Average house prices are up 30% since the market peak in 2007 as successive lockdowns prompt buyers to search for more space.

The average value of a home in the UK has reached £230,700 – 30% above the previous market peak in 2007.

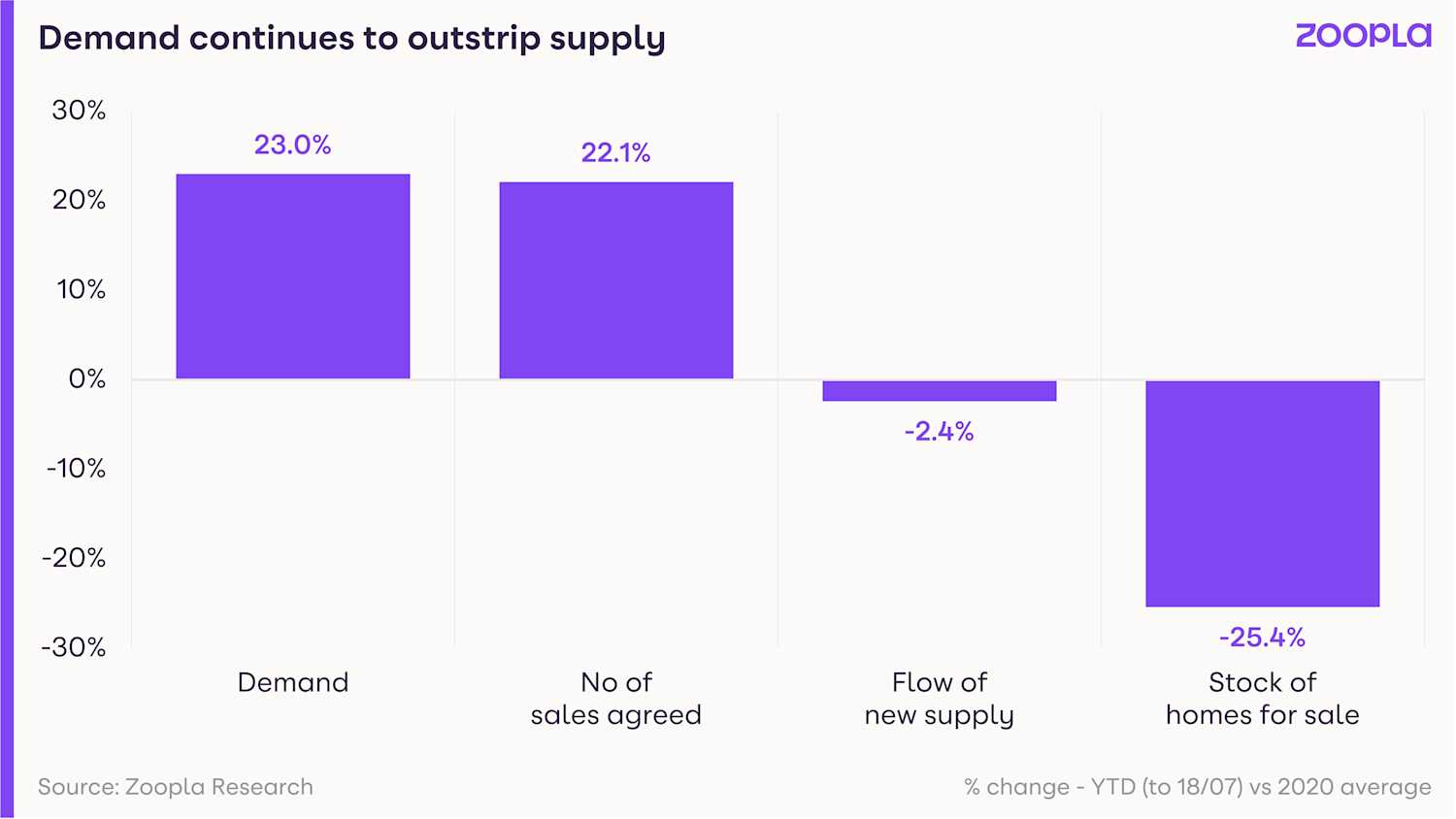

House prices have been driven higher by a mismatch between the number of homes for sale and surging demand from potential buyers.

And a pandemic-led clamour for more space is making family homes particularly sought-after, with demand for this type of property more than doubling during the past year alone.

What's happening to house prices?

