A trade body has criticised the various UK governments for “rushing blindly” into poorly-constructed regulation of short lets.

The angry words from the Short Term Accommodation Association follow a court decision at the end of last week relating to a Scottish local authority bid to strictly regulate Airbnb-style short lets. Edinburgh council wanted to introduce the licensing scheme following complaints about the high number of short-term lets in the Scottish capital. Opponents of Airbnb claimed that short lets fuelled housing shortages and led to increased anti-social behaviour

Short let landlords in the Scottish capital had until October 1 to apply for a licence, with people who list whole properties on sites such as Airbnb also needing planning permission. Renting out a room in your own home, or letting your home while on holiday, would still be allowed.

However, a group of landlords in Edinburgh took the city council to court and following a two-day hearing at the Court of Session, Lord Braid agreed that part of the proposal was unlawful.

Now the proposal - which had the backing of the Scottish Government and was seen as a template for regulation - lies in tatters.

Activist groups from across the UK claim the Edinburgh model could have been used as a template for short let regulation nationwide - but that now lies in tatters. Opponents of the scheme raised £300,000 through crowdfunding for a judicial review at the Court of Session.

Lord Braid ruled that the lack of provision for temporary licences and requirement for some hosts to supply floor coverings went beyond the council's powers. He said the policy was unlawful because it breached existing laws on what licensing authorities could do under the law.

He wrote in his judgment: “It is not the function of the respondent's licensing authority to decide that a licence should not be granted because a property is of a particular type or is in a particular area. For the respondent to adopt a normal practice of not granting an short term licence for premises in a tenement, even where planning permission had been granted, is irrational and contrary to the purposes of the overall statutory scheme. It would be perverse and oppressive for the respondent, upon receipt of a licensing application, to require an applicant to obtain planning permission for a tenement property; and thereafter, planning permission having been obtained, to refuse the licence for no other reason than that the property was in a tenement."

The Scottish Government had backed the Edinburgh scheme, claiming that a proliferation of short lets reduced the stock available for mainstream letting.

Rosie Walker, head of litigation at Gilson Gray representing the short let operators who brought the action said, “the court found that the City of Edinburgh Council’s short-term let licensing policy was unlawful at common law and in breach of The Provision of Services Regulations 2009 for a number of different reasons. Most strikingly they found that it was not for the council, as licencing authority, to decide that a licence should not be granted just because a property is in a tenement. Our clients took the brave decision to bring this action against the local authority to protect their businesses and, more widely, to protect an industry that is very important to the Edinburgh economy.

Short-term accommodation providers create a significant number of jobs in the city and deliver flexible accommodation that hotels and other operators simply cannot – particularly during important events like the Edinburgh Festival. The campaign was the largest crowdfunded legal case in Scottish history, underlining the strength of support for our clients. It comes on the back of years of engagement by the Industry with the Scottish Government and the local authority to try to put in place a workable regulatory framework.”

Andy Fenner, chief executive of the Short Term Accommodation Association said, “this decision is further proof that local and national governments across the UK are rushing blindly into plans to regulate the short term rental industry, risking unintended consequences that will seriously damage local economies and the hundreds of thousands of people who rely on the short term rental industry for their livelihoods. We've said all along that a registration scheme should be the first step, so that policy decisions can be based on fact not fiction. Introducing a registration scheme first is the only way to understand the breadth and depth of the holiday let market, and the wider economic contribution it makes. The short term rental industry contributed £27.7 billion to the UK economy in 2021. In some areas that rely heavily on tourism, these restrictions could have a severe impact.

The knock-on effects of rule changes that have already been introduced in Scotland and Wales are yet to become clear. The short-term rental industry is an easy target when it comes to the housing crisis but the focus should be elsewhere. Housebuilding has slumped, targets have been abandoned and the nation is littered with empty homes and second homes that never attract a penny of tourism spending.”

Is the short-term lets market to blame for the housing crisis?

We all hear about the rise in short-term lets, and how it might be to blame for the housing crisis – but is it really true?

With growing regulation around short-term rentals such as Airbnbs, many holiday-let owners are being forced out of the market. This investigation looks at the data behind short-term rentals and why they might not be to blame for the situtation. One estimate from Alma Economics suggests the total number of short-term and holiday lettings in England in 2022 could only be 257,000.

However, with nearly five million properties in the private rented sector, this means that only 6% are short-term and holiday lets. The report commissioned by the Department for Culture, Media and Sport gathered information from both owners and organisations such as Airbnb.

Data provided by these organisations indicate that between 69-76% of total listings are for entire premises that are furnished. Nearly two-thirds of all short-term and holiday lets in England are in the South-West, South-East or London. However, whilst Alma Economic says the number could be an underestimate, as the same property could be listed on multiple platforms, data from one firm shows active short-term lets in London have never returned to pre-Covid levels.

