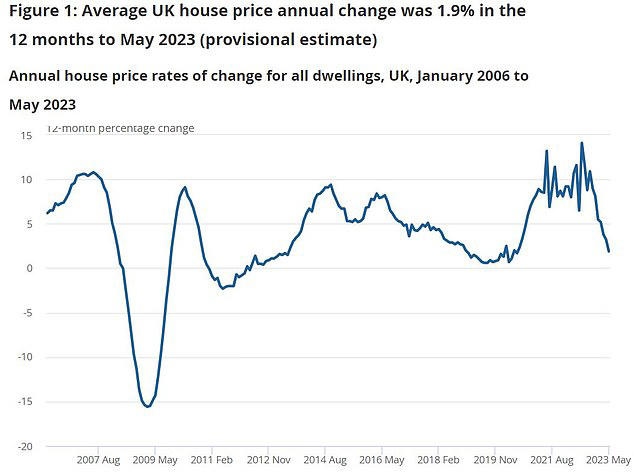

House price growth slowed to 1.9% in the 12 months to May and a further slowdown is expected as the full extent of mortgage rate rises feeds through.

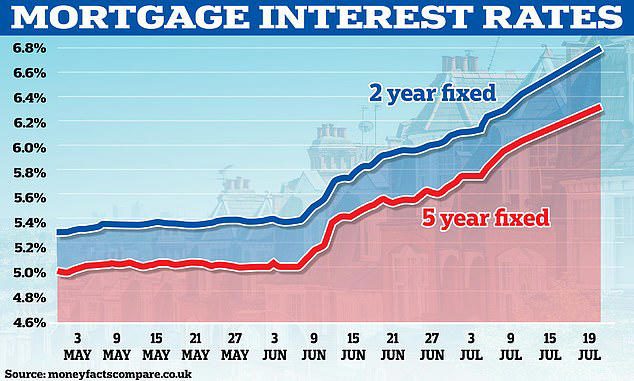

Annual property price inflation in May fell from 3.2% in April taking the UK's average house price to £286,000, £6,000 higher than 12 months ago - but £7,000 below the recent peak in September 2022, according to the Office for National Statistics. Mortgage rates have risen rapidly since May's disappointing inflation data increased the likelihood of further Bank of England base rate hikes and this is yet to feed through to the ONS index.

The market expects the base rate to rise to somewhere between 5.75 and 6% by the end of the year, a 1% increase from its current level of 5%, the highest since April 2008.

House price growth is continuing to slow as the impact of higher mortgage rates feeds through to the market

© Provided by This Is Money

Tomer Aboody, director of property lender MT Finance, says "although property prices still managed to rise slightly over the past year, these figures illustrate the reduction in buyer confidence. As the market gets to grips with constant negativity in terms of rising interest rates and high inflation, we will see a slowdown in property transactions. Something needs to change in order to inject some fuel into the market, as sales volumes are nearly half what they were this time last year. The property market is the backbone of the UK economy and can't be allowed to grind to a complete halt."

Oxford Economics, an economic forecasting and analysis organisation, expects house prices to fall 13% from the highest point in this price cycle to the lowest with transaction volumes remaining low.

Modupe Adegbembo, G7 Economist at AXA Investment Managers told This is Money she sees "prices falling by 10%, as a headline number 10% is large but needs to be seen in the context of what has been a buoyant housing market over the past three years. We saw a sharp increase in activity and the growth of house prices over that period, about 20% so the 10% has to be viewed in that context as a correction."

Rising mortgage rates continue to put downward pressure on the market with further slowing of hosue price growth expected

© Provided by This Is Money

Iain McKenzie, chief executive of The Guild of Property Professionals, says "the outlook for the property market continues to be a mixed bag, as house prices remain relatively steady even while overall growth is slowing down. Homeowners can rest assured that their property has not lost significant value this year. Affordability has been the biggest barrier to home ownership in recent times, inflating house prices beyond what people can afford and stopping prospective buyers from saving for a deposit. We expect this cooling trend to continue throughout the rest of the year, albeit at a much slower pace than the gloomy forecasts we were seeing at the start of 2023."

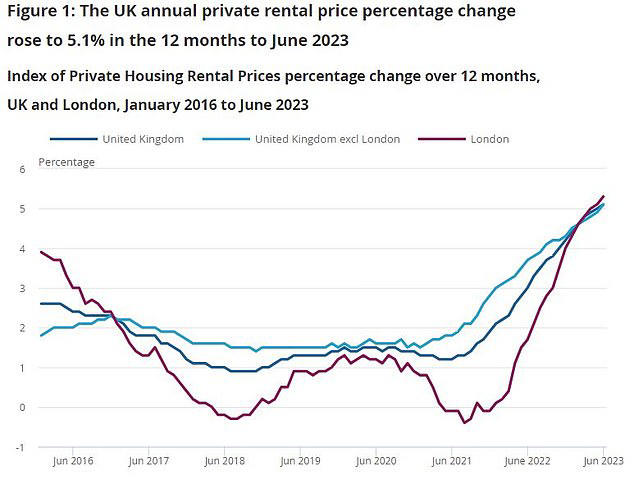

In contrast to house prices the rate of rental price growth has increased.

Private rental costs increased 5.1% in the 12 months to June 2023, up from 5.0% in the 12 months to May 2023.

Private rental costs in the UK continue to increase as demand outstrips supply putting upward pressure on rents

© Provided by This Is Money

The situation is unlikely to improve for tenants as figures show a 57% increase in the mismatch between supply and demand since June 2022. This means that pressure on rent prices remains, with a majority of responding agents reporting rents increasing month-on-month on average.

At the same time new data from homeless charity Shelter reveals every day 172 private renting families in England are handed a Section 21 no-fault eviction notice by their landlord – equal to one every eight minutes. In May, the Government published its Renters (Reform) Bill to ban Section 21 evictions, which divided opinion among renters and landlords.

However, since then the bill has failed to make any progress through Parliament.