Property asking prices in the UK have fallen to their lowest point since 2018 as soaring mortgage rates add further pressure to buyers, data from Rightmove suggests.

According to the property website, average new seller asking prices fell by 1.9% in August - or £7,021 - on average, dropping to £364,895.

This represents a reduction of more than double the seasonal drop of 0.9%, which is normally attributed to a typical "summer slowdown". Tim Bannister, Rightmove's director of property science, said "there are still significant challenges in saving up enough for a deposit and affording higher mortgage payments. However, would-be buyers are now likely to see greater property choice in their area and therefore a home more likely to suit their needs compared to during the pandemic."

Mortgage deals have eased back from the peak seen in July, with the average five-year fixed rate now resting at 5.81%, down from 6.08% three weeks ago. Nevertheless, demand is still being weighed on across the market, prompting many sellers to price more competitively to attract buyers against the backdrop of holidays, cost of living pressures, and the highest Bank of England Base Rate since 2008.

Average asking prices are now £8,000 (2%) lower than at their peak in May - but this must be viewed in the larger context of significant house price growth over the past four years, with average prices still £59,000 (19%) higher than in August 2019 and while there may be more choices available, Mr Bannister said "there is no glut of properties for sale. The number of available properties is still lower than at this time in 2019 and homes still selling more quickly, with the average time to find a buyer now 55 days compared to 61 days in 2019. While a 1.9% drop in just one month seems dramatic, it's in part an expected seasonal drop as sellers coming to market realise that they have to compromise on price due to the traditionally quieter summer holiday period."

Falling: Average new seller asking prices fall by 1.9% (-£7,012) this month to £364,895, the biggest fall in August since 2018, according to Rightmove© Provided by This Is Money

Average asking prices in the first-time buyer sector are down by 1% compared to last year, while average advertised rents for the equivalent type of home are up by a "staggering" 12% over the same period. The property experts said this could indicate that for those who can, getting on the housing ladder remains an attractive option.

Mr Bannister said "our analysis shows that homes that are priced right the first time, rather than priced too high only to be reduced later, are not only more likely to find a buyer but more likely to find a buyer quickly. This supports local agent reports of a two-speed market, with some properties for sale being overpriced and at risk of going stale, and many competitively priced homes which are attracting multiple prospective buyers."

However, the data also shows there has been a 15% drop in the number of sales being agreed on now than at this point in 2019, as many put off their plans to move due to market volatility.

Mr Banniser stated "the lower level of agreed sales compared to this time in 2019 indicates the affordability challenges that many buyers currently face. However, with sales holding up more strongly in the typical first-time buyer sector, owning your own home remains an appealing option for those that can afford it, with the alternative being an extremely frenzied rental market, where rents are at record levels."

Rightmove said some sellers were 'seizing the initiative and heeding their agents' advice to price competitively for their current local market conditions.

Shifting sentiment: It represents the first meaningful downward shift in asking prices after months of very little movement, bar December.

© Provided by This Is Money

Henry Pryor, a professional buying agent and property expert says "he expects prices to fall further from where they are now. Eventually gravity will have it's way,' says Pryor, 'average asking prices have risen by 19% since 2020 but the impact of higher interest rates is starting to chip away at sale prices and so sellers and their estate agents must follow suit. To get ahead of the market - when buyers return in September after the holidays - many are trying to show they are serious, by quoting a more modest price but remember two things; average asking prices are still where they were a year ago.

House prices fall 5.3% year-on-year in August

The Nationwide House Price Index for August indicates a monthly fall in prices of 0.8% feeding through cumulatively to an annual drop of 5.3%. The average price of a property (not seasonally adjusted) now stands at £259,153 down £14,600 from the last August peak in 2022.