Number of active rentals is down across the capital

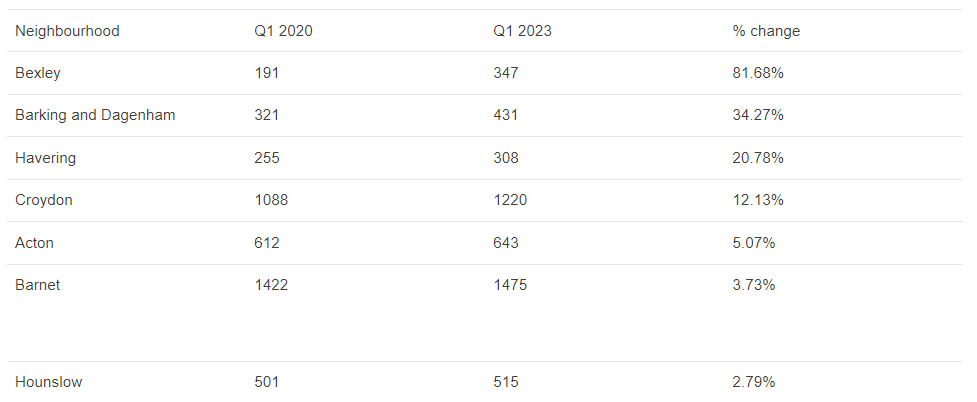

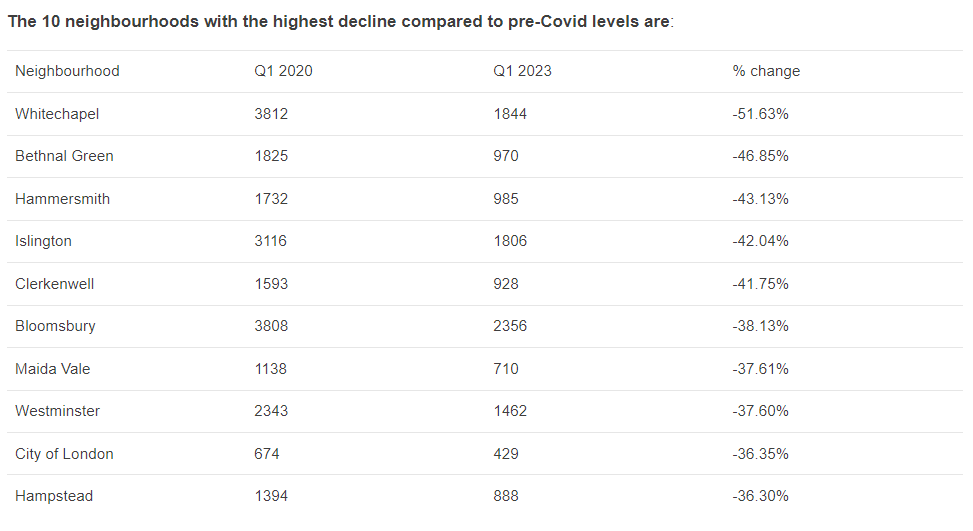

In a study by Your AirHost, the number of active rentals, which includes properties that had at least one day reserved or available each month, is down across the capital by 27% compared with the beginning of 2020. The data, which uses figures from AirDNA, identify only seven neighbourhoods where the number of active rentals has risen, with the average growth in these areas being just 23%.

While some of the neighbourhoods with the highest decline are in central London, supply issues are affecting other places in London, too.

A shrinking holiday let market does not translate to more properties available on the market

Airhost says, “the decline in available listings is therefore likely not a representation of demand but of shrinking availability in both long-term and short-term rental properties.”

Owner of Your AirHost, Stefan Hoffelner, says, "that studies like this show that short-term rentals are not the reason for the housing crisis. The political climate was harsh and that short-term rental owners had become “the new villain of the housing crisis. Recent discussions might lead people to believe that the short-term rental market is growing out of control. While there may be some communities that have a limited amount of housing where availability is being exacerbated by short-term rentals, the perception is more significant than the actual problem. The availability of London properties on short-term rental sites like Airbnb has been fluctuating since the beginning of the pandemic but, in almost all cases, availability has never reached pre-Covid levels.”

A shrinking holiday-let market does not translate to more properties available on the market and often, the argument against homes being used for holiday lets is combined with the issue of second homes which can result in a reduction of housing stock for renters and first-time buyers. However, these are two issues which need to be addressed separately to help solve the problem of housing availability. As evidenced by the market in London, it’s also clear that a shrinking crop of holiday lets does not necessarily translate to more properties available on the market.”

