A growing number of people are struggling to find homes to rent, as the supply-demand imbalance in the PRS continues to widen, new figures show.

According to the newly released End of Year 2022 Property & Homemovers Report from property and data insight specialist, TwentyCi there are now more homes available to buy, but there are significantly fewer properties to let.

The data reveals that the availability of stock within the owner-occupied market is now back to a pre-pandemic norm, but the reverse is true for the letting market. The figures show a 5% increase in new instructions to the owner-occupied market in 2022 and a 14% drop in sales agreed which together have resulted in a significant easing of stock available across all regions of the UK. Most areas now have five months or more of supply, which is more than double the levels in some regions during 2021. This is far closer to the number of houses available for sale back in 2019 prior to the onslaught of Covid-19.

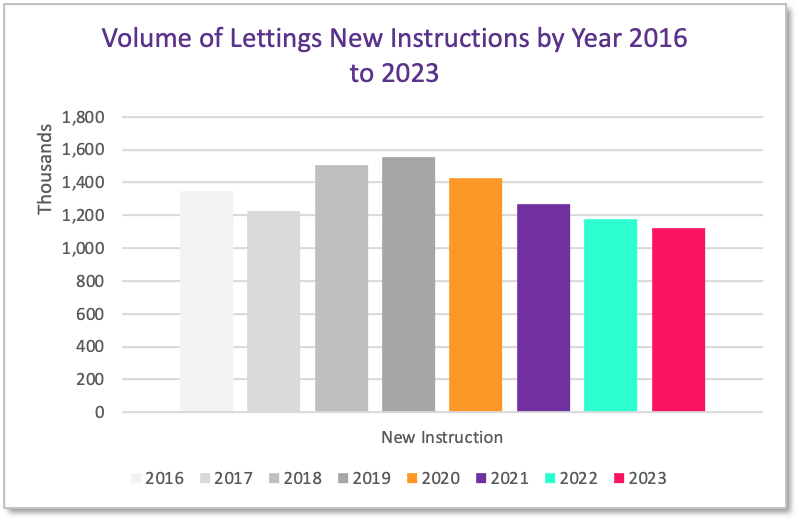

Inner London and Wales have the most available stock with over six months, whilst Scotland and the Northeast currently have the least at around four and a half months of stock each. Despite this easing of the supply squeeze, house prices have remained buoyant, 8.4 per cent higher than in 2019, but down from the peak recorded in Q2 2022. In contrast, new instructions within the letting market are down by almost 8% compared to 2021 and by over 25 per cent since 2019.

Buy-to-let landlords are rapidly withdrawing from the market as tax, regulatory and cost environments have become less favourable. Apart from Inner London, which currently has four and a half months of letting property stock on the books, all regions sit between 1.5 and three months of rental homes available.

Renters in Scotland and Northern Ireland are in the most precarious situation. Lack of supply is further compounded on the demand side as tenants are deferring decisions to buy because of the cost-of-living crisis. This pressure has resulted in average monthly asking price reaching £1652, an increase of £200 since 2021 and almost £300 since the ‘norm’ of 2019.

TwentyCi’s MD, Colin Bradshaw, commented: “2022 was a turbulent year when the widely anticipated housing market re-calibration began to take effect. We’ve seen some key shifts; most markedly in the stock situations for both the owner-occupied and lettings markets. With the cost-of-living crisis continuing to deepen, 2023 looks set to be another fast-changing year and it will be important to keep on top of market trends.”

Rented home supply drops sharply as landlords flee the PRS

There has been a ‘significant’ drop in the supply of rental accommodation as landlords have sold up because of increasing regulation, research reveals. According to TwentyEA, the supply of homes to rent fell by 8% year on year in 2022 and by 25% since 2019. The findings also highlight that tenant demand for rental homes is also falling, but less than supply. However, underlying tenant demand is still strong with demand volumes last year falling by 4% on 2021 and by 17% on 2019.

This means, the UK’s largest homemover database reveals, that rent prices are increasing because of renter demand for fewer available homes. The firm says that rents have risen by an average of 22% since 2019. Landlords leaving the private rented sector

And with landlords leaving the private rented sector, the volume of lettings stock has been falling since March 2021. In December 2022, there were only 199,725 properties for rent available – that’s in stark contrast with December 2019, when there were 328,412 homes.

Stuart Ducker, the strategic solutions director of TwentyEA, said: “There is simply too much demand and not enough supply. Average agreed let prices have continued to rise in the medium term with prices up by 8.5% over the last year and 22% up since 2019. If Government legislation on the private rental sector continues, and it looks like it will, expect prices to rise further if incomes rise.”

Available lettings stock has dropped by 39% in just three years

Mr Ducker also points out that available lettings stock has dropped by 39% in just three years and that increasing regulation in the PRS is leading to many landlords to divest. He adds: “This supply side, pitched against underlying demand for rental properties has created a perfect storm. Whilst TwentyCi does not issue forecasts to the market, our view is that new lettings instructions will fall by a further 5% on 2022 to 1,121,000. While this is not good news for tenants, it’s great for agents and landlords who will continue to see their rents rising in real terms after years of decline.”

Rents hit new record highs across the country

Average asking rents in inner London have soared past £3,000 per month for the first time, according to Rightmove. The property portal has published data for the fourth quarter of 2022 and it also reveals that the capital’s rents leapt by 5.8% on the previous quarter to reach £2,480. However, it appears that 2023 has seen competition for rental homes easing with a growing supply of property for renters – but there’s still an issue with supply and demand.

Rents outside of London

Rents outside of the capital have also set a record, Rightmove says, with a new high of £1,172 per month – that’s an increase of 9.7% in a year. The number of properties available to rent increased by 13%, the biggest jump since 2013. Tenants enquiring about rental properties rose by 7% in the same period, and that’s a 53% rise compared to 2019. Rightmove predicts that national average asking rents for newly available properties will rise a further 5% this year – unless there is an increase in the number of homes to rent. Elsewhere, Wales and the South West saw the biggest rise in the number of properties to rent. This led to a drop of 1% in average asking prices.

Landlords need to balance rent rises

Rightmove’s director of property science, Tim Bannister, said: “Although the fierce competition among tenants to find a home is starting to ease, it is still double the level it was back in 2019. Letting agents are seeing extremely high volumes of tenant enquiries and dealing with tens of potential tenants for each available property. Landlords will need to balance any rent rises with what tenants can afford to pay in their local area, to continue to find tenants quickly and avoid any periods where their home is empty due to tenants not being able to meet the asking rent, and that there is more property choice for renters compared to the record low levels of last year which will help with the levels of competition."

Mr Bannister said: “This is why we’re forecasting that the pace of annual growth will ease to around 5% by the end of the year nationally, although this would still significantly exceed the average of 2% that we saw during the five years before the pandemic.”

No sign of the rental market slowing down

James Redington, the sales and lettings director at Douglas and Gordon, said: “There is no sign of the rental market slowing down due to the continuing imbalance between supply and demand. We’ve seen the highest rent increases we’ve seen for decades, and we don’t expect this to slow down in the short term.”

Simon Leigh, a director at Hackney and Leigh, said: “The rental market remains buoyant, and the majority of our landlords are still receiving multiple applications on their properties. Rents have remained stable, due in part to the cautious approach from landlords when considering rent increases at renewal stage, preferring to retain good tenants rather than have even a small void period, or incur the associated costs. Given the widely reported cost of living crisis, tenants who have been affected are generally being proactive in approaching us with any financial concerns, allowing us to work with them where possible and assist them in managing their issues.”