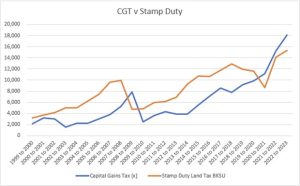

New figures from HMRC reveal that the taxman collected £18.1 billion in CGT in 2022/23 and means the public now pay more CGT than the hated Stamp Duty.

Capital Gains Tax (CGT) receipts are rocketing as buy-to-let landlords sell off swathes of property as mortgage rates rise and house prices fluctuate, research from NFU Mutual reveals.

New figures from HMRC (main picture) reveal that the taxman collected £18.1 billion in CGT in 2022/23 – a huge £7bn more than two years previously – and means the public now pay more CGT than the hated Stamp Duty.

Buy-to-let landlords offloading property are behind these rocketing receipts, which are set to continue as the CGT annual tax-free exemption has been slashed from £12,300 a year to £6,000 and is set to fall to £3,000 from April next year.

Sean McCann, Chartered Financial Planner at NFU Mutual, says, “there are several factors behind these huge increases. More buy-to-let landlords are offloading property because of increasing mortgage rates and are being hit based on the rise in the value of their property. With the value of the average UK property having increased by 75% over the last 10 years, many are facing substantial bills.”

CGT is paid when investors realise gains on shares or properties that aren’t their main residence and McCann says, "tax changes have led many landlords to bring forward the sale of their properties to benefit from a higher tax-free exemption. There are a number of CGT traps that people unwittingly fall into. Most notably, few people realise giving away property, shares, or other investments can trigger a tax bill. For example, if a parent gives property or a portfolio of shares to their children, that’s deemed to be a disposal and could be liable for Capital Gains Tax. It’s also possible the gift could be hit with a subsequent Inheritance Tax bill if the person making the gift dies within seven years.”

Letting Relief & Capital Gains Tax

In general, there is no Capital Gains Tax (CGT) due on the disposal of a property which has been used as the main family residence. This relief from CGT is commonly known as 'private residence relief'. However, where all or part of the home has been rented out the entitlement to relief may be affected. Homeowners that let all or part of their house may not benefit from the full private residence relief, but may benefit from letting relief.

Homeowners that lived in their home at the same time as tenants, may qualify for letting relief on gains they make when they sell the property. Letting relief does not cover any proportion of the chargeable gain made while the home is empty.

The maximum amount of letting relief due is the lower of:

- The amount of private residence relief due

- £40,000

- The amount of gain you've made on the let part of the property

Worked example:

- You used 40% of your house as your home and let out the other 60%.

- You sell the property, making a gain of £60,000.

- You're entitled to private residence relief of £24,000 on the part used as your home (40% of the £60,000 gain).

- The remaining gain on the part of your home that's been let is £36,000.

The maximum letting relief due is £24,000 as this is the lower of:

- £24,000 (the private residence relief due)

- £40,000

- £36,000 (the gain on the part of the property that's been let)

The letting exemption is only available when the conditions outlined above apply, most importantly that the property owner(s) were/are in shared occupancy with a tenant. The letting relief was more generous prior to 6 April 2020, when the requirement for the property owner to live in the property at the same time as their tenants did not apply.

Buy-to-let - landlords exiting the market

Expert singles out taxation and regulation changes in exodus from landlords Close to half a million landlords are expected to exit the buy-to-let sector over the next five years, according to data from Hamptons.

The research also revealed that 140,000 landlords left the market last year; with an expectation for a mass exodus, one expert believes the reasoning behind this stems from a variety of challenges facing buy-to-let landlords, principally the changes in taxation and regulation. Why are landlords choosing to exit the market?

Since 2015, Hiten Ganatra, managing director at Visionary Finance said, "there have been several key changes to taxation and regulation that have combined to make it less attractive for landlords to remain in the buy-to-let sector. These include ending the mortgage tax relief, higher stamp duty for additional property purchase, removal of the wear and tear allowance, depreciation, and the reduction of CGT allowance."

Ganatra said, "landlords are also having to battle with local authorities who are charging them for multi-occupancy homes in which they are having to pay a fee for each room they rent. This is decimating the sharer and student model for landlords, which is essentially creating another tax hike. The process of evicting tenants for breaches and non-rent payment is also, in recent times, becoming costly and time-consuming leaving landlords with the financial stress of having to meet their mortgage and upkeep costs."

Finally, he said mortgage interest hiking as it has done in the last six months has meant highly-geared landlords are finding that their rents no longer cover mortgage payments.

Overcoming the impact of a mass exodus

Ganatra said, "the figures showing the number of landlords leaving the sector are staggering, and he believes will only heap further pressure on tenants who will ultimately pay the price through higher rents and reduced stock in the rental market. The argument that if landlords are forced to sell, more stock will become available in the housing market which will help to bring down house prices is futile because homebuyer affordability is being squeezed due to the increase in interest rates. The fact is, all these pressures will curtail any new investment or rental stock coming to the market, and result in increased competition among renters, which will drive up rents even further."

He added there is also a very real possibility of a rental and homelessness crisis, as more people struggle to secure or afford rental accommodation, which will only serve to harm the most vulnerable in society.

Encouraging landlords to remain

One possible solution, Ganatra said, "would be to give landlords some level of temporary respite on the interest rate relief as that could help reduce the need for rising costs to be passed onto tenants who already spend a large part of their disposable income on rent. It would also help safeguard the spiraling rental sector and protect the interests of both tenants and landlords alike, by encouraging landlords to remain in the market as well as keep rents affordable. As things currently stand, by doing nothing and leaving things how they are, we are at risk of seeing more buy-to-let landlords sell up and move on, prompting a contraction in the market which will result in a smaller and much more expensive private rental sector."