Is it enough to stop further base rate hikes?

Annual inflation fell to 7.9% in June from the previous month’s 8.7%, but some industry experts believe that the figure is still not low enough to stop the Bank of England (BoE) from further increasing the base rate.

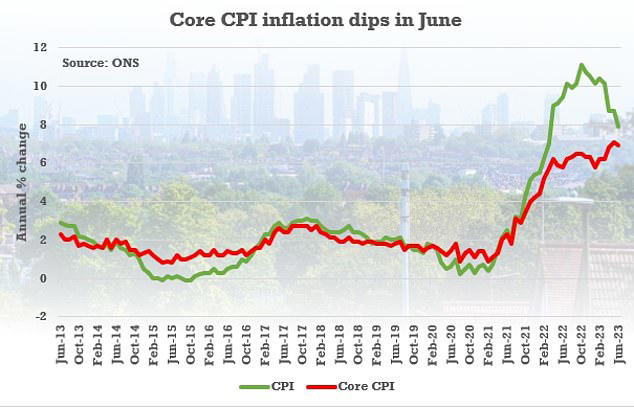

The latest consumer price inflation (CPI) data released by the Office for National Statistics (ONS) on Wednesday showed that CPI rose by 0.1% on a monthly basis.

Grant Fitzner, chief economist at the Office for National Statistics said “inflation slowed substantially to its lowest annual rate since March 2022, driven by price drops for motor fuels, meanwhile, core inflation also fell back after hitting a 30-year high in May. Food price inflation eases slightly this month, although it remains at very high levels. Although costs facing manufacturers remain elevated, especially for construction materials and food items, the pace of growth has fallen across the last year with the overall cost of raw materials falling for the first time since late 2020.”

While inflation is slowly cooling, many experts believe that the BoE will continue to raise interest rates as June’s CPI figure is nowhere near the government’s annual inflation target of 2%.

Nigel Green, chief executive at independent financial advisory deVere Group said “despite the data showing that the battle against inflation in the UK is being won, we expect the Bank of England will confirm it’ll continue with its aggressive interest rate hiking agenda at the monetary policy meeting on August 1. We believe the bank will insist that although inflation is certainly coming down, it is doing so very, very gradually. It remains sticky – still the highest in the G7 – and a long way from the 2% target. They will say prices are still far too high and rising at a quicker pace than they have done in the past. In addition, they are likely to cite strong wage growth in the three months to May.”

Green added that he would not be surprised if there were another 50 basis point hike, further raising the base rate, which has already climbed from a record low 0.1% in December 2021 to an almost 15-year high 5% after 13 consecutive rate increases.

The worst is over, Sunak finally closes in on inflation pledge

At the start of the year, Rishi Sunak set out five “immediate priorities” after a tumultuous 2022. Top of the list was halving inflation.

Price increases were running at 10.1% when he made the pledge, meaning it must hit 5% by December to fulfill it. The Prime Minister has faced nervousness month after month since then, as inflation has remained stubbornly high and repeatedly come in above forecasts.

Even as price pressures dropped quickly in the US and in parts of Europe, Britain’s figure looked unhappily sticky. At long last, however, inflation has fallen rapidly. Consumer prices in June were up 7.9% on the year, according to the Office for National Statistics. This is certainly a very high rate by historical standards, and almost four-times the Bank of England’s 2% target. But it represents a sharp drop from May’s 8.7% and is firmly below economists’ expectations.

Kallum Pickering, economist at Berenberg Bank, says if current patterns continue, “inflation should fall fast over coming months towards a 4-5% rate by the end of the year and to within the 2-3% range by the middle of next year.”

If correct, Sunak would meet his first target.

Nobody doing the weekly shop will see obvious evidence that inflation is coming down yet. Food and drink last month cost 17.3% more than it did a year ago, an astronomical increase and slowing only a touch from March’s peak of more than 19%, according to the Office for National Statistics. While the energy price cap edged down in April, gas bills in June were still more than twice as expensive as they were before Russia invaded Ukraine.

Yet there are promising signs inflation is on the wane. Drivers cannot fail to have noticed that petrol is down to £1.43 per litre on average, from a peak of £1.91 last July.

The figures will be cheered by the Bank of England, which has been under intense pressure to bring inflation back anywhere close to its 2% target, which was last met in July 2021. Inflation is not yet near this goal but it is down significantly from the peak of 11.1% reached in October last year and now at a 16-month low.

The Bank’s monetary policy committee (MPC) has been ramping up interest rates for the past year and a half in a bid to get on top of price rises. It has so far raised rates from 0.1% in December 2021 to 5% last month, yet the dramatic tightening has proved impotent when it comes to headline inflation.

Partly this is because the energy crisis was an international crisis, with food prices similarly set on global markets. But also it is because the full impact of interest rate rises are generally thought to take between 18 and 24 months to fully pass through to consumer prices, so the main force of those decisions by the Bank should only now be starting to bite.