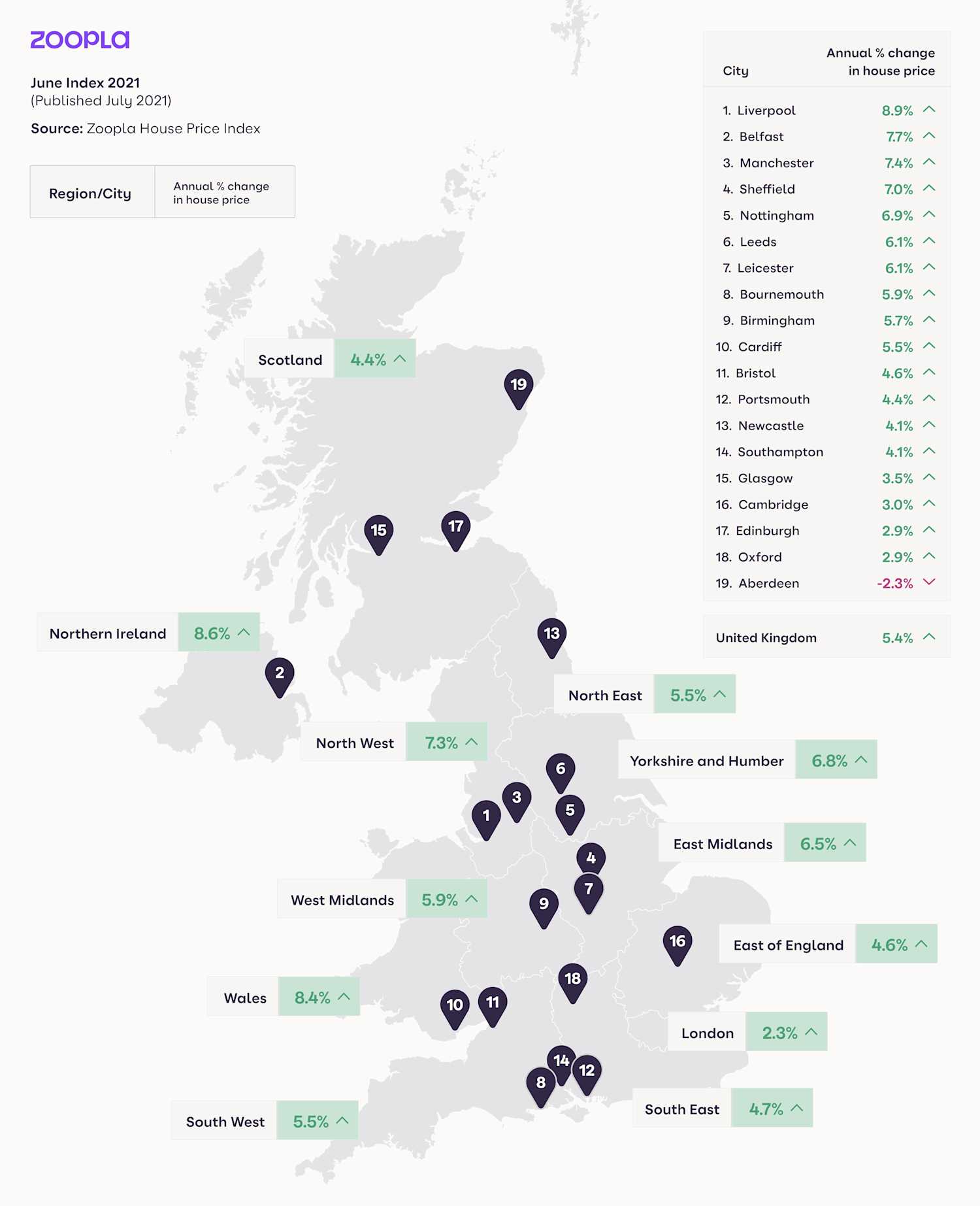

House price growth continued to gather pace in June, with property values increasing at an annual rate of 5.4%. That's more than double the growth of 2.2% seen during the previous 12 months.

Northern Ireland and Wales saw the strongest house price growth at 8.6% and 8.4% respectively, the highest rates for 16 years in both countries.

At a regional level, house price growth was at its highest in the northwest and Yorkshire & the Humber.

And at a city level, Liverpool, Belfast and Manchester took the top three spots. In fact, cities in northern regions, where property remains more affordable, accounted for nine of the top 10 places with the fastest house price growth.

Meanwhile, house price growth in London has been trailing the rest of the UK for eight months, and this month was no exception.

How busy is the property market?

The housing market showed no sign of slowing in June, with the number of housing sales agreed running 22% ahead of average levels in 2020.

Demand from potential buyers eased slightly, dipping by 9% in the first two weeks of July after the stamp duty holiday on the first £500,000 of property ended.

But to put this into context, buyer demand remains 80% higher compared with this time of year in the more normal housing market conditions of 2017 to 2019.

In London, demand from potential buyers has polarised. In the city's outer boroughs, where there's larger volumes of houses and properties with outside space, buyer demand is a staggering 86% higher than average levels between 2017 and 2019. In contrast, in inner London boroughs, it is only up 2%.

Meanwhile, the shortage of homes for sale across the piste continued, with a 25% fall in the number of homes on the market in the first six months of this year compared with the same time in 2020.

What could this mean for you?

First-time buyers

While buyer interest for houses has more than doubled as a result of the pandemic-led search for space, demand for flats is broadly unchanged from a year ago. So it could be a good opportunity to purchase an apartment.

That said, expect to see competition from other people taking their first step onto the property ladder, with lending to first-time buyers up 25% compared with 2020.

If you're after a helping hand, the government has a number of schemes aimed at assisting first-time buyers, including Help to Buy and the new 95% mortgage guarantee.

And remember that that there's also stamp duty relief available for first-time buyers that goes beyond the current stamp duty holiday.

Home-movers

The number of homes for sale has failed to keep pace with demand from potential buyers since January, with no sign of a rebalance expected to play out imminently.

You could be in a strong position to secure a quick sale on your existing home at a good price – particularly if you own a house that's suitable for a family.

When it comes to searching for your next property, the limited number of homes on the market means you are likely to have less choice. You could also face stiff competition from other potential buyers.

And, if more space is high on your agenda, why not see how far your budget could stretch in different areas?

What’s the outlook?

Annual house price growth is expected to reach 6% in the coming months. It’s then expected to start easing back to between 4% and 5% towards the end of the year as the second phase of the stamp duty holiday ends and economic conditions become more challenging.