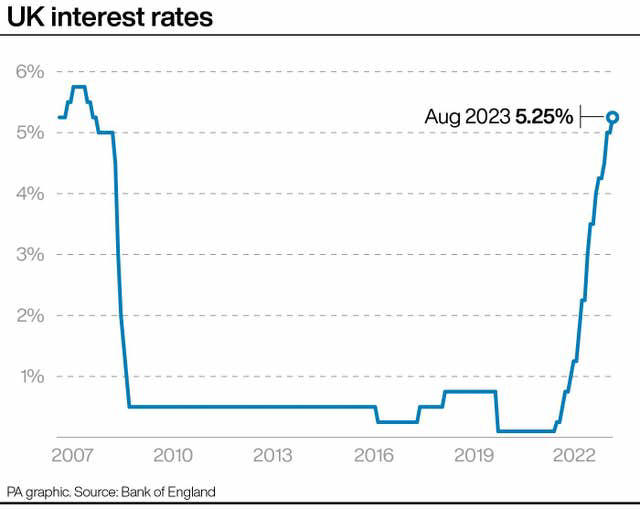

The Bank of England (BoE) raised interest rates by 0.25%, increasing the current bank base rate from 5% to 5.25%.

The central bank has now increased the base rate 14 consecutive times in a row since rates first started to increase in December 2021, it is now at its highest level in more than 15 years - February 2008. Latest consumer price index figures from the Office for National Statistics show that annual inflation fell to 7.9% in June from the previous month’s 8.7%. Still, financial experts expected that the BoE’s Monetary Policy Committee would implement a rate hike today, albeit at a slower pace, considering the recent decline in annual inflation.

According to UK Finance, the latest 0.25% base rate hike means that homeowners would be paying a monthly average of £23.71 more on their tracker mortgage and £15.14 more on their standard variable rate mortgage. It is a different story for fixed rate mortgages, however, as brokers have assured borrowers that any change in interest rates today would not have any effect on fixed rates for now.

Bank of England's Bailey speaks after interest rates rise to 5.25%

Governor Andrew Bailey and other top Bank of England officials spoke to reporters after the British central bank raised its key interest rate by a quarter of a percentage point to 5.25% on Thursday. Below are quotes from Bailey and other members of the Monetary Policy Committee at their press conference.

BOE GOVERNOR BAILEY ON WHERE RATES ARE HEADED

"I'm not going to judge what the path of rates will be. Not least because as the report indicates more than one path may deliver inflation back to target sustainably. We had some unpleasant surprises in June, we've seen some of that turn around, which is frankly, you can put into context today, why I don't think, speaking personally, I don't think there was a case for a 50 basis point raise today. We hope that we can deliver the path that we've set out in the report, because the path we've set out in the report does not have a recession in it. We will have to see. There is no presumed path of interest rates from here."

BOE GOVERNOR BAILEY ON DIRECTION OF INFLATION

"We expect inflation to take a further step down in the July data which will be published in two weeks time, I think that will come down to around 7% at that point... followed by another larger step down in October's data. We do expect core goods inflation to ease over the rest of the year. And there are indicators that suggest it could happen faster than our projection. The evidence has gone one way then gone a bit the other way. So I don't think it is time to sort of declare it's (the fight against inflation) all over and we're sort of sitting where we are for the moment, because I think that really does sit at odds with the fact that we've had some very big pieces of news and they're not going in the same direction. So we have to remain evidence driven. We've continued to use language which we've used before, which is to say, if we get more evidence of more persistent inflation, then we will have to react to that."

BOE GOVERNOR BAILEY ON WAGE-PRICE SPIRAL

"I wouldn't agree with that … I think the path of inflation and the first half is now much more assured," he said, when asked whether the bank has lost control.

BOE GOVERNOR BAILEY ON LABOUR MARKET, WAGE INFLATION

"A lot will depend on what happens in the labour market, and to pay. There are signs that the labour market is loosening. In our judgement, upside surprises on wage inflation suggests that it will take longer for second round effects to go away than it did for them to appear in response to the sharp rise in prices of many imported goods over 2021 and 2022. Other parts of the labour market I think are softening, but that pay element of the labour market hasn't."