There had been fears the Bank was getting desperate. In a shock and awe move the MPC last month raised interest rates by 0.5 percentage points, effectively a double move compared to the 0.25pp moves of the two prior policy meetings.

Economists anticipated another such jump next month. But now inflation is falling faster than expected, analysts suspect the Bank will opt for a smaller move instead.

Samuel Tombs, at Pantheon Macroeconomics, says this “gives the MPC the green light to increase Bank Rate by 0.25pp next month. The worst is over for UK households and that the MPC will not need to raise the Bank Rate all the way to 6.25%, as markets priced-last week.”

Financial markets agree. Reacting to the lower inflation figure, traders now expect interest rates to top out at 5.75% at the end of this year. More price drops are on the way, with the energy price cap falling again in July, which will help lower next month’s inflation figure. Headline inflation is not the only factor in play, and other measures of price pressures add to the reassurance that costs are finally coming under control.

Behind the main number, core inflation is also closely watched. This measure strips out energy and food prices with the aim of getting somewhere closer to an indication of price pressures in the domestic economy, rather than in import-heavy sectors.

Core inflation fell to 6.9% in June from 7.1% in May, a welcome turnaround given this had been rising in previous months even as headline inflation was easing. An alternative measure of UK-generated inflation comes in the services sector. While the cost of goods and energy often relates to global prices, the price of services is more dependent on wages. Pressure here also eased a touch from 7.4% in May to 7.2% in June, again marking a departure from recent increases.

Then there are price pressures facing businesses, which indicate the costs coming down the pipeline towards consumers. Prices paid by businesses for the goods and services which they buy dropped by 2.7%, the first year-on-year fall in their costs since November 2020. It marks a dramatic shift from the situation last summer when companies found their costs soaring by almost one-quarter.

This is passed on to their customers, whether they sell to consumers or to other businesses. Factory gate prices rose just 0.1% on the year, again the smallest rise since the end of 2020. But big risks remain. When it comes to pressure on households, the end of inflation altogether would not mean a fall in the cost of living - merely that prices would plateau at today’s high levels.

So workers will still be keen to demand more pay to try to recover the spending power lost over the recent years of high inflation. Just last week, the Governor of the Bank of England and the Chancellor were warning workers and businesses not to go overboard on pay rises.

Average earnings in May were up 7.4% on the year, with pay in the private sector increasing by 7.7% - within touching distance of inflation, indicating that workers may soon at least be on an even keel when it comes to their finances, even if they do not actually feel better off. But this is a danger from the MPC’s point of view, as higher pay represents higher costs for businesses, as well as giving families more spending power, which can itself in turn add to inflationary pressures.

The Bank of England is not likely to want to take its foot off the brakes until policymakers are certain inflation is under control - after the experience of the past two years, and given inflation is still almost four-times its target, officials dare not risk complacency. Yael Selfin, chief economist at KPMG UK, says the Bank is unlikely to change course when inflation is still extremely high, even if it is moving in the right direction.

“While the Bank of England will welcome the fall in inflation, it is unlikely to substantially change its hawkish policy stance as inflation continues to run significantly above target,” she says.

Bank of England rate hike bets recede after inflation drops

LONDON (Reuters) - Investors scaled back their bets that the Bank of England will hike interest rates aggressively after lower-than-expected inflation numbers on Wednesday prompted a huge rally in British government bonds. Consumer price inflation slowed to 7.9% in June from 8.7% in May, a bigger drop than almost all the economists polled by Reuters had expected. Core and services inflation - closely watched by the BoE - cooled too.

Markets responded in dramatic fashion.

Before Wednesday's data, investors had assigned a roughly 60% chance that the BoE would hike rates on Aug. 3 by a half-percentage point. That turned into a 60% chance of a quarter-percentage point hike after the data. The predicted peak for Bank Rate was no longer priced in at 6% with the overnight index swap curve showing just as much chance of a 5.75% peak.

Gilt yields dropped sharply, especially for shorter-dated bonds that are most sensitive to the interest rate outlook.

Michael Metcalfe, head of macro strategy at State Street Global Markets, said "June's inflation data will make welcome reading for gilts and the BoE alike but after upside surprises totalling a not-so-cool 1.5% in the past four-months, it will take more than just one month's data to calm rate markets."

The two-year yield was down 27 basis points on the day at 1108 GMT - on track for the biggest daily drop since March 13, when bonds surged after the collapse of Silicon Valley Bank. The yield fell as low as 4.800%, its lowest since June 15.

Yields for longer-dated gilts fell sharply too, with the 10-year yield down 18 bps on the day. The gap between 10-year gilt and German Bund yields - which had widened sharply in recent months to reflect Britain's more acute inflation problem - narrowed to 185 bps from 199 bps on Tuesday its lowest level in over a month.

