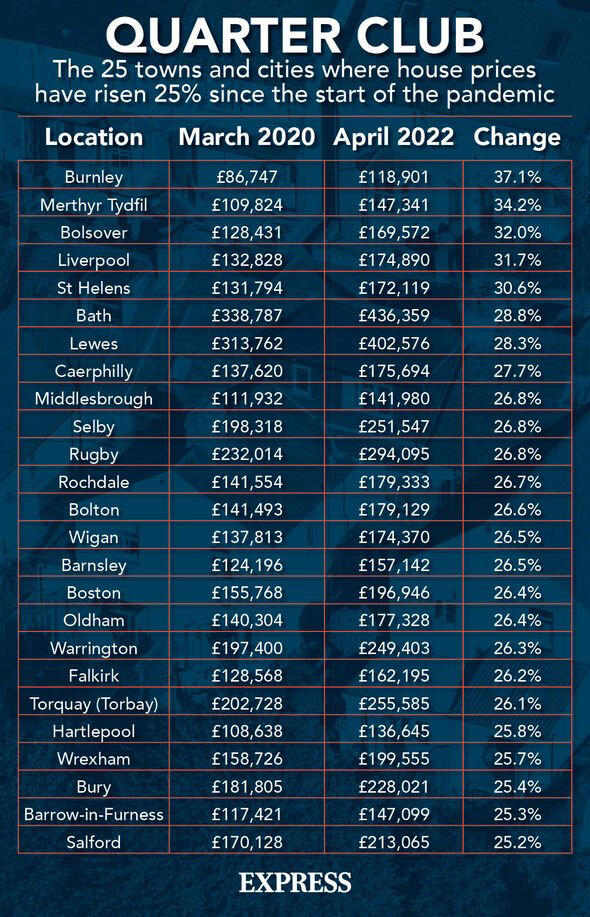

Since the pandemic hit in March 2020, 25 towns and cities in the UK have rocketed in price by one quarter. Later life mortgage broker Responsible Life shared which UK destinations have become more expensive post-Covid.

House prices in Burnley, Lancashire, have increased by a huge 37 percent between March 2020 and April 2022.

In March 2020, the average house price was £86,747, and in April 2022, £118,901.

The second biggest increase was in Merthyr Tydfil, south Wales, from £109,824 to £147,341, a 34.2 percent increase.

Houses in Bolsover, Derbyshire, increased by 32 percent over the course of the pandemic in the third greatest increase, from £128,431 to £169,572.

In just two years, Burnley homes went up by a staggering £32,154.

This meant that prices increased by £37,517. (Merthyr Tydfil)

In Bolsover, this meant an average increase of £41,141.

Of the 25 areas, Salford's house pricing surge was the least drastic at 25.2 percent, from £170,128 to £213,065.

These are Bath, Lewes and Torquay, which offer a sought after mix of town and country living.

Steve Wilkie, Executive Chairman of Responsible Life, spoke about the findings.

He said: "These housing markets have seen some thundering house price growth since the pandemic began."

However, while many have suffered due to this, one particular group is benefitting financially from increased house prices.

"The cost of living crisis is hurting people of all ages and the rally has stretched affordability to breaking point for younger buyers.

"However, for retirees, it's a different story.

"Many homeowners approaching retirement, or already retired, are being offered some protection by the strength of their biggest asset."

He continued: "For those in later life lucky enough to have benefited to this degree, the boom will have provided some welcome headroom in retirement.

"In fact, fewer homeowners will end up needing a lifetime mortgage early in retirement or at all.

"Retirement Interest Only Mortgages (RIOMs) are another way of paying off traditional home loans but passing affordability tests has been challenging in the past due to rules surrounding sole survivor income.

"Shrinking LTVs will have made them accessible to many more homeowners, while others will have much greater scope to borrow against the wealth locked up in their home."