Rent prices will continue to rise as landlords quit the property market in record numbers, one of the country’s leading property associations claims.

The National Association of Property Buyers, warns that the current market conditions are leaving it “deeply unattractive” for landlords to enter - resulting in many existing ones to sell up and quit. Spokesman Jonathan Rolande said “at the moment with such a lack of capital growth, you have to ask who would choose to be a landlord?

Higher rents have gone some way to balance the books but many with a mortgage do little more than cover the interest each month. More landlords will try to quit this year as capital values and saleability falls.”

Rolande added that he expects overall activity in the housing market to drop off rapidly in the next six months. The traditional dip in sales during the holiday season is almost upon us. Expect sales volumes to fall over the next six weeks exacerbating the downward pressure on prices. The normal bounce in September is likely to be very subdued as the burden of increased interest rates begins to bite. Those with an existing mortgage are more unlikely to move upmarket, landlords – at least those requiring a mortgage – are not expected to add much volume to their portfolios and many more will exit altogether, selling in the Autumn market. With the current circumstances, a price freefall is very unlikely but an increased supply of property and reducing buyer numbers will inevitably lead to anxious sellers slashing prices to attract a diminishing number of purchasers. In terms of property, it looks like there is a very bleak Winter ahead.”

A report unveiled last week, found that buyer interest, sales and property prices suffered in June as mortgage rates continued to surge. In June, new buyer enquiries dropped to an eight-month low due to a "renewed deterioration" in the UK sales market, according to the Royal Institution of Chartered Surveyors (Rics).

Many estate agents surveyed by Rics believe further falls could continue over the coming months.

Massive drop in lettings supply creates new rent rise record

The average rent on a newly let property in Britain rose to £1,273 pcm in June, a new record according to lettings agency Hamptons. This means that the average rent cost £110 pcm or 9.4% more than the same time last year, marking the sixth strongest annual rent increase since the agency’s records began in 2014.

Overall, this increase will cost the average tenant an extra £1,315 a year than if they moved into a new home last year. Having passed the £1,000 pcm mark for the first time in May, the average rent on a one-bed home in Great Britain rose 11.1% year-on-year to average £1,017 pcm.

This means the average one-bed now costs the same as the average two-bed just 15 months ago in April 2022. Similarly, the average two-bed rent (£1,170 pcm) is now the same as what a three-bed cost in January 2022. Rental growth has been similar for both two (10.9 per cent) and three-bed (9.3%) homes.

Rents are increasing across all regions, however the pace of growth cooled in Greater London and Scotland, where rents have been rising the most, as well as in the East of England. Rents in the North of England joined Greater London in seeing double-digit growth in June.

This marked the fourth time on record that rents in the three Northern regions (North East, North West and Yorkshire and The Humber) rose by more than 10 per cent, all of which have occurred in the last 24 months. Aneisha Beveridge, head of research at Hamptons, says “rents are rising across the board, which suggests that the supply squeeze and rising landlord costs are pushing up rents across the market. Additionally, high mortgage rates, which have priced out would-be first-time buyers, are stoking rental demand. While there are a similar number of households looking to rent as in 2019, there are 47 per cent fewer homes available. With interest rates set to stay higher for longer and few new landlords buying, these pressures seem likely to continue in the medium term.”

Tenant competition heats up: Numbers registering per letting agent SURGES 27% compared to a year ago

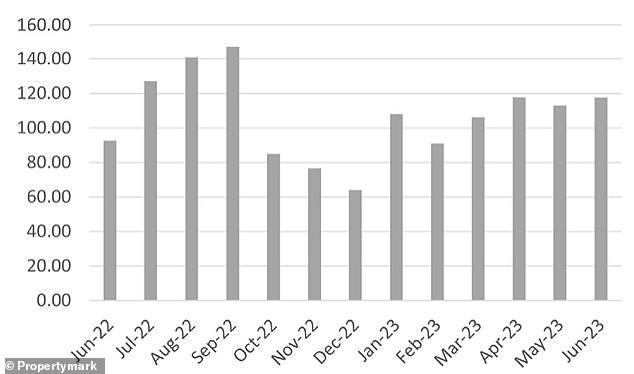

Competition among tenants looking for a new home to rent remains rife, according to new data. Figures from trade body Propertymark suggest that new tenant registrations strengthened in June. An average of 118 tenants signed up at each agency branch, compared to 113 a month earlier.