BOE GOVERNOR BAILEY ON THE HOUSING MARKET

"We are seeing of course some adjustment in the housing market. Yes we've seen some decline in house prices, on the other hand, the latest numbers suggests... that the was a small increase in net lending... and a small increase in mortgage approvals. The evidence on the housing market is, yes, there is an adjustment, of course, I don't think we should be surprised at that. But I would certainly not wish to talk this up into a crisis in the housing market, because I think there's plenty of evidence that suggests that this is a process that has some moderating influences in it as well."

BOE DEPUTY GOVERNOR RAMSDEN ON CONSECUTIVE RATE RISES

"The risks on persistence have been crystallising prior, through this year. That's why we've been having to raise rates in response to increasing evidence on persistence. So it's not suddenly that that evidence has appeared, we've been seeing that evidence for some time, which is why we're having to keep raising rates."

BOE DEPUTY GOVERNOR BROADBENT ON BRINGING INFLATION DOWN SUSTAINABLY

"We have to make sure inflation comes down sustainably to target, and therefore we have to be focussed on making sure that that average interest rate, given the information we have right now, is sufficient to ensure that happens. Our focus is very much on the medium term, and we have to (en)sure that interest rates over that period are sufficiently restrictive. What we can say is we think we're seeing evidence that the rate of interest is above the neutral rate without saying precisely what that is because we're beginning to see an effect on demand - that's what we're prepared to say."

BOE GOVERNOR BAILEY ON SERVICE PRICE INFLATION

"Service price inflation was 7.2% in June, which was higher than we projected in May, and it remains high in our near term projection for the rest of the year... Now this upside surprise was primarily driven by some of the more volatile subcomponents of services prices, such as air fares and package holidays, and also vehicle excise duty which is unrelated to the balance of demand and supply in the economy, so we should not read too much into this surprise for this reason."

BOE GOVERNOR BAILEY ON FOOD PRICE INFLATION

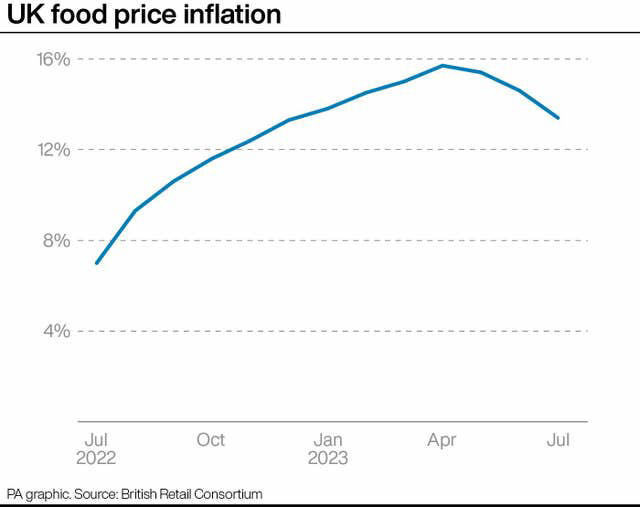

"Where there is more uncertainty is around the time it will take the other non-energy components of the consumer price inflation to come down as well. Price inflation for food and non-alcoholic beverages has been very high. But it does appear to have peaked. We do expect that food price inflation will come down gradually over the rest of this year. Food price inflation is declining, and it's going to go on declining. It's taking longer than I think anybody expected."

Government set to meet target to halve inflation, Bank of England says

Prime Minister Rishi Sunak will have reason to celebrate on Thursday as the Bank of England forecast that he would meet his promise to halve inflation by the end of this year. The Bank forecast said that due to drops in international energy prices, inflation is set to fall to around 4.9% averaged over the final three months of 2023.

Inflation was running at 10.7% in the final quarter of last year, meaning that to hit their target ministers would have to hope for inflation, measured by the Consumer Prices Index (CPI, would fall to 5.3%. But meeting the goal was largely out of the Government’s hands. One of the main tools for combatting inflation is interest rates, which are set by the Bank of England. And the Bank said that it is largely energy prices, set by global markets, that ministers have to thank for reduced inflation.

(PA Graphics) © Provided by PA Media

Food price inflation, which has a particularly large impact on the living costs of lower-income families due to it making up a larger share of these families’ budgets, remains extremely high.

The Bank of England

“CPI inflation was expected to fall significantly further, to around 5% by the end of the year, accounted for by lower energy, and to a lesser degree food and core goods price inflation,” the Bank said.

“Services price inflation, however, was projected to remain elevated at close to its current rate in the near term. Food price inflation, which has a particularly large impact on the living costs of lower-income families due to it making up a larger share of these families’ budgets, remains extremely high.”

But it expects annual food inflation to fall to around 10% by the end of the year as lower input prices make their way down the supply chain. Though inflation is expected to drop, the Bank does not expect to meet its 2% inflation target for two years, in the second quarter of 2025.

Chancellor of the Exchequer, Jeremy Hunt said "If we stick to the plan, the Bank forecasts inflation will be below 3% in a year’s time without the economy falling into a recession. But that doesn’t mean it’s easy for families facing higher mortgage bills so we will continue to do what we can to help households."

Bank of England Chief Economist Huw Pill said on Friday "there was growing evidence that the central bank's run of interest rate increases was bringing down inflation which has weakened but remains almost four times the BoE's 2% target. The MPC is committed to achieving its target," Pill said during an online presentation organised by the BoE. "There are increasing signs that the policy actions it's taken over the last 18 months are working in pursuit of that target."

Industry Opinion

Lewis Shaw, owner of Mansfield-based Shaw Financial Services said "there will be no movement in fixed rate mortgage pricing because this has already been baked in. Considering the rollercoaster we’ve been on for the past few months, gilts staying flat over two weeks is manna from heaven, allowing lenders to price mortgages more accurately.”

Craig Fish, managing director at London-based mortgage broker Lodestone, echoed Shaw’s statement saying that "most fixed rates on offer right now already have a rate rise factored into them. What is going to impact them, though, is the release of the inflation data on August 16, and what that does to swap rates, which influence mortgage pricing,” Fish pointed out. “If, as expected, inflation falls, I suspect we may see more lenders continue to lower rates as we have seen over the past week.”

Darryl Dhoffer, founder of Bedford-based The Mortgage Expert, also emphasised the significance of the inflation data due to be published mid-month. “Looking at the past two weeks, two-year and five-year swap rates, which influence the pricing of two-year and five-year mortgages, have largely remained steady, which implies that lenders have already priced in any rises in fixed rates,” Dhoffer said. “I would not expect the majority of lenders to reprice any fixed rates until the next release of inflation figures on August 16.”

For mortgage holders who are struggling with their payments due to the increase in borrowing rates, UK Finance said a range of options are available for help, tailored to each person’s circumstances. The trade body also recently launched its ‘Reach Out’ campaign to encourage people to reach out to lenders, which assembled teams of experts ready to help anyone struggling with their mortgage payments.

Over the past several weeks, more than 40 mortgage lenders, representing over 90% of the mortgage market, have also signed up to the government’s new Mortgage Charter, committing them to provide additional support for borrowers. This includes giving customers approaching the end of a fixed-rate mortgage the chance to lock in a deal and request a better like-for-like deal if rates change up to six months ahead, and a guarantee of no possession within 12 months of their first missed payment.

The Monetary Policy Committee was split in its voting. Six members voted for the quarter-point hike, two for a half-point, with only one voting not to raise at all.

This is the 14th consecutive increase in a row, and means landlords’ mortgage payments have increased by almost 240% since December 2021, according to the National Residential Landlords Association.

Ben Beadle, chief executive of the NRLA, said “with landlord profits at their lowest level for 16 years, the vast majority are doing all they can to protect tenants from the impact of growing mortgage rates. However, without government action, renters face a bleak future as growing costs lead to a loss of more rental homes from the market. Analysis for the NRLA has found that 735,000 rental properties could be lost across the UK if interest rates peaked at 5%. With an average of 20 requests to view each available home to rent already, today’s announcement will only worsen matters.”