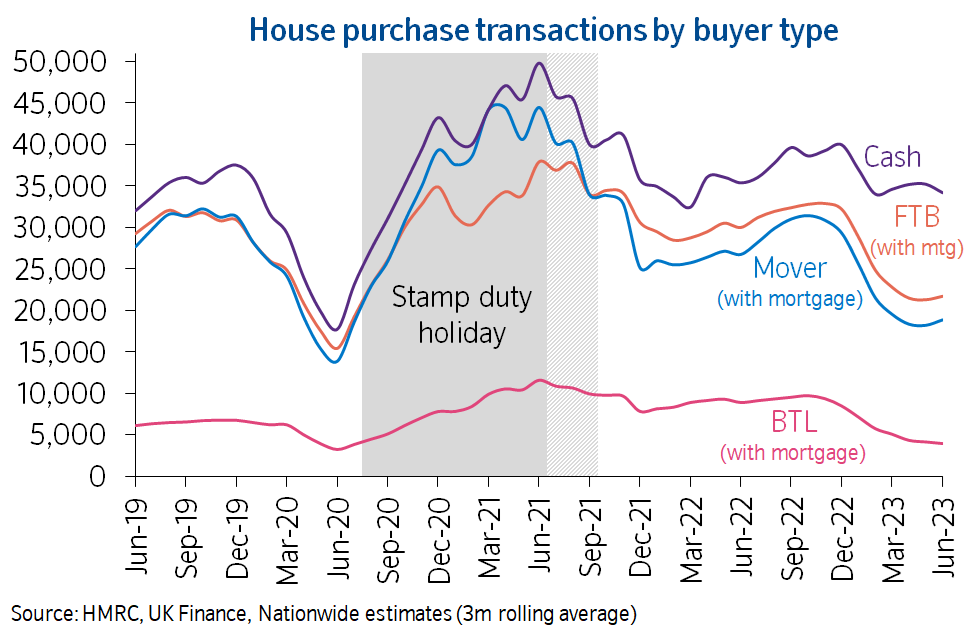

Market activity in the first 6 months of 2023 has seen a 20% drop in completed transactions against 2019 levels and a full 40% drop against the same period in 2021. Cash transactions have unsurprisingly been the most resilient against mortgaged completions due to the cost of borrowing.

A relatively soft landing is still achievable

Nationwide’s Chief Economist, Robert Gardner, said “August saw a further softening in the annual rate of house price growth to -5.3%, from -3.8% in July, the weakest rate since July 2009. Prices fell by 0.8% over the month, after taking account of seasonal effects. The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels. For example, mortgage approvals have been around 20% below the 2019 average in recent months and mortgage application data suggests the weakness has been maintained more recently (we explore the evolving composition of transactions in more detail below). Nevertheless, a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters’) expectations.

In particular, unemployment is expected to remain low (below 5%) and the vast majority of existing borrowers should be able to weather the impact of higher borrowing costs, given the high proportion on fixed rates, and where affordability testing should ensure that those needing to refinance can afford the higher payments. While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.”

Homebuyers are feeling the pinch: Mortgage borrowing hits lowest level since Covid

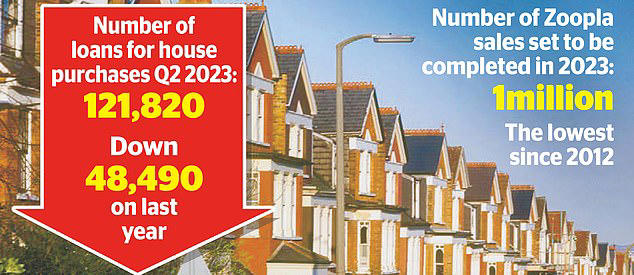

Borrowing for house purchases has fallen to the lowest level since the pandemic as higher interest rates and the cost of living squeeze make it increasingly difficult to afford a home. Figures from trade body UK Finance showed the number of loans for first-time buyer and home mover purchases fell to 121,820 in the second quarter of the year.

Separate data from property website Zoopla showed the number of home sales overall this year was on course to be the lowest since 2012.

Meanwhile, comments from Karen Ward, an adviser to the Chancellor and strategist at JP Morgan Asset Management, suggested there was more gloom to come with central banks set to push western economies into recession in order to be sure of winning the battle against inflation.

Rejecting the idea of a ‘soft landing’, Ward, a member of Jeremy Hunt’s economic advisory council, said there would need to be signs of weakness before policymakers felt able to ease their tough approach.

Borrowing down: Figures from trade body UK Finance showed the number of loans for first-time buyer and home mover purchases fell to 121,820 in the second quarter of the year

© Provided by This Is Money

Ward told Bloomberg TV "the likelihood of a recession I think is still high, that’s what’s going to get rid of inflation."

The latest data from UK Finance showed a 28% fall in the number of home loans compared with the same period a year ago, the lowest level since the second quarter of 2020 when lockdowns brought the market to a standstill. UK Finance said that over the first half of this year levels of housing market activity ‘have remained very low by comparison with recent years’.

