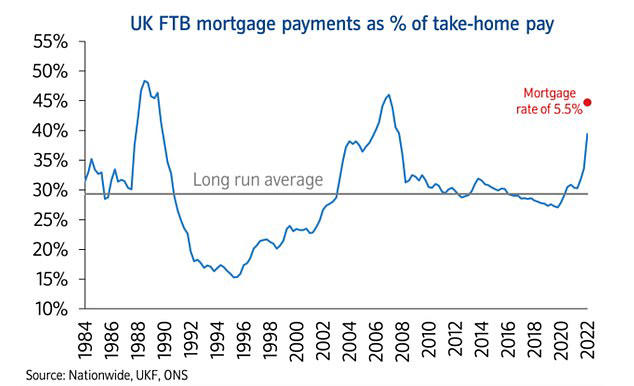

Increased mortgage rates have hit housing affordability in the UK, according to new figures from lender Nationwide, with first time buyers now facing levels last seen in the run up to the financial crisis.

For an average first-time buyer with a 20% deposit and a mortgage rate of 5.5% the payments will make up around 39 per cent of their take home pay. Despite predictions of a fall in house prices this year, raising a deposit is still a significant hurdle for those saving for their first home.

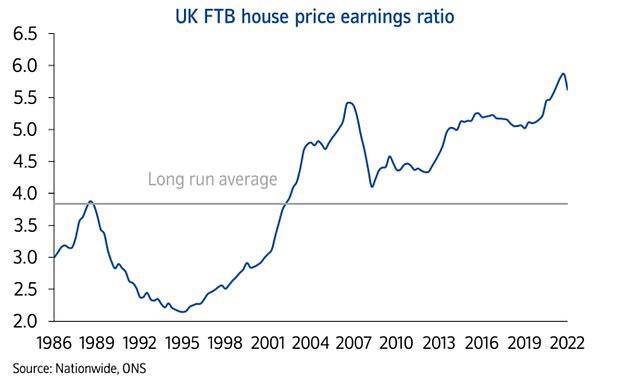

Andrew Harvey, senior economist at Nationwide, says it is due to the rapid rise in house prices over the past few years and comparably slow wage growth. "Between the start of the pandemic and the end of 2022, house prices increased by 19%, while incomes rose by a much more modest 9%. This in turn means that a 20% deposit on a typical first-time buyer home is now equivalent to 112% of the pre-tax income of a typical full-time employee, a similar level to a year ago, and only modestly below the all-time high of 117% recorded earlier in 2022."

And while households in the UK saved an extra £200bn over lockdown, the majority was accrued by older wealthier savers, meaning first time buyers are still turning to friends and family for help with a house deposit. The data shows that in 2021/22 a third of first-time buyers had some help raising a deposit, up from 27 per cent in the mid-1990s.

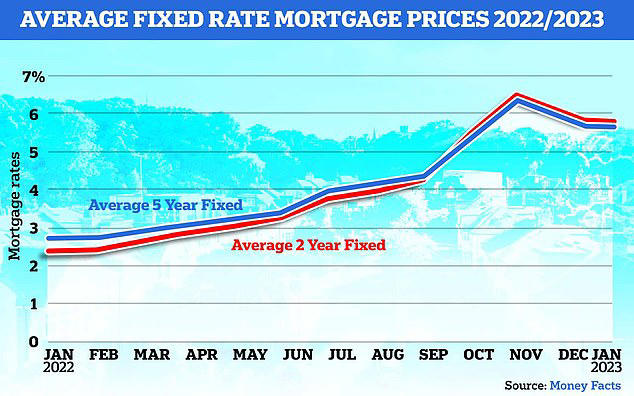

Furthermore, the rise in rents over the past year coupled with the end of the Government's Help to Buy scheme mean first-time buyers are even more squeezed, especially while inflation continues to outpace wage growth. Tom Bill, head of UK residential research at Knight Frank said, "This is a confusing moment for anyone buying a property. Mortgage rates are 3% points higher than they were this time last year, but are also falling. After 13 years of ultra-low borrowing costs, monthly outgoings will rise by hundreds of pounds at a time when cost-of-living pressures are already biting. However, rates are falling as the shock of the mini-Budget works its way through the system, though any decline will not take us back in time much beyond last September. The message in 2023 is stay close to your mortgage broker."

