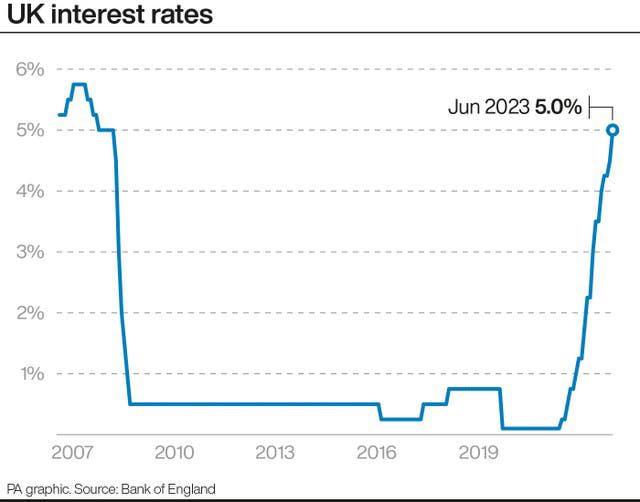

The Bank of England looks likely to raise rates by a quarter-point to 5.25% on Aug. 3, though economists and markets see a risk of a repeat of June's surprise half-point hike as inflation remains hotter than in other big economies.

Both the U.S. Federal Reserve and the European Central Bank increased interest rates by a quarter of a percentage point this week, but unlike the BoE, markets think they are at or near the end of their rate-tightening cycle. In contrast, bets on where BoE rates will peak have swung sharply since the central bank's last rate move on June 22 as investors try to work out if Britain has a deep-rooted inflation problem, or if rapid price growth is on the cusp of the sharp slowdown seen elsewhere.

"Where rates go after August will depend on the extent to which second-round effects persist," said Andrew Goodwin, chief UK economist at Oxford Economics, referring to the knock-on impact on wages and prices of last year's surge in energy costs.

Expectations for peak BoE rates reached 6.5% on July 11 after data showed record wage growth. But they fell back after a bigger-than-expected decline in consumer price inflation. Investors are now split fairly evenly between a peak of 5.75% or 6% late this year or early in 2024. The surge in rate expectations has pushed mortgage costs to their highest since 2008, and higher rates are weighing on house-building and some other sectors. A survey on Monday showed private-sector growth had fallen to a six-month low this month.

FINELY BALANCED?

Most economists polled by Reuters this week see rates going up to 5.25% from 5% this week and peaking at 5.75%, but for many the decision is finely balanced. "We believe the MPC will still want to send a strong signal on inflation," said economists at HSBC, who expect a rate rise to 5.5%, in what would be the central bank's 14th straight hike.

BoE Governor Andrew Bailey said this month that it was "crucial we see the job through" to curb inflation, and Deputy Governor Dave Ramsden said that even after recent falls, inflation remained "much too high".

Consumer price inflation dropped to 7.9% in June from 8.7% in July, a far bigger decline than markets had expected and one that brought it in line with what the BoE forecast in early May, when markets expected rates to peak at around 5%. Still, that inflation rate is nearly four times the BoE's 2% target and double the rate in the United States. Ramsden said the fall had been driven more by short-term moves in energy prices, with less softening in longer-term pressures.

The picture from Britain's job market is mixed. Wage growth excluding bonuses held at an annual rate of 7.3% in the three months to May, the joint highest since records began in 2001. However, unemployment rose unexpectedly to a 16-month high of 4% as more people entered the labour market, and employers advertised fewer job vacancies.

"The interpretation of the data ... is dependent on the eye of the beholder and could be deployed to make the case for (increases of) either 25 basis points or 50 basis points," RBC economists Peter Schaffrik and Cathal Kennedy said.

Following the end of Silvana Tenreyro's tenure on the BoE's Monetary Policy Committee, fellow external member Swati Dhingra is likely to be alone in making the case that producer price inflation - rather than wage growth - is a better guide to future consumer price inflation trends. Annual producer price inflation fell to 0.1% in June, its lowest since December 2020, down from a high of nearly 20% last July, which it hit just a few months before CPI peaked at 11.1%.

Former Kroll Institute chief economist Megan Greene will replace Tenreyro. She is likely to be more hawkish than Tenreyro, and wrote this month that it would be "a mistake" for central bankers to assume inflation would automatically return to pre-pandemic levels.