The report added: ‘This weakness stems from the significantly greater affordability challenges currently faced by borrowers’.

Though house prices have started to fall and wage growth is accelerating, the ratio of prices to income – a key measure of how hard it is to afford a home – remains close to historic highs. Meanwhile, higher interest rates for new mortgages, combined with steeper monthly outgoings as inflation bites, have ‘significantly raised the bar’ for borrowers to meet affordability criteria that – under rules set by the City regulator – must be met in order to be approved for a loan.

‘With these affordability pressures unlikely to ease rapidly, house purchase lending is likely to remain constrained over the near term,’ UK Finance said.

Despite the squeeze on incomes caused by high inflation and rising interest rates, consumer spending rose in the second quarter. This was partly thanks to the wall of savings many households built up during the pandemic. Eric Leenders, managing director of personal finance at UK Finance, said ‘whilst the cost of living challenges have created acute hardship for many, we have also seen that other consumers were largely able to pay off their credit card bills and meet their monthly mortgage payments. Some have been dipping into their savings to help pay the bills, whereas some of those with savings have moved their money to accounts with higher rates to maximise their income."

Separate figures from Zoopla suggested that the number of housing sale completions in 2023 was set to fall 21% compared with last year to 1m – the lowest level for 11 years. They also pointed to annual house price growth slowing to 0.1%.

Richard Donnell, executive director at Zoopla, said "house price growth has slowed rapidly over the last year as demand weakens in the face of higher mortgage rates. Prices are falling more in southern England where higher mortgage rates have priced more people out of the housing market, weakening demand."

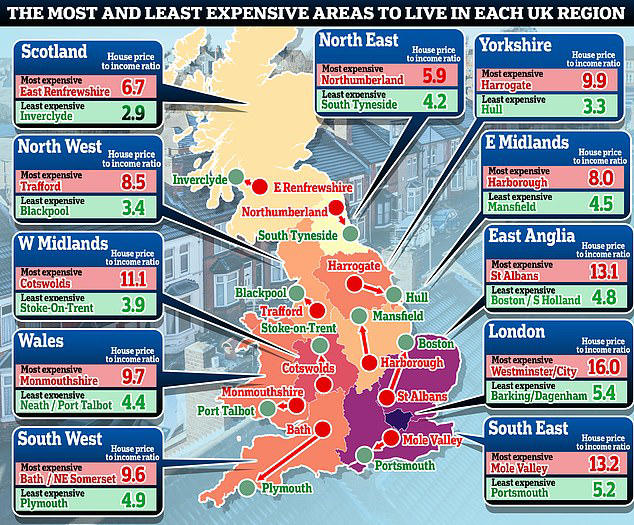

Most AND least affordable areas to buy a home in each UK region

Despite house prices falling over the past year, higher mortgage rates will be pricing many buyers out of the types of homes and areas they want to live in. One in four movers went to a more affordable area this year, according to the estate agent Hamptons International, up from one in five in 2022.

Aneisha Beveridge, head of research at Hamptons International said 'households are slowly but surely adapting to higher rates. While movers continue to be spurred on by the three D's – debt, divorce and death – first-time buyers have gone against the odds and purchased a record 28 per cent of homes across Great Britain this year. But with higher mortgage rates limiting how much they can borrow, many are adapting by purchasing smaller homes in more affordable locations."

Move somewhere cheaper: One in four households moved to a more affordable area this year, up from one in five in 2022, according to Hamptons

© Provided by This Is Money

None will be more impacted by higher mortgage rates than first-time buyers.

Mortgage costs have increased by 25% for first-time buyers over the last year alone, according to research by Halifax, from an average payment of £1,095 per month up to £1,364, as a result of higher interest rates. However, the impact of higher interest rates isn't felt equally across the country. It will depend somewhat on the average house price and earnings in each given area.

The cost of a typical UK home is now 6.7 times average earnings, according to Halifax - but this varies considerably depending on where you live. The cheapest local area to live in the UK is Inverclyde in Scotland, where average house prices are only 2.9 times higher than average annual earnings.

The most expensive local area to live in is either Westminster or the City of London where house prices are a staggering 16 times the average annual income in each area. According to Halifax's data, the average house price in London's two most expensive areas is £915,000 - almost seven times more expensive than the average £134,000 house price of Inverclyde.

