plans tended to differ slightly depending on the types of controls proposed.

These are broadly split into three categories:

- First generation rent controls – a 'hard' control in which rents are fixed and remain frozen;

- Second generation rent controls – rent increases are limited to a set percentage or pegged to inflation; or

- Third generation rent controls – these allow initial rents (such as new tenancies) to be freely set by landlords or with a very light restriction but limit rent increases within tenancies.

A statement from the NRLA, following the results of its survey, says that rent controls typically lead to a reduction in supply, fewer incentives for landlords to invest in property upgrades, and tenants staying longer and locking out younger renters.

The NRLA has long warned that they controlling or freezing rents could actually make the problem worse, with landlords - no longer able to make their business models stack up - more likely to leave the sector.