Lettings chain Fine & Country says rents are likely to steadily rise through the summer.

Nicky Stevenson, managing director of Fine & Country says, "this is typical for this time of year as more contracts come up for renewal and students finish exams and begin their property search. Prime market average rents have risen to £3,825, up 12.3% year-on-year, a rise in all regions, with the exception of the North East and the South East. According to Rightmove, demand continues to outpace supply, with renter demand up 42% on 2019 and the number of properties to rent is down by almost half. Many renters are choosing to extend their contract rather than brave the open market, some with deals of three years or more. Data from Uswitch reveals that over a third of renters would both renew their contract and accept a rent increase if they had a positive relationship with their landlord.

With the highly anticipated Renters Reform Bill now going through Parliament, agents should not two specific objectives of the measure - to eliminate Section 21 evictions and promote the adoption of periodic tenancies rather than fixed-term ones. The aim is to make the private rented sector safer and fairer for renters. Renters will be given two months’ notice for rent increases and the ability to challenge rent rises above the market rate for their home to stop excessive rent increases. Minimum housing standards will be established.

The bill also includes measures to benefit landlords, such as rights to reclaim possession, and the creation of a new online portal for landlords."

Summer rents soar with 18% annual rises in places

Data from London-focussed agency Foxtons reveals that average weekly rental prices in May have surpassed the peak of 2022. The average weekly rent in London passed £600 in May, a 13% increase year-on-year. Central London, once again, achieved the highest average weekly rent. However, East London showed the highest year-on-year increase at 18 per cent compared to May 2022.

Foxtons’ analysis of London data shows that market activity picked up significantly in May as the busy summer lettings period kicked off. New listings increased 22% from April to May, whilst applicant demand increased 31% over the same period. Registrations remained broadly flat compared to last year, however Foxtons saw registrations rise eight per cent in South London and 13% in West London year-to-date compared to last year.

The average rental budget for applicants increased two per cent from April to May. Applicants looking to rent in North and East London increased their budgets the most, budgeting 12% more than last year. The percentage of budget that renters spend to secure a property has increased for the first time in three months, taking the overall average to 102%. Renters in Central London spent 108% of their registered budget in May 2023, a 7% increase compared to April 2023.

The agency’s lettings director - Gareth Atkins saaid, "we are seeing trends in demand and supply return to a more traditional cycle, in line with what was commonplace before Covid. The one major difference is that even with May’s increase in properties to rent, applicant demand is far exceeding supply. This is partly due to the normal summer influx of incoming university students, corporate relocations and families moving during school holidays combined with the reality that supply has never returned to pre-Covid levels. In May, eight per cent more renters registered per each new instruction; an early sign of the competition to come.”

Rental affordability now at its worst in a decade – Zoopla

Rents continue to rise, outpacing earnings for quite a while now. Growing faster than earnings for the last 21 months, rents now take up the highest proportion of earnings in a decade at 28.3%, according to a report from property listing platform Zoopla.

The average rent in the UK has risen to £1,126 a month in April, with rents in London as high as £2,000 a month. The average UK rent has now increased by £110 a month, or 10.4%, since April 2022, marking the 15th consecutive month of double-digit growth in rental inflation. Zoopla said this level of rental inflation is high by historical standards and ahead of average earnings growth, which is currently at 6.5%.

Rental affordability is currently at its worst in a decade for seven of the 12 regions of the UK. While renting in London is the worst in terms of affordability, with rents averaging around 40% of gross earnings, it is still below the peak of 43% reached in September 2015.

Richard Donnell, executive director at Zoopla, commented on the report findings, “renters continue to face a relentless increase in rents, compounding wider cost-of-living pressures and making home moving decisions ever more challenging, especially for singles and those on lower incomes. The chronic imbalance between supply and demand continues to push rents higher, but we expect increasingly stretched affordability will start to reduce the pace of rental growth into 2024. While there is concern over the impact of higher mortgage rates on those with mortgages, renters have already seen a £2,820 a year increase in rental costs over the last 5 years. Some renters are experiencing more stress from higher rents with a jump in those finding the rent difficult to pay. While a proportion of landlords continued to sell, talk of an exodus was overstated.

The real pressure of higher mortgage rates on landlords hits the 20 to 30% with the highest loan-to-value mortgages where landlords may need to inject extra capital when they refinance or look to sell,” he pointed out. “Half of all landlord sales are in London and the South East, where yields are lowest and the economics of being a landlord are toughest.”