FRESH FORECASTS

The BoE will also update its growth and inflation forecasts alongside the rate decision, both of which are likely to be lower than in May due to higher market rate expectations - an important component of the forecast. On Tuesday the International Monetary Fund forecast Britain's economy would grow 0.4% this year - the second slowest in the Group of Seven advanced economies, after Germany.

In normal times, the extent to which the BoE's forecast for inflation in two or three years' time deviates from its 2% target also served as a signal of how much the central bank agreed with market rate bets. However, in recent months the BoE has placed less emphasis on its medium-term forecast. Bailey and BoE Chief Economist Huw Pill have instead focused on the risk of inflation persistence that is not captured in the central forecast.

"If the BoE believed its own forecasts, it would be cutting rates, not raising them," HSBC said.

House price meltdown warning ahead of Bank of England's next interest rate move

More interest rate hikes by the Bank of England (BoE) would risk a housing market meltdown, a finance expert has said. The BoE's Monetary Policy Committee (MPC) is due to announce its next base rate move on August 3 after a 0.5 percentage point rise surprised some analysts in June.

Business owners from across the country have warned another rate hike by the Bank would inflict even more pain on households and firms. Marcus Wright, Managing Director at Bolton Business Finance, told Express.co.uk "the Bank of England should not raise rates any further. In fact, the BoE seem to be the only people in the entire country that think rates need to go up further. Inflation is starting to come down and the most recent rate rises have not even had a chance to feed through to the economy yet. We will have problems much worse than inflation if they keep raising rates, like a meltdown in the housing market and a serious economic crash."

The average UK house price fell slightly in June, down by about £300 compared to May with a typical property costing £285,932, according to Halifax. Kim Kinnaird, Director at Halifax Mortgages, said it was the third consecutive monthly fall, but a "modest" one.

The annual drop of -2.6% (-£7,500) was the largest year-on-year decrease since June 2011 with the rate of decline largely reflecting the impact of historically high house prices last summer. Samuel Mather-Holgate, independent financial advisor at Swindon based Mather and Murray Financial, told Express.co.uk "all the data is showing that raising rates has failed, inflation is coming down at its own pace and will return to target soon. Increasing rates will likely lead to deflation over the medium term, a severe recession, a housing price crash of up to 25% and homelessness on a colossal scale. The only right thing to do would be to slowly cut rates until they are around two percent. This would breathe confidence back into the housing market, equity investments would rise and households currently struggling to put food on the table would have some respite."

Imran Hussain, Director at Harmony Financial Services in Nottingham, said "Threadneedle Street should leave rates alone.The whole country is nervous around the Bank of England's decision to increase rates as the only blunt instrument they seem to be using to combat inflation. With inflation dropping slightly, now is the time to pause as many families are seeing their disposable income "pretty much disappear. There are only so many subscriptions people can cancel before they are simply working to just turn the lights on."

Inflation fell by more than expected in June and was its slowest in more than a year at 7.9%. Core inflation - which excludes the price of food, energy, alcohol and tobacco - also dropped, coming in at 6.9% compared to May's 7.1% high. But inflation is still well above the Bank's 2% target.

Lewis Shaw, founder and mortgage expert at Shaw Financial Services in Mansfield, said "inflation is still running almost four times above the Government inflation target of two percent, which means there's still a lot of pressure on the Bank of England to continue raising rates until we're out of the woods. Moreover, because of many public and private sector pay rises, the MPC will be worried about second-round effects taking hold and worsening the situation. If they raise rates again in August, there shouldn't be too much movement in mortgage rates. However, this will significantly impact businesses carrying large floating rate debts, and we could see many more insolvencies and unemployment rising. This will undoubtedly cause pain, which is unfortunately what the Bank of England are trying to achieve. The dose makes the poison, and we must hope they get it right. Otherwise, we're in for a rocky road."

Wes Wilkes, CEO of Newcastle based Net-Worth NTWRK, said the Bank must raise, but by 25 basis points rather than 50. He said "I appreciate it's tough for borrowers and businesses of course, but while we have seen inflation numbers fall from their highs in recent weeks, they are still four times the Bank of England's target of two percent. We saw in the 1970s the risk of halting too soon and how quickly inflation can roar back causing more significant economic damage."

He recommended the BoE hikes its base rate once more and then observe the data as it comes through with a possible pause in September should the recent downward change become a trend.

Mr Wilkes said "the biggest policy error was to be so late in tackling inflation, to compound this now by pausing would be scandalous."