Regionally Scotland and the North have the lowest house price to earnings ratio of just 3.4%. By contrast, London has the highest ratio of 9.2%. At a local authority level Westminster in the capital has the worst affordability at 15.6% and Inverclyde in Scotland is the most affordable at 2.6%.

In addition, some areas have become more affordable. Tewkesbury in the South West has seen affordability improve by 0.9% to 5.9%, and Brent in London improved by 0.8% to 11.1%.

There is also good news as mortgage rates are continuing to drop from the highs seen in October. The average two-year fixed rate is now 5.63%, down from 5.79% on 1st January, according to Moneyfacts.

The five-year fixed rate average has also fallen, dropping to 5.43% from 5.63% at the start of the month. Most experts now expect rates to settle somewhere between 4 and 5% this year, with many fixed deals now below 5% despite a succession of base rate increases. Samuel Mather-Holgate, financial advisor at Mather and Murray Financial said, 'Data in this report is no surprise. What's concerning is the Government seem to be doing nothing about it. A scheme for home builders and buyers alike is urgently needed to stimulate the affordable housing sector. Help to Buy wasn't perfect by a long shot, but when it was removed it dried up an already parched sector of the housing market."

Housing affordability hit by rising mortgage rates – nationwide

Affordability may improve a bit in the year ahead, economist says.

The rise in the cost of servicing the typical mortgage due to the increase in mortgage rates had a considerable impact on housing affordability for potential buyers over the past year, the Nationwide Building Society said.

According to senior economist Andrew Harvey, the trend began towards the end of 2021, with typical five-year fixed rates rising from 1.3% in late 2021 to 2.9% by mid-2022, as market interest rates that underpin mortgage pricing rose steadily. "It relected expectations that the Bank of England would have to raise rates significantly in the years ahead to help bring surging inflation back to its target rate of 2%. But mortgage rates surged after the mini budget in late September, reaching their highest levels since 2010, over four times higher than the lows prevailing in 2021. While wider financial market conditions had stabilised by the end of 2022, with market interest rates falling back towards the levels prevailing before the mini budget, mortgage rates are taking longer to normalise.”

The Nationwide Building Society Affordability Report released on Friday also showed that high house prices relative to average earnings continue to make raising a deposit a significant barrier for first-time buyers.

“Unfortunately, raising a deposit remains a major hurdle for prospective buyers,” Harvey commented. “In recent quarters, strong wage growth and a small fall in house prices has led to a modest fall in the house price to earnings ratio. But this has done little to improve the situation, as it follows several years when house price growth outpaced earnings by a wide margin.”

Nationwide reported that between the start of the pandemic and the end of 2022, house prices increased by 19%, while incomes rose by a more modest 9%.

“While UK households, in aggregate, saved £200 billion more in bank deposits than we would have expected over the pandemic period as a result of lockdowns, the majority of this was accrued by older, wealthier households and therefore probably helped fewer first time buyers step into the market than it might first appear,” Harvey pointed out.

“Indeed, the data suggests that a significant proportion of first-time buyers have continued to draw on help from friends and family or an inheritance to help raise a deposit in recent years.”

Despite the gloomy findings of the report, Harvey said there is some scope for affordability to improve a bit in the year ahead.

“Longer-term interest rates, which underpin mortgage pricing, have fallen back towards the levels prevailing before the mini budget,” he noted. “If sustained, this should feed through to mortgage rates and improve the affordability position for potential buyers, albeit modestly, as will solid rates of income growth, especially if combined with weak or negative house price growth.

“Nevertheless, the overall affordability situation looks set to remain challenging in the near term. Saving for a deposit will still be a struggle for many. The cost-of-living is set to outpace earnings growth by a significant margin again this year, while labour market conditions are widely expected to weaken.”

The economist added that rents have also been rising at their strongest pace on record, which will be a further drag for those currently renting who are looking to buy a home.

The Help to Buy Equity Loan scheme that helped those with a smaller deposit buy a new build property is due to end in March. However, the mortgage guarantee scheme, which helps to secure the availability and lower the cost of higher LTV mortgages, has been extended unetil the end of 2023.