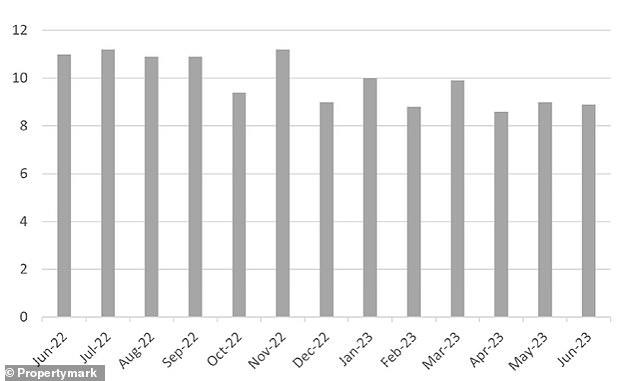

This figure is 27% higher than June 2022, when there was an average of 93 tenants registering per branch. At the same time, the number of properties available to rent per Propertymark branch member remained at nine, which is a drop of 19% compared to a year ago. With demand up and stock levels down, it is no surprise that the mismatch between supply and demand continued to grow in June with an average of 13 new tenants registering per available property over the month, according to Propertymark.

It equates to a 57% increase in the mismatch between supply and demand compared to June last year.

The number of new tenants registered per member branch during the past year is revealed

© Provided by Daily Mail

Propertymark revealed data showing the properties available to rent on average per member branch

© Provided by Daily Mail

This mismatch between supply and demand has translated into higher rents, with 62% of agents saying rents increased monthly on average at their branch during June. The average rent in Britain rose 10% during the past 12 months, hitting a record high of £1,213 a month in May, according to HomeLet.

The landlord insurance provider revealed the London rental market in particular shows no signs of slowing down. There have only been a handful of occasions in which the monthly average has been recorded above £2,000 a month, with May's average of £2,039 being the highest ever recorded.

Harriet Scanlan, of Richmond estate agency Antony Roberts, said demand for rental properties continues to substantially outweigh supply. Some tenants are becoming desperate because of the lack of stock. For example, we received an offer from a family who had been searching for six weeks and were running out of time before their current lease expires. They are restricted to the area as they have young children in the local school. Some tenants are becoming desperate because of the lack of stock. For example, we received an offer from a family who had been searching for six weeks and were running out of time before their current lease expires. There was a lot of competition for the property so they offered both the landlord and me a £1,000 bonus each, which was of course declined and we went to 'best and final' offers. Every time we launch a new property we are inundated with enquiries and receive multiple offers over the asking price, thus increasing the rents."

Nathan Emerson, of Propertymark, said 'this worrying mismatch between supply and demand continues to put pressure on rents. Governments need to stop tinkering around the edges of the problem and look to adequately incentivise the provision of desperately needed homes in the private rented sector."

Propertymark also reported its sales data, with the average number of new buyers registered per member branch falling to 69 in June, down from 86 in May.

Demand was 5% lower in June compared to the same month last year. The average number of viewings per property continued to fall back slightly from its recent peak in April.

In June, the average number of viewings per available property was 2.6 compared to 3.3 in April. Meanwhile, the supply of new homes up for sale per member branch continued to lessen in June - now at eight per member branch. Propertymark said that while a summer lull is generally expected, the average number of sales agreed per member branch held at seven in June - the same figure as the previous month.

Mr Emerson added "the data was encouraging despite disappointing wider economic news for the country. It is clear that a core portion of the country are still looking to get moving and are not put off by current conditions and of course those coming to the market with a home to sell are most often also looking to buy, which keeps the wheels of the market turning for all."

Rents now 5.1% higher than last year

Rental market is filled with uncertainties at the moment. Rents paid by tenants in the UK’s private rented sector (PRS) rose by 5.1% in the 12 months to June, up from the 5% year-on-year increase of the previous month.

The Office for National Statistics (ONS) said that the June figure represented the largest annual percentage change since this data series began in January 2016. It also noted that the annual growth rate of private rental prices in the UK began to increase in the second half of 2021. Annual private rental prices increased by 5.1% in England, 5.8% in Wales and 5.5% in Scotland in the 12 months to June 2023. Within England, the highest annual percentage change was in the West Midlands at 5.4%, while the North East saw the lowest at 4.4%.

London’s annual percentage change in private rental prices was 5.3%, above the average in England, and its highest annual rate since September 2012, the latest ONS Index of Private Housing Rental Prices also revealed. The Association of Residential Letting Agents (ARLA) stated in its June 2023 Housing Insight Report that the number of new prospective tenants remained strong in June compared with May, while stock levels remained insufficient. The mismatch between supply and demand continued to grow in June, with figures showing a 57% increase in the mismatch since the same month of the previous year.

Meanwhile, the Royal Institution of Chartered Surveyors (RICS) reported in its June 2023 UK Residential Market Survey that tenant demand increased in June while new landlord instructions had fallen to the lowest level since May 2020. With rising demand still being met with weakening supply, RICS reported that rental prices were expected to rise higher over the near term.

According to consultancy TwentyCi, the number of available private rental homes dropped to a 14-year low as landlords continue to exit the market due to rising mortgage costs, with only 241,000 PRS homes available last month.

Data from Cornerstone Tax also showed that just one in five landlords said their investment had been a profitable one, with a further 20% admitting that they had lost money in the investment. As a result, 65,000 rental properties went up for sale in the first three months of 2023.

Average asking rental price for properties hits record high

The average asking rent for properties both inside and outside of London have hit a new record high, according to a property website. Data from Rightmove shows tenants outside of London are being asked to pay an average £1,231 per month, with properties inside London reaching a record of £2,567.

For the second quarter of 2023, rent outside the capital has increased by £308 (33%) from the same period in 2019, where the average price per month was £923. Similarly, London asking rents have increased by £559 (28%) in four years.

The asking rent of a property is the price listed by the landlord.

Rightmove's director of property science Tim Bannister said "average asking rents for new tenants have risen at a rapid pace since the pandemic, reflecting the significant increase in demand, the demand is being driven by a change in housing needs, such as space to work from home."

In addition to rent increases, the average time it takes to find a tenant is 17 days, the quickest time recorded in Rightmove data since November 2022.

There are also less rental properties on the market, as landlords sell up. Around 16% of properties currently for sale were previously available on the rental market, up from 13% in January 2019, Rightmove said.

"Some highly leveraged landlords are considering selling due to interest rate rises, but we find most are mortgage-free, and in most cases our advice is to avoid a knee-jerk reaction," Allison Thompson, national lettings managing director of Leaders Romans Group said.

Matt Hutchinson, director of Spareroom, told Metro.co.uk "the impact this rent rise will have on renters, one huge issue is that renters are simply staying put to avoid higher rents, even if they want to move. People are even turning down job offers and career opportunities to avoid having to move in such a manic market. That could have a serious knock on effect for the economy as a flexible, mobile workforce is essential, in the longer term, if rents keep increasing the way they have been, we run the real danger of London simply becoming unaffordable. What happens then? Does the capital just become a theme park for the rich and tourists?"

Mr Hutchinson also talked about the reasons behind rent price increases which have been driven by a number of factors. "Rents are at all time highs in every single region of the UK and in almost every major town and city. This isn’t simply a London issue, it’s happening right across the UK. There are two key factors – the first is a huge spike in demand post-covid (with several factors contributing) and the second is a big drop in supply of properties over the past seven years. Government is pushing smaller buy to let landlords out of the market, but nobody’s replacing them. So we’re losing huge chunks of rental stock, much of which is going to short-term and holiday lets. We don’t have a hotel room crisis, we have a housing crisis, so unless government has plans to increase the supply of rental properties, it’s hard to see how anything will change in the near future," he said.

Around 16% of properties currently for sale were previously available on the rental market, signs that landlords are selling up.

This is a figure which is up from 13% in January 2019, Rightmove confirmed.

Richard Donnell, director at Zoopla, told Metro.co.uk about the further pressures renters face and offered some advice. He said "although rental growth is running in double digits for the 15th consecutive month – it’s important to note that this is only for new lets agreed. For some renters, it could be a smart move to stay place in their current rental as they will usually experience a smaller rental increase. Renters continue to face a relentless increase in rents, which is compounded by wider cost of living pressures and making home moving decisions ever more challenging, especially for singles and those on lower incomes. Rents also continue to rise due to a chronic shortage of homes for rent, which is being stoked by a strong jobs market, record immigration and rising mortgage rates making home buying more expensive and delaying the plans of would-be first-time buyers."

Lynne Lancaster, head of estate agency at Penrith Farmers and Kidd’s, said ‘demand continues to well outstrip supply and we are actually seeing more tenants stay put for longer rather than move after the agreed term."