Does last weeks lower than expected inflation reading mean mortgage rates have peaked?

There is hope of some 'breathing space' for mortgage rates after the latest inflation data showed the price growth is slowing, meaning less pressure for large base rate rises. The Consumer Prices Inflation measure dropped to 7.9% in June, down from 8.7% in May, falling further than the market prediction of 8.2%.

As a result, swap rates – the main pricing mechanism for mortgage rates – are expected to continue falling after dropping slightly last week. For the 1.3 million households who need to remortgage over the next 12 months the question now is whether rates will begin to fall from their current highs or if, despite brightening economic conditions, these levels are the new normal.

Inflation is contiuing to fall leading to hopes the Bank of England will slow the pace of its base rate increases.

© Provided by Daily Mail

Where are rates now?

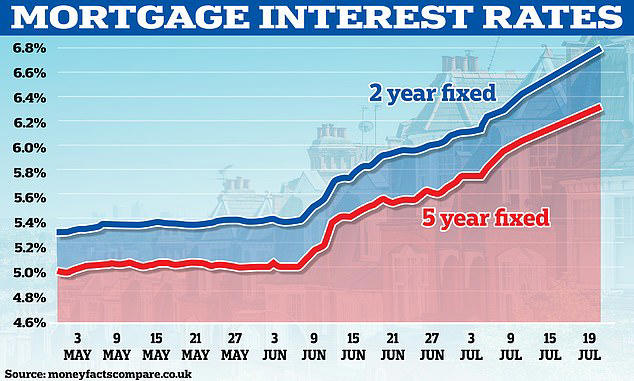

The market has seen a succession of speedy price hikes on mortgage rates as lenders have struggled to keep ahead of rising swap rates.

Halifax pushed up its mortgage rates by as much as 0.6% points with several of its fixed products now over 7%. A two-year fixed rate with a 40% deposit was 6.07%, it rose to 6.67% from midnight on wednesday.

NatWest has hiked several of its fixed rate products by up to 0.4% for new business. All of the mortgages affected are for buyers or homeowners with 10% equity in the home.

Nick Mendes, mortgages technical manager at John Charcoal says "it is hard to know why NatWest has upped its rates but suggests it may be to maintain service levels. Across the market, the average two-year fixed rate is now 6.81% according to Moneyfacts, rising for the first time since 14 July."

The five-year fixed rate average is now 6.33%, up from 6.3% on tuesday.

Despite the market volatility house prices rose 1.9 per cent in the 12 months to May 2023, down from 3.2 per cent in April, according to the latest data from the ONS.

Growth is anticipated to slow further as the full impact of rising mortgage rates hit demand as the sharp rise only began in the latter part of the month and as such won't be reflected in this data.

Will rates fall now inflation has come down?

Although swap rates are falling with the two-year rate well under 6% at 5.66 and the five-year rate at 4.8%, there are other factors lenders take into account when pricing. Firstly, while the cost of credit has now fallen marginally, lenders will be keen to play it safe and avoid being caught out if costs go back up.

This means that they are unlikely to drop prices in line with swap rates and instead retain a margin that will keep prices around their current levels.

Mortgage rates have risen sharply since disappointing inflation data in May spooked the market

© Provided by Daily Mail

Jonathan Burridge, founding adviser at hybrid mortgage adviser, We Are Money said "this news will be a great relief to all, especially the policymakers, but, we need to see more before we can start to make any judgements. If this is a trend, then we should start to see some easing of pricing, but let's not get too carried away just yet. Inflation is still too high, so the Bank of England's rate policy is unlikely to change and traders have responded ahead of this news, so any adjustment will be slow and incremental."

Secondly, despite the welcome drop in inflation the UK's rate remains above its European peers and the Bank of England is expected to continue increasing its base rate to further tackle the problem.

Markets still expect the rate to hit around 6% before the end of this year, before falling in the first half of 2024. This means that any sharp change to mortgage rates is unlikely in the short term as lenders take a longer view.

Chis Sykes, technical director at Private Finance told This is Money "it is very hard to say explicitly what could cause rates to fall, but one thing is for certain, if inflation keeps falling consistently and defies expectations in future months too this would affect lenders cost of funding and this could be passed onto borrowers. This data today is positive news as obviously the BofE will take this into account next time they meet and this will change their recommendations."

However, many now expect mortgage rates to stop rising providing welcome relief for borrowers and brokers who have had to navigate rapid product withdrawals and rate changes over the past few weeks. Lewis Shaw, founder of Shaw Financial Services added "this should mean the Bank of England only raises rates next month by 0.25%, so for mortgage holders this is great news. I'm going out on a limb here to say fixed mortgage rates have peaked. We may see a little shuffling around but the continued painful increases are over. That doesn't mean that we're out of the woods because monetary policy takes a long time to show up, however it does mean we can now start to see the faint glimmer of a light at the end of the tunnel."