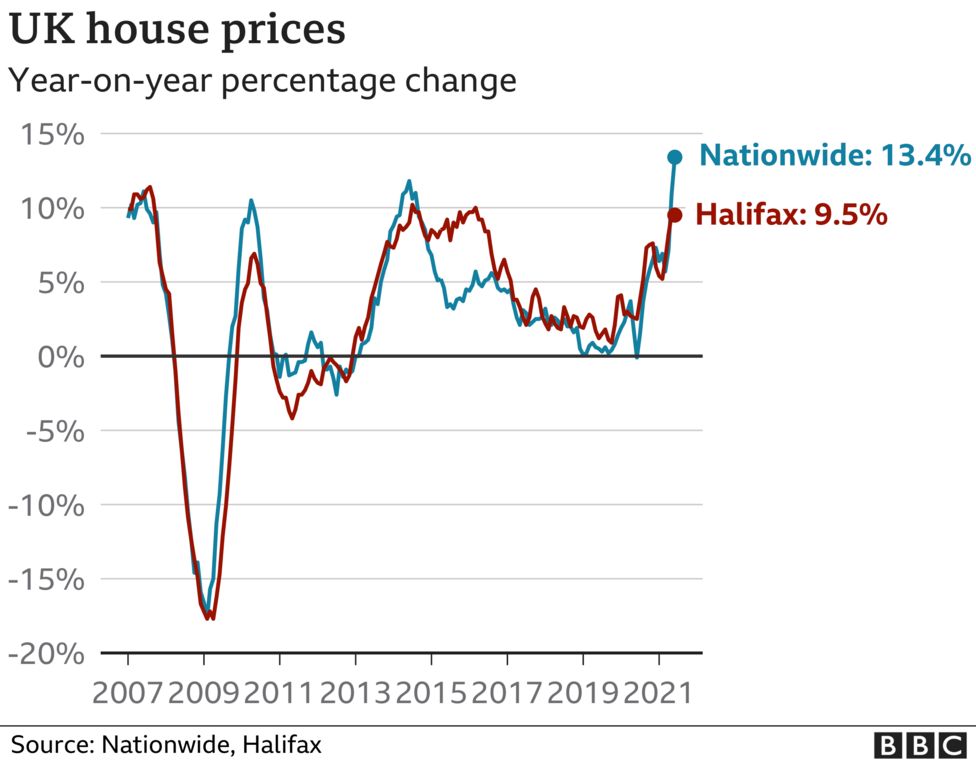

UK house prices rose 13.4% in the year to June, the fastest pace since November 2004, the Nationwide has said.

The building society said the average house price increased to £245,432 from £216,403 in June 2020.

Nationwide chief economist Robert Gardner said prices were "close to a record high" in relation to average incomes, which he added "makes it even harder" for first-time buyers.

He told the BBC the pandemic had "stimulated" the housing market.

Mr Gardner said lots of people had "reassessed what they want from home" in terms of space and where they live as a result of the coronavirus lockdowns.

"The pandemic is an unusual kind of shock - it has stimulated housing market activity rather than the shock holding back the market which is normally what happens," he added.

The Nationwide bases the findings on its own mortgage data. It said while the rapid annual growth was partly due to prices being "unusually weak" during the first lockdown last year, the market continued to "show significant momentum".

All parts of the UK saw a rise in house prices in the second quarter of 2021, with Northern Ireland and Wales experiencing the largest year-on-year increases of 14% and 13.1% respectively.

The slowest rate of price growth was seen in Scotland, where property values increased by 7.1%, while London was England's weakest performing region, with prices rising 7.3%

Mr Gardner said despite the increase in house prices to "new all-time highs", the typical mortgage payment was "not high by historic standards compared to take home pay, largely because mortgage rates remain close to all-time lows".

House prices are rising fast; prompted by stamp duty holidays, sustained by estate agent marketing, and - significantly - inspired by a Covid-related change of priorities among buyers.

Of course, this is a general picture. The UK housing market is a series of mini-markets. Just ask someone trying to sell a flat at the moment and they may feel they are in a parallel universe.

What really is in doubt is whether this boom will be followed by a bust.

If the economy fails to recover and jobs are lost, some people may be forced to sell and fewer will want to buy. If that is sustained and prices fall, negative equity looms for new buyers who are borrowing heavily now to buy somewhere bigger in which to live and work.

Stamp duty factor

The market in recent months has continued to be stimulated by stamp duty holidays in England, Wales and Northern Ireland.

From the 1st of July, those tax breaks start to be withdrawn, and will return completely to the pre-pandemic levels by October.

Nicky Stevenson, managing director at estate agents Fine and Country, said: "Annual house price growth of this magnitude is something no one thought they'd see, particularly with the stamp duty holiday now tapering out.

"The final closure of the stamp duty scheme at the end of September may have no impact at all because other factors are so much more important, namely the race for space, low supply, accidental savings and low interest rates."

However, some analysts point to the link between housing demand and jobs as key to the future of property prices.

Danni Hewson, financial analyst at AJ Bell, said unemployment would be closely watched.

"How many people will still be in a job once the furlough scheme ends? How many mortgage holidays will result in quick sales? There is no getting away from the fact that the next few months will be difficult for many people once support is withdrawn," she said.