Research uncovers buy-to-let hotspots for a second home investment.

Research by London rental platform Rentd has found that the buy-to-let sector is showing signs of potential growth with the level of investment into additional dwellings and the value of these purchases climbing year on year.

Around 10% of the population are thought to own an additional property, with the vast majority investing in a buy-to-let rental property.

Analysing data on additional property purchases made in the financial year 2020–21, Rentd found there was a 3.2% increase in transaction volume, with these purchases carrying a market value of £70.9 billion, a 13% increase on the previous year.

“Changes to stamp duty tax thresholds on second homes and buy-to-let properties have been just one government initiative designed to deter additional bricks and mortar investment,” Ahmed Gamal, founder and chief executive of Rentd, commented.

“But despite their endeavours to dampen appetites, additional property purchase still accounted for around one in five of all residential transactions in the last year alone. Not only is the level of this investment increasing, but the value of these portfolios has also climbed considerably and it’s fair to say that the buy-to-let sector, in particular, is far from on its knees.”

According to the research, the South West has seen the largest increase in market activity for additional property investment, with an 8.1% annual increase in transactions, while the value of these purchases has climbed by a huge 22.4%.

At 6.6%, the South East has seen the second largest increase in market activity concerning additional property investment, with the value of the market also up 17.6%.

The North East ranks third, where there have been 5.5% more additional properties purchased in the last year, although the East of England has seen the third largest uplift in the value of these transactions at 16.1%.

The East Midlands (-2%) and West Midlands (-2.2%) are the only two regions to see a decline in transaction volume where additional property purchases are concerned, although both have seen the market value of these transactions increase at 8.2% and 7.1% respectively.

While London sits mid-table where the annual change in market activity is concerned, the capital is the most valuable market for additional property investment by some margin, with £23.2 billion invested in the last year.

At Borough level, Sutton has seen the biggest uplift in activity, with additional property investment increasing by a huge 33.3% year on year, while Merton (28.6%) and Hounslow (22.2%%) also saw some of the largest annual increases in investment.

However, it’s Hillingdon that has seen the biggest boost where market values are concerned, with the total value of additional property purchases made over the last year coming in 59.3% higher than the previous year.

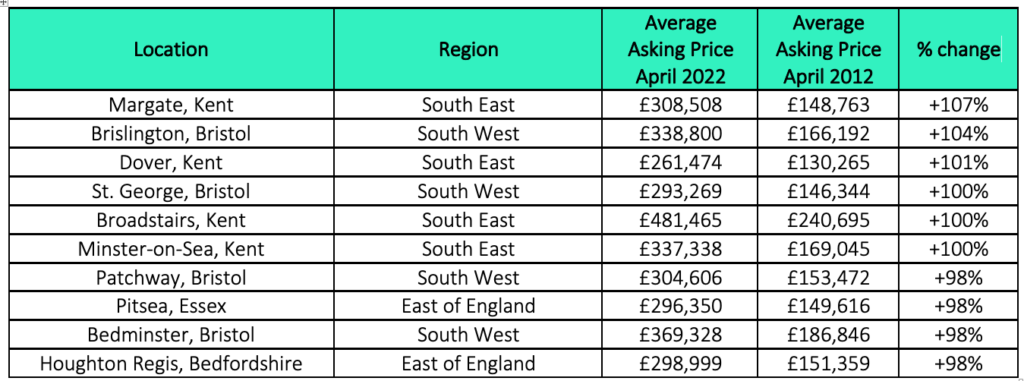

The UK Property Price Hotspots of the Decade

A new study has revealed the ten areas across Great Britain that have seen the biggest property price increases in the last decade.

The research found that Margate in Kent tops the list of property price hotspots, with average asking prices more than doubling from £148,763 to £308,508 in ten years – that’s a £159,745 (107 per cent) increase!

Brislington, in Bristol, is the second property price hotspot, with prices rising 104 per cent from £166,192 to £338,800 while Dover, in Kent, where the value of properties has also more than doubled (+101%) to £261,474 came third.

Mark Brooks, CEO of Miles & Barr in East Kent said: “It is no surprise to us to see Margate top the list of areas that have increased in price the most over the last ten years. Margate provides prospective buyers with the opportunity to live in a picturesque town with stunning views of the sea, and with travel time back to London taking less than 1 hour 30 minutes to St Pancras station, it is a place that allows many to either solely work from home or have a hybrid working solution. Developments such as the Turner Gallery and Dreamland, alongside investments by Kent County Council, have brought new energy to the town and they also have attracted tourists to Margate which increases the local economy.”

Areas in the South West and the South East made up the majority of the top ten hotspots, with four locations each. However, it was areas in the East of England that saw the biggest jump in asking prices with average increases of 63 per cent.

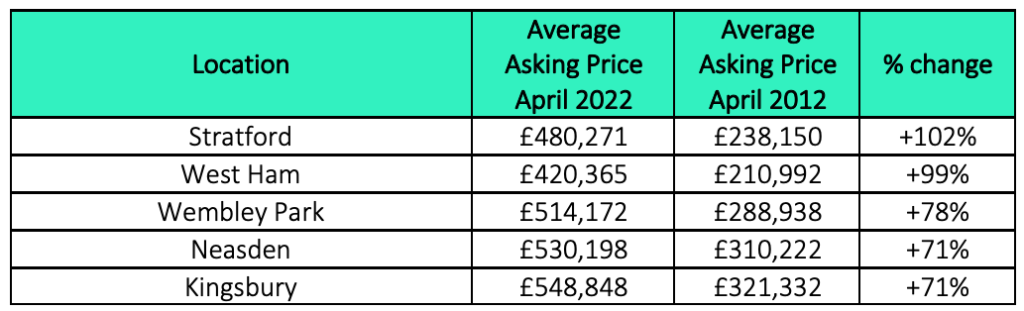

Meanwhile, in London, the researchers found areas around the newly opened Jubilee Line stations where properties have increased the most in value over the last ten years. Stratford topped the list, with asking prices near the station more than doubling on average (+102%) from £238,150 to £480,271 in a decade, while West Ham came second (+99%) and Wembley Park was third (+78%).

Jubilee Line Hotspots, source Rightmove

Rightmove’s Director of Property Science Tim Bannister said: “Homeowners in Kent are some of the biggest winners in this study, with four locations in the top ten, while for buyers, it’s easy to see the appeal in moving to an area near the coast for less the national average asking price. Bristol also emerges as a key hotspot, with four areas of the city also making up the top ten. With working patterns very different to that of a decade ago, it will be fascinating to see market dynamics in ten years from now, particularly in cities such as Bristol which may continue to attract more people who may have traditionally headed to London.”