More landlords moving out of the holiday letting sector

AirBnb owners are leaving the market for long-term lettings following changes to the regulations in Scotland, according to property firm DJ Alexander Ltd.

Since October last year, licensing is mandatory for all short-term let accommodation across Scotland. New hosts must apply to their local authority for a licence before accepting bookings or receiving guests. Existing hosts must apply for a licence before 1 October 2023. Also, since last year, landlords in Scotland are required to apply for planning permission to operate a holiday let.

DJ Alexander said, "that it had been approached by holiday lettings landlords wanting to shift to long-term residential letting because of costs and uncertainty over the introduction of more stringent regulations."

One Glasgow landlord, who wished to remain anonymous, told the firm, “my feeling is that I am being forced out of the market by these new regulations. We are being asked to pay thousands of pounds to submit an application for planning permission when there is no guarantee that this will be approved.”

David Alexander, chief executive of DJ Alexander said, “we are seeing many landlords moving out of the holiday letting sector simply because of the uncertainty of the new regulations and the costs of implementing the rules.”

Your AirHost’s Mr Hoffelner said, "if Scotland’s regulations come into force in England this could lead to a drop in the number of available holiday lets."

1.5% of all landlords are also holiday let owners

A Freedom of Information request from Hamptons reveals that 63,000 individuals (rather than a company) received income from 65,000 furnished holiday let properties in the UK.

When compared to nearly five million properties in the PRS, is small in comparison. The research also reveals that whilst some longer-term landlords have moved across to the short-let market, it is only a very small number. Just 1.5% of all landlords are also holiday let owners, up from about 1.3%.

Research by Capital Economics in 2020 shows that the majority of landlords are unlikely to consider switching from long-term to short-term lets. The firm’s research reveals 60% of landlords are very unlikely to switch to short-term lets. A further 23% said that they were ‘fairly unlikely’ to do so. The reason that was most commonly cited for not wanting to offer short-term lets was the extra work involved. The report said when offering short-term lets, the landlord has to take responsibility for tasks that would usually be the tenants’ responsibility such as paying bills, furnishing the property and cleaning the property.

The report said 50% of landlords were concerned about the uncertainty in income from short-term lets. It states, one of the potential problems for landlords in offering short-term lets is that there are usually longer periods where the property is vacant, and the income stream is less predictable. Given a large market for short-term lets is tourists, the demand for properties tends to be seasonal.

Short-term lets market is not the main reason for the UK’s housing crisis

Whilst there may not be a definitive figure for the number of short-term lets, a growing number of landlords are leaving the short-term lets market due to more regulation – and this will probably grow.

As Mr Hoffelener said, "the short-term lets market is not the main reason for the UK’s housing crisis and a shrinking holiday let market does not necessarily mean more properties becoming available to rent."

Are There Too Many Holiday Homes? Census figures revealed

New data from the Office for National Statistics, based on the 2021 Census results, show growth in the number of holiday homes.

The South West had the highest concentration of holiday homes compared with other English regions and Wales, at 7.5 for every 1,000 homes. This was followed by Wales, with 6.9 holiday homes for every 1,000 homes. London had the lowest, at 0.6 per 1,000.

The figure was higher in local authority areas known as popular tourist destinations.

In South Hams in Devon, there were 44.1 holiday homes for every 1,000 homes. This was the highest rate of any local authority area in England and Wales excluding the Isles of Scilly, which has a particularly small resident population. South Hams has a long coastline and is home to the southern part of Dartmoor National Park, as well as the South Devon Area of Outstanding Natural Beauty.

South Hams was followed by Gwynedd in North Wales (41.0 per 1,000 homes), which contains most of Eryri (Snowdonia) National Park, North Norfolk (38.7 per 1,000) and the Isle of Anglesey (32.9 per 1,000).

Within local authorities, there were some areas where the concentration of holiday homes was even higher. For example in the Salcombe, Malborough and Thurlestone area of South Hams, there were 171.9 holiday homes for every 1,000 homes. In Abersoch and Aberdaron in Gwynedd, the figure was 153.3 per 1,000.

There were seven areas in England and Wales where more than 1 in 10 homes were used as holiday homes.

These also included, in Cornwall, Trebetherick and Whitecross (139.5 per 1,000 homes) and Padstow and St Issey (120.5 per 1,000); meanwhile in King’s Lynn and West Norfolk, Brancaster, Burnham Market and Docking (130.4 per 1,000 homes) and Hunstanton (103.8 per 1,000); and in North Norfolk, Wells and Blakeney (109.1 per 1,000 homes).

Many of these locations with particularly high concentrations of holiday homes were in coastal areas, or near national parks.

The same survey suggests a significant increase in staycations - although it’s worth noting that the Census was conducted in 2021 when some Covid travel restrictions were in place.