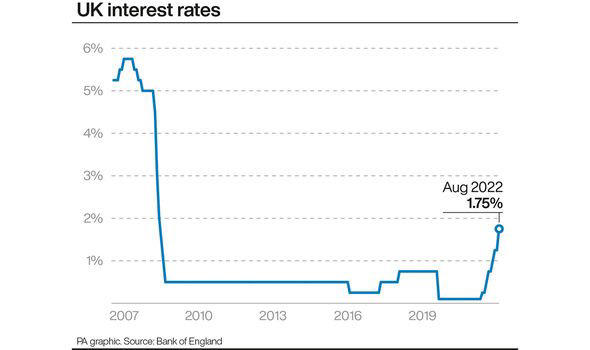

The Bank of England has been increasingly raising its base interest rate since the start of the year in an effort to curb rising inflation.

Interest rates are raised to discourage spending and reward saving, however, with higher rates can come higher mortgage repayments, which undoubtedly comes as a concern to homeowners and potential investors.

Interest rates currently sit at 1.75 percent and with inflation now reaching double digits of 10.1 percent, this rate is only expected to increase.

Buy-to-let mortgages are designed for investors intending to rent out the property to tenants. Typically, these landlords use interest-only mortgages to help generate more cash flow.

However, Claire Flynn, mortgage expert at money.co.uk said: "Soaring borrowing costs, insurance premiums and maintenance fees are all thought to be putting prospective and current landlords alike off the buy-to-let market."

Some property owners have already taken action by passing on the higher borrowing costs to their tenants, increasing rental prices to combat falling profit margins.

Yet, this is likely to leave many renters distressed and more stretched financially due to the overall cost of living pressures across the country.

But it might not be all bad news for tenants who would like to get on the property ladder.

Ms Flynn said: "With landlords turning their backs on rising mortgage interest rates, there could be an increasing number of properties on the market, potentially providing more options for first-time buyers.

"The housing market momentum may also be showing signs of slowing, with Halifax reporting a 0.1 per cent month-on-month fall in house prices across the UK in July."

Is now a good time to invest in a buy-to-let property?

Ms Flynn said: "It is important to note that purchasing a buy-to-let property still has much to offer, and becoming a landlord can be a good investment opportunity, providing a regular source of income, plus a potential long-term yield from property value increases.

"That's not to say that becoming a landlord is without its risks though."

For those contemplating taking the leap into the buy-to-let industry, Ms Flynn has shared her top tips for success.

Making decorative changes inside your home is easy to do, but it can be much more difficult when it comes to your garden or the structure of your property. Neighbours and boundary rules are just some of the factors that you have to consider.

Research the market

Ms Flynn said: "If you are considering investing in a buy-to-let property, be sure to conduct research into local supply and demand before making any decisions.

"This will help you to purchase a property that provides a good rental yield."

Save a larger deposit

Ms Flynn explained: "The larger the deposit you have, the more likely you will be able to secure a lower interest rate.

"Most lenders will expect around a 25 percent deposit for a buy-to-let mortgage, but you can often access better rates with a 40 percent deposit."

Factor in all costs

Ms Flynn said: "Make sure you factor in both the interest rate and any fees when comparing the cost of mortgage deals, as you may find a mortgage with a higher interest rate but lower fees work out cheaper overall."