The association called on the government to scrap tax changes like the elimination of tax relief to boost supply.

It also suggested that housing benefit rates should be unfrozen so vulnerable tenants receive assistance during this challenging period.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, said “a small rise in rates had been widely expected but the pace and size of these increases is almost as important. Lenders have already allowed for another uplift in rates to their mortgage pricing and there are hopes that mortgage rates should start edging downwards. While a quarter-point rise won’t be welcomed by borrowers on variable rates, it is a positive in a way as rates could have risen by more than that, as they did at the last meeting. Confidence and expectation that rates are at, or near, their peak make such a difference to homebuying decisions. We have already seen quite a bit of talk about rates coming down, so it is clear to us that many are sitting on their hands before making any big buying decisions.”

CEO of Octane Capital, Jonathan Samuels, said “whilst an unpopular opinion, it could be argued that the Bank of England hasn’t been daring enough in their decision to increase rates again today and really another 0.5% increase was needed in order to tame inflation. It’s far better to have a short period of pain brought about by higher interest rates, rather than a sustained period of significant economic turmoil and uncertainty. Take America, for example, where rates started to rise at a similar time to the UK, but in a far more aggressive manner. Inflation there is already back to 3% and so the target of 2% is within reach. If we had been as bold, then we too would be close to achieving the much heralded ‘soft landing’ and would be far closer to interest rates falling than we are now.”

Director of Benham and Reeves, Marc von Grundherr, commentsed “a fourteenth consecutive base rate hike will come as yet another nail in the coffin for the nation’s borrowers and will do little to boost a property market that has been treading water in recent months. We have seen some positive signs in recent weeks with mortgage approvals climbing. However, while this boost in market activity is good news, higher interest rates are likely to stifle the purchasing power of the nation’s buyers even more, resulting in the further stagnation of house prices.”

Managing Director of Barrows and Forrester, James Forrester, commented “the nation’s borrowers will be forgiven for feeling like they are trapped in some sort of Bank of England Groundhog Day, with rates increasing for the fourteenth consecutive time today. The base rate is now the highest seen in over fifteen years and so the latest generation of buyers will no doubt be panicked by the steep cost of borrowing they face in the current market. The silver lining is that a lower rate of increase suggests that we could be nearing the peak and while we expect to see lucky number fifteen materialise, they could well plateau before the year is out.”

Managing Director of House Buyer Bureau, Chris Hodgkinson, said “despite interest rates increasing consistently over such a sustained period of time, the property market is yet to topple. However, while it has remained largely impervious where property values are concerned, there is a growing undercurrent of instability forming beneath the surface. This is taking the form of less buyer activity, longer transaction times and, ultimately, a higher chance of transactions collapsing before they reach the finish line. So while sales are still completing and for a fair price, sellers can expect a far more turbulent time making it through to completion.”

CEO of RIFT Tax Refunds, Bradley Post, commentsed “the Bank of England’s ‘aggressive’ approach to managing inflation via interest rates has, to date, been pretty abysmal. It’s fair to say that they haven’t acted swiftly enough, or with the required level of intent to actually curb inflation, which remains extremely high. At the same time, fifteen consecutive base rate hikes have had a serious impact on the average household, who are now not only dealing with a sustained increase in the cost of living, but are also paying the price when borrowing to make ends meet.”

Anna Clare Harper, CEO of sustainable investment adviser GreenResi, commented “this rise in interest rates means that two million households with mortgages on variable rates, or with their fixed rates coming to an end this year, face even higher monthly mortgage payments. The impact cannot be understated: the cost of housing will be closer to, or even above, net incomes for many householders. We can expect to see many of these property owners selling up for lower prices. Investors we work with are currently buying at 20 to 30% below peak 2022 house prices, though it is worth noting that peak values reflected a mini-bubble from reduced stamp duty combined with very low interest rates through Covid. Despite price reductions, housing is no more affordable today, since higher interest rates also affect potential property purchasers. This means demand for rental properties is likely to continue to grow, making rents ever higher.”

