The research from Benham and Reeves shows that across England and Wales, just short of a quarter of a million homes are owned by overseas buyers

The total market value of foreign-owned homes in England and Wales currently stands at £90.7 billion, research from Benham and Reeves shows.

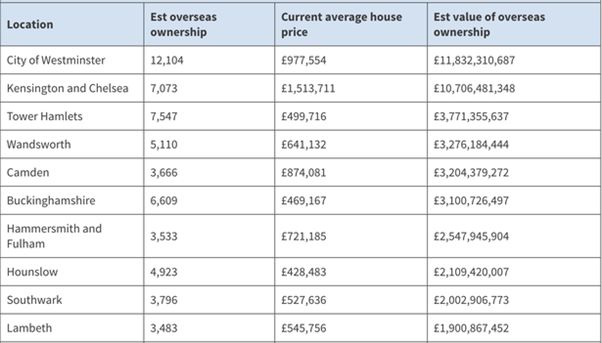

The study uncovered which areas of the property market are home to the highest value of homes owned by overseas homeowners.

It looked at the latest available data on the number of homes owned by individuals with an overseas correspondence address, along with the current market value of these homes in each respective area of the nation.

The research shows that across England and Wales, just short of a quarter of a million homes are owned by overseas buyers. In the current market, that’s over a staggering £90.7 billion worth of property.

On a regional basis, London is home to the highest value of foreign-owned homes, with the 85,451 properties belonging to overseas homeowners equating to a total value of £45.3 billion.

It comes as no surprise then, that where the total value of foreign-owned homes is concerned, 15 of the top 20 areas of England and Wales are located within the capital.

The value of foreign-owned homes in Westminster and Kensington and Chelsea eclipses the rest of the market by some margin.

Westminster ranks top, with foreign-owned homes commanding a current market value of £11.8 billion, while in Kensington and Chelsea this total sits at £10.7 billion.

Tower Hamlets ranks third, although some way off the top two, with overseas homeowners sitting on £3.7 billion worth of property, followed by Wandsworth (£3.3 billion) and Camden (£3.2 billion).

Outside of the capital, Buckinghamshire is home to the highest value of foreign-owned homes at £31.1 billion, while Tandridge (£1.6 billion), Liverpool (£1.4 billion), Salford (£1.1 billion) and Manchester (£1.1 billion) also make the top 20 list.

Marc von Grundherr, director of Benham and Reeves, comments: It’s not just domestic homeowners who have benefited from some extreme rates of house price appreciation in recent years and despite attempts to deter foreign interest, the value of homes owned by overseas buyers remains considerable, to say the least.

He said: While London is home to the highest concentration of foreign-owned property market wealth, it’s certainly not confined to the boundaries of the capital alone, and overseas buyers remain an important segment of the market across England and Wales.

GCC Nationals Expected to Increase UK Property Investments

According to a report by Knight Frank, Gulf-based high-net-worth families have returned to property investments in recent months

In the face of global inflationary pressures, supply-chain disruption, and interest rate rises, Gulf Cooperation Council (GCC) nationals are expected to increase their investments in UK real estate, according to a new report.

The Bank of London and The Middle East (BLME), a London-based independent Shariah-compliant bank, stated that there is a clear opportunity for Gulf Cooperation Council investors to unleash the post-pandemic potential of property assets across the United Kingdom, with regional markets now outpacing London’s growth.

The Bank of London and The Middle East stated that investors concerned with wealth preservation should concentrate their efforts in London, despite lower potential yield and capital appreciation, because the city is regarded as a ‘safe’ investment bet.

However, for higher yield potential, investors might look at regions away from the capital.

For example, prime City of London office yields are currently at 3.75 per cent, whereas their equivalent in the regions is 4.75 per cent, the bank said.

According to a May report by property consultancy Knight Frank, Gulf-based high-net-worth families have returned to property investments in recent months as the real-estate market recovered from the worst effects of the COVID-19 pandemic.

It was recently reported that Gulf Cooperation Council investors are leveraging a weak pound to buy assets in the UK’s luxury property market after the pound fell to its lowest level against the dollar since March 2020 in early June. According to Knight Frank, the number of offers accepted in prime central and outer London reached a 10-year high in May.