While many people won't necessarily be prepared to move from one end of the country to another in order to find cheaper housing, some may be prepared to move somewhere closer to home. Halifax has provided This is Money with a breakdown of the most expensive and cheapest local authorities in each region, to show where buyers could look for something more affordable.

Although it won't necessarily make sense for the majority of homebuyers to pick between the most expensive and cheapest locations in a given region, it does at least show how different local areas can be when it comes to housing affordability - and some are geographically quite close to one another.

For example, in the North West, Blackpool and Trafford, in Greater Manchester, are only 49 miles apart by road and yet Blackpool house prices (£134,000) are 3.4 times annual earnings compared to Trafford's (£330,000) 8.5 times house price to earnings ratio.

Darren Sellwood, senior branch manager at estate agent Entwistle Green in Blackpool, argues that other than being a great place to live, Blackpool offers excellent potential for both buy-to-let investors seeking rental income and long-term house price growth. He says 'if I was looking to invest in a property to live in or as an income driver, I’d look no further than Blackpool - a vibrant coastal town with affordable property options and a booming tourism industry. It has iconic attractions, beautiful beaches, and substantial ongoing development projects - with millions of private and public money being invested. This includes the Talbot Gateway Project, the relocation of 3,500 DWP workers to Blackpool Town Centre and new planned Multiversity training centre."

Another coastal location offering the best value for money in its region is the city of Portsmouth, where average house prices are 5.2 times annual earnings. Just 60 miles northeast of Portsmouth is Mole Valley in south Surrey, where house prices are typically 13.2 times more expensive than earnings.

Gemma Atkin, senior branch manager at estate agent, Fox & Sons in Portsmouth, says 'the sunny side city of Portsmouth with the beach and the sea on our doorstep, offers easy access into other main cities such as London and Bournemouth, without needing to pay the high house prices like in these areas. We have an array of different era properties, being in such a rich historical city, which appeals to everyone. With good transport links, including buses, ferries, trains and coaches, your chosen lifestyle - city or rural - is at your fingertips."

The least and most expensive local authorities in each region of the UK

In London, one of the most expensive local authorities is the City of London, where house prices are 16 times more than average incomes in the area. Eight miles east of the City of London is the cheapest London local authority, Barking and Dagenham, where house prices are 5.4 times average incomes.

Estate agents from Barking and Dagenham were keen to point out that both areas should appeal to people wanting to live and work in London.

Jeff Vedgen, branch manager at estate agent, William H Brown, in Barking said "Barking is an up-and-coming cosmopolitan area of London. It is now regarded as the new jewel of the East End. Barking's new "settlers" have been drawn in by its dynamic and vibrant feel and to its fantastic transport links into the City and West End. Along with its established networks it now boasts an Uber boat link which makes it a perfect place to set up home."

Lee Clark, senior valuations manager at Bairstow Eves in Dagenham adds "Dagenham has fantastic transport links. It has three district line stations providing direct access for commuters into London, as well as close access to the A13 and M25. The borough further benefits from various parks, as well as Beam Country Park for homeowners to enjoy open green space in an area of London that is still very affordable."

Someone living and working in the West Midlands could potentially choose between the Cotswolds, where house prices are 11.1 times average incomes, and Stoke-on-Trent where prices are only 3.9 times the typical annual income. Meanwhile, those looking to get on the property ladder in Yorkshire and Humberside could consider Hull over Harrogate given they are just 69 miles apart.

Hull is the cheapest local authority in the region with average house prices worth 3.3 times the average income in the area.

Meanwhile, Harrogate is the most expensive place to buy in the region, with house prices 9.6 times higher than the average annual income.

While moving to a different area has become easier for many thanks to hybrid working, that is not the case for everyone. Henry Pryor, a professional buying agent and property expert, expects increasing numbers of first-time buyers and home movers to compromise on location given higher mortgage costs. He says 'for the past 100 years people have moved to places that they can afford. They have compromised. With the increase in working from home, many people can afford to live further from work and for those fortunate to be able to do so, this is a huge luxury. For those who can't work from home - the nurses, the teachers, the fireman or the factory worker - this is not an option. They would have to change jobs to be able to move somewhere more affordable - Something that more and more people are having to consider."