Alex Lyle, director of Richmond estate agency Antony Roberts, said “yet another interest rate rise, coming on the back of so many and with the potential for more to come, creates further uncertainty for the housing market. Although some areas have proven remarkably resilient to rising interest rates, inevitably this is less the case the higher they go. This latest rate rise will give those buyers who were perhaps wavering another excuse to back out. Many buyers and sellers are already sitting tight until the autumn in the hope that the situation will be clearer by then, particularly if inflation continues to fall.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said “after 14 rate rises in as many meetings, it’s time for the Bank to press the pause button. Give this latest rate rise time to take effect and see how the markets react before deciding whether to continue with these rate increases. Consecutive rate rises have been painful; it’s time to let them do their job, rather than causing continued anxiety and distress for borrowers. Those with a base-rate tracker will see their mortgage rate increase by 25 basis points. A borrower with a £250,000 repayment mortgage on a 25-year term and a current pay rate of 4.5% will see their monthly payments rise from £1,390 to £1,425.

The cumulation of 14 successive rate rises is significant. A borrower with a £250,000 mortgage on a tracker pegged at 1 per cent over base rate will have seen their monthly payments rise from £943 in December 2021, when base rate rose from 0.1 per cent to 0.25%, to £1,649 today. Lenders have already priced this increase into their fixed rates so we don’t expect pricing to rise. Indeed, a number of lenders have reduced fixed rates in the past few days on the back of calmer Swaps, which underpin the pricing of fixed-rate mortgages. The extreme volatility we have seen in Swaps over the past few weeks has settled following June’s better-than-expected inflation data. However, while other lenders may reduce their fixed rates, long gone are the days of rock-bottom pricing. Borrowers due to come off cheap fixes face a real payment shock, so it is important to plan ahead as much as possible and act now. Rates can be booked up to six months before you need them so speak to a whole-of-market broker as to what’s available.

If when you come to remortgage rates are cheaper, borrowers can choose another deal. If you are not due to remortgage for a year or two, pay down other, more expensive, debt, cut unnecessary spending and consider overpaying on your mortgage if possible to lessen the pain when the time comes.”

Simon Gammon, Managing Partner at Knight Frank Finance, commented “today’s rise in the Bank Rate has been priced in for some time and we expect lenders to continue making small cuts to mortgage rates during the coming weeks. Inflation data published later this month will be far more important for the path of mortgage rates and, barring any surprises, it’s likely that the peak in fixed rate mortgages has passed. Tracker rates are still quite a bit cheaper than fixed rates, despite today’s rise, which is driving elevated levels of remortgaging activity. Many borrowers are now opting for tracker products with a view to fixing once mortgage rates fall further.”

Tom Bill, head of UK residential research at Knight Frank, commented “today’s rise was priced in and fixed-rate mortgage deals will be unaffected. Tracker rates will rise but the growing popularity of these deals shows there is a belief that the bank rate is near its peak. It has been a bumpy ride back to normality for interest rates, with the previous government doing too much too quickly and the Bank of England arguably doing too little too late, but the last 14 years of ultra-low rates will increasingly be seen as the exception rather than the rule. Some lenders are cutting rates and as inflation continues to fall, sentiment in the housing market will improve. That said, downwards pressure on prices and transaction volumes will continue into next year as more people roll off fixed-rate deals and while the market is not on its knees, demand will remain subdued through to the next election.”

Gareth Lewis, managing director of property lender MT Finance, said “with yet another rate rise from the Bank of England, one wonders whether the true impact of successive rate rises is actually having the desired effect. With so many homeowners on fixed-rate mortgages, there is a time lag before they come off their existing rates and the increase in interest rates has an impact. By raising Bank Rate, the Bank is being seen to be doing something to tackle inflation but is it actually working?

There may be a case for leaving alone for a while and waiting to see what impact these successive interest rate rises is actually having, particularly as we come out of the summer holidays when the picture is distorted.”