New lets slump a quarter in a year, claims LonRes

The latest lettings market snapshot produced by London-focussed property data firm LonRes shows little change in the supply-constrained rental sector. However, figures show that in May the number of new lets agreed was down by 25.4% compared to a year earlier. LonRes says this is down purely to the low levels of stock coming to market.

New instructions are 6.3% lower on an annual basis and 47.7% below their pre-pandemic level based on data from 2017 to 2019. But the firm does offer a word of caution saying that the latter figure may overstate the fall, because demand is so strong many properties are let without needing to be listed in the first place.

Rental growth in the London markets under study in May was 8.5% on an annual basis, a slight rise on recent months but well below the figures seen last year. Rental values across Prime London are around 25 to 30% above where they were pre-pandemic. While demand continues to outstrip supply in general, changes in time on the market suggest higher value properties are becoming slightly slower to let.

Compared to their benchmarks from 2017 to 2019, all value bands were being let much more quickly a year ago. But the more affordable properties continue to let very quickly, while those in the £1000+ per week band have slowed by more than 10%.

Rent devours highest proportion of income in a decade

The cost of rent now accounts for 28% of people’s incomes, stretching more households financially.

Rental growth currently sits at 10.4% in a year, with half (53%) of tenants saying there’s been an increase in the past six months, Zoopla’s UK Rental Market Report shows. A shortage of rental properties combined with higher energy and mortgage costs are behind the rise.

The availability of property is currently a third lower than the five-year average.

Sarah Coles head of personal finance, Hargreaves Lansdown said “it’s horrible for all renters, and according to the ONS, fewer than half say paying the rent is still easy. However, it’s causing enormous problems for those whose finances were tighter in the first place – including those on lower incomes. Some 15% find it very difficult to pay the rent – and the proportion falling behind has doubled in six months from 4% to 8%. In London, life is even harder for tenants, as rents are up 13.5% to over £2,000 a month. Rent now makes up 40% of income in London. Forget flat whites and avocados, at this level it becomes increasingly difficult to pay the rent and cover the bare essentials before running into financial difficulty.

The problem is the massive imbalance of supply and demand, as landlords continue to pull out of the market, while renters keep flooding in. There’s every sign that this trend is set to continue. Plenty of landlords are wrestling with higher mortgage costs, and can’t make the maths work any more, so they’re selling up. The trend is particularly striking in London and the South East, where more expensive property means mortgages are larger – just over half of Landlord sales are in these regions. Higher mortgage rates for longer is going to force more landlords to sell up.”

Rents rise for sixth consecutive month as demand hots up

June saw the cost of rent across England rise for the sixth consecutive month, according to Goodlord’s latest Rental Index. During June, voids also dropped steeply, highlighting rising demand as we enter the busiest season for the lettings calendar.

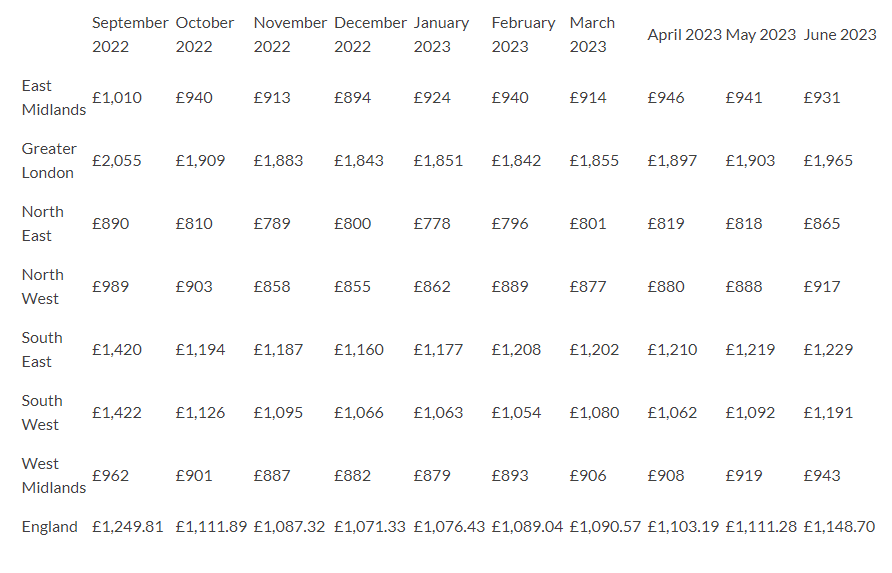

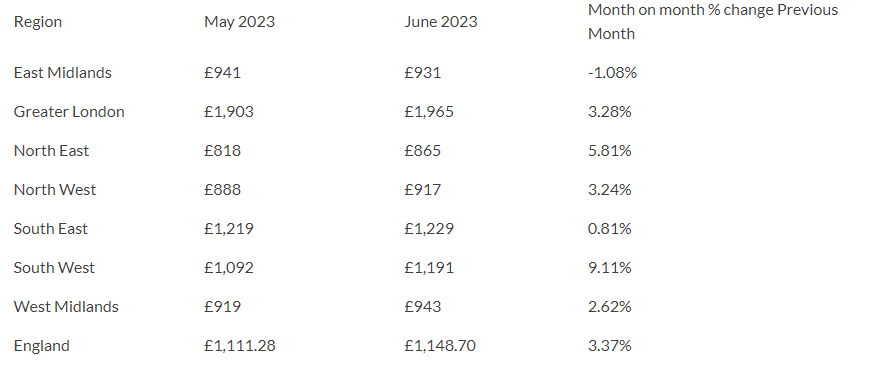

The cost of rent rose in seven of the eight regions monitored by Goodlord during June. The average cost of rent per property in England is now £1,148 per calendar month (pcm). This is up from £1,111pcm in May – a 3.3% increase. The biggest rise in prices was recorded in the South West, where rents rose by a huge 9% during June – rising from £1,092pcm to £1,191pcm.

Only one region recorded a decline in the cost of rent. The East Midlands saw costs drop by 1.08%. The highest prices are found in Greater London, where the average cost of a rental property is now £1,965 per month.

Rental costs have risen for six consecutive months, with prices now at their highest level recorded since September 2022. The highest average rents last year were recorded in September, when costs hit a peak of £1,249.

Cost of rent per property:

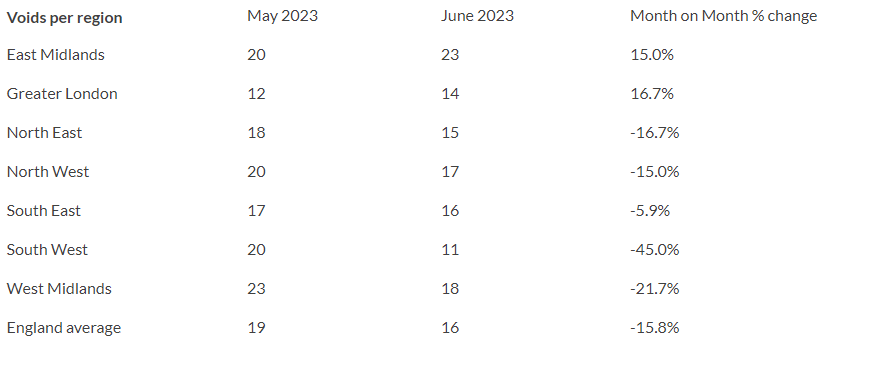

During another month of rental cost rises, another key indicator that the market is heating up for summer can be seen in the void figures.

During June, void periods in England fell by an average of three days – dropping from 19 to 16 days on average – a reduction of 15%. The biggest change was recorded in the South West, traditionally a region that sits in the middle of the pack when it comes to void averages. But a surge of demand in the area saw voids drop from 20 days to just 11 – a huge 45% shift. This means the South West had the lowest void periods in England during June.

Three further regions saw double-digit declines in voids – the North East (-16%), North West (-15%) and the West Midlands (-21%). However, two regions saw an uptick in voids during June. Numbers were up by 15% in the East Midlands (rising from 20 days to 23) and by 16% in Greater London (up from 12 to 14 days).

Oli Sherlock, director of insurance at Goodlord, commented “we’ve now seen six consecutive months of price rises and we predict this to continue throughout the summer. The fairly sizable drop in void periods during June also reflects this intensification of demand, as tenants snap up properties as soon as they come on the market. “We’ll likely see prices and demand peaking as we hit the start of the academic year and, whilst things normally begin to cool down over the autumn and winter, if supply issues continue we could see this pressure on rental stock continue, affecting all industry stakeholders.”

Full data breakdown Sept 2022 – June 2023: