Buying off-plan property figures show sales of properties that are not yet built are on the rise:

- A total of 37% of new homes sold last year found a buyer before being built

- Rise in sold off-plan homes is due to a lack of second-hand properties for sale

- A total of 24% of new detached home completions in 2021 were sold off-plan

Home hunters are being warned about the potential traps in buying off-plan after new figures claimed sales of homes not yet built was on the rise.

Sales of such properties have risen for the first time since 2016 and buyers have shifted to buying off-plan houses rather than flats - as owner-occupiers rather than investors, according to the research by Hamptons.

But experts warned homebuyers about the potential dangers of buying off-plan, both due to the challenge of financing such a move, and making sure you get the property you expect, as changes are often made last minute by developers.

Doug Miller at Lansdown Financial Services, warned: 'There are many unnerving stories that have been told when buying off plan, including rooms and gardens being built smaller than the original dimensions suggested and and even windows missing from certain rooms.

'Obtaining a mortgage is difficult due to the long gap between reserving the property and it actually being built, as most traditional mortgage offers are only valid for six months.

'You are expected to exchange contracts quickly, and once this is done there is no going back so always make sure you research the builders in depth and check how set in stone the plans are for the development, as any changes by the builders could really impact the desirability of the new development.'

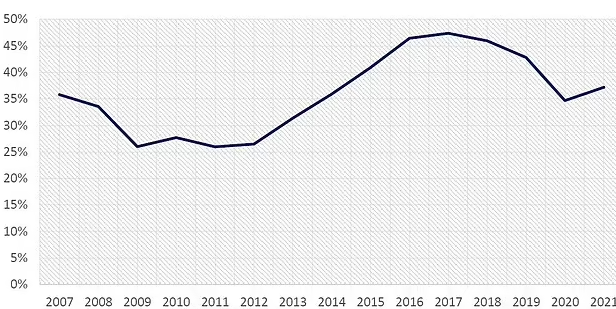

It comes after Hamptons estate agents said that 37 per cent of new homes sold last year found a buyer before being built.

It is the first rise since 2016, up from 35 per cent in 2020. While this figure remains below the peak of 47 per cent recorded in 2017, it has reversed the subsequent downward trend.

It means that more new homes were sold off-plan in 2021 than in 2007 when the agent's records began.

It attributed the rise in homes being sold off-plan to a lack of second-hand properties for sale. It said that the rise is being driven by more houses - as opposed to flats - being sold before completion.

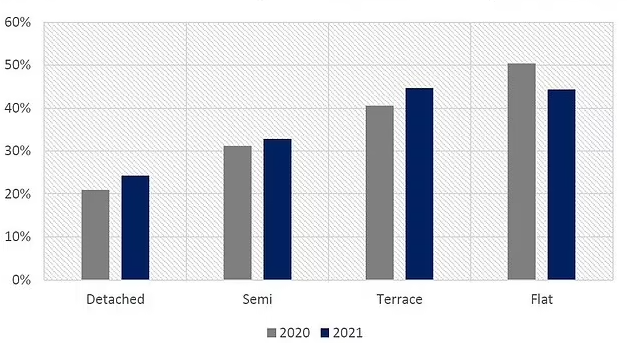

A total of 24 per cent of new detached home completions in 2021 were sold off-plan compared to 21 per cent in 2020. This figure rose from 31 per cent to 33 per cent for semi-detached properties and from 41 per cent to 45 per cent for terraced homes.

However, the proportion of flats sold-off plan fell from 50 per cent to 44 per cent. It means that for the first time since 2007, a terraced house was more likely to be sold off-plan than a flat.

Obtaining a mortgage on an off-plan property for sale is difficult due to the long gap between reserving the property and it actually being built

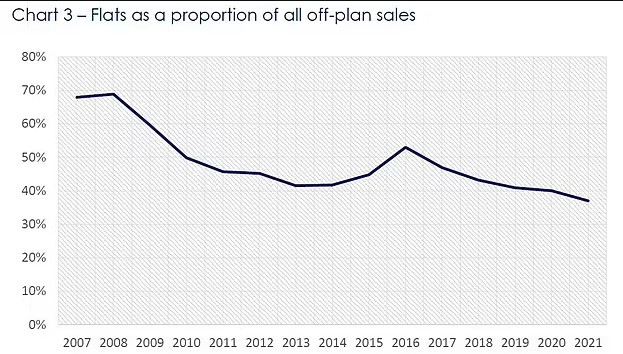

Flats have been plagued with issues in recent years, particularly in urban areas, including dangerous cladding and toxic ground rents.

They have also lost their shine among many buyers due to the pandemic's race for space and demand for larger coastal and more rural homes.

Flats made up 37 per cent of all homes sold off-plan in 2021, down from a peak of 53 per cent in 2016 and a larger peak of 69 per cent in 2008. Hamptons said off-plan buyers are increasingly likely to be owner-occupiers seeking houses rather than flats.

It is in contrast to pre-2016, and before the 3 per cent stamp duty surcharge on second homes was introduced, when off-plan sales were firmly driven by flats sold to investors.

The estate agent added that the largest developments continued to see a higher share of homes sold off-plan, as these schemes tend to be best set up to agree forward sales.

Last year 70 per cent of properties at 50-plus home developments were sold off-plan compared to 25 per cent at developments of less than 10 homes.

But these figures mask a shift that saw an increase in the share of homes sold off-plan at smaller schemes - up from 19 per cent in 2020 - as buyers sought out individuality, while off-plan sales rates in larger developments remained unchanged

Most new build buyers hand over a standard 10 per cent deposit on exchange of contracts with the balance payable on completion.

This means that last year buyers paid a record £1.1billion in deposits to developers for homes that had yet to be built, according to Hamptons.

This is three times the amount handed over in 2007 - at £348million - and marks the first time this figure has exceeded £1billion.

This value has been driven up by rising prices and a steady shift towards more houses and fewer flats being sold off-plan, which has pushed up the size of the average deposit.

| Cotswold | 86% |

| Monmouthshire | 74% |

| Southwark | 67% |

| East Hertfordshire | 67% |

| Gravesham | 67% |

| Sandwell | 65% |

| Calderdale | 65% |

| Hackney | 65% |

| Welwyn Hatfield | 65% |

| Thurrock | 63% |

Most new build buyers hand over a standard 10 per cent deposit on exchange of contracts with the balance payable on completion.

This means that last year buyers paid a record £1.1billion in deposits to developers for homes that had yet to be built, according to Hamptons.

This is three times the amount handed over in 2007 - at £348million - and marks the first time this figure has exceeded £1billion.

This value has been driven up by rising prices and a steady shift towards more houses and fewer flats being sold off-plan, which has pushed up the size of the average deposit.

Whether this shorter-term shift has the potential to turn into a longer-term trend remains to be seen, but unlike the past, it's owner-occupiers rather than investors who are likely to continue driving off-plan